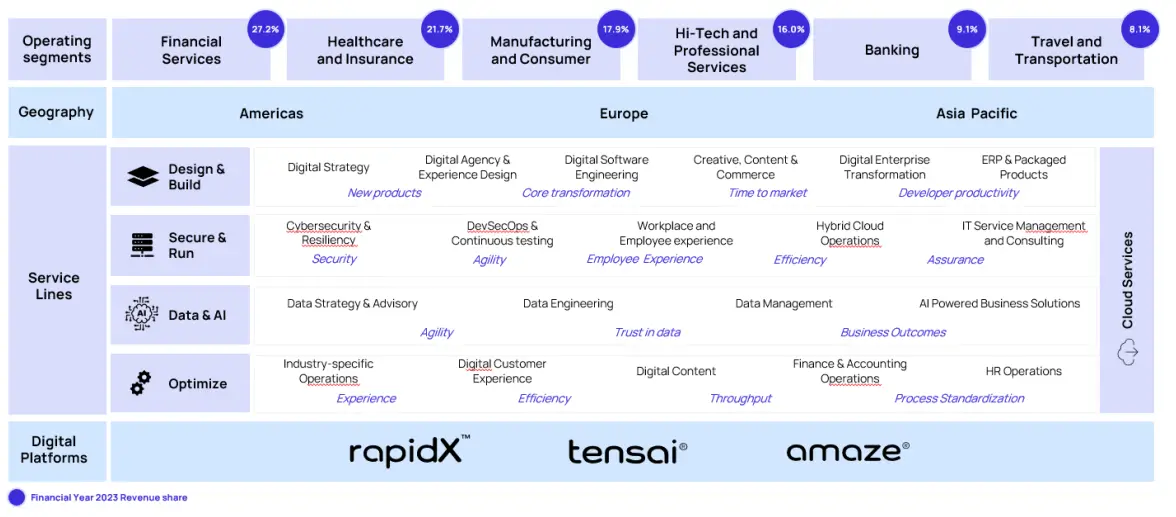

Hexaware Technologies Unlisted Share Description – Hexaware Technologies is a prominent global IT, BPO, and consulting service. Founded in 1992 and headquartered in Navi Mumbai, Maharashtra, the company has established itself as a key player in digital transformation and technology solutions provider. It caters to various industries, including banking, financial services, healthcare, insurance, manufacturing, logistics, and retail, leveraging its expertise in automation and AI-powered processes. Hexaware delivers services through its AI-enabled digital platforms, which include RapidX™ for digital transformation, Tensai® for AI-driven automation, and Amaze® for cloud adoption. The company serves clients across the Americas, Europe, and the Asia-Pacific region, encompassing India and the Middle East.

Hexaware Technologies focuses on providing cloud computing, artificial intelligence, robotic process automation, and data analytics, positioning itself as a digital-first enterprise. Its global presence and strategic partnerships with leading tech providers have cemented its status as a preferred partner for businesses undergoing digital transformation.

The company voluntarily delisted from Indian stock exchanges in November 2020 following its acquisition by private equity firm Baring Private Equity Asia (now EQT). In 2021, Carlyle acquired Hexaware from Baring, in one of the largest private equity deal pegged at nearly USD3 billion.

After four years of operating privately, Hexaware is now gearing up for a re-listing through an Initial Public Offering (IPO), offering equity shares to the public. This IPO is expected to attract significant attention due to Hexaware’s proven track record, solid financials, and commitment to technological advancements.

Read Also: Hero FinCorp Unlisted Share Price

Revenue Sources (Products & Services) of Hexaware Technologies

- IT Consulting Services

- Business Process Outsourcing (BPO)

- Cloud and Infrastructure Management

- Digital Transformation Solutions

- Application Development and Maintenance

- Data Analytics and Artificial Intelligence

- Automation and Testing Services

- Cybersecurity Solutions

- Enterprise Resource Planning (ERP) Implementation

Hexaware Technologies Subsidiary Companies

- Softcrylic Technologies Solutions India Private Limited

- Mobiquity Softech Private Limited

- Hexaware Technologies Inc. (USA)

- Hexaware Technologies UK Limited

- Hexaware Technologies Mexico S. de R.L. de C.V.

- Hexaware Technologies Asia Pacific Pte Ltd

- Hexaware Technologies GmbH

- Mobiquity Inc.

- Guangzhou Hexaware Information Technologies Limited

What Makes Hexaware Technologies Interesting?

As of H1 CY 2024, Hexaware Technologies reported a total revenue of INR 5,724.4 crore, reflecting a robust growth trajectory. The revenue distribution includes 45% from Application Development, 25% from Cloud and Infrastructure Services, 20% from Business Process Outsourcing, and 10% from Digital Transformation Solutions. This diverse income base highlights its adaptability and strength in catering to emerging technology trends.

With a CAGR of 7.3% projected for the global IT services market from CY 2024 to 2029, Hexaware is expected to benefit from rising demand for AI-driven automation, cloud adoption, and data analytics. The company’s aggressive expansion strategy and focus on innovation further strengthen its competitive edge.

Key Highlights –

- Hexaware Technologies plans to raise up to INR 9,950 crore through its IPO, comprising an offer for sale by the promoter CA Magnum Holdings (a Carlyle affiliate).

- The total income rose by 12.5%, increasing from INR 5,089 crore for the six months ending 30 June 2023, to INR 5,724.4 crore for the six months ending 30 June 2024.

- The company’s weighted average cost of acquisition per equity share is INR 385.35.

- As of 30 June 2024, Hexaware has established a global delivery network consisting of 38 delivery centers supported by 16 offices across the Americas, Europe, and the Asia-Pacific region.

- Hexaware Technologies recently expanded operations in Europe and Asia-Pacific to strengthen its international footprint and enhance global delivery capabilities.

- As of 30 June 2024, the company employed 31,870 people across 28 countries, with a diverse presence spanning major nations, languages, time zones, and regulatory environments.

- Hexaware has secured strategic partnerships with leading cloud providers such as AWS, Microsoft Azure, and Google Cloud to enhance its service offerings and provide end-to-end cloud solutions.

- The company’s R&D investments have fueled advancements in AI, machine learning, and process automation, positioning it as a leader in digital transformation solutions.

Read Also: boAt Unlisted Share Price

Hexaware Technologies Board of Directors

- Mr. Larry Quinlan, Non-Executive Chairman

- Mr. Srikrishna Ramakarthikeyan, CEO & Executive Director

- Mr. Neeraj Bharadwaj, Director

- Mrs. Sandra Horbach, Director

- Mr. Julius Genachowski, Director

- Mrs. Lucia Soares, Director

- Mr. Kapil Modi, Director

- Mr. Shawn Devilla, Director

- Mr. Milind Sarwate, Independent Director

- Mr. Vikash Sharma, Independent Director

- Mrs. Sukanya Kripalu, Independent Director

Hexaware Technologies Partners

- Microsoft

- AWS

- Google Cloud

- Salesforce

- Oracle

- IBM

Hexaware Technologies Unlisted Share Details

| Name | Hexaware Technologies Limited |

| Face Value | INR 1 per share |

| ISIN Code | INE093A01041 |

| Lot Size | 100 shares |

| Demat Status | NSDL, CDSL |

| Hexaware Technologies Unlisted Share Price | INR 1,070 per share |

| Market Cap | INR 64,956 crore |

| Total number of shares | 60,70,60,868 shares |

| Website | www.hexaware.com |

Read Also: Capgemini Technology Services Unlisted Share Price

Hexaware Technologies Unlisted Share Details – Shareholding Pattern

Details of shareholders holding of the equity shares capital in the company as of 30 June 2024 (CY):

| Shareholder Name | % to Holding | No. of shares |

| CA Magnum Holdings | 95.15 | 57,76,04,202 |

| Public Shareholders | 4.85 | 2,94,56,666 |

Read Also: Orbis Financial Unlisted Share Price

Hexaware Technologies Unlisted Share Details – Financial Metrics

| Particulars | CY 2021 | CY 2022 | CY 2023 | H1 CY 2024 |

| Revenue | 7,177.7 | 9,199.6 | 10,380.3 | 5,684.3 |

| Revenue Growth (%) | 14.62 | 28.17 | 12.83 | – |

| Expenses | 6,303.4 | 8,255.8 | 9,120.6 | 4,987.0 |

| Net income | 748.8 | 884.2 | 997.6 | 553.6 |

| Margin (%) | 10.43 | 9.61 | 9.61 | 9.74 |

| RONW (%) | 21.4 | 23.4 | 23.6 | 12.2 |

| NAV | 57.65 | 62.09 | 69.60 | 75.07 |

| EBITDA (%) | 16.7 | 15.2 | 15.3 | 15.6 |

| EPS | 12.32 | 14.53 | 16.41 | 9.13 |

Read Also: Capital Small Finance Bank Unlisted Share Price

Hexaware Technologies Unlisted Share Peer Comparison

| Company | 3-yr Sales CAGR (%) | RONW (%) | NAV | MCap (INR crore) |

| Hexaware Technologies | 10.64 | 23.6 | 69.77 | 64,956 |

| Persistent Systems | 32.9 | 22.1 | 321.82 | 1,00,998 |

| Coforge | 25.3 | 23.0 | 586.63 | 64,854 |

| LTIMindtree | 42.1 | 22.9 | 676.55 | 1,70,246 |

| Mphasis | 11.0 | 17.7 | 465.33 | 54,815 |

Hexaware Technologies Annual Reports

Hexaware Technologies IPO DRHP

Hexaware Technologies Annual Report CY 2023

Hexaware Technologies Annual Report CY 2022

Hexaware Technologies Annual Report CY 2021

Read Also: NSE Unlisted Share Price

Hexaware Technologies Unlisted Share FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is Hexaware Technologies unlisted share price?

Hexaware Technologies unlisted stock price today is INR 1,070 per share. Shares are purchased in lots of 100 shares.

Who determines Hexaware Technologies share price today?

The unlisted share price is influenced by transaction prices, demand-supply dynamics, recent funding valuations, and profitability ratios.

What is the Hexaware Technologies IPO expected date?

Hexaware Technologies IPO expected date to be launched soon. The IT firm filed a DRHP with SEBI on 9 September 2024 for its INR 9,950 crore IPO. The IPO is expected to be one of the biggest in the history of India’s IT services sector and plans to launch Hexaware Technologies IPO in the first half of 2025.