Last Updated on May 1, 2017 by Krishna Bagra

In a landmark public offer, the government of India plans to sell 10.2% of its equity stake through HUDCO IPO. This will be the first public sector undertaking IPO (PSU IPO) in nearly five years after National Building Construction Corporation Ltd (NBCC) brought its IPO in March 2012. Following the successful listings of Shankara Building Products, Avenue Supermarts and Music Broadcast Ltd, investors’ hopes are pretty high from HUDCO as PSU IPOs are known to be wealth creators in the long run. NBCC is the latest example as it has become a multibagger investment for many investors.

HUDCO – India’s premier development institution – has priced its IPO in the range of INR56 – 60 per share and the sale of 204,058,747 shares will mobilize INR1,224.3 crore (INR12.24 billion). Investors can place their bids between 8 and 11 May in multiples of 200 shares. As with most other PSU IPOs, retail investors will get a discount of INR2 per share. There will be no anchor book and all the shares will be offered through an offer for sale (OFS). The IPO will be managed by IDBI Capital Markets & Securities, ICICI Securities, Nomura Financial Advisory and Securities, and SBI Capital Markets while Alankit Assignments has been appointed the registrar. In HUDCO IPO review, we try to find out the positives and negatives and if retail investors should subscribe to the offer (even though we know investors will flock in droves!).

HUDCO IPO details | |

| Subscription Dates | 8 – 11 May 2017 |

| Price Band | INR56 – 60 per share |

| Fresh issue | Nil |

| Offer For Sale | 204,058,747 shares (INR1,224.3 crore) |

| Total IPO size | 204,058,747 shares (INR1,224.3 crore) |

| Minimum bid (lot size) | 200 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

HUDCO IPO Review: All OFS and we still love this

As mentioned earlier, HUDCO IPO will comprise of only an OFS and there will be no fresh shares by the company. As a result, HUDCO will not get any money from the IPO and all the funds will go to the government. Through the President of India, the government owns 100% of the housing finance development institution as of now and its shareholding will come down to 89.8% following the IPO. Our regular readers know that we are averse to full OFS or OFS-heavy issues as such public offers end up becoming exit route for existing investors. However, OFS is the recommended and sometimes, the only route, if the company in question is in no need of money. This was highlighted in the case in BSE IPO which went on to reward shareholders.

HUDCO isn’t very different either as we will see in the following paragraphs.

HUDCO IPO Review: Premier finance body

HUDCO offers loans for housing and urban infrastructure projects in India but it is not just a finance company. It bankrolls housing finance companies and offers venture capital in housing and urban development sectors. Effectively speaking, the Miniratna company is the official channel for the government’s various housing and urban development schemes. As of 31 December 2016, its total outstanding loan portfolio was INR363,858 million. Out of this, INR112,281 million, or 30.86%, were for Housing Finance loans which includes social housing, residential real estate and retail finance under HUDCO Niwas. INR251,577 million, or 69.14% of the outstanding loan portfolio were Urban Infrastructure Finance loans including water supply, roads and transport, power, among others.

Read Also: Here is why you should consider opening a Free Demat Account

Out of the total loan portfolio, state governments and their agencies accounted for 89.9%, private sector entities form 9.7% and individuals only 0.4%. With average loan size of INR552.75 million, HUDCO is into bulk loans to state governments who, in turn, extend the finance to or utilise the finance for the ultimate individual beneficiaries (public and private sector borrowers).

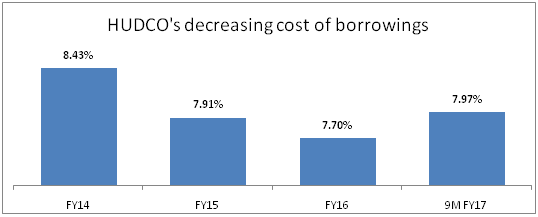

HUDCO enjoys highest credit rating and its strong relationships with government enables access to funds for a long-term duration, lower cost of borrowing and from a diversified lender base. HUDCO’s long term bonds are rated AAA by CARE, India Ratings & Research and ICRA. At the same time, its cost of borrowing has been coming down.

Source: HUDCO Red Herring Prospectus

HUDCO IPO Review: Financial performance

As a result of the key role it plays in the government schemes and low cost of borrowings, HUDCO has both ends of financing equation sorted out. The company’s revenues have increased in each of the last four years and are on track to grow this year as well. Similarly, profits have remained strong and have never dipped in any of the recent years. However, it appears the winning streak may be broken this year as its profits in the last nine months are trailing on annualized basis.

Another thing to highlight in HUDCO IPO review is the company’s reducing profitability. Even though profits have expanded in the last four years, margins have slipped below 20% in the latest nine months for the first time in the last five years. Although we like the margins even at the reduced levels of 18.5% because of HUDCO’s proven business model, it may be an important factor for some investors.

HUDCO has robust performance on other parameters as well. This includes Net Interest Margin (NIM) of 4.1% in FY2016 and 4.2% in the latest nine months. To put it in perspective, LIC Housing Finance reported its highest NIM of 2.97% in the quarter ended 31 March 2017. Gross NPAs may appear quite high at 6.8% of its total loan portfolio, the company has made provisions and net NPAs are only 1.51%. It is worth highlighting that HUDCO has now stopped sanctioning housing finance loans to private sector which accounted for maximum NPAs.

HUDCO’s consolidated financial performance (in INR crore) | ||||||

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | 9M FY2017 | |

| Total revenue | 2,778.6 | 2,921.3 | 3,002.9 | 3,427.8 | 3,350.1 | 2,678.0 |

| Total expenses | 1,838.9 | 1,880.6 | 1,877.8 | 2,258.0 | 2,229.5 | 1,937.2 |

| Profit after tax | 621.6 | 699.7 | 734.0 | 768.3 | 810.6 | 496.3 |

| Net margin (%) | 22.4 | 24.0 | 24.4 | 22.4 | 24.2 | 18.5 |

Source: HUDCO Red Herring Prospectus

HUDCO IPO Review: Should you subscribe?

HUDCO’s was accorded the Miniratna status in fiscal 2005 and it is indeed a ratna that is yet to sparkle to its full glory. As the government’s focus is on developing affordable housing and urban infrastructure, HUDCO will continue to play a crucial role in rollout of these schemes. Work under these schemes such as DAY-NULM (Deendayal Antyodaya Yojana-National Urban Livelihoods Mission), JNNURM (Jawaharlal Nehru National Urban Renewal Mission) and PMAY-HFA (Pradhan Mantri Awas Yojana – Housing for All) has already started. In fact the Housing for All scheme is taking shape very well and HUDCO is one of the two Central Nodal Agencies, along with NHB, to channelize the subsidy to the prime lending institutions including banks and housing finance companies. HUDCO will also play an important role in the government’s new scheme of Smart Cities and AMRUT (JNNURM replacement).

Going forward, HUDCO will focus on housing finance loans which offers better NIM and lower gross NPA. With gross NPAs at 6.8%, there is tremendous scope for improvement as this is not an ideal condition. As mentioned earlier, HUDCO has taken a conscious step to move away from lending to private sector entities and this should help in controlling NPAs.

In terms of valuations, the upper end of the price band at INR60 per share attracts a P/E multiple of 15 on the basis of consolidated earnings for FY2016. Retail investors will get a further discount of INR2 per share which will reduce the effective P/E ratio to 14.5. HUDCO’s Return on Net Worth (RONW) at 9.6% isn’t bad either, although it is down from previous years. Its book value of INR42 per share means the IPO price values the company at P/BV ratio of 1.4. Since HUDCO has no listed peer, these figures can’t be benchmarked against any other company.

Read Also: Upcoming IPOs in 2017 to keep an eye on

However, investing in HUDCO is not just about valuations. As we outlined in our previous article about what makes HUDCO and interesting play, it is clear that HUDCO will be a prime beneficiary of the megatrend of increasing urbanization (half of India is expected to live in cities by 2050) and an acute shortage of housing in urban and rural areas. As a result, the outlook is bright for HUDCO and retail investors may do well to keep it in their long term portfolios for multibagger returns. Along the way, investors will keep benefitting from regular dividends, although the yields as of now are not very high. As the government will continue to be the biggest shareholder, HUDCO is likely to keep paying rich dividends.

Overall, HUDCO IPO review tells us that the company is leaving something on the table for IPO investors as grey market rates also indicate. Grey market premium (GMP) in HUDCO shares is currently around INR25 per share which indicates strong demand and a high possibility of a rewarding listing. Head to our discussion page on HUDCO IPO to keep yourself updated about these price movements.