ICICI Prudential Nasdaq 100 Fund opens on 27 September and will remain open through 11 October 2021. Investors can place their applications in the open-ended fund for minimum INR1,000 and in multiples of INR500 thereafter. Through ICICI Prudential Nasdaq 100 NFO review, we aim to find out if this is something investors should be considering for their long-term portfolio.

Two things immediately popup in mind once the name of Nasdaq pops up. First is the access to industry megatrends like driverless cars and artificial intelligence and second is the appreciation of US Dollar against Indian Rupee.

The stupendous rise in market cap of leading tech and e-commerce companies like Amazon, Tesla, Apple etc in recent years has demonstrated that these players represent a secular growth trend at a collective level. These opportunities are where the profit pools will be concentrated in future and frankly, very few such opportunities are listed in the domestic stock markets.

The depreciation of Indian Rupee against the US Dollar is another long-term trend that has been playing out since our independence. In 1947, one Indian Rupee was equal to one US Dollar and in the last 74 years, the exchange rate now reads 1USD=INR74! In simple terms, what it means is that investments in INR need to work much harder just to maintain parity with USD.

A 10% appreciation in INR is not equal to a 10% appreciation in USD!

From a long-term planning perspective, it makes perfect sense to diversify and allocate some capital to US markets.

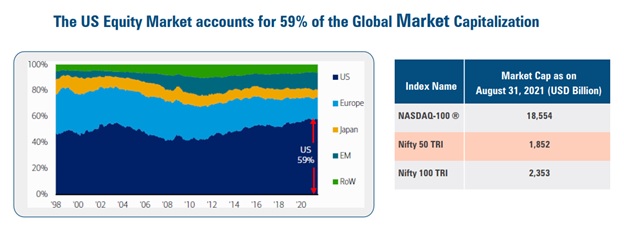

Besides these two points, there are other advantages of investing in the US markets. Despite all the talks about the changing world order, the US is the natural leader in global market capitalization and is likely to maintain this leadership in coming several decades.

ICICI Prudential Nasdaq 100 NFO review – A concentrated bet on tech

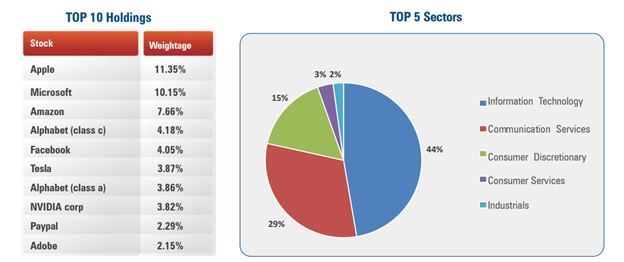

This automatically means that whenever cutting-edge technology needs capital, it will head to the US markets. The recent Freshworks IPO on Nasdaq is a case in point. It also helps to know that Nasdaq 100 index has 44% weightage in technology stocks. This concentration has allowed Nasdaq 100 index to beat other prominent US indexes such as S&P 500. Another plus point for ICICI Pru Nasdaq 100 fund!

Read Also: Aditya Birla AMC IPO Review

The following chart outlines index constituents as on 31 August 2021. With 44% weightage coming directly from Information Technology sector, it is clearly the dominating theme but it doesn’t stop there as the other sectors such as communication services and consumer discretionary also include a tech flavor.

ICICI Nasdaq 100 Fund review – Risk factors

While everything is fine so far, ICICI Nasdaq 100 fund isn’t free of its risks. One of the prominent ones is the high concentration on tech sector which is flying high and may correct going forward. However, this is a risk one must live with when it comes to tech investing. This was a valid concerned six years ago and yet the sector has outperformed others.

Since specific stocks enjoy much higher weightage in the index, it exposes our investments to company specific risks such as anti-trust proceedings against Google, thereby impacting its parent Alphabet. Now this is a very real risk, because some of the constituents are abnormally big and a single policy change can put them under regulatory scanner not just in the US but also in other markets. No escape, live with it!

Another risk is with regards to currency exchange rates. The long-term trend of INR depreciation against USD might reverse in future. Now this is a bit hypothetical and a logic for the sake of it. Enough said!

Overall, ICICI Prudential Nasdaq 100 NFO review tells us the virtues of hassle-free investing in a theme that is likely to gain more traction in the coming years. In addition, the hedge against currency depreciation is something too good to be missed.