Following hectic activity in September, India’s IPO market is taking it easy in the month of October. Good new is that this sluggishness is likely to get over with at least two IPOs coming up in October. First offer on the block is IRM Energy IPO, which aims to raise INR 545.4 crore. In the IRM Energy IPO Review, we try to understand its business model and see if investors should invest or not in this upcoming IPO.

#1 IRM Energy IPO Review – Business Background and Market Outlook

IRM Energy is a City Gas Distribution (CGD) player with operations in Banaskantha (Gujarat), Fatehgarh Sahib (Punjab), Diu & Gir Somnath (Union Territory of Daman and Diu/Gujarat), and Namakkal & Tiruchirappalli (Tamil Nadu). The company is at present operational in all areas except Namakkal & Tiruchirappalli, where the work is under way. As of 30 June 2023, it had 52,454 domestic customers, 269 commercial customers, and 184 industrial customers.

The company has positioned itself as the provider of safe, clean, and cost-effective fuel for households, commercial establishments, and industrial units, as well as for fuel requirements in the transport segment.

The company is providing the following offerings while maintaining a customer-centric approach and making continuous efforts to upgrade its services:

- As of 30 June 2023, the company operated a total of 66 CNG retail outlets and 1 pure play mother station i.e. a total of 67 outlets, of which 3 are COCO (company-owned, company-operated) stations (including 1 pure play mother station), 36 DODO (dealer-owned, dealer-operated) CNG stations, representing ~54% of total CNG stations. These stations feature the IRM Energy branding, which serves to enhance the company’s corporate identity. Additionally, the company operates 28 OMC (Oil marketing companies) CNG stations.

- The company has connected 184 industrial customers (comprising ~93% of total PNG sales in the first quarter of FY 2023-2024)

- Introduced various attractive registration plans, which makes it affordable to switch to piped natural gas for domestic households, commercial establishments, and industries

- The company has set up an L-CNG station in Veraval municipality which will aid in faster penetration in the Diu and Gir Somnath. It intends to set up more L-CNG stations in its other areas.

#2 IRM Energy IPO Analysis – Offer Details

The IRM Energy IPO is scheduled to open from 18 October 2023 through 20 October 2023, with a price range of INR 480 to 505 per share. The IPO consists of a Fresh Issue of 10,800,000 shares, valuing the offering between INR 518.4 to 545.4 crore. It is worth highlighting that the company will not get any funds from IPO proceeds as it is totally a Fresh Issue. The minimum bid size is 29 shares, priced at INR 14,645, and retail investors are allotted 35% of the shares. The IPO will be listed on both BSE and NSE.

Read Also: 2 Tata Group IPOs lined up in 2023, check details

#3 IRM Energy IPO – Market Positioning

IRM Energy is engaged in the business of laying, building, operating, and expanding the city or local natural gas distribution network. It is an integrated value-driven energy enterprise, developing natural gas distribution projects in geographical areas (GAs) for industrial, commercial, domestic, and automobile customers. Natural gas demand from the CGD sector is likely to log growth at 15-16% CAGR between FY 2022 and FY 2030.

The company has also signed an MoU with Mindra EV Private Limited on 24 August 2022 for setting up an EV charging infrastructure at DODO Stations and COCO Stations for a period of five years. This enables to further its vision of transitioning towards becoming an energy-oriented company.

#4 IRM Energy IPO Review – Competition

The number of entities participating in the CGD sector has increased over the past decade. CGD infrastructure is attracting not only domestic but also foreign investors. Singapore-headquartered companies such as Atlantic Gulf and Pacific (AG&P) and Think Gas Distribution have established CGD companies in India, while France-based Total Energies SE has partnered with Adani Gas to form Adani Total Gas Limited (ATGL). Similarly, US-based I Squared Capital and Japanese Osaka Gas forayed into the CGD sector by investing in AG&P in 2021.

ATGL is the largest CGD player on a standalone basis (having presence in 33 GAs), followed by Indian Oil Corporation Limited (28 GAs). Further, ATGL is the largest entity in terms of a combined GA count, at 52, including the GAs held through a JV with IOCL. The CGD market primarily comprises 10-15 players. Of these, the top five players hold 136 GAs (i.e., 46%) of the total 295 GAs allotted in all CGD bidding rounds until an eleventh round of bidding.

Read Also: All About Ebix Cash IPO

#5 IRM Energy IPO Review – Strong Parentage

IRM Energy is promoted by Cadila Pharmaceuticals and Mr Rajiv Modi who also happens to be the Chairman and Managing Director of Cadila Pharmaceuticals. This makes IRM Energy something of a family concern but lends immense credibility and financial firepower.

Japanese natural gas player Shizuoka Gas also owns 2.9% equity stake in IRM Energy. The company is evaluating opportunities with Shizuoka Gas to import and wholesale R-LNG to India through bilateral contracts on a gas exchange platform.

#6 IRM Energy IPO – Exclusivity in GAs

Since CGD business requires a lot of capital to setup the network, companies are usually given exclusivity for operations and it is no different in case of IRM Energy. The company has received 25 years of exclusivity period for laying, building and expansion of the CGD network in each of the four regions from the date of authorization.

However, this doesn’t stop other CGD players for marketing purposes by using IRM Energy’s infrastructure. Its exclusivity period in this regard expired in Banaskantha and Fatehgarh Sahib during 2023 which means that competition other CGD players is likely to emerge in the near future.

#7 IRM Energy IPO Analysis – Financial Performance

The company has a consistent track record of growth in volumes. For instance, the volume of supplied natural gas increased from 63 MMSCM for FY 2021 to 196.43 MMSCM for FY 2023, at a CAGR of 76.58%.

IRM Energy has done well in the financial performance department. The company has managed to post consistent growth in its top line, thanks to growing demand for CNG in urban areas. At the same time, its expenses have grown, and not exactly in a linear fashion, leading to uneven profits and margins.

| FY 2021 | FY 2022 | FY 2023 | |

| Revenue | 211.81 | 546.14 | 1,039.14 |

| Expenses | 166.46 | 396.83 | 970.66 |

| Net income | 34.87 | 128.04 | 63.08 |

| Margin (%) | 16.46 | 23.44 | 6.07 |

Read Also: Upcoming IPOs in October 2023

#8 IRM Energy IPO Review – Valuations

The improvement in financial performance has not been limited to just the top line and bottom line. Other key parameters including RONW and Debt-to-equity ratio have also posted marked improvements in the last 3 years. In these years, its debt-to-equity ratio has declined from 1.17 to 0.86.

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 12.39 | 43.88 | 20.93 |

| PE ratio | – | – | 22.93 – 24.13 |

| RONW (%) | 29.67 | 52.53 | 18.23 |

| NAV | 40.55 | 82.98 | 114.48 |

| ROCE (%) | 19.98 | 39.01 | 14.19 |

| EBITDA (%) | 38.49 | 39.61 | 12.14 |

| Debt/Equity | 1.17 | 0.59 | 0.86 |

#9 IRM Energy IPO Review – Peer Comparison

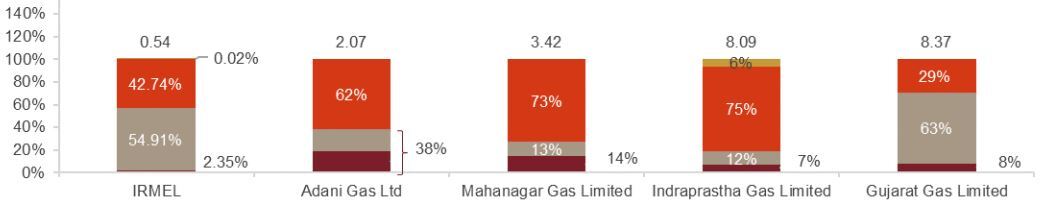

CGD is a growing market in India and has several prominent players including Mahanagar Gas, Indraprastha Gas and Adani Total Gas. With topline just above INR 1,000 crore, IRM Energy is the smallest of the lot. With size of business operations not helping it, the onus falls on valuations. Since CGD isn’t really a rocket science, there are lot of listed peers.

IRM Energy is demanding a pre-offer PE valuation of roughly 24x which stands to go up further on the post-listing basis. In contrast, its larger peers like Gujarat Gas, Indraprastha Gas and Mahanagar Gas are available at PE multiples of 19x or less. There is an exception of Adani Total Gas but that’s simply because it has Adani name in it!

Quite similarly, its larger peers have better performance on other parameters such as Return on Net Worth (RONW).

#10 IRM Energy IPO Review – Conclusion

Valuations are not and should not be seen in solation. Given the state of peer comparison, the issue appears to have been priced on the higher side. Although it has strong topline growth to its credit, how much premium to account for this factor is something for the market to decide.

As we noted earlier, there is an overhang in terms of its marketing exclusivity coming to an end. Nevertheless, it shouldn’t be seen necessarily in negative light as any new player will need to pay transportation tariff to IRM Energy.

On the positive side, there is a premium on IRM Energy IPO GMP which offers some comfort to prospective investors. We would reiterate that grey market premiums should not be used as an investment decision.