Last Updated on December 16, 2023 by Krishna Bagra

Muthoot Microfin has garnered significant pre-IPO traction with its anchor investor allotment. The company has managed to place shares worth INR 284.99 crore with 26 anchor investors at the upper price band of INR 291 per share. Muthoot Microfin IPO anchor investors include several prominent names. This strong pre-IPO demand bodes well for the upcoming public offering, scheduled to open on December 18, 2023.

Muthoot Microfin IPO Anchor Investors: Pre-IPO Momentum

| Sr. No | Name of Anchor Investor | No. of Equity Shares Allocated | % of Anchor Investor Portion | Bid Price (₹. per Equity Share) | Total Amount Allocated (₹) |

| 1 | WCM INTERNATIONAL SMALL CAP GROWTH FUND | 9,08,820 | 9.28% | 291.00 | 26,44,66,620.00 |

| 2 | JNL MULTI-MANAGER INTERNATIONAL SMALL CAP FUND | 5,21,322 | 5.32% | 291.00 | 15,17,04,702.00 |

| 3 | WCM INTERNATIONAL SMALL CAP GROWTH FUND L.P. | 5,03,472 | 5.14% | 291.00 | 14,65,10,352.00 |

| 4 | THE NORTH CAROLINA SUPPLEMENTAL RETIREMENT PLANS GROUP TRUST | 5,06,175 | 5.17% | 291.00 | 14,72,96,925.00 |

| 5 | CLEARWATER INTERNATIONAL FUND | 4,23,810 | 4.33% | 291.00 | 12,33,28,710.00 |

| 6 | FLORIDA RETIREMENT SYSTEM – ALLSPRING GLOBAL INVESTMENTS, LLC (EMSC) | 3,43,689 | 3.51% | 291.00 | 10,00,13,499.00 |

| 7 | ICICI PRUDENTIAL LIFE INSURANCE COMPANY LIMITED | 7,56,024 | 7.72% | 291.00 | 22,00,02,984.00 |

| 8 | HDFC LIFE INSURANCE COMPANY LIMITED | 7,56,024 | 7.72% | 291.00 | 22,00,02,984.00 |

| 9 | BAJAJ ALLIANZ LIFE INSURANCE COMPANY LTD. | 7,56,024 | 7.72% | 291.00 | 22,00,02,984.00 |

| 10 | MUTHOOT FINANCE LIMITED . | 10,30,965 | 10.53% | 291.00 | 30,00,10,815.00 |

| 11 | ACM GLOBAL FUND VCC | 5,15,508 | 5.26% | 291.00 | 15,00,12,828.00 |

| 12 | KOTAK MAHINDRA LIFE INSURANCE COMPANY LTD. | 5,15,508 | 5.26% | 291.00 | 15,00,12,828.00 |

| 13 | SBI GENERAL INSURANCE COMPANY LIMITED | 3,66,003 | 3.74% | 291.00 | 10,65,06,873.00 |

| 14 | ASTORNE CAPITAL VCC – ARVEN | 3,43,689 | 3.51% | 291.00 | 10,00,13,499.00 |

| 15 | MORGAN STANLEY ASIA (SINGAPORE) PTE. – ODI | 3,43,689 | 3.51% | 291.00 | 10,00,13,499.00 |

| 16 | ICICI LOMBARD GENERAL INSURANCE COMPANY LTD | 1,71,870 | 1.75% | 291.00 | 5,00,14,170.00 |

| 17 | RELIANCE GENERAL INSURANCE COMPANY LIMITED | 1,71,870 | 1.75% | 291.00 | 5,00,14,170.00 |

| 18 | CHOLAMANDALAM MS GENERAL INSURANCE COMPANY LTD | 1,71,870 | 1.75% | 291.00 | 5,00,14,170.00 |

| 19 | PRAMERICA LIFE INSURANCE LIMITED | 68,730 | 0.70% | 291.00 | 2,00,00,430.00 |

| 20 | PLIL LARGE CAP EQUITY FUND ULIF00427/08/08LARCAPFUND140 | 49,860 | 0.51% | 291.00 | 1,45,09,260.00 |

| 21 | PLIL PARTICIPATING NON-LINKED INDIVIDUAL LIFE FUND LIFE 00108/04/13 LIFETRADP140 | 50,880 | 0.52% | 291.00 | 1,48,06,080.00 |

| 22 | LARGE CAP ADVANTAGE FUND | 1,200 | 0.01% | 291.00 | 3,49,200.00 |

| 23 | FLEXICAP OPPORTUNITIES FUND | 1,200 | 0.01% | 291.00 | 3,49,200.00 |

| 24 | INTEGRATED CORE STRATEGIES (ASIA) PTE. LTD. | 1,71,870 | 1.75% | 291.00 | 5,00,14,170.00 |

| 25 | COPTHALL MAURITIUS INVESTMENT LIMITED – ODI ACCOUNT | 1,71,870 | 1.75% | 291.00 | 5,00,14,170.00 |

| 26 | SOCIETE GENERALE – ODI | 1,71,870 | 1.75% | 291.00 | 5,00,14,170.00 |

| Total | 97,93,812 | 100.00% | 2,84,99,99,292 | ||

Financial Inclusion Champion

- Muthoot Microfin focuses on empowering women through microloans, primarily targeting income generation in rural areas.

- It employs a joint liability group model, catering exclusively to women in low-income households.

- Muthoot Microfin IPO anchor investors are positive on the business model. As of December 31, 2022, Muthoot Microfin ranks as the fourth-largest NBFC-MFI in India by gross loan portfolio.

Regional Dominance

- Muthoot Microfin holds the third-largest position among NBFC-MFIs in South India.

- It boasts the top MFI market share in Kerala and a significant presence in Tamil Nadu (16% market share).

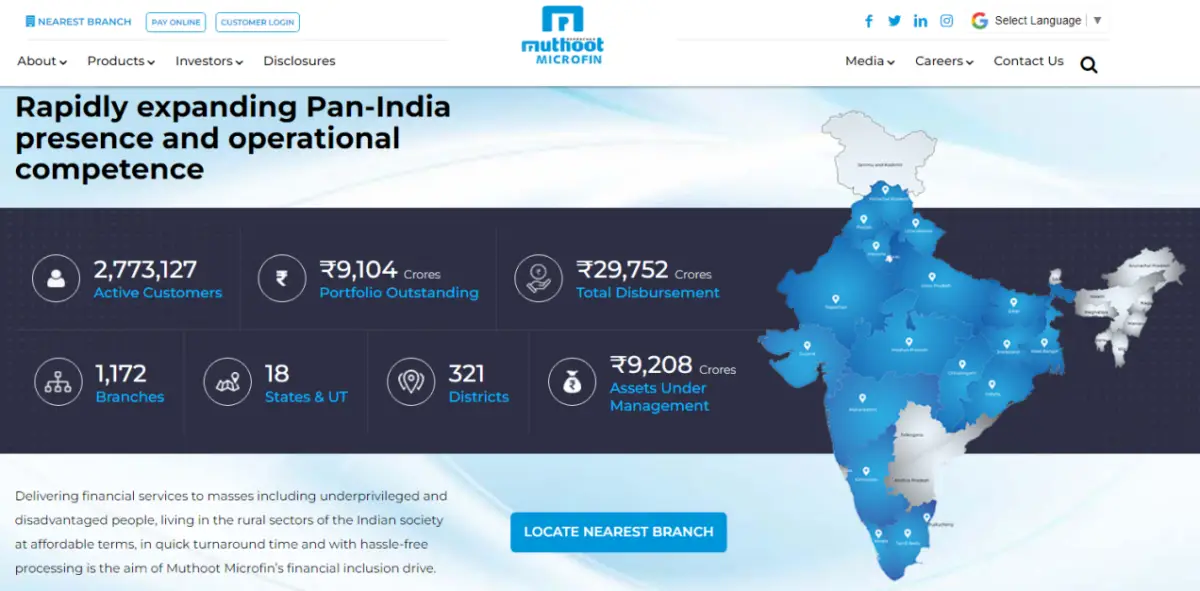

Strong Operational Footprint

- The company has a robust loan portfolio of INR 92,082.96 million as of March 31, 2023.

- It serves a remarkable 2.77 million active customers through a dedicated workforce of 10,227 employees.

- Muthoot Microfin operates across 1,172 branches strategically located in 321 districts across 18 states and union territories.

- Its focus on expanding into underserved rural markets ensures convenient access for its target customers.

Investment Potential

- Muthoot Microfin’s strong financial performance, market leadership, and dedication to financial inclusion make it a compelling investment proposition.

- The upcoming IPO presents an opportunity to participate in the growth story of India’s microfinance sector.

- While Muthoot Microfin IPO anchor investors are positive about the company, grey market is not far behind. The company’s IPO GMP is currently at nearly INR 100 per share, translating to a premium of nearly 34%.

- The company will compete with several others IPOs next week but positive sentiments in the stock market are likely to help.