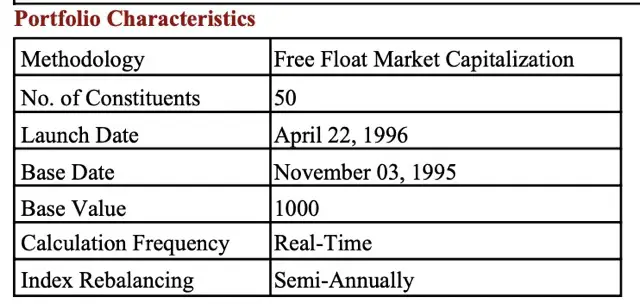

The Nifty 50 Index is widely recognized as the benchmark of Indian equity markets, representing the performance of the top 50 blue-chip companies listed on the National Stock Exchange (NSE). Designed using the free-float market capitalization method, the index is an effective barometer of market trends, investor sentiment, and sectoral shifts.

Launched in 1996 with a base year of 1995, the Nifty 50 has evolved into a multi-faceted tool — not just for investors tracking market momentum, but also for fund managers benchmarking portfolios, issuers creating ETFs and structured products, and analysts studying economic shifts.

Nifty 50 Weightage article provides a comprehensive and up-to-date analysis of the Nifty 50 in 2025, combining historical insights, sectoral breakdowns, stock weightages, and investment strategies.

nifty 50 weightage: The Foundation of Indian Equity

Meaning and Origin

The term “Nifty 50” combines “Nifty”, derived from National Stock Exchange Fifty, and “50”, denoting the number of constituent companies. It is one of the earliest and most liquid equity indices in India, often compared to international benchmarks like the S&P 500 in the U.S.

Computation Methodology

- Method: Free-float market capitalization.

- Review: Semi-annual, with cut-off dates on 31 January and 31 July.

- Variants:

- Nifty 50 (INR)

- Nifty 50 (USD)

- Nifty 50 Total Returns Index (TRI, Gross & Net)

- Nifty 50 Dividend Points Index

This ensures global relevance, allowing international investors to track Indian equities in multiple currencies.

Read Also: Nifty PE Ratio – Most Important Points You Need to Know

Nifty 50 Sector Weightage

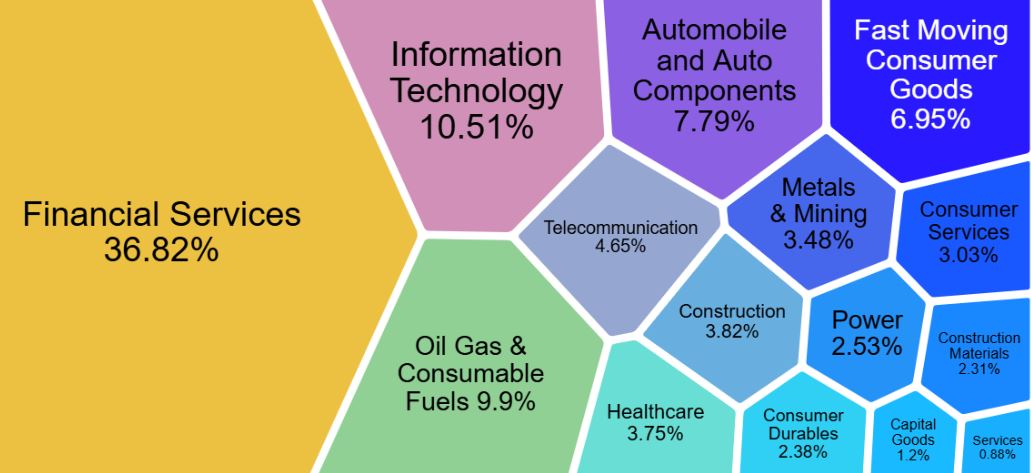

The NIFTY 50 Index gives a weightage of 36.82% to Financial Services, 10.51% to IT, 9.90% to Energy, 7.79% to Automobiles, 6.95% to Consumer Goods, and 4.65% to Telecommunication. The NIFTY 50 index is a free-float market capitalization index. It is essential to highlight that the Nifty weightage keeps changing according to the performance of constituent stocks.

Nifty 50 Stocks Weightage 2025: Nifty 50 Companies Weightage

| COMPANY NAME | SECTOR | WEIGHTAGE (%) |

| HDFC Bank Ltd. | Financial Services | 13.11 |

| ICICI Bank Ltd. | Financial Services | 9.00 |

| Reliance Industries Ltd. | Oil, Gas & Consumable Fuels | 8.31 |

| Infosys Ltd. | Information Technology | 4.78 |

| Bharti Airtel Ltd. | Telecommunication | 4.65 |

| Larsen & Toubro Ltd. | Construction | 3.82 |

| ITC Ltd. | Fast Moving Consumer Goods | 3.45 |

| Tata Consultancy Services Ltd. | Information Technology | 2.85 |

| State Bank of India | Financial Services | 2.79 |

| Axis Bank Ltd. | Financial Services | 2.70 |

| Kotak Mahindra Bank Ltd. | Financial Services | 2.60 |

| Mahindra & Mahindra Ltd. | Automobile and Auto Components | 2.55 |

| Hindustan Unilever Ltd. | Fast Moving Consumer Goods | 2.13 |

| Bajaj Finance Ltd. | Financial Services | 2.11 |

| Eternal (Zomato) | Consumer Services | 1.97 |

| Maruti Suzuki India Ltd. | Automobile and Auto Components | 1.75 |

| Sun Pharmaceutical Industries Ltd. | Healthcare | 1.55 |

| NTPC Ltd. | Power | 1.40 |

| HCL Technologies Ltd. | Information Technology | 1.39 |

| UltraTech Cement Ltd. | Construction Materials | 1.36 |

| Titan Company Ltd. | Consumer Durables | 1.35 |

| Tata Motors Ltd. | Automobile and Auto Components | 1.26 |

| Bharat Electronics Limited | Capital Goods | 1.20 |

| Tata Steel Ltd. | Metals & Mining | 1.15 |

| Power Grid Corporation of India Ltd. | Power | 1.13 |

| Trent Ltd | Consumer Services | 1.06 |

| Asian Paints Ltd. | Consumer Durables | 1.03 |

| Grasim Industries Ltd. | Construction Materials | 0.96 |

| Bajaj Finserv Ltd. | Financial Services | 0.94 |

| Jio Financial Services | Financial Services | 0.92 |

| Hindalco Industries Ltd. | Metals & Mining | 0.92 |

| Adani Ports and Special Economic Zone Ltd. | Services | 0.88 |

| JSW Steel Ltd. | Metals & Mining | 0.88 |

| Bajaj Auto Ltd. | Automobile and Auto Components | 0.86 |

| Tech Mahindra Ltd. | Information Technology | 0.85 |

| Oil & Natural Gas Corporation Ltd. | Oil, Gas & Consumable Fuels | 0.82 |

| Cipla Ltd. | Healthcare | 0.81 |

| Coal India Ltd. | Oil, Gas & Consumable Fuels | 0.77 |

| Eicher Motors Ltd. | Automobile and Auto Components | 0.76 |

| Nestle India Ltd. | Fast Moving Consumer Goods | 0.75 |

| HDFC Life Insurance Company Ltd. | Financial Services | 0.75 |

| Shriram Finance | Financial Services | 0.73 |

| SBI Life Insurance Company Ltd. | Financial Services | 0.73 |

| Dr. Reddy’s Laboratories Ltd. | Healthcare | 0.69 |

| Apollo Hospitals Enterprise Ltd. | Healthcare | 0.69 |

| Wipro Ltd. | Information Technology | 0.64 |

| Tata Consumer Products Ltd. | Fast Moving Consumer Goods | 0.63 |

| Hero MotoCorp Ltd. | Automobile and Auto Components | 0.60 |

| Adani Enterprises Ltd. | Metals & Mining | 0.53 |

| IndusInd Bank Ltd. | Financial Services | 0.44 |

Recent Changes in Index Composition

Additions & Exits

In the September 2025 review, two major reshuffles were announced:

- Additions: InterGlobe Aviation (IndiGo) and Max Healthcare.

- Exits: Hero MotoCorp and IndusInd Bank.

This reflects a shift towards sectors like aviation and healthcare, while legacy players in automobiles and mid-tier banking make way for newer growth leaders.

Earlier Updates

- September 2024: Trent Ltd. (retail) and Bharat Electronics Ltd. (defense) entered, highlighting retail consumption and defense investments.

Such changes are aligned with the eligibility criteria — liquidity, free-float market cap, trading frequency, and F&O eligibility

Also Read: Tata Group Companies: Comprehensive List of All Companies

Investment Avenues in Nifty 50

- Direct Stock Purchase: Investors can buy shares of all 50 constituents. However, replicating the index requires significant capital — about INR 1.9 lakhs for one share each, and more if weighted exposure is considered.

- Index Mutual Funds & ETFs: A more accessible route is via Nifty 50 mutual funds or ETFs, available with minimum SIPs of INR 500. These funds mirror index performance, offering diversification at low cost.

- Nifty F&O trading (Futures and Options): Traders can participate in Nifty F&O contracts, but these involve leverage risks. They are best suited for experienced investors with risk management strategies.

Why Nifty 50 Matters for Investors

- Barometer of Indian Economy: Covers multiple sectors, representing 65%+ of NSE’s free-float market cap.

- Benchmarking Tool: Used by mutual funds, PMS, and hedge funds.

- Global Access: Computed in INR, USD, AUD, CAD for international relevance.

- Liquidity & Depth: Stocks are among the most liquid, ensuring ease of entry and exit.

- Policy Impact: Sensitive to RBI rate changes, budget announcements, and global macro factors.

Top Nifty 50 Stocks List 2025: Selection Criteria

The inclusion is guided by strict eligibility norms:

- Liquidity: Impact cost ≤ 0.5% for 90% of trades in the last 6 months.

- Free-Float Market Capitalization: Must be ≥ 1.5× that of the smallest constituent.

- Trading Frequency: 100% over the past 6 months.

- F&O Eligibility: Only companies traded in the derivatives segment qualify.

- Listing History: At least 6 months (IPO stocks may qualify in 3 months).

These rules ensure investability, stability, and representation.

Read Also: Investing in US Stocks Through NSE IFSC

Read Also: Upcoming Reliance Group IPOs: Two IPOs Lined-Up

Nifty 50 Stocks Weightage – Recent Years

Nifty 50 Stocks Weightage 2024

| Company Name | Industry | Weightage (%) |

| Adani Enterprises Ltd. | Trading – minerals/ mining | 0.59 |

| Adani Ports and Special Economic Zone Ltd. | Port | 0.85 |

| Apollo Hospitals Enterprise Ltd. | Hospital | 0.70 |

| Asian Paints Ltd. | Paints | 0.97 |

| Axis Bank Ltd. | Private sector bank | 2.86 |

| Bajaj Auto Ltd. | Motorcycles/scooters | 0.92 |

| Bajaj Finance Ltd. | Nbfc | 1.80 |

| Bajaj Finserv Ltd. | General insurance | 0.81 |

| Bharat Electronics Ltd. | Defense | 0.99 |

| Bharat Petroleum Corporation Ltd. | Refineries/marketing | 0.53 |

| Bharti Airtel Ltd. | Telecom – services | 4.01 |

| Britannia Industries Ltd. | Consumer food | 0.53 |

| Cipla Ltd. | Pharmaceuticals | 0.79 |

| Coal India Ltd. | Industrial minerals | 0.82 |

| Dr. Reddy’s Laboratories Ltd. | Pharmaceuticals | 0.80 |

| Eicher Motors Ltd. | Motorcycles/scooters | 0.62 |

| Grasim Industries Ltd. | Cement | 0.85 |

| HCL Technologies Ltd. | Computers – software | 1.91 |

| HDFC Bank Ltd. | Private sector bank | 12.70 |

| HDFC Life Insurance Company Ltd. | Life insurance | 0.62 |

| Hero MotoCorp Ltd. | Motorcycles/scooters | 0.51 |

| Hindalco Industries Ltd. | Aluminium | 0.82 |

| Hindustan Unilever Ltd. | Diversified | 1.95 |

| ICICI Bank Ltd. | Private sector bank | 8.52 |

| ITC Ltd. | Cigarettes & related products | 4.24 |

| IndusInd Bank Ltd. | Private sector bank | 0.60 |

| Infosys Ltd. | Computers – software | 6.38 |

| JSW Steel Ltd. | Steel | 0.81 |

| Kotak Mahindra Bank Ltd. | Private sector bank | 2.47 |

| Larsen & Toubro Ltd. | Engineering-designing-construction | 4.00 |

| Mahindra & Mahindra Ltd. | Passenger/utility vehicles | 2.51 |

| Maruti Suzuki India Ltd. | Passenger/utility vehicles | 1.35 |

| NTPC Ltd. | Power | 1.49 |

| Nestle India Ltd. | Consumer food | 0.73 |

| Oil & Natural Gas Corporation Ltd. | Oil exploration | 0.87 |

| Power Grid Corporation of India Ltd. | Power – transmission | 1.32 |

| Reliance Industries Ltd. | Refineries/marketing | 7.77 |

| SBI Life Insurance Company Ltd. | Life insurance | 0.59 |

| Shriram Finance Ltd. | Nbfc | 0.76 |

| State Bank of India | Public sector bank | 2.88 |

| Sun Pharmaceutical Industries Ltd. | Pharmaceuticals | 1.92 |

| Tata Consultancy Services Ltd. | Computers – software | 3.94 |

| Tata Consumer Products Ltd. | Tea & coffee | 0.56 |

| Tata Motors Ltd. | Passenger/utility vehicles | 1.46 |

| Tata Steel Ltd. | Steel | 1.08 |

| Tech Mahindra Ltd. | Computers – software | 1.02 |

| Titan Company Ltd. | Gems, jewellery, and watches | 1.27 |

| Trent Ltd. | Speciality retail | 1.49 |

| UltraTech Cement Ltd. | Cement | 1.23 |

| Wipro Ltd. | Computers – software | 0.81 |

Nifty 50 Stocks Weightage 2023

| Company Name | Industry | Weightage (%) |

| Adani Enterprises Ltd. | Trading – minerals/ mining | 0.79 |

| Adani Ports and Special Economic Zone Ltd. | Port | 0.79 |

| Apollo Hospitals Enterprise Ltd. | Hospital | 0.6 |

| Asian Paints Ltd. | Paints | 1.61 |

| Axis Bank Ltd. | Private sector bank | 3.22 |

| Bajaj Auto Ltd. | Motorcycles/scooters | 0.81 |

| Bajaj Finance Ltd. | Nbfc | 2.15 |

| Bajaj Finserv Ltd. | General insurance | 0.96 |

| Bharat Petroleum Corporation Ltd. | Refineries/marketing | 0.45 |

| Bharti Airtel Ltd. | Telecom – services | 2.75 |

| Britannia Industries Ltd. | Consumer food | 0.66 |

| Cipla Ltd. | Pharmaceuticals | 0.69 |

| Coal India Ltd. | Industrial minerals | 0.9 |

| Divi’s Laboratories Ltd. | Pharmaceuticals | 0.52 |

| Dr. Reddy’s Laboratories Ltd. | Pharmaceuticals | 0.74 |

| Eicher Motors Ltd. | Motorcycles/scooters | 0.6 |

| Grasim Industries Ltd. | Cement | 0.83 |

| HCL Technologies Ltd. | Computers – software | 1.63 |

| HDFC Bank Ltd. | Private sector bank | 13.52 |

| HDFC Life Insurance Company Ltd. | Life insurance | 0.72 |

| Hero MotoCorp Ltd. | Motorcycles/scooters | 0.57 |

| Hindalco Industries Ltd. | Aluminium | 0.95 |

| Hindustan Unilever Ltd. | Diversified | 2.5 |

| ICICI Bank Ltd. | Private sector bank | 7.36 |

| ITC Ltd. | Cigarettes & related products | 4.31 |

| IndusInd Bank Ltd. | Private sector bank | 1.11 |

| Infosys Ltd. | Computers – software | 5.8 |

| JSW Steel Ltd. | Steel | 0.88 |

| Kotak Mahindra Bank Ltd. | Private sector bank | 2.95 |

| LTIMindtree Ltd. | Computers – software | 0.61 |

| Larsen & Toubro Ltd. | Engineering-designing-construction | 4.39 |

| Mahindra & Mahindra Ltd. | Passenger/utility vehicles | 1.63 |

| Maruti Suzuki India Ltd. | Passenger/utility vehicles | 1.43 |

| NTPC Ltd. | Power | 1.56 |

| Nestle India Ltd. | Consumer food | 1 |

| Oil & Natural Gas Corporation Ltd. | Oil exploration | 0.84 |

| Power Grid Corporation of India Ltd. | Power – transmission | 1.14 |

| Reliance Industries Ltd. | Refineries/marketing | 9.2 |

| SBI Life Insurance Company Ltd. | Life insurance | 0.68 |

| State Bank of India | Public sector bank | 2.59 |

| Sun Pharmaceutical Industries Ltd. | Pharmaceuticals | 1.43 |

| Tata Consultancy Services Ltd. | Computers – software | 4.05 |

| Tata Consumer Products Ltd. | Tea & coffee | 0.69 |

| Tata Motors Ltd. | Passenger/utility vehicles | 1.45 |

| Tata Steel Ltd. | Steel | 1.19 |

| Tech Mahindra Ltd. | Computers – software | 0.84 |

| Titan Company Ltd. | Gems, jewellery, and watches | 1.61 |

| UPL Ltd. | Pesticides and agrochemicals | 0.31 |

| UltraTech Cement Ltd. | Cement | 1.28 |

| Wipro Ltd. | Computers – software | 0.7 |

Nifty 50 Stocks Weightage 2022

| Company Name | Industry | Weightage (%) |

| Adani Enterprises Ltd. | Trading – minerals/ mining | 1.32 |

| Adani Ports and Special Economic Zone Ltd. | Port | 0.77 |

| Apollo Hospitals Enterprise Ltd. | Hospital | 0.57 |

| Asian Paints Ltd. | Paints | 1.74 |

| Axis Bank Ltd. | Private sector bank | 3.16 |

| Bajaj Auto Ltd. | Motorcycles/scooters | 0.51 |

| Bajaj Finance Ltd. | Nbfc | 2.19 |

| Bajaj Finserv Ltd. | General insurance | 1.05 |

| Bharat Petroleum Corporation Ltd. | Refineries/marketing | 0.4 |

| Bharti Airtel Ltd. | Telecom – services | 2.52 |

| Britannia Industries Ltd. | Consumer food | 0.64 |

| Cipla Ltd. | Pharmaceuticals | 0.73 |

| Coal India Ltd. | Industrial minerals | 0.59 |

| Divi’s Laboratories Ltd. | Pharmaceuticals | 0.54 |

| Dr. Reddy’s Laboratories Ltd. | Pharmaceuticals | 0.64 |

| Eicher Motors Ltd. | Motorcycles/scooters | 0.56 |

| Grasim Industries Ltd. | Cement | 0.81 |

| HCL Technologies Ltd. | Computers – software | 1.37 |

| HDFC Bank Ltd. | Private sector bank | 8.96 |

| HDFC Life Insurance Company Ltd. | Life insurance | 0.7 |

| Hero MotoCorp Ltd. | Motorcycles/scooters | 0.44 |

| Hindalco Industries Ltd. | Aluminium | 0.86 |

| Hindustan Unilever Ltd. | Diversified | 2.86 |

| Housing Development Finance Corporation Ltd. | Housing finance | 5.94 |

| ICICI Bank Ltd. | Private sector bank | 7.76 |

| ITC Ltd. | Cigarettes & related products | 3.65 |

| IndusInd Bank Ltd. | Private sector bank | 0.99 |

| Infosys Ltd. | Computers – software | 6.9 |

| JSW Steel Ltd. | Steel | 0.9 |

| Kotak Mahindra Bank Ltd. | Private sector bank | 3.31 |

| Larsen & Toubro Ltd. | Engineering-designing-construction | 3.15 |

| Mahindra & Mahindra Ltd. | Passenger/utility vehicles | 1.49 |

| Maruti Suzuki India Ltd. | Passenger/utility vehicles | 1.39 |

| NTPC Ltd. | Power | 0.99 |

| Nestle India Ltd. | Consumer food | 0.87 |

| Oil & Natural Gas Corporation Ltd. | Oil exploration | 0.72 |

| Power Grid Corporation of India Ltd. | Power – transmission | 0.91 |

| Reliance Industries Ltd. | Refineries/marketing | 10.98 |

| SBI Life Insurance Company Ltd. | Life insurance | 0.69 |

| State Bank of India | Public sector bank | 2.94 |

| Sun Pharmaceutical Industries Ltd. | Pharmaceuticals | 1.35 |

| Tata Consultancy Services Ltd. | Computers – software | 4.17 |

| Tata Consumer Products Ltd. | Tea & coffee | 0.58 |

| Tata Motors Ltd. | Passenger/utility vehicles | 0.87 |

| Tata Steel Ltd. | Steel | 1.14 |

| Tech Mahindra Ltd. | Computers – software | 0.79 |

| Titan Company Ltd. | Gems, jewellery, and watches | 1.35 |

| UPL Ltd. | Pesticides and agrochemicals | 0.48 |

| UltraTech Cement Ltd. | Cement | 1 |

| Wipro Ltd. | Computers – software | 0.73 |

Risks and Considerations

While Nifty 50 provides stability, risks remain:

- Sector Concentration: Banking holds ~37%, making the index sensitive to RBI policies.

- Global Linkages: IT and energy stocks depend on foreign demand and crude oil prices.

- Rebalancing Risks: Companies may get excluded due to underperformance.

- Market Valuations: P/E ratio (2025: 21.46), P/B (3.27), dividend yield (1.37%) suggest periodic overvaluation

Nifty 50 Weightage Frequently Asked Questions

How many stocks are in the Nifty 50 Index?

The Nifty 50 index comprises 50 stocks selected based on their free-float market capitalization.

Which sector has the maximum weightage in Nifty 50?

Nifty 50 sector weightage is dominated by Financial Services which holds 36.82% of the index. Information Technology follows with a 10.51% share, while the Energy sector accounts for 9.90%, making them the next most dominant players in the Nifty 50 sector weightage list for 2025.

How often is the Nifty 50 rebalanced?

The Nifty 50 index is re-balanced on a semi-annual basis i.e., every six months. The cut-off dates for rebalance purposes are 31 January and 31 July of each year.

How soon an IPO stock can enter the Nifty 50 Companies List 2025?

Although the index requires a minimum listing history of 6 months, this criterion can be relaxed to 3 months for recently listed stocks through IPO, provided all other requirements are met.

What is the Reliance weightage in Nifty 50?

As of 29 August 2025, Reliance’s weightage in the Nifty 50 stood at 8.31%, making it one of the most valuable companies in India.

Good feedback