Last updated on July 12, 2024

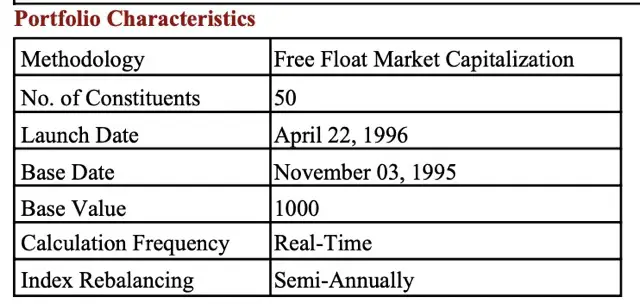

The Nifty 50 stock list tracks the performance of the top 50 blue-chip companies on the National Stock Exchange (NSE) based on market capitalization. The Nifty 50 is an Indian benchmark index. It represents the weighted average of the top 50 NSE-listed companies. Nifty 50 Index is formed by combining two terms: Nifty, which refers to the National Stock Exchange, and 50, a collection of the National Stock Exchange’s 50 best-performing stocks.

Essentially, it serves as a barometer for the overall movement of the stock market. NIFTY 50 can be used for various purposes such as benchmarking fund portfolios, launching index funds, ETFs, and structured products. NIFTY 50 is computed in four currencies namely Indian Rupee (INR), US Dollar (USD), Australian Dollar (AUD), and Canadian Dollar (CAD).

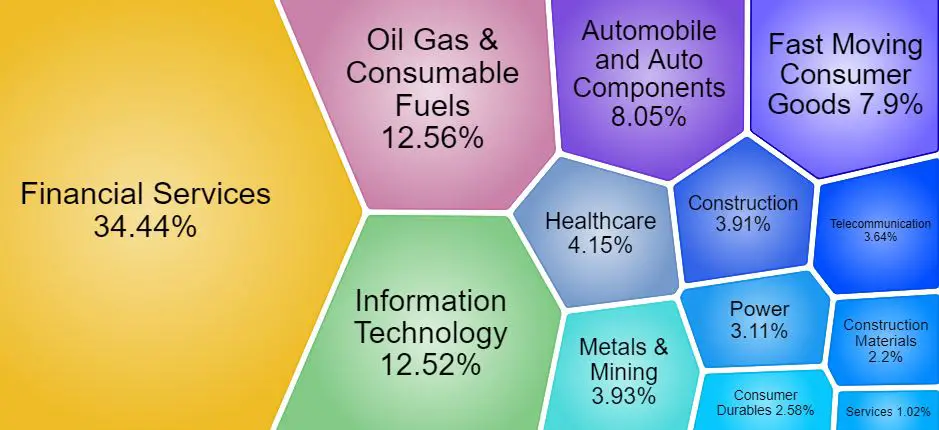

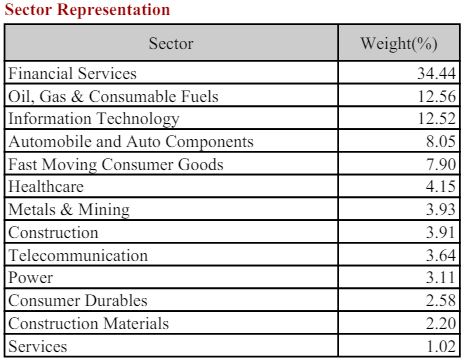

Nifty 50 Sector Weightage

The NIFTY 50 Index gives a weightage of 34.44% to Financial Services, 12.56% to Energy, 12.52% to IT, 8.05% to Automobiles, 7.90% to Consumer Goods, and 4.15% to Healthcare. The NIFTY 50 index is a free-float market capitalization index. It is important to highlight that the Nifty 50 weightage of sectors keeps changing according to the performance of constituent stocks.

Read Also: Nifty PE Ratio – Most Important Points You Need to Know

Nifty 50 Companies Weightage: 2024

The Nifty 50 share list top 10 stocks consisted of the following

Nifty 50 Stock List 2024: Nifty Stock Weightage 2024

| COMPANY NAME | SECTOR | WEIGHTAGE (%) |

| HDFC Bank Ltd. | Financial Services | 11.95 |

| Reliance Industries Ltd. | Oil Gas & Consumable Fuels | 9.98 |

| ICICI Bank Ltd. | Financial Services | 7.95 |

| Infosys Ltd. | Information Technology | 5.33 |

| Larsen & Toubro Ltd. | Construction | 3.91 |

| Tata Consultancy Services | Information Technology | 3.73 |

| ITC Ltd. | Fast Moving Consumer Goods | 3.70 |

| Bharti Airtel Ltd. | Telecommunication | 3.64 |

| Axis Bank Ltd. | Financial Services | 3.39 |

| State Bank of India | Financial Services | 3.07 |

| Mahindra & Mahindra | Automobile and Auto Components | 2.62 |

| Kotak Mahindra Bank Ltd. | Financial Services | 2.50 |

| Hindustan Unilever Ltd. | Fast Moving Consumer Goods | 2.08 |

| Bajaj Finance Ltd. | Financial Services | 1.87 |

| NTPC Ltd. | Power | 1.69 |

| Tata Motors Ltd. | Automobile and Auto Components | 1.64 |

| Sun Pharmaceutical Industries | Healthcare | 1.55 |

| Maruti Suzuki India Ltd. | Automobile and Auto Components | 1.50 |

| HCL Technologies Ltd. | Information Technology | 1.46 |

| Power Grid Corporation of India | Power | 1.42 |

| Tata Steel Ltd. | Metals & Mining | 1.35 |

| Titan Company Ltd. | Consumer Durables | 1.34 |

| UltraTech Cement Ltd. | Construction Materials | 1.27 |

| Asian Paints Ltd. | Consumer Durables | 1.24 |

| Coal India Ltd. | Oil Gas & Consumable Fuels | 1.02 |

| Adani Ports and Special Economic | Services | 1.02 |

| Oil & Natural Gas Corporation | Oil Gas & Consumable Fuels | 1.01 |

| Bajaj Auto Ltd. | Automobile and Auto Components | 1.00 |

| Hindalco Industries Ltd. | Metals & Mining | 0.95 |

| Grasim Industries Ltd. | Construction Materials | 0.93 |

| IndusInd Bank Ltd. | Financial Services | 0.91 |

| Nestle India Ltd. | Fast Moving Consumer Goods | 0.86 |

| Tech Mahindra Ltd. | Information Technology | 0.86 |

| JSW Steel Ltd. | Metals & Mining | 0.84 |

| Bajaj Finserv Ltd. | Financial Services | 0.81 |

| Adani Enterprises Ltd. | Metals & Mining | 0.78 |

| Shriram Finance | Financial Services | 0.76 |

| Cipla Ltd. | Healthcare | 0.73 |

| Dr. Reddy’s Laboratories Ltd. | Healthcare | 0.73 |

| Hero MotoCorp Ltd. | Automobile and Auto Components | 0.68 |

| Wipro Ltd. | Information Technology | 0.68 |

| Tata Consumer Products Ltd. | Fast Moving Consumer Goods | 0.65 |

| SBI Life Insurance Company | Financial Services | 0.63 |

| Britannia Industries Ltd. | Fast Moving Consumer Goods | 0.61 |

| Eicher Motors Ltd. | Automobile and Auto Components | 0.60 |

| Apollo Hospitals Enterprise | Healthcare | 0.59 |

| HDFC Life Insurance | Financial Services | 0.59 |

| Bharat Petroleum Corporation | Oil Gas & Consumable Fuels | 0.56 |

| Divi’s Laboratories Ltd. | Healthcare | 0.55 |

| LTIMindtree | Information Technology | 0.47 |

Top Nifty 50 Companies: How to Invest in Them?

1- Investing directly in individual stocks

One can directly buy stocks in the Nifty 50 index if capital availability is there. To purchase one share from each of the Nifty 50 constituents, an investor needs to invest approximately INR 1.9 lakhs and not all retail investors have this much money to invest. Furthermore, managing 50 stocks can be extremely difficult.

Read Also: Difference Between FDI and FII Explained in 10 Points

2- Invest through Mutual Fund

A better decision is to pick mutual funds that invest the pool money in NIFTY 50 stocks only. One can start investing in a mutual fund tracking NIFTY 50 companies with a minimum SIP of INR 500. Investment can also be made in lumpsum mode.

3- Nifty F&O trading (Futures and Options)

Investors with limited capital can invest in Nifty Futures and Options, but because of the high leverage in the F&O sector, investors may incur significant losses.

Top Nifty 50 Companies List 2024: Selection Criteria

A set of guidelines and criteria need to be followed to determine which stocks or companies will be included in the Nifty 50 stocks. The following are the criteria for deciding on Nifty 50 companies:

Read Also: Investing in US Stocks Through NSE IFSC

Nifty 50 Stocks: Liquidity

The Nifty 50 stocks must have traded at an average impact cost of 0.50% or less during the last six months for 90% of the observations for a portfolio of INR 10 crores. In simple terms, impact cost is the cost that an investor must incur to execute his buy or sell order against the ideal cost of that stock. Companies with lower impact costs are more likely to have high liquidity than companies with higher impact costs.

Liquidity in the context of stock markets means a market where large orders can be executed without incurring a high transaction cost. The transaction cost referred to here is attributable to a lack of market liquidity rather than the fixed costs typically incurred such as brokerage, transaction charges, depository charges, and so on. Liquidity is generated by market buyers and sellers who are constantly looking for buying and selling opportunities. Buyers and sellers pay a high price when there is a lack of liquidity.

Read Also: Nifty Auto Index – Full list of constituents and their weightages

Nifty 50 Stocks: Float-Adjusted Market Capitalization

Their free-float market capitalization determines the NSE 50 list of companies. Nifty 50 stocks’ free-float market cap is calculated by multiplying its stock price by the total number of shares available in the market. For example, if a company has 20,000 shares in free float and the price of each is INR 100, the company’s free-float market cap is INR 20 lakh (20,000 * 100). Companies will be eligible for inclusion in the NIFTY 50 stocks index provided the average free-float market capitalization is at least 1.5 times the average free-float market capitalization of the smallest constituent in the index.

Nifty 50 Stocks: Trading Frequency

The company’s trading frequency should be 100% in the last six months.

Nifty 50 Companies List 2024: Futures & Options segment

Only companies that are permitted to trade in the F&O segment are eligible to be included in the Nifty 50 stock list.

Nifty 50 Stocks: Newly-listed Stock

The Nifty 50 company list stocks should have a listing history of 6 months. If a company files for an IPO, it will be eligible for inclusion in the index if it meets the normal eligibility criteria for the index for 3 months rather than 6 months. This relaxation is only for IPO listing and the listing history remains 6 months for other listing options such as demergers and takeovers.

Happy Investing!

Latest Content From IPO Central

Nifty 50 Index Frequently Asked Questions

How many stocks are in the Nifty 50 Index?

Nifty 50 index comprises 50 stocks selected based on their free-float market capitalization.

Which sector has the maximum weightage in Nifty 50?

With a weightage of (34.44%), Financial Services is the leading sector in the Nifty 50 index. Oil & Gas (12.56%) and Information Technology (12.52%) are the next dominant sectors in Nifty 50 companies list for 2024.

How often is Nifty 50 rebalanced?

Nifty 50 index is re-balanced on a semi-annual basis i.e. every six months. The cut-off dates for rebalance purposes are 31 January and 31 July of each year.

How soon an IPO stock can enter the Nifty 50 Companies List 2024?

Although the index requires a minimum listing history of 6 months, this criterion can be relaxed to 3 months for recently listed stocks through IPO, provided all other requirements are met.