The NIFTY Auto Index is designed to depict the behavior and performance of the Automobile segment of the financial market. The NIFTY Auto Index is made up of 15 tradable, exchange-traded companies. The index represents auto-related sectors like Automobiles 4 wheelers, Automobiles 2 & 3 wheelers, Auto Ancillaries and Tyres. The index has a base date of 1 January 2004 and is indexed to a base value of 1000. In this article, we have compiled a Nifty auto weightage which is periodically updated.

Like its elder cousin, the NIFTY 50, the NIFTY Auto Index is also calculated using the free float market capitalization method. The index level reflects the total free float market value of all stocks in the index relative to a particular base market capitalization value. The index represents about 6.65% of the free float market capitalization of the stocks listed on the NSE and 92.92% of the free float market capitalization of the stocks forming part of the automobile sector universe as of 30 December 2011.

NIFTY Auto companies index can be used to benchmark fund portfolios and launch index funds by mutual funds, ETFs, and structured products.

Read Also: NSE IFSC Trading In US Stocks: All You Need To Know

Nifty Auto Index Re-Balancing

Nifty Auto Index is re-balanced on a semi-annual basis, with the cut-off dates being 31 January and 31 July of each year. What this means is that for a semi-annual review of indices, average data for six months ending the cut-off date is considered. Four weeks’ prior notice is given to the market from the date of the change.

Nifty Auto Index: Auto Eco-System

- Original Equipment Manufacturers (OEMs) are the big players in automotive ecosystems. Naturally, they have an advantage and bargaining power over the other players. Maruti Suzuki, Bajaj Auto, and other OEMs are examples.

- The auto ancillaries are vendors of different components to OEMs and are part of the ecosystem. Numerous auto ancillaries produce tyres, engines, fasteners, forging components, crankshafts, batteries, and so on. Motherson Sumi, Sundram Fasteners, Gabriel India, Exide Industries, and MRF are the ancillaries among Nifty auto companies.

Nifty Auto Companies: Key Drivers

- Shares of four-wheeler companies such as Maruti, Ashok Leyland, and Mahindra & Mahindra have risen by up to 50% over the last 12 months on the bourses as sales improved amid easing semiconductor shortages and increased demand.

- Except for two-wheelers, the rest of the auto industry is extremely sensitive to changes in the overall economic outlook and interest rates due to its ticket size. Consumer sentiment is important in high-priced purchases. Furthermore, the outlook for commercial vehicles is influenced by the general economy.

- Automobiles are either a user’s discretionary purchase or used for economic purposes. The auto industry is cyclical, with periodic downturns. Economic activity, interest rates, available financing options, wage/salary growth, and the regulatory environment all influence cycle sensitivity.

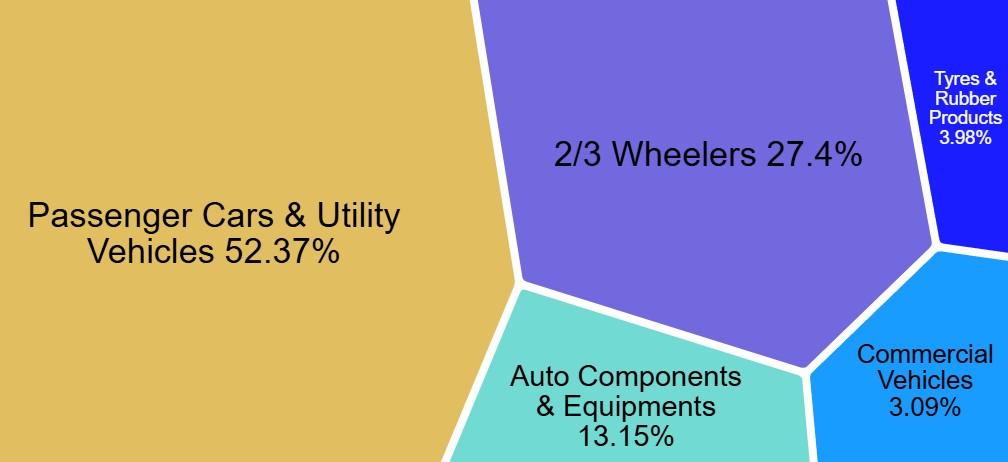

Nifty Auto Weightage

In terms of weightage, the top companies in the Nifty Auto Stocks list are Mahindra & Mahindra 24.02%, Maruti Suzuki India 16.49%, Tata Motors 11.86%, Bajaj Auto 8.12%, and Eicher Motors 7.13%.

Nifty Auto Stocks List With Weightage

| Company Name | Sector | Price (INR) | Weightage (%) |

| Mahindra & Mahindra Ltd | Passenger Cars & Utility Vehicles | 3,295.3 | 24.02 |

| Maruti Suzuki India Ltd | Passenger Cars & Utility Vehicles | 14,752.0 | 16.49 |

| Tata Motors Ltd. | Passenger Cars & Utility Vehicles | 675.5 | 11.86 |

| Bajaj Auto Ltd. | 2/3 Wheelers | 8,689.5 | 8.12 |

| Eicher Motors Ltd. | 2/3 Wheelers | 6,133.0 | 7.13 |

| TVS Motor Company Ltd. | 2/3 Wheelers | 3,256.0 | 6.54 |

| Hero MotoCorp Ltd. | 2/3 Wheelers | 5,091.7 | 5.61 |

| Samvardhana Motherson International | Auto Components & Equipments | 92.1 | 3.48 |

| Ashok Leyland Ltd | Commercial Vehicles | 129.8 | 3.09 |

| Bosch Ltd. | Auto Components & Equipments | 39,225.0 | 2.94 |

| Tube Investments of India | Auto Components & Equipments | 2,943.4 | 2.69 |

| Bharat Forge Ltd. | Auto Components & Equipments | 1,124.6 | 2.51 |

| MRF Ltd. | Tyres & Rubber Products | 142,275.0 | 2.43 |

| Balkrishna Industries Ltd. | Tyres & Rubber Products | 2,318.9 | 1.56 |

| Exide Industries | Auto Components & Equipments | 394.0 | 1.53 |

Nifty Auto Stock Index

Read Also: Biggest Automobile Companies in India

Nifty Auto Stocks List: Eligible Basic Industries

The following industries are eligible to be considered when forming companies for inclusion in the Nifty Auto Index List:

- 2/3 Wheelers

- Auto Components & Equipment

- Batteries – Automobile

- Castings & Forgings

- Commercial Vehicles

- Fastener

- Gas Cylinders

- Passenger Cars & Utility Vehicles

- Tractors

- Trading – Auto Ancillaries

- Trading – Automobiles

- Tyres & Rubber Products

Nifty Auto Stocks List: Eligibility Criteria

- Companies should form part of the NIFTY 500 at the time of review. In case the number of eligible stocks representing a particular sector within NIFTY 500 falls below 10, then the deficit number of stocks shall be selected from the universe of stocks ranked within the top 800 based on both average daily turnover and average daily full market capitalization based on the previous six-month period data used for index rebalancing of NIFTY 500.

- Companies should form a part of the Automobile sector.

- The company’s trading frequency should be at least 90% in the last six months.

- The company should have a 6-month listing history. If a company files for an IPO, it will be eligible for inclusion in the index if it meets the normal eligibility criteria for the index for 3 months rather than 6 months. The final selection of 15 companies shall be made based on the free-float market capitalization of the companies.

- Nifty Auto weightage of each stock is calculated based on its free-float market capitalization, such that no single stock shall be more than 33% and the weightage of the top 3 stocks cumulatively shall not be more than 62% at the time of rebalancing.

- Companies will be included if their free-float market capitalization is at least 1.5 times the free-float market capitalization of the smallest index constituent in the respective index.

Conclusion

The automotive industry is an important sector in the Indian economy and it weighs nearly 7.79% in the Nifty 50 Index. Accordingly, Nifty Auto is an important index but one should not pick Nifty Auto stocks purely based on past returns. The auto industry is highly cyclical and depending on research and risk appetite, one should invest.

Nifty Auto Stocks Weightage FAQs

How many stocks are there in the Nifty Auto Index?

Nifty Auto Index has 15 stocks from auto-related sectors like Automobiles 4-wheelers, Automobiles 2 & 3-wheelers, Auto Ancillaries, and Tyres.

How frequently is the Nifty Auto Index rebalanced?

Nifty Auto Index is rebalanced every 6 months, with the cut-off dates being 31 January and 31 July of each year.

Which company tops in the Nifty Auto weightage?

As of 29 August 2025, Mahindra & Mahindra had the maximum weightage of 24.02%.

What is Nifty Auto’s performance in the last 12 months?

As of 29 August 2025, the index delivered losses of 3.74% over the last 1 year including dividends.

Can we trade in the Nifty Auto index?

Unlike the Nifty 50, there is no instrument to directly trade the Nifty Auto index. However, investors can invest in mutual funds tracking the index. One such example is Nippon India Nifty Auto ETF.