The Nifty Energy Index is a sectoral index which tracks the performance of companies in India’s energy sector, covering petroleum, gas and power industries. Comprising 40 stocks listed on the National Stock Exchange of India (NSE), the index is a benchmark for fund portfolios and underlies various investment products. Here is the Nifty Energy weightage which is updated periodically.

What is the Nifty Energy Index?

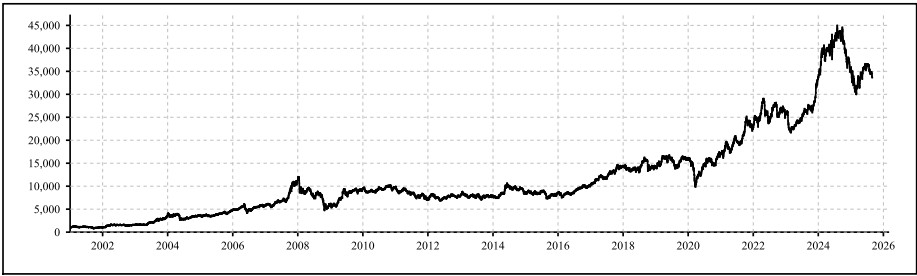

Nifty Energy is calculated using the free float market capitalization method, where the level of the index reflects the total free float market value of all the stocks in the index relative to a base market capitalization value. The base date for the index is 1st January 2001 and the base value is 1000, though it was launched in July 2005.

Nifty Energy Sector can be used for various purposes like benchmarking fund portfolios and launching index funds, ETFs and structured products.

Nifty Energy Companies Re-Balancing

Nifty Energy is rebalanced on a semi-annual basis. The cut-off dates are 31 January and 31 July of each year. For semi-annual review of indices, average data for six months ending the cut-off date is considered. A prior notice of at least four weeks is given to the market from the date of the change. As a result, the changes made on 31 January will be effective from 31 March.

Index Governance

Nifty Energy is managed by a professional team under a three-tier governance structure comprising:

- Index Maintenance Sub-Committee: Oversees the maintenance of the index.

- Board of Directors: NSE Indices Limited

- Index Advisory Committee (Equity): Guides index methodologies.

Key Features of the Nifty Energy Index

- Sector Focus: Represents the performance of companies from the energy sector including oil, gas, electricity and other energy-related businesses.

- Advance Notification: Market participants are given at least four weeks’ notice before any index changes are implemented.

- Free Float Market Capitalization: Uses the free float market capitalization method for index calculation, ensuring representation based on publicly available shares.

- Base Date and Value: Has a defined base date and base value, serving as a benchmark for performance comparison.

- Liquidity and Eligibility Criteria: Constituents are selected based on predefined eligibility criteria, including trading frequency and liquidity requirements.

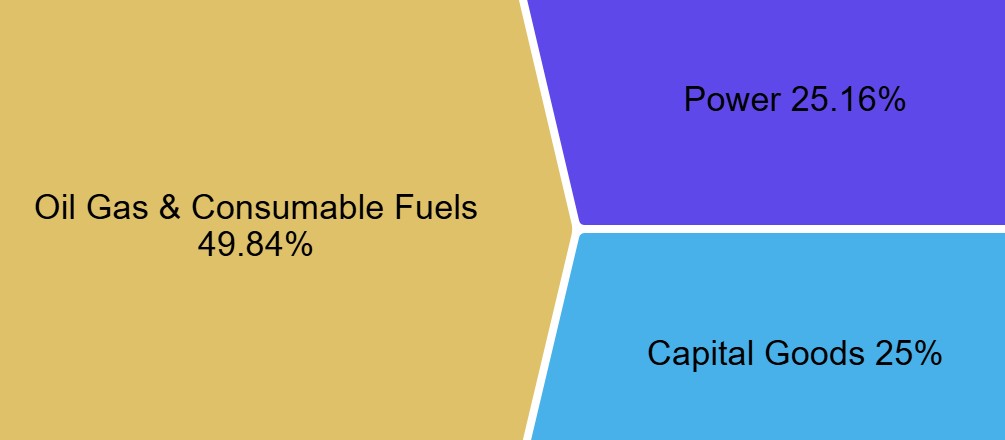

Nifty Energy Sector Weightage

The NIFTY Energy Index gives a weightage of 9.82% to Reliance Industries, 9.79% to Oil & Natural Gas Corporation, 9.18% to Coal India, 6.92% to NTPC Ltd, and 6.95% to Suzlon Energy. The NIFTY Energy is a free-float market capitalization index. It is important to highlight that the Nifty Energy weightage of sectors keeps changing according to the performance of constituent stocks.

Nifty Energy Sectoral Distribution

Nifty Energy Stocks List With Weightage 2025

| COMPANY NAME | SECTOR | WEIGHTAGE (%) |

| Reliance Industries Ltd. | Oil, Gas & Consumable Fuels | 9.82 |

| Oil & Natural Gas Corporation | Oil, Gas & Consumable Fuels | 9.79 |

| Coal India Ltd. | Oil, Gas & Consumable Fuels | 9.18 |

| NTPC Ltd. | Power | 6.92 |

| Suzlon Energy Ltd. | Capital Goods | 5.95 |

| Power Grid Corporation of India Ltd. | Power | 5.56 |

| GAIL (India) Ltd. | Oil, Gas & Consumable Fuels | 5.03 |

| CG Power and Industrial Solutions Ltd. | Capital Goods | 3.94 |

| GE Vernova T&D India Ltd. | Capital Goods | 3.05 |

| Tata Power Co. Ltd. | Power | 2.80 |

| Siemens Ltd. | Capital Goods | 2.40 |

| Bharat Heavy Electricals Ltd. | Capital Goods | 2.37 |

| ABB India Ltd. | Capital Goods | 2.32 |

| Oil India Ltd. | Oil, Gas & Consumable Fuels | 2.30 |

| Petronet LNG Ltd. | Oil, Gas & Consumable Fuels | 2.18 |

| Hitachi Energy India Ltd. | Capital Goods | 2.15 |

| Adani Power Ltd. | Power | 2.11 |

| Bharat Petroleum Corporation Ltd. | Oil, Gas & Consumable Fuels | 1.80 |

| Adani Total Gas Ltd. | Oil, Gas & Consumable Fuels | 1.77 |

| Indraprastha Gas Ltd. | Oil, Gas & Consumable Fuels | 1.56 |

| Indian Oil Corporation Ltd. | Oil, Gas & Consumable Fuels | 1.54 |

| Adani Green Energy Ltd. | Power | 1.25 |

| Adani Energy Solutions Ltd. | Power | 1.23 |

| Inox Wind Ltd. | Capital Goods | 1.18 |

| JSW Energy Ltd. | Power | 1.17 |

| Thermax Ltd. | Capital Goods | 1.10 |

| Hindustan Petroleum Corporation Ltd. | Oil, Gas & Consumable Fuels | 1.09 |

| NHPC Ltd. | Power | 1.09 |

| Gujarat State Petronet Ltd. | Oil, Gas & Consumable Fuels | 1.04 |

| Torrent Power Ltd. | Power | 1.04 |

| Aegis Logistics Ltd. | Oil, Gas & Consumable Fuels | 0.91 |

| Gujarat Gas Ltd. | Oil, Gas & Consumable Fuels | 0.78 |

| Mahanagar Gas Ltd. | Oil, Gas & Consumable Fuels | 0.77 |

| Reliance Power Ltd. | Power | 0.55 |

| Triveni Turbine Ltd. | Capital Goods | 0.53 |

| CESC Ltd. | Power | 0.43 |

| Jaiprakash Power Ventures Ltd. | Power | 0.39 |

| NLC India Ltd. | Power | 0.33 |

| SJVN Ltd. | Power | 0.30 |

| Castrol India Ltd. | Oil, Gas & Consumable Fuels | 0.29 |

Nifty Energy Index

Nifty Energy Stocks List: Eligibility Criteria

To be included in Nifty Energy, companies must meet the following criteria:

- Inclusion in Nifty 500: Companies should be part of Nifty 500 at the time of review. If fewer than 10 eligible stocks from the energy sector are present in Nifty 500, additional stocks will be selected from the top 800 based on average daily turnover and full market capitalization over the last six months.

- Sector Classification: Companies must belong to the energy sector.

- Trading Frequency: Companies should have a trading frequency of at least 90% over the last six months.

- Listing History: Companies should have a minimum listing history of one month as of the cutoff date.

- Selection Criteria: The final selection of 40 companies is based on free float market capitalization.

- Weightage Constraints: No single stock shall have more than 33% weightage and the cumulative weightage of the top three stocks shall not exceed 62% at the time of rebalancing.

Nifty Energy Stocks List: Eligible Basic Industries

Companies from the following industries are eligible to be considered for inclusion in the Nifty Energy Companies Index List:

- Coal

- Gas Transmission/Marketing

- Heavy Electrical Equipment

- Integrated Power Utilities

- LPG/CNG/PNG/LNG Supplier

- Lubricants

- Offshore Support Solution Drilling

- Oil Exploration & Production

- Oil Storage & Transportation

- Oil Equipment & Services

- Power – Transmission

- Power Distribution

- Power Generation

- Power Trading

- Refineries & Marketing

- Trading – Coal

- Trading – Gas

Conclusion

Nifty Energy serves as a key benchmark for tracking the performance of India’s energy sector. By including leading companies across the oil, gas, and power industries and applying a systematic, transparent review process, the index offers investors a reliable tool for sectoral analysis and investment. This industry accounts for approximately 9.99% of the Nifty 50 Index.

Nifty Energy Index Weightage FAQs

How many stocks are there in the Nifty Energy Index?

Nifty Energy Index has 40 stocks like Reliance Industries, Oil & Natural Gas Corporation, Coal India, and NTPC Ltd.

How frequently is the Nifty Energy Index rebalanced?

The Nifty Energy Index is rebalanced every 6 months with the cut-off dates being 31 January and 31 July each year.

Which company tops in Nifty Energy stocks weightage?

On 29 August 2025, Reliance Industries had the maximum weightage of 9.82%, followed by Oil & Natural Gas Corporation at 9.79%.

What is Nifty Energy’s performance in the last 12 months?

As of 29 August 2025, the index delivered losses of 22.08% over the last 1 year, including dividends.

Can we trade directly in the Nifty Energy index?

Unfortunately, there are no instruments to trade intraday in the index. However, various mutual funds and ETFs are tracking the Energy index. One such example is ICICI Prudential Nifty Energy ETF. Investors can also pick sectoral mutual fund schemes like Nippon India’s CPSE ETF and SBI Energy Opportunities Fund which has a good overlap with the Nifty Energy Index.