The Indian equity market has seen a rise in thematic indices that allow investors to track specific segments of the economy. Among them, the Nifty MNC Index has established itself as a unique benchmark, designed to capture the performance of multinational companies (MNCs) with foreign promoter shareholding exceeding 50%. These businesses typically bring global expertise, strong governance standards, and highly recognizable brands to the Indian market.

Investors often analyze the Nifty MNC Stocks weightage to understand sectoral exposure and company-wise dominance within the index. With a well-defined methodology and periodic rebalancing, the index reflects how multinational companies contribute to India’s growth story while offering a diversified and defensive investment opportunity.

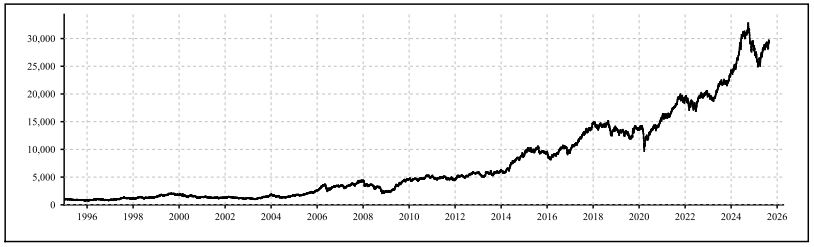

The index was launched on January 2, 1995, with a base value of 1,000 points. Initially comprising 15 companies, it was later expanded to include 30 companies on September 28, 2018. Today, the index not only reflects the strength of global businesses operating in India but also serves as an investment avenue through ETFs, index funds, and structured products.

What is the Nifty MNC Full Form, Meaning, and Index?

- Full Form: Nifty Multi-National Companies Index

- Theme: Tracks Indian-listed multinational companies with foreign promoter shareholding above 50%

- Base Date: 2 January 1995

- Base Value: 1,000

Read Also: Nifty Pharma Stocks List With Weightage in 2025

Methodology and Calculation

The Nifty MNC Index is calculated using the free-float market capitalization method, ensuring that the index level reflects the aggregated free-float value of all constituent stocks. Each stock’s weight is capped at 10% during rebalancing, although it may temporarily exceed this limit between review cycles.

This methodology prevents over-concentration in a single company while ensuring that large-cap and liquid companies dominate the index. As a result, investors gain a well-diversified basket of MNCs across different industries.

Governance and Rebalancing

The index is governed and maintained by NSE Indices Limited under a structured three-tier framework:

- Board of Directors of NSE Indices Limited

- Index Advisory Committee (Equity)

- Index Maintenance Sub-Committee

Constituents are rebalanced semi-annually, with cut-off dates on January 31 and July 31 each year. The review process considers six months of average data on turnover, market capitalization, and trading frequency. The market is notified at least four weeks in advance of any changes, ensuring transparency and predictability for investors.

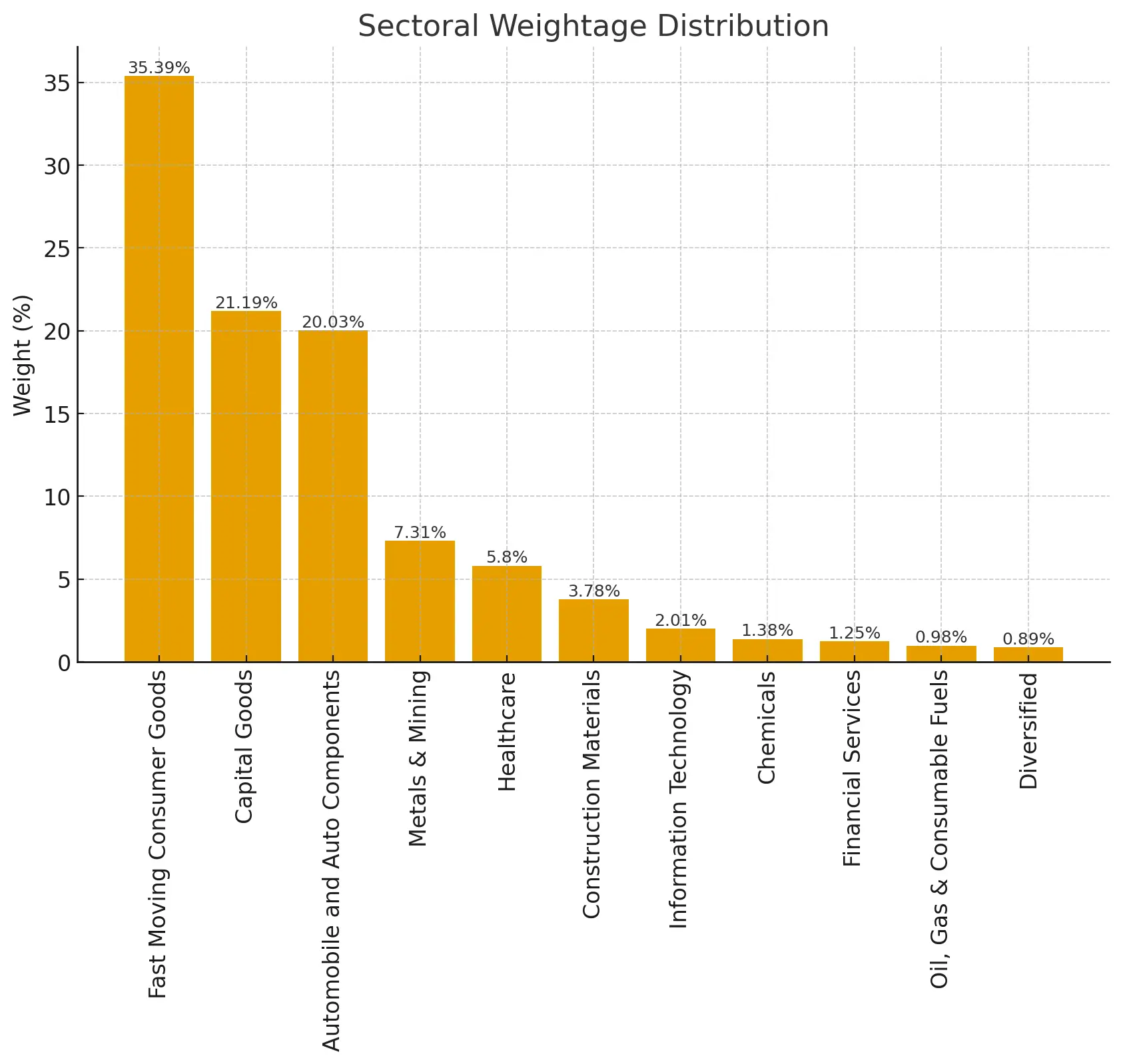

Nifty MNC Sector Weightage

The NIFTY MNC Index gives a weightage of 35.39% to FMCG, 21.19% to Capital Goods, 20.03% to Automobile and Auto Components, 7.31% to Metals & Mining, 5.80% to Healthcare, 3.78% to Construction Materials, and 2.01% Information Technology. The NIFTY MNC index is a free-float market capitalization index. It is important to highlight that the Nifty MNC weightage of sectors keeps changing according to the performance of constituent stocks.

Nifty MNC Sectoral Distribution

Nifty MNC stocks as of 31 August 2025

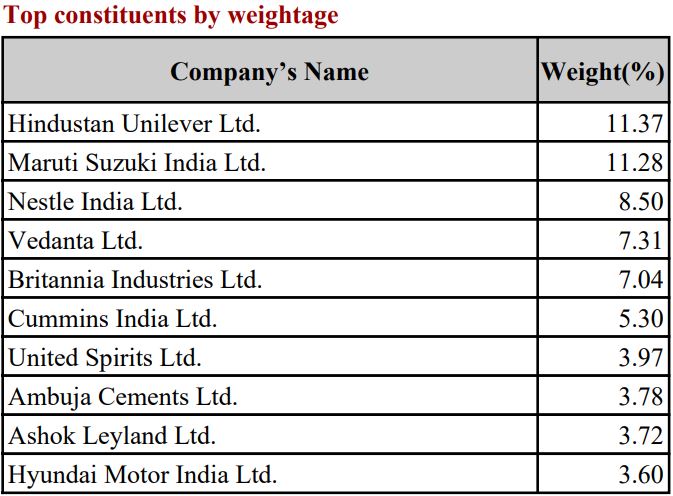

Top 10 Nifty MNC Companies by Weightage in 2025

The Nifty MNC Index list of top 10 stocks consisted of the following:

👉 Clearly, HUL and Maruti Suzuki together make up ~22% of the index weightage, showing their dominance.

Nifty MNC Stocks Weightage

| COMPANY NAME | STOCK SYMBOL | SECTOR | WEIGHTAGE (%) |

| Hindustan Unilever Ltd. | HINDUNILVR | FMCG | 11.37 |

| Maruti Suzuki India Ltd. | MARUTI | Automobile and Auto Components | 11.28 |

| Nestle India Ltd. | NESTLEIND | FMCG | 8.50 |

| Vedanta Ltd. | VEDL | Metals & Mining | 7.31 |

| Britannia Industries Ltd. | BRITANNIA | FMCG | 7.04 |

| Cummins India Ltd. | CUMMINSIND | Capital Goods | 5.30 |

| United Spirits Ltd. | UNITDSPR | FMCG | 3.97 |

| Ambuja Cements Ltd. | AMBUJACEM | Construction Materials | 3.78 |

| Ashok Leyland Ltd. | ASHOKLEY | Capital Goods | 3.72 |

| Hyundai Motor India | HYUNDAI | Automobile and Auto Components | 3.60 |

| Bosch Ltd. | BOSCHLTD | Automobile and Auto Components | 3.55 |

| Colgate Palmolive (India) Ltd. | COLPAL | FMCG | 3.15 |

| Siemens Ltd. | SIEMENS | Capital Goods | 2.78 |

| ABB India Ltd. | ABB | Capital Goods | 2.69 |

| Hitachi Energy India | POWERINDIA | Capital Goods | 2.49 |

| Oracle Financial Services Software Ltd. | OFSS | Information Technology | 2.01 |

| Abbott India Ltd. | ABBOTINDIA | Healthcare | 1.68 |

| Schaeffler India Ltd. | SCHAEFFLER | Automobile and Auto Components | 1.60 |

| Gland Pharma Ltd. | GLAND | Healthcare | 1.53 |

| J.B. Chemicals & Pharmaceuticals Ltd. | JBCHEPHARM | Healthcare | 1.43 |

| Linde India Ltd. | LINDEINDIA | Chemicals | 1.38 |

| United Breweries Ltd. | UBL | FMCG | 1.37 |

| CRISIL Ltd. | CRISIL | Financial Services | 1.25 |

| Escorts Kubota Ltd. | ESCORTS | Capital Goods | 1.21 |

| Cohance Lifesciences | COHANCE | Healthcare | 1.15 |

| Timken India Ltd. | TIMKEN | Capital Goods | 1.06 |

| SKF India Ltd. | SKFINDIA | Capital Goods | 1.06 |

| Castrol India Ltd. | CASTROLIND | Oil, Gas & Consumable Fuels | 0.98 |

| 3M India Ltd. | 3MINDIA | Diversified | 0.89 |

| Honeywell Automation India Ltd. | HONAUT | Capital Goods | 0.87 |

Nifty MNC Index Vs Other Sectoral Indices

Read Also: Nifty IT Stocks List With Weightage in 2025

Eligibility Criteria for Nifty MNC Index

For a company to be included in the Nifty MNC Index, it must satisfy the following conditions:

- Be a part of the Nifty 500; if fewer than 10 sector stocks are eligible, the universe may expand to the top 800 companies by turnover and market cap.

- Maintain foreign promoter shareholding above 50%.

- Exhibit at least 90% trading frequency over the last six months.

- Have a minimum one-month listing history as of the cut-off date.

- Pass final selection based on free-float market capitalization.

Why Should Investors Track the Nifty MNC Index?

The index offers several advantages for investors:

✅ Strong Governance: Backed by global promoter entities, ensuring compliance with international standards.

✅ Defensive Exposure: High weight in FMCG and Healthcare makes it resilient during downturns.

✅ Global Brand Advantage: Companies like Nestle, HUL, and Maruti Suzuki have unmatched consumer trust.

✅ Investment Access: ETFs such as Kotak Nifty MNC ETF allow retail investors to participate with ease.

Risks of Investing in Nifty MNC

⚠️ Currency Exposure: Rupee depreciation can affect the margins of foreign-owned firms.

⚠️ Regulatory Uncertainty: Shifts in FDI and taxation policies can directly impact profitability.

⚠️ Defensive Bias: The index tends to lag behind more aggressive benchmarks during bullish phases.

Future Outlook

The outlook for the Nifty MNC Index remains positive. India’s rising consumption demand, expanding middle class, and global manufacturing shift under the China+1 strategy create long-term opportunities for multinational companies. FMCG and Auto are expected to remain key growth drivers, while Capital Goods and Metals could benefit from cyclical upswings in infrastructure and industrial activity.

For investors seeking stability, governance quality, and consistent compounding, the Nifty MNC Index offers a compelling case for inclusion in long-term portfolios.

Read Also: Nifty Auto Stocks List With Weightage in 2025

Nifty MNC Stocks List with Weightage FAQs

How many stocks are there in the Nifty MNC Index?

Nifty MNC Index has 30 stocks like Hindustan Unilever, Maruti Suzuki India, Nestle India, Vedanta Ltd, and Britannia Industries.

How frequently is the Nifty MNC Index rebalanced?

The Nifty MNC Index is rebalanced every 6 months, with the cut-off dates being 31 January and 31 July each year.

Which company tops in Nifty MNC weightage stocks?

On 31 August 2025, Hindustan Unilever had the maximum weightage of 11.37%, followed by Maruti Suzuki India at 11.28%.

What is Nifty MNC’s performance in the last 12 months?

As of 31 August 2025, the index had a negative return of 3.99% over the last 1 year, including dividends.

Can we trade directly in the Nifty MNC index?

No, direct trading in the Nifty MNC Index is not possible. However, investors can gain exposure through index-based exchange-traded funds (ETFs) such as Kotak Nifty MNC ETF.