The Indian economy has significantly benefited from the Information Technology (IT) industry, which has become one of the largest sectors in the country. Contributing over 8% to the national GDP, it has established itself as a cornerstone of the domestic economy. Consequently, the Nifty IT Index serves as a critical sectoral benchmark in the Indian stock market, accurately reflecting the performance of the IT segment. This index provides valuable insights for investors and market participants regarding the health of the IT industry in India.

In this article, we have compiled a Nifty IT stocks list with weightage which is periodically updated. Nifty IT companies index can be used to benchmark fund portfolios and launch index funds by mutual funds, ETFs, and structured products.

Table of Contents

Read Also: Nifty Metal Stocks With Weightage

What is the Nifty IT index?

The Nifty IT Index is made up of 10 tradable, exchange-traded companies selected based on the free-float market capitalization method. The index represents companies engaged in activities such as software development, hardware, and IT infrastructure, among others. The index has a base date of 1 January 1996 and is indexed to a base value of 1000. The base value of the index was revised from 1000 to 100 with effect from 28 May 2004.

Since the Nifty IT Index is designed to emulate the behaviour and performance of the IT segment, its constituent stocks need to earn at least 50% of their revenue from IT-related services such as hardware & equipment production, IT-enabled services, and education in addition to the ones mentioned above.

Read Also: NSE IFSC Trading In US Stocks: All You Need To Know

Nifty IT Companies Re-Balancing

Constituent companies in the Nifty IT Index are re-balanced on a semi-annual basis. The cut-off date is 31 January and 31 July of each year, i.e. For a semi-annual review of indices, average data for 6 months ending the cut-off date is considered.

A prior notice of at least four weeks is given to the market from the change date. As a result, changes made on 31 January will be effective from 31 March.

Index Governance

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE Indices Limited, the Index Advisory Committee (Equity), and the Index Maintenance Sub-Committee.

Nifty IT Index: Key Drivers

- Market Sentiment: The overall market sentiment has been positive, with IT stocks leading a rally. For instance, major players like Infosys and TCS have shown significant gains, reflecting investor confidence in the sector despite global uncertainties.

- Global Economic Conditions: The performance of global markets, particularly in major economies like the United States, has a direct influence on Indian IT stocks. For instance, trends in U.S. technology spending and corporate earnings can affect investor sentiment towards Indian IT firms.

- Government Policies: A key pillar of strength for the industry has been government support through the establishment of Special Economic Zones (SEZ), tax benefits, and accelerated depreciation. Many of these benefits continue as of date.

Nifty IT Index: IT Eco-System

- The Indian IT industry is almost entirely service-based with very few players following the product-led pathway.

- Since the service delivery is virtually most of the time and the business model is based on service outsourcing, it is not uncommon for the original vendor to further outsource chunks of the project to specialized players. These subcontractors are typically much smaller in size and specialize in a particular technology or domain.

Read Also: Nifty PSE Stocks List With Weightage in 2024

Nifty IT Weightage

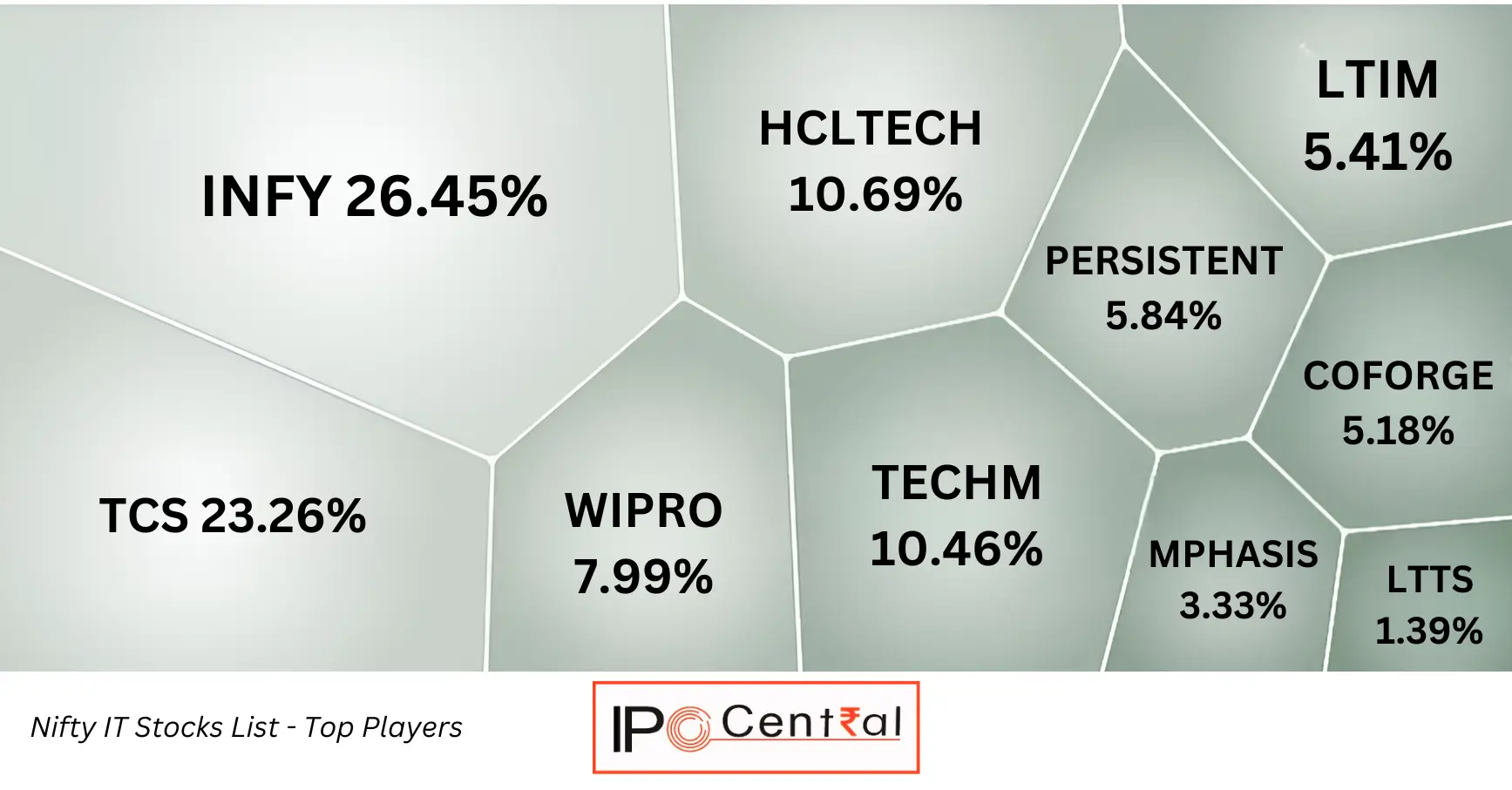

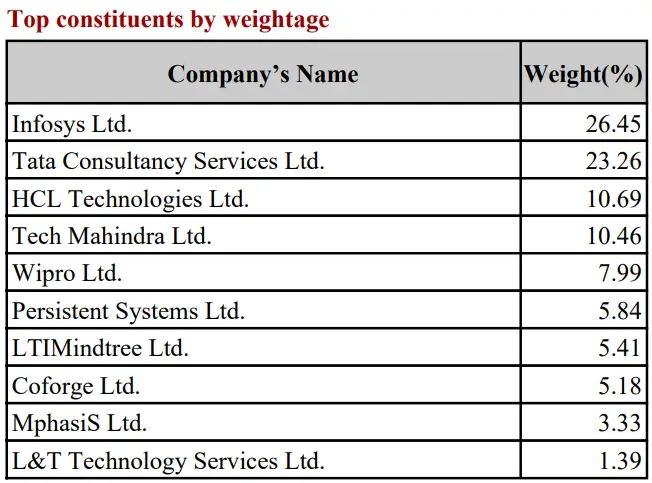

In terms of weightage, the top companies in the Nifty IT Stocks list are Infosys (26.45%), Tata Consultancy Services (23.26%), HCL Technologies Ltd (10.69%), Tech Mahindra (10.46%), and Wipro (7.99%).

Nifty IT Stocks List With Weightage

| Company Name | Industry | Price (INR) | Weightage (%) |

| Infosys Ltd. | Information Technology | 1,902.25 | 26.45 |

| Tata Consultancy Services | Information Technology | 4,244.60 | 23.26 |

| HCL Technologies Ltd. | Information Technology | 1,898.40 | 10.69 |

| Tech Mahindra Ltd. | Information Technology | 1,747.45 | 10.46 |

| Wipro Ltd. | Information Technology | 571.65 | 7.99 |

| Persistent Systems Ltd. | Information Technology | 5,796.25 | 5.84 |

| LTI Mindtree Ltd. | Information Technology | 6,133.70 | 5.41 |

| Coforge Ltd. | Information Technology | 8,327.50 | 5.18 |

| MphasiS Ltd. | Information Technology | 2,883.55 | 3.33 |

| L&T Technology Services | Information Technology | 5,307.00 | 1.39 |

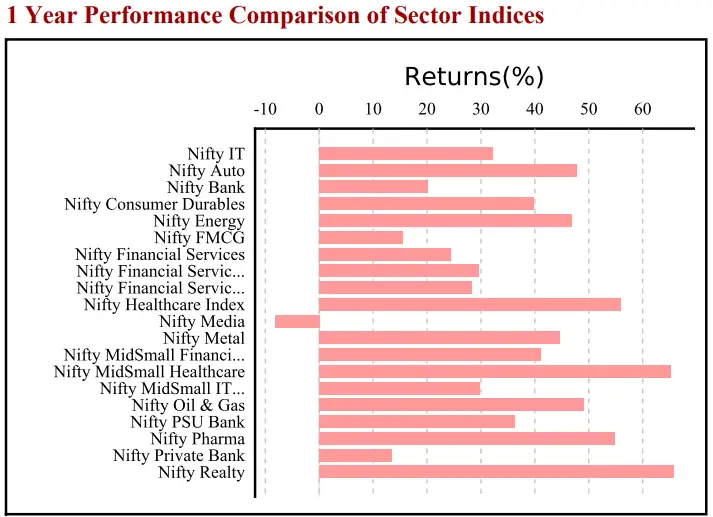

Nifty IT Index Sectoral Performance

Nifty IT Index Vs Other Sectoral Indices

Read Also: Biggest Automobile Companies in India

Nifty IT Stocks List: Eligibility Criteria

- Nifty 500 Inclusion: Companies must be part of the Nifty 500 at the time of review. If the number of eligible stocks in a specific sector within the Nifty 500 falls below 10, additional stocks will be selected from the top 800 ranked by average daily turnover and average daily full market capitalization over the past six months, as used for Nifty 500 index rebalancing.

- Sector Requirement: Companies must belong to the Information Technology (IT) sector.

- Trading Frequency: The company must have a trading frequency of at least 90% over the last six months.

- Listing History: The company should have a minimum listing history of one month as of the cutoff date.

- Final Selection Criteria: The final selection will consist of 10 companies, prioritized based on free-float market capitalization. Preference will be given to companies that are available for trading in NSE’s Futures & Options segment at the time of selection.

- Weightage Calculation: The weightage of each stock in the index is determined by its free-float market capitalization, ensuring that no single stock exceeds 33% and that the combined weightage of the top three stocks does not surpass 62% during rebalancing.

Nifty IT Stocks List: Eligible Basic Industries

The following industries are eligible to be considered when forming companies for inclusion in the Nifty IT Index List:

- Software Development & Consulting

- Hardware & Equipment

- IT-enabled Services

- IT Infrastructure

- Education

Conclusion

IT industry is an important sector in the Indian economy and it weighs nearly 13.76% on the Nifty 50 Index. Accordingly, Nifty IT is an important index but one should not pick Nifty IT stocks purely based on past returns. Even though the IT industry has delivered secular growth in the past, investors need to take a good view of the industry structure and prospects before investing.

Nifty IT Index Weightage FAQs

-

How many stocks are there in the Nifty IT Index?

Nifty IT Index has 10 stocks like Infosys Ltd, TCS, HCL Technologies Ltd, Tech Mahindra, and Wipro Ltd.

-

How frequently is the Nifty IT Index rebalanced?

The Nifty IT Index is rebalanced every 6 months with the cut-off dates being 31 January and 31 July of each year.

-

Which company tops in Nifty IT weightage?

As of 31 October 2024, Infosys Ltd had the maximum weightage of 26.45%, followed by Tata Consultancy Services Ltd at 23.26%.

-

What is Nifty IT’s performance in the last 12 months?

As of 31 October 2024, the index had returned 34.87% over the last 1 year. This includes dividends posted by the constituent companies.

-

Can we trade in the Nifty IT index?

Investors have various options to invest in traditional mutual funds and ETFs tracking the IT index. One such example is Nippon India ETF Nifty IT popularly known as Nifty BeES. Some sectoral mutual fund schemes are ICICI Prudential Technology Fund and Franklin India Technology Fund although these schemes don’t strictly follow the Nifty IT index.

Very useful