The Nifty Metal Index is designed to represent the performance and behavior of the metals sector in India, including mining activities. This index consists of a maximum of 15 stocks that are listed on the National Stock Exchange (NSE).

In this article, we have compiled a Nifty Metal stocks list with weightage which is periodically updated. The Nifty Metal Index can be utilized to benchmark fund portfolios and facilitate the launch of index funds, ETFs, and structured financial products.

What is the Nifty Metal Index?

The index is calculated using the free float market capitalization method, meaning its value reflects the total free float market value of all constituent stocks relative to a specified base market capitalization. The base date for the index is 1 January 2004, with a base value set at 1,000, although it was officially launched in July 2011.

Nifty Metal Index can be used for a variety of purposes such as benchmarking fund portfolios and launching index funds, ETFs, and structured products.

Read Also: NSE IFSC Trading In US Stocks: All You Need To Know

Nifty Metal Companies Re-Balancing

The constituent companies in the Nifty Metal Index are rebalanced on a semi-annual basis, with cut-off dates set for 31 January and 31 July each year. For the semi-annual review of the index, average data from the six months leading up to the cut-off date is taken into account.

A prior notice of at least four weeks is provided to the market before any changes take effect. Consequently, changes made on 31 January will become effective on 31 March.

Index Governance

The Nifty Metal Index is managed by a professional team at India Index Services and Products Limited (IISL), which operates under a structured three-tier governance framework. This structure includes the Board of Directors of IISL, the Index Advisory Committee (Equity), and the Index Maintenance Sub-Committee. It is important to note that IISL is a subsidiary of the National Stock Exchange (NSE), ensuring that the index is governed with a high level of oversight and adherence to best practices in index management.

Read Also: Nifty PSE Stocks List With Weightage in 2024

Nifty Metal Index: Key Drivers

The metal and mining industry in India is characterized by its substantial size, which is largely driven by the domestic market. This sector requires significant capital investments and involves long gestation periods for projects. Consequently, there are frequent mismatches between demand and supply, leading to fluctuations in product prices. However, demand is fairly inelastic as metals are widely used in industries and commercial and residential applications.

By extension, the cyclicality is reflected in the performance of the Nifty metal index through sharp peaks and troughs.

Read Also: Nifty FMCG Stocks List With Weightage in 2024

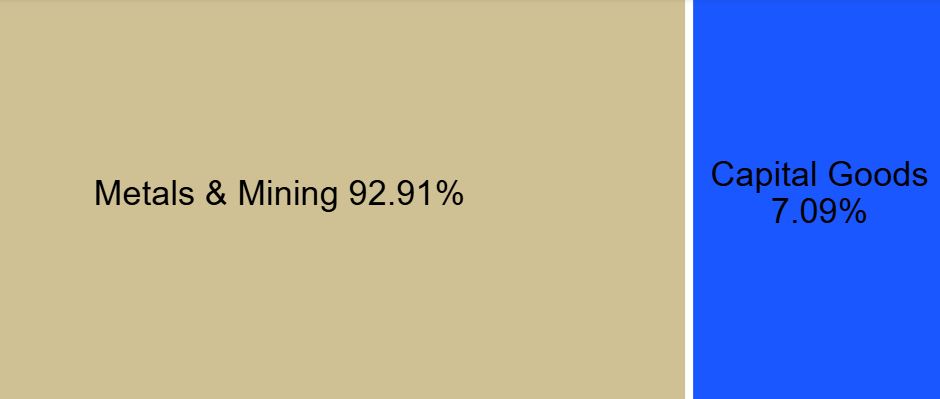

Nifty Metal Weightage

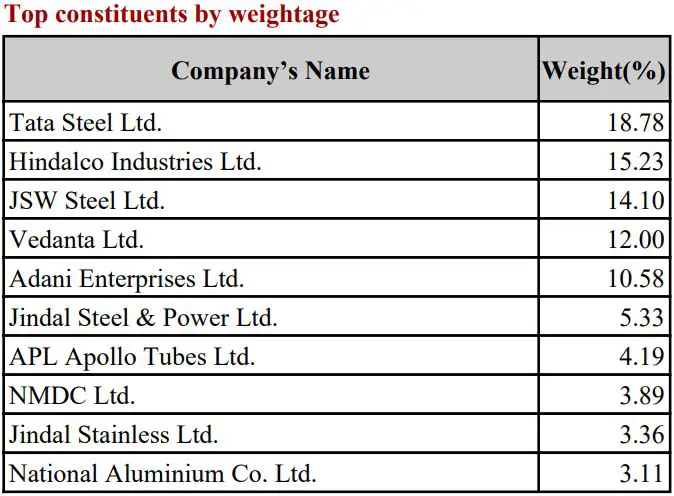

In terms of weightage, the top companies in the Nifty Metal Stocks list are Tata Steel (18.78%), Hindalco Industries (15.23%), JSW Steel (14.10%), Vedanta Ltd (12.00%), and Adani Enterprises (10.58%),

Read Also: Nifty Pharma Stocks List With Weightage in 2024

Nifty Metal Stocks List With Weightage

| Company Name | Industry | Price (INR) | Weightage(%) |

| Tata Steel Ltd. | Metals & Mining | 143.67 | 18.78 |

| Hindalco Industries Ltd. | Metals & Mining | 659.85 | 15.23 |

| JSW Steel Ltd. | Metals & Mining | 953.30 | 14.10 |

| Vedanta Ltd. | Metals & Mining | 443.80 | 12.00 |

| Adani Enterprises Ltd. | Metals & Mining | 2,257.50 | 10.58 |

| Jindal Steel & Power Ltd. | Metals & Mining | 877.25 | 5.33 |

| APL Apollo Tubes Ltd. | Capital Goods | 1,457.30 | 4.19 |

| NMDC Ltd. | Metals & Mining | 226.80 | 3.89 |

| Jindal Stainless Ltd. | Metals & Mining | 672.35 | 3.36 |

| National Aluminium Co. Ltd. | Metals & Mining | 251.37 | 3.11 |

| Steel Authority of India Ltd. | Metals & Mining | 114.09 | 2.55 |

| Hindustan Zinc Ltd. | Metals & Mining | 498.50 | 2.51 |

| Hindustan Copper Ltd. | Metals & Mining | 278.80 | 1.47 |

| Ratnamani Metals & Tubes Ltd. | Capital Goods | 3,527.40 | 1.45 |

| Welspun Corp Ltd. | Capital Goods | 747.05 | 1.45 |

Nifty Metal Index Vs Other Sectoral Indices

Read Also: Nifty IT Stocks List With Weightage in 2024

Nifty Metal Stocks List: Eligibility Criteria

- Companies should form part of the Nifty 500 at the time of review. In case, the number of eligible stocks representing a particular sector within the Nifty 500 falls below 10, then the deficit number of stocks shall be selected from the universe of stocks ranked within the top 800 based on both average daily turnover and average daily full market capitalization based on previous six months period data used for index rebalancing of Nifty 500.

- Companies should form a part of the Metals sector.

- The company’s trading frequency should be at least 90% in the last 6 months.

- The company should have a minimum listing history of 1 month as of the cutoff date.

- The final selection of companies shall be done based on the free-float market capitalization.

- The weightage of each stock in the index is calculated based on its free-float market capitalization such that no single stock shall be more than 33% and the weightage of the top 3 stocks cumulatively shall not be more than 62% at the time of rebalancing.

Nifty Metal Stocks List: Eligible Basic Industries

Companies from the following industries are eligible for inclusion in the Nifty Metal Index:

- Aluminium

- Copper

- Diversified Metals

- Ferro & Silica Manganese

- Industrial Minerals

- Iron & Steel

- Iron & Steel Products

- Pig Iron

- Precious Metals

- Sponge Iron

- Trading – Metals

- Trading – Minerals

- Zinc

Conclusion

As noted earlier, the metals and mining industry provides essential inputs for various other sectors, making it a vital component of the Indian economy. This industry accounts for approximately 3.54% of the Nifty 50 Index. While it enjoys strong and inelastic demand, it is also subject to prolonged industry cycles that can last for several years.

Read Also: Nifty Auto Stocks List With Weightage in 2024

Nifty Metal Index Weightage FAQs

-

How many stocks are there in the Nifty Metal Index?

Nifty Metal Index has 15 stocks like Tata Steel, Hindalco Industries, JSW Steel, and Vedanta Ltd.

-

How frequently is the Nifty Metal Index rebalanced?

The Nifty Metal Index is rebalanced every 6 months with the cut-off dates being 31 January and 31 July of each year.

-

Which company tops in Nifty Metal stocks weightage?

On 31 October 2024, Tata Steel had the maximum weightage of 18.78%, followed by Hindalco Industries Ltd at 15.23%.

-

What is Nifty Metal’s performance in the last 12 months?

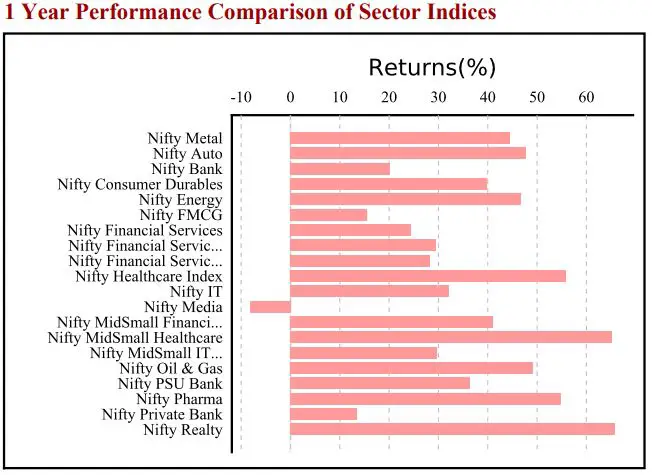

As of 31 October 2024, the index had returned 45.31% over the last 1 year including dividends.

-

Can we trade directly in the Nifty Metal index?

Unfortunately, there are no instruments to trade solely in the metal index. Mutual funds and ETFs tracking commodities (such as ICICI Prudential Commodities Fund) are the closest proxies that investors can resort to. Several fund houses have Business Cycle Funds which can also go heavy on metals depending on the business environment at the time.