Last updated on May 8, 2023

By its very nature, IPO market continues to be highly volatile and dances according to sentiments in broader markets. Nevertheless, primary market has been a core part of overall financial and securities system. There is no shortage of IPOs that went on to create enormous wealth for investors. However, one challenge that new (as well as seasoned) investors face is how to find good IPOs. On the face of it, most IPOs may look good and taking a longer term view is where things get complicated.

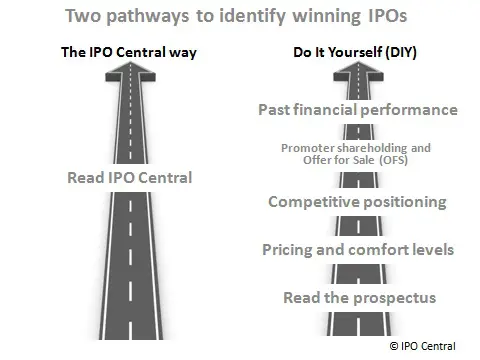

In a typical tongue in cheek style, we are going to suggest that you visit IPO Central regularly (subscription form on the right!) and follow us on social media platforms to find good IPOs. Since IPO Central is oriented towards investor education, we are more than happy to share the parameters for IPO selection which indicate if a public offer is worth your hard-earned money. Here are some steps to find good IPOs:

#1 Read prospectus to find good IPOs

IPO investing is uniquely different from trading listed stocks. Novice investors often jump on any IPO that comes along. For an IPO investor, it is necessary to know about business prospects and operations of a company. Other factors that need to be considered include management track record, risks involved, and purpose of raising funds to name a few. An in-depth scan of red herring prospectus (RHP) often throws important pieces of information and makes it an effective tool to find good IPOs. This one cannot be emphasized enough and there are solid reasons why SEBI insists on enough disclosures.

#2 Check pricing and peer valuation for better IPO selection

Pricing in absolute terms does not mean anything. An IPO at INR10 per share may be expensive and another one at INR50 per share may be inexpensive. Pricing is of utmost importance but needs to be seen along with profits and business growth. The stock market is a forward looking mechanism and is often willing to pay a high premium for companies that promise huge growth. During bull-runs, promoters tend to price IPOs at steep valuations leaving little or no money on the table. There has to be some margin for error and indicators like grey market premium (GMP) vanish quickly if something bad happens in global markets.

Thus, it is critical for investors to avoid applying in IPOs with steep pricing and peer valuation is very helpful in ascertaining this. By comparing various valuation metrics such as price/earnings ratio, it can be checked if a particular IPO is overpriced or not. Despite being a strong brand and showing business growth in years leading to IPO, S Chand failed to deliver returns for IPO investors. It was a clear case of stretched valuations as another equally successful listed peer Navneet Education was available at lower valuations. As we covered in this case study, S Chand actually went on to lose 78% from its IPO price in the next two years.

Read Also: Here is why you should consider opening a Free Demat Account

Many IPO investors apply for listing gains but there is merit in the argument of having a high degree of comfort level with the space one is going to make investment in. Just in case market sentiments turn weak and the shares actually list at a discount, an investor should be able to hold the shares for sometime (we recommend at least six months). It would be a perfect recipe for disaster if a risk-averse investor decides to invest in the IPO of a fledgling technology company.

#3 Look for the company’s competitive positioning

Factors like past performance, number of years in business, and growth prospects can offer valuable insights to find good IPOs. Market share is another great indicator, more so in emerging sectors where profits may still be far. Going forward, a number of e-commerce players are expected to tap the primary markets. Most of these companies will not be profitable as is the case with Infibeam. However, a leading player in its sector cannot be discounted solely on account of loss-making operations.

Often, IPO-bound companies claim there are no comparable businesses like theirs to justify high valuations. Except a few instances such as an IPO by a stock exchange, such claims fall flat. Even in cases where there are no listed peers available in an industry, parallel examples may exist in other industries.

Read Also: List of IPOs with SEBI approval in India

#4 Promoters of good IPOs have skin in the game

Promoters need to have a skin in the game. If promoters of a struggling company are among sellers in IPO, it is hardly inspiring for retail investors. Similarly, IPOs with a heavy Offer For Sale (OFS) component may not be best investment for small investors. After all, why would an investor like to exit a growing business?

It needs to be mentioned though that a little more analysis is required in the case. Private equity investors are not promoters and thus, need to sell out after 4-7 years of making their investments but these investors exiting completely is generally a sign of offers that are not rewarding for IPO investors. On the other hand, if a prominent external investor decides to stick around in a profitable business, even though selling some stake, it is a sign of confidence that there are better times ahead. Quite effective to identify good IPOs, isn’t it?

#5 Avoid companies which are too generous to promoters

Another clean hack investors can employ to find good IPOs is to figure out if promoters are rewarding themselves a bit too much. Businesses are supposed to make money for shareholders and it doesn’t take long for things to become ugly if promoters happen to be ONLY shareholders. Promoters often end up paying themselves too much either directly or indirectly and this is never a good sign. The problem is particularly pronounced in the case of first generation entrepreneurs and SME IPOs. Internal controls are often weak in such cases as promoter and business often become synonyms.

If promoters have sucked profits out of a business in the past, there are strong chances that they will figure out ways of doing the same after the IPO. There are a number of ways of doing it and investors can do well by avoiding companies which have been too generous to its promoters in the past. It can take the form of remuneration not linked to performance, excessive dividend or a web of related companies which supply goods or services at high prices.

Examples: Precision Camshafts and Power Mech Projects.

On the whole, IPO investments meant for long-term are generally beneficial, provided IPO selection is good. It is better to equip oneself about the details of the company. Long term investors stay calm in turbulent times wait for the tables to turn. On the other hand, short term gainers should opt for selling shares as and when profits are available.

We sincerely hope that these practical ways to find good IPOs are helpful to you. Please tell us your thoughts in comments below.