OYO Unlisted Share Price Description – OYO is a global, technology-led hospitality platform operated under PRISM (formerly Oravel Stays), the group’s newly adopted corporate identity. PRISM functions as the parent and umbrella brand for a diversified portfolio spanning budget, mid-market, premium hospitality, vacation homes, extended-stay accommodations, and hospitality technology solutions, while OYO continues as the primary consumer-facing brand for budget and mid-scale hotels worldwide.

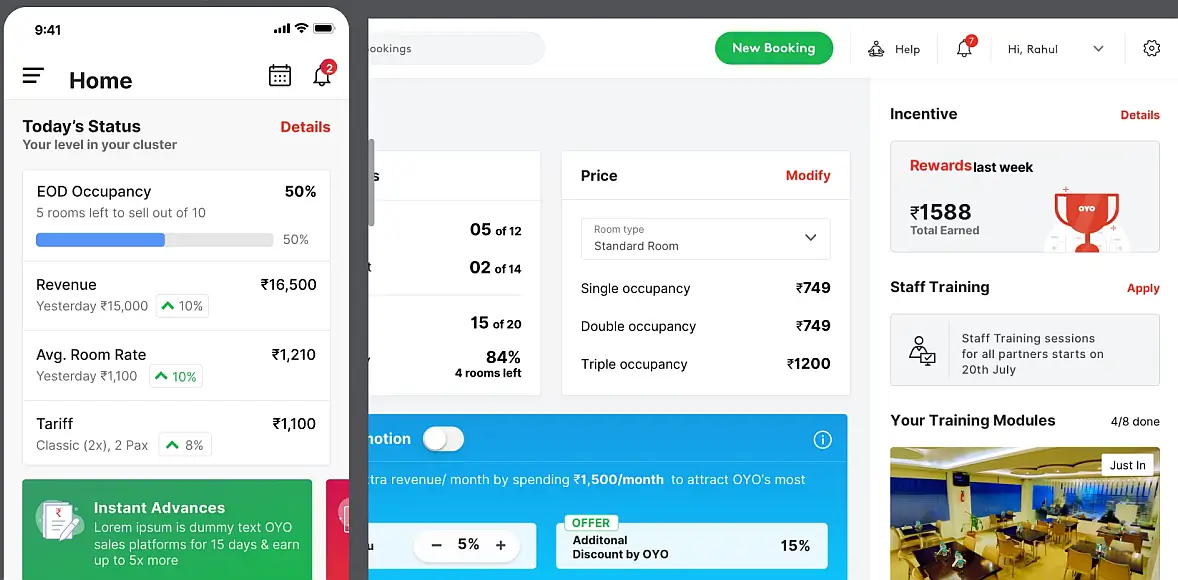

As of FY25, IPO-bound OYO offers 40+ integrated, full-stack technology products and solutions that empower entrepreneurs and small hospitality businesses to enhance revenue, optimise pricing, and simplify daily operations. The platform enables operations across over 1,41,000 hotels and home storefronts in more than 35 countries, including India, the United States, Europe, Southeast Asia, and the Middle East, serving a global customer base exceeding 100 million users.

Founded in 2013 by Ritesh Agarwal, the company has evolved from a budget-hotel aggregator into one of the world’s most vertically integrated hospitality technology platforms. Through its asset-light business model, OYO helps patrons transform fragmented and underutilised hospitality assets into branded, digitally enabled storefronts with higher visibility and improved revenue potential, while offering customers a broad range of trusted accommodations at compelling price points.

The group’s full-stack technology ecosystem spans digital onboarding, revenue and yield management, daily business operations, customer experience management, and direct-to-consumer (D2C) distribution, delivered through proprietary patron platforms such as Co-OYO and OYO OS, alongside consumer-facing apps and websites. Under PRISM’s umbrella, the group is strategically focused on profitability, premiumization, and sustainable global growth.

Table of Contents

OYO Subsidiary Companies

- OYO Hotels and Homes Private Limited

- OYO Apartment Investment LLP

- OYO OTH Investment I LLP

- OYO Midmarket Investments LLP

- Sunday Proptech Limited (Formerly OYO Financial and Technology Services Pvt Ltd)

- Guerrilla Infra Solutions Pvt Ltd

- Supreme Sai Construction and Developers LLP

- Mypreferred Transformation and Hospitality Private Limited

- Oravel Employee Welfare Trust

- OYO Kitchen India Private Limited

- OYO Vacation Homes Rental LLC

- OYO Rooms and Hospitality (UK) Ltd

- Innov8 Workspaces India (Formerly OYO Workspaces India Private Limited)

- Luxabode Hotels Private Limited & More

OYO Customer Mobile Application

Read Also: Sterlite Power Unlisted Shares

Key Highlights FY 2024 – 25

- Corporate Rebranding to PRISM: During FY25, Oravel Stays Limited announced a strategic rebranding to PRISM as its new corporate parent identity. PRISM now operates as the umbrella brand for the group’s diversified businesses across budget, mid-market and premium hospitality, vacation homes, extended stays, and hospitality technology, while OYO continues as the primary consumer-facing brand globally.

- Sustained Profitability: FY25 marked the company’s second consecutive profitable year, with Profit After Tax (PAT) of INR 244.82 crore, compared to INR 229.58 crore in FY24, reinforcing the durability of its turnaround.

- Sharp Increase in Gross Booking Value (GBV): GBV surged by ~53% year-on-year to ~INR 16,250 crore, supported by growth in both hotels and homes storefronts, higher GBV per storefront, and rising direct-to-consumer bookings.

- Transformational Acquisition – G6 Hospitality: During FY25, the company completed the acquisition of G6 Hospitality, the operator of iconic North American brands Motel 6 and Studio 6. This acquisition significantly expanded the group’s footprint in the United States and Canada, adding ~1,500+ hotels and strengthening its presence in the value and extended-stay lodging segment.

- Expansion of European Vacation Homes Portfolio: The company continued scaling its European vacation rental brands including Belvilla, DanCenter, CheckMyGuest, and Traum-Ferienwohnungen, strengthening its position across key markets such as the Netherlands, Germany, Denmark, and France.

- Premiumization via Company-Serviced Hotels: FY25 saw accelerated expansion of Company-Serviced Hotels across India, Southeast Asia, the UK, and the Middle East, supporting higher service standards, stronger brand perception, and improved unit economics.

- Global Scale: As of March 31, 2025, the platform operated over 1,41,000 hotels and home storefronts across 35+ countries, serving a global customer base exceeding 100 million users.

- Balance Sheet & Financing Strengthening: The company refinanced earlier borrowings, including acquisition-related debt, through a USD 830 million Term Loan B, extending maturities to 2029 and enhancing financial flexibility.

Read Also: Biggest Unlisted Companies in India

OYO Unlisted Share Price Details

| Name | OYO Unlisted Share Price Details |

| Face Value | INR 1 per share |

| ISIN Code | INE561T01021 |

| Lot Size | 1,000 shares |

| Demat Status | NSDL, CDSL |

| OYO Share Price | INR 27.50 per share |

| Market Cap | INR 38,536 crore |

| Total number of shares | 14,01,31,10,522 Shares |

| Website | www.oyorooms.com |

PRISM Board of Directors

- Ritesh Agarwal, Founder, Chairman & Non-Executive Director

- Aditya Ghosh, Non-Executive Director

- Bheju Somaia, Non-Executive & Independent Director

- Dr. Deepak Malik, Non-Executive & Independent Director

- Troy Alstead, Non-Executive & Independent Director

- William Steve Albrecht, Non-Executive & Independent Director

- Sumer Juneja, Additional Non-Executive Director

PRISM Unlisted Share Price – Shareholding Pattern

Details of shareholders holding shares in the company:

| Shareholder Name | % to Holding | No. of shares |

| RA Hospitality Holdings (Cayman) | 34.90 | 58,34,00,000 |

| Ritesh Agarwal | 29.65 | 49,57,30,720 |

| SVF India Holdings (Cayman) | 1.40 | 2,33,60,000 |

OYO Unlisted Share Price – Financial Metrics

| Particulars | FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|---|---|

| Revenue | 3,961.65 | 4,781.36 | 5,463.95 | 5,388.79 | 6,252.83 |

| Revenue Growth (%) | (69.91) | 20.69 | 14.28 | (1.38) | 16.0 |

| Expenses | 6,937.07 | 6,985.32 | 6,799.70 | 5,725.78 | 5,169.33 |

| Net Income (PAT) | (4,103.27) | (2,141.66) | (1,286.52) | 229.58 | 244.82 |

| Margin (%) | (103.57) | (44.79) | (23.55) | 4.26 | 3.9 |

| ROE (%) | (1.57) | (4.35) | (3.02) | (0.45) | NA |

| EBITDA (%) | (47.19) | (10.03) | 4.69 | 16.48 | 17.3 |

| ROCE (%) | (1.57) | (4.34) | (3.01) | (0.45) | NA |

| EPS (₹) | (5.62) | (3.14) | (1.93) | 0.36 | 0.38 |

Quick Takeaway (FY25)

- Revenue all-time high INR 6,253 Cr

- Consistent profitability (second straight profitable year)

- EBITDA margin peak ~17% → strong operating leverage

- Clear turnaround story from Loss-making phase (FY21–FY23)

Read Also: Best IPOs That Doubled Investors’ Money

OYO (PRISM) Annual Reports

- OYO Annual Report FY 2024 – 2025

- OYO Annual Report FY 2023 – 2024

- OYO Annual Report FY 2022 – 2023

- OYO (Oravel Stays) Draft Red Herring Prospectus Nov 2022

- OYO (Oravel Stays) Annual Report FY 2021 – 2022

PRISM Unlisted Share Price – Peer Comparison

| Company | 3-yr Sales CAGR (%) | PE Ratio | Net Margin (%) | ROCE (%) | MCap (INR crore) |

| OYO (PRISM) | 7 | 76.39 | 3.9 | NA | 38,536 |

| Viceroy Hotels | 37.9 | 9.38 | 56.93 | 9.15 | 730 |

| Country Club Hospitality | (6.80) | 30.00 | 3.70 | 2.70 | 280 |

PRISM Unlisted Share Price FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is the Oravel Stays unlisted share price?

OYO unlisted share price today is INR 27.50 per share. Shares are purchased in lots of 1,000 shares.

Who determines the OYO share price unlisted?

The unlisted share price is determined by a variety of factors including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.

When is the OYO IPO date planned?

The much-awaited IPO of OYO is likely to be launched in 2026, as the company has filed fresh offer documents with the capital markets regulator, SEBI.

What is the OYO grey market price today?

The grey market price for OYO (PRISM) unlisted shares is around INR 26 to INR 28 per share, according to IPOCentral.

Looking to buy OYO shares.

Hi

Please share Oyo share price