Gujarat-based Uma Converter Limited has filed draft papers for its Initial Public Offering (IPO) with markets regulator SEBI on 30 June 2021. The packaging material company plans to raise INR36 crore by issuing new shares. Uma Converter IPO aims to raise the funds for upgrading manufacturing facility and towards repayment or prepayment of unsecured loans. Book Running Lead Manager to the offer is GYR Capital Advisors Private Limited.

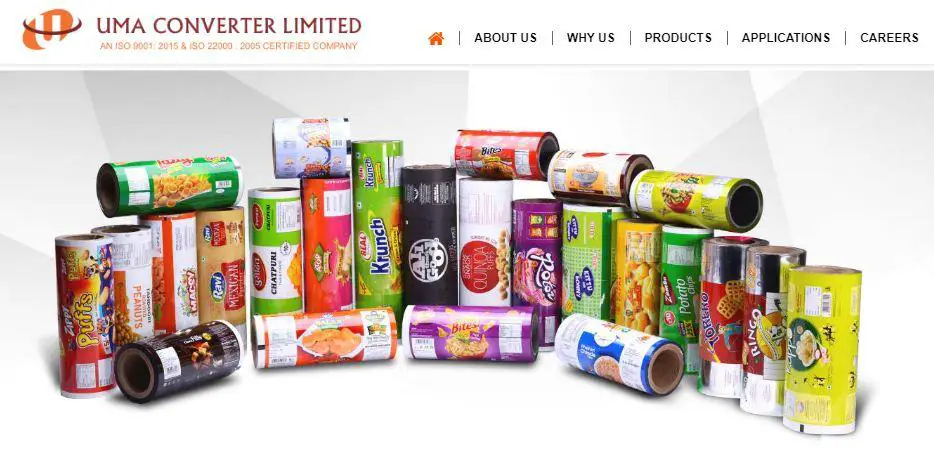

Uma Converter is engaged into production of multi-functional flexible packaging material, catering to the packaging requirements of various industries including food and beverage, e-commerce, pharmaceutical, hygiene and personal care, household and agricultural sectors. Its products are crafted out of an extensive range of industry approved materials such as polyethylene terephthalate, biaxially-oriented polypropylene, polythene, cast polypropylene, foil, paper, bio-degradable films, etc. The company’s product portfolio largely consists of multi-color pouches, stand-up pouches, zip-lock pouches, vacuum pouch, paper bag, e-commerce bag, etc.

Read Also: Here is what makes Clean Science IPO interesting

In the domestic market, the company has a widespread presence in 17 states. In addition, it is also exporting finished products to countries such as Saudi Arabia, Australia, Senegal and the United States of America.

Uma Converter IPO: Scaling Manufacturing Capacity

Uma Converter has two manufacturing plants in Gujarat with aggregate production capacity of 10,800 metric tonnes per annum (MTPA). This capacity is divided equally among the two plants at Gandhinagar and Ahmedabad. The company has already expanded manufacturing capacity by 1,800 MTPA at one of its plants which is currently under trial stage. Using the IPO proceeds, it plans to further expand capacity to 9,000 MTPA.

Packaging is among the industries which are clocking high growth in India despite the ill-effects of the pandemic. According to industry estimates, this growth is likely to continue in the next 5 years with CAGR of 23%.

Uma Converter has clearly benefitted from this trend. Its sales revenues stood at INR91 crore in FY2018 while top line is expected to touch INR157.5 crore on an annualized basis in FY2021. The trend in profits has been somewhat subdued but the company’s operations have been profitable in each years and it is on track to post highest profits in recent years in FY2021.

Uma Converter’s financial performance (INR crore)

| FY2018 | FY2019 | FY2020 | 9M FY2021 | |

| Revenue | 91.0 | 104.8 | 104.0 | 118.1 |

| Expenses | 85.8 | 99.2 | 100.2 | 112.8 |

| Net income | 4.1 | 4.3 | 2.7 | 4.2 |

| Margin (%) | 4.5 | 4.1 | 2.6 | 3.6 |