Lucknow-based India Pesticides is scheduled to launch its IPO on 23 June 2021. The company is aiming to mobilize up to INR 800 crore by issuing fresh shares and an offer for sale (OFS).Investors can place orders for minimum 50 shares and in multiples thereafter which are priced in the range of INR290 – 296 per share. India Pesticides is an R&D-driven agrochemical producer of Technical products with a developing Formulation business. The company is the quickest developing agrochemical organization in India in terms of volume in Fiscal 2020. Through India Pesticides IPO review, we try to study the pros and cons of the company’s operations.

India Pesticides IPO details

| Subscription Dates | 23 – 25 June 2021 |

| Price Band | INR290 – 296 per share |

| Fresh issue | INR100 crore |

| Offer For Sale | INR700 crore |

| Total IPO size | INR800 crore |

| Minimum bid (lot size) | 50 shares |

| Face Value | INR1 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

India Pesticides: Business Model

India Pesticides commenced its operations in 1984 and then diversified into manufacturing herbicide and fungicide Technicals and active pharmaceutical ingredients (APIs). As of now, the company is the sole Indian producer of five Technicals and is among the leading manufacturers globally for Captan, Folpet and Thiocarbamate Herbicide, in terms of production capacity.

Indian Pesticides also manufacture herbicide, insecticide and fungicide formulations. Here is a deeper understanding of its product portfolio.

Technical: India Pesticides produces generic Tchnicals. This type of product is used in the manufacturing of fungicides, herbicides and APIs with applications in the dermatological product. Some of the products the company produces are:

Folpet: Folpet is used to manufacture fungicides that control fungal growth at vineyards, cereals, crops and biocide in paints.

Cymoxanil: Cymoxanil is used to manufacture fungicides that control downy mildews of grapes, potatoes, vegetables and several other crops.

Major herbicides technical the company manufacture include 135 Thiocarbamate herbicides. This is used in field crops, such as wheat and rice worldwide.

Active Pharmaceutical Ingredients (API): These are substances or a mixture of substances intended to be used in the production of a medicine product. When the API is used in medicine, they become an active ingredient of the product.

India Pesticides’ API product are used in anti-scabies drug which is used in the treatment of scabies and pediculosis. The company’s API products are also used in anti-fungal drugs which act on fungal hyphae and inhibits squalene epoxidase.

Formulation: India Pesticides manufactures and sells various formulations of insecticides, fungicides and herbicides, growth regulators and acaricides. These all are ready-to-use products.

The company manufactures over 30 formulations that include Takatvar, IPL Ziram-27, IPL Dollar, IPL Soldier and IPL Guru as of 30 September 2020.

India Pesticides has two manufacturing plants located at UPSIDC industrial area at Dewa Road, Lucknow and Sandila, Hardoi in UP. The company has an aggregate installed capacity of the Agro-chemical technical 19,500 MT and formulation was 6,500 MT.

The company exports its Technical product to Australia and different nations in Europe, Asia and Africa. The revenue contribution through Technical exports is 62% and domestic sale of Formulation contributes 28% in revenue.

It has a diverse set of customers which includes crop protection product manufacturing companies, such as, Syngenta Asia Pacific Pte, UPL Limited, Ascenza Agro, Conquest Crop Protection Pty, Sharda Cropchem and Stotras Pty.

India Pesticides IPO Review: Financial Performance

India Pesticides’ financial performance has been on a strong footing in recent years as revenues and profitability improved. Revenue increased from INR 346 crores to INR 655.4 crores from FY2019 to FY2021, reoresenting a CAGR of 38%. In the same timeframe, its EBITDA margins jumped from 20.7% to 29.2%.

Simialrly, its net margins improved from 12.7% to 20.6% as comprehensive income swelled threefold to INR134.9 crore in FY2021. India Pesticides is a net debt-free company and this helped in boosting profitability and margins.

India Pesticides’ Financial Performance (in INR crore)

| FY2019 | FY2020 | FY2021 | |

| Revenue | 346.0 | 489.7 | 655.4 |

| Expenses | 284.9 | 396.4 | 475.4 |

| Comprehensive income | 43.9 | 70.6 | 134.9 |

| Margin (%) | 12.7 | 14.4 | 20.6 |

India Pesticides IPO Review: Should you invest?

From the points observed above, it is evident that the company has fast-growing operations. This is likely to continue as the company focuses on formulations business going forward and high margin products in horticulture and floriculture.

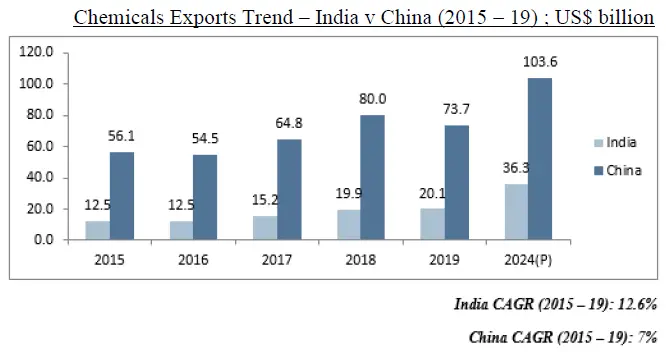

It also helps that the company has a competitive advantage in specializing chemical sector. India Pesticides has domestic as well as international market presence and a consistent track record of financials. The company also stands to gain from the trend of shift in chemical production from China to India.

India Pesticides’ Earnings Per Share (EPS) stood at INR12.07 in FY2021. The offer’s price band of INR290 – 296 per share values the company at a Price/Earnings (PE ratio) range of 24.0 – 24.5. This is quite attractively priced when compared with peers like Dhanuka Agritech (31.7), Bharat Rasayan (36.1), UPL (35.1), Rallis India (32.9), PI Industries (79.2), Sumitomo Chemical (78.9) and Atul (38.2).

India Pesticides’ Return on Net Worth (RONW) stood at 34.5% in FY2021. This is higher than all of the above mentioned competitors. Overall, the combination of growing revenues, diversified products, sizeable exports, improving profitability, strong research & development make it an attractive investment option.