PKH Ventures is all set to launch its IPO on 30 June 2023. Priced in the range of INR 140 – 148 per share, the Construction & Hospitality player aims to raise as much as INR 379.35 crore through a mix of fresh shares and an offer for sale. Here are some major highlights on PKH Ventures IPO from RHP.

#1 PKH Ventures IPO: Business Overview

Incorporated in 2000, PKH Ventures has diversified business operations in Construction & Development, Hospitality, and Management Services. Here is more on these verticles:

Construction & Development Business: It ventured into the business of Construction and Development through its subsidiary, Garuda Construction in the year 2012 with the development of its Mumbai Hotels. The company executes Civil Construction works and development of Third-Party Developer projects, Government Projects, and Government Hotel Development Projects. Construction business contributed 61.2% of revenues in the first nine-months of FY 2022-23.

Hospitality Business: PKH Ventures’ knowledge and experience of providing its services for almost two decades laid the foundation of the Hospitality vertical. The company ventured into the hospitality sector by developing and operating two hotels viz., a luxury hotel at Vasai, on the outskirts of Mumbai in the year 2014 and a boutique hotel near the Mumbai International Airport in 2015. It also manages and operates a luxury resort at Aamby Valley, Lonavala, near Mumbai. In the latest nine months of FY 2022-23, Hospitality business contributed 30.7% in topline.

Management Services Business: The company commenced business by providing management services at various airports in the country such as airport entry ticket counters and toll management. It was offering these services to 13 airports in India in 2009 and had also set up kitchens for in-flight catering near Ahmedabad airport. However, this segment has seen a massive drop in business as the company’s focus has shifted to construction and hospitality. It generated 7.3% of revenues in the latest period.

Read Also: Live IPO Subscription Status

#2 PKH Ventures IPO: Ongoing Projects

PKH Ventures executes Civil Construction works and development of Third-Party Developer projects, Government Projects, and Government Hotel Development Projects. As of 15 March 2023, Garuda Construction’s Third-Party Developer Order Book was INR 468.28 crores. The company has been awarded two Government Projects, viz., the Hydro Power Project and the Nagpur Project with an estimated aggregate cost of INR 213.83 crores.

Further, the company has recently been awarded three Government Hotel Development Projects i.e. Rajnagar Garhi Project, Pahadikhurd Project, and Tara Resort Project in the State of Madhya Pradesh on DBFOT basis by way of a letter of award each dated 4 November 2022 from the Madhya Pradesh Tourism Board. It completed the construction of the Delhi Police Headquarters in April 2021.

#3 PKH Ventures IPO: Business Outlook

The construction sector is India’s second-largest economic segment after Agriculture. The sector contributed 8% to the national GVA (at constant price) in FY 2022. Over the long term, the outlook for construction sector is favorable supported by continued government spending on infrastructure. The Government has expanded the National Infrastructure Policy (NIP) during the Budget to 7,400 projects from 6,835 projects and announced plans for the National Monetization Pipeline and Development Finance Institution (DFI) to improve the financing of infrastructure projects.

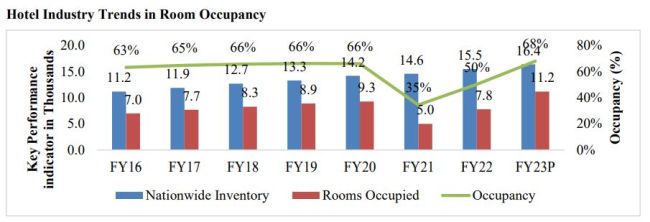

Similarly, the hospitality industry is expected to see robust demand in FY 2024. The growth outlook for hotels will be driven primarily by the ramp up in tourist sentiments, increased traction in leisure travel, increased business travel and uptick in foreign tourist arrivals (FTAs) which are already leading to better occupancy rates as seen below.

#4 PKH Ventures IPO: Shareholding Pattern

The details of shareholders holding 1% or more of the paid-up Equity Share Capital of the company as of the date of filing this Red Herring Prospectus are set forth below:

| Name of Shareholder | No. of Equity Shares | (%) of Equity Share Capital |

| Pravin Kumar Agarwal | 4,07,56,680 | 63.69 |

| Ayesspea Holdings and Investments Private Limited | 1,97,87,200 | 30.92 |

| Deepa Travels Private Limited | 34,40,000 | 5.38 |

#5 PKH Ventures IPO: Financial Performance

PKH Ventures’ revenue from operations declined 17.46% to INR 199.35 crore in FY 2022 from INR 241.51 crore in FY 2021. This was primarily on account of the aftereffects of Covid-19 pandemic as both the biggest verticals saw muted activity, followed by a gradual recovery.

| FY 2020 | FY 2021 | FY 2022 | 9M FY 2023 | |

| Revenue | 165.89 | 241.51 | 199.35 | 125.46 |

| Expenses | 161.45 | 201.11 | 159.84 | 99.25 |

| Net income | 14.09 | 30.57 | 40.52 | 28.64 |

| Margin (%) | 8.49 | 12.66 | 20.33 | 22.83 |

#6 PKH Ventures IPO: Valuations & Margins

While the company saw reduction in the top line, it did well to maintain its margins as outlined below.

| FY 2020 | FY 2021 | FY 2022 | |

| EPS | 2.35 | 5.06 | 6.33 |

| PE ratio | – | – | 22.12 – 23.38 |

| RONW (%) | 9.43 | 16.55 | 12.38 |

| NAV | 199.06 | 230.92 | 51.16 |

| ROCE (%) | 10.61 | 12.94 | 15.00 |

| EBITDA (%) | 13.38 | 29.71 | 40.35 |

| Debt/Equity | 0.17 | 0.52 | 0.30 |

#7 PKH Ventures IPO: Employees

As of 31 March 2023, PKH Ventures had 156 permanent employees. It undertakes periodic need-based recruitment every year to maintain the size and skill set of the workforce, which may otherwise decline as a result of attrition and retirement of employees. As of 31 March 2023, the company had 41 employees working in the Construction & Development and 103 employees engaged in Hospitality business.

PKH Ventures IPO will compete with IdeaForge, Cyient DLM, and Senco Gold for investors’ funds. This makes it an interesting competition and it helps that this upcoming IPO is commanding a premium in the grey market.