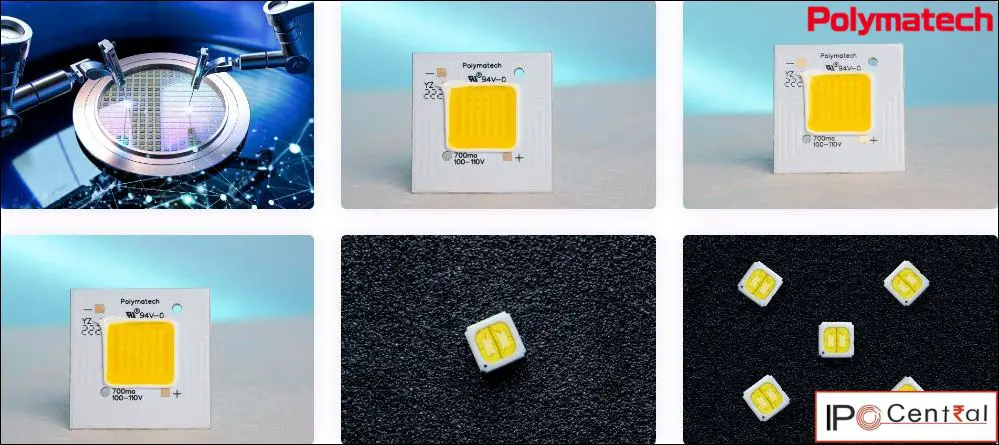

Polymatech Electronics IPO Description – Polymatech Electronics, India’s premier opto-semiconductor chip manufacturer, embarked on its journey in 2019. Leveraging state-of-the-art European and Japanese technologies, it strives to deliver top-notch products meeting global standards. Its solutions cater to domains where photonics, the science of light waves, holds pivotal importance.

As of September 2023, the company’s products are categorized into two main groups: (i) Fully packaged Opto-Semiconductor Chips, available in various forms such as COB, HTCC, MLCC, LTCC, etc., referred to as ‘Opto-Semiconductor Chips’ or simply ‘Chips’, and (ii) Luminaries.

Polymatech primarily operates in the design and packaging stages. Currently, assembly into the final product is only conducted for the luminaries utilized in large-area lighting. The company has also developed and conducted trials for several other products, including Photosynthesis lighting for horticulture, Aquaculture lighting, UV light for operation theaters for surgeries, Sanitization Lighting for the food processing industry, Lights used in Endoscopy and Laparoscopy equipment, Li-Fi (Light fidelity) equipment for transmitting data through light

Polymatech Electronics serves a diverse clientele, including multinational corporations, with some belonging to the Fortune 1000 list. The luminaries find placement in various establishments, including factories like Shin-Etsu in Japan, Vishay Precision Group, Stanley, Lohman, and Okaya in Japan, AMRL Hitech City, ASPEN Infra, Mori Mura in Japan, airports such as Coimbatore airport managed by Everrise Electric, stadiums like Sawai Mansingh Stadium, gurudwaras such as Banglasaheb in New Delhi, and temples such as Parthasarathi Temple in Chennai.

Promoters of Polymatech Electronics – Mr. Eswara Rao Nandam, Ms. Uma Nandam, and Mr. Vishaal Nandam

Table of Contents

Polymatech Electronics IPO Details

| Polymatech Electronics IPO Dates | Coming soon |

| Polymatech Electronics Issue Price | Coming soon |

| Fresh issue | INR 750 crores |

| Offer For Sale | NIL |

| Total IPO size | INR 750 crores |

| Minimum bid (lot size) | Coming soon |

| Face Value | INR 10 per share |

| Retail Allocation | 35% |

| Listing On | BSE, NSE |

Polymatech Electronics Issue Financial Performance

| FY 2021 | FY 2022 | FY 2023 | |

| Revenue | 45.01 | 125.87 | 649.02 |

| Expenses | 39.94 | 93.04 | 484.98 |

| Net income | 6.29 | 34.27 | 167.77 |

| Margin (%) | 13.97 | 27.23 | 25.85 |

Polymatech Electronics Offer News

- Polymatech Electronics RHP

- Polymatech Electronics DRHP

- ASBA IPO Forms

- Live IPO Subscription Status

- IPO Allotment Status

Polymatech Electronics Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 0.99 | 5.40 | 26.02 |

| PE ratio | – | – | – |

| RONW (%) | 20.91 | 49.71 | 52.75 |

| NAV | – | – | 44.25 |

| ROCE (%) | 18.00 | 42.95 | 75.57 |

| EBITDA (%) | 27.90 | 33.43 | 28.97 |

| Debt/Equity | 0.76 | 0.60 | 0.13 |

Polymatech Electronics IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| Coming soon | – | – | – |

Polymatech Electronics IPO Subscription – Live Updates

Coming soon

Polymatech Electronics IPO Allotment Status

Polymatech Electronics IPO allotment status will be available on Link Intime’s website. Click on Link Intime IPO weblink to get allotment status.

Polymatech Electronics IPO Dates & Listing Performance

| IPO Opening Date | Coming soon |

| IPO Closing Date | Coming soon |

| Finalization of Basis of Allotment | Coming soon |

| Initiation of refunds | Coming soon |

| Transfer of shares to demat accounts | Coming soon |

| Polymatech Electronics IPO Listing Date | Coming soon |

| Opening Price on NSE | Coming soon |

| Closing Price on NSE | Coming soon |

Polymatech Electronics IPO Reviews – Subscribe or Avoid?

Angel One –

Anand Rathi –

Antique Stock Broking –

Arihant Capital –

Ashika Research –

BP Wealth –

Capital Market –

Canara Bank Securities –

Choice Broking –

Dalal & Broacha –

Elite Wealth –

GCL Broking –

Geojit –

GEPL Capital –

Hem Securities –

ICICIdirect –

Investmentz –

Jainam Broking –

DR Choksey –

LKP Research –

Marwadi Financial –

Mehta Equities –

Motilal Oswal –

Nirmal Bang –

Reliance Securities –

Religare Broking –

Samco Securities –

SBI Securities –

SMC Global –

Swastika Investmart –

Ventura Securities –

Polymatech Electronics Offer Lead Manager

KHAMBATTA SECURITIES LIMITED

1 Ground Floor, 7/10, Botawala Building,

9 Bank Street, Hormiman Circle, Fort, Mumbai400001

Phone: 011-41645051, 022-66413315

Email: [email protected]

Website: www.khambattasecurities.com

Polymatech Electronics Offer Registrar

LINK INTIME INDIA PRIVATE LIMITED

C-101, 1st Floor, 247 Park L.B.S. Marg,

Vikhroli West, Mumbai – 400 083, Maharashtra

Telephone: +91 810 811 4949

Email: [email protected]

Website: www.linkintime.co.in

Polymatech Electronics Contact Details

POLYMATECH ELECTRONICS LIMITED

Plot OZ-13, SIPCOT Hi-Tech SEZ, Oragadam,

Kancheepuram-602105 Tamil Nadu India

Phone: +91 94891 27000

Email: [email protected]

Website: www.polymatech.in

Polymatech Electronics IPO FAQs

How many shares in Polymatech Electronics IPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 50%, NII – 15%, and Retail – 35%.

How to apply for Polymatech Electronics Public Offer?

The best way to apply for Polymatech Electronics‘ public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is Polymatech Electronics IPO GMP today?

Polymatech Electronics IPO GMP today is INR NA per share.

What is Polymatech Electronics kostak rate today?

Polymatech Electronics kostak rate today is INR NA per application.

What is Polymatech Electronics Subject to Sauda rate today?

Polymatech Electronics’ subject-to-Sauda rate today is INR NA per application.