Tata Capital, the company which is among the principal functioning arms of the Tata group, is in preparation for tapping capital markets and launch its IPO. The market has already started a buzz in regards to the same even though the IPO plans are just in the shaping phase. Various sources and sites are anticipating Tata Capital IPO as the biggest IPO in India surpassing even the LIC IPO where the corporation raised over INR 21,000 crores through an Offer for Sale (OFS).

The Tata group is now in the process of merging some of the group companies in line with the IPO plan. In Tata Capital IPO, the company is believed to offload up to 5% of shares via OFS.

Financial Services Arm of Tata Group

Tata Capital is registered with the Reserve Bank of India as a Systematically Important Non-Deposit Accepting Core Investment Company. It is engage in the business as a financial and investment service provider and offers lending and other services in the same segment to its customers. Tata Capital is a customer-centric and trusted organization offering a wide range of financial services and solutions.

Tata Capital as we know is the principal financial services company and the holding company of other Tata entities like Tata Capital Financial Services Limited, Tata Capital Housing Finance Limited, Tata Cleantech Capital Limited, and Tata Securities Limited. The other primary company of the Tata group is Tata Sons Limited which is the promoter of several group companies. The majority of shares of Tata Sons itself are held by philanthropic trusts. The trusts function towards the upliftment and support of health, education, livelihood generation, and art and culture.

The customers of Tata Capital include individuals or retail, corporates, and institutions. The company caters to a wide range of customers and provides them with services like Personal Loans, Private Equity, Home Loans, Wealth Products Distribution, Commercial and SME Finance, Cleantech Finance, Institutional Distribution, Tata Cards, Loan Against Property, Business Loans, Leasing Solutions, and Other Consumer Loans.

Tata Capital is ranked among the Top 3 diversified NBFCs in India. The company was the 5th most profitable company in the Tata Group in financial year 2021-22. It has presence in over 267 locations, out of which 86% of locations are in non-metro cities.

Read Also: Upcoming Tata Group IPOs in 2024

Tata Capital IPO: Strong Financial Standing

During the financial year 2022-23, Tata Capital posted a revenue of INR 13,637 crores, up 32.5% from previous year. While top line grew at healthy rate, its net income grew at even higher rate in the latest year. Profit after tax (PAT) in FY 2022-23 stood at INR 2,975 crore, surging 80.5% year on year (y/y). On similar lines, its EPS (Earnings Per Share) jumped from INR 4.69 to INR 8.46 in the latest year.

Further, the total assets of the company are INR 135,562.25 crores in the latest year, marking an increase from INR 102,375.56 crores in the previous year. In this year, the company also attained its highest-ever Return on Equity (ROE) of 23%.

As of 30 September 2023, the company served over 3.1 million customers.

Read Also: Biggest Holding Companies in India

The Tata Group

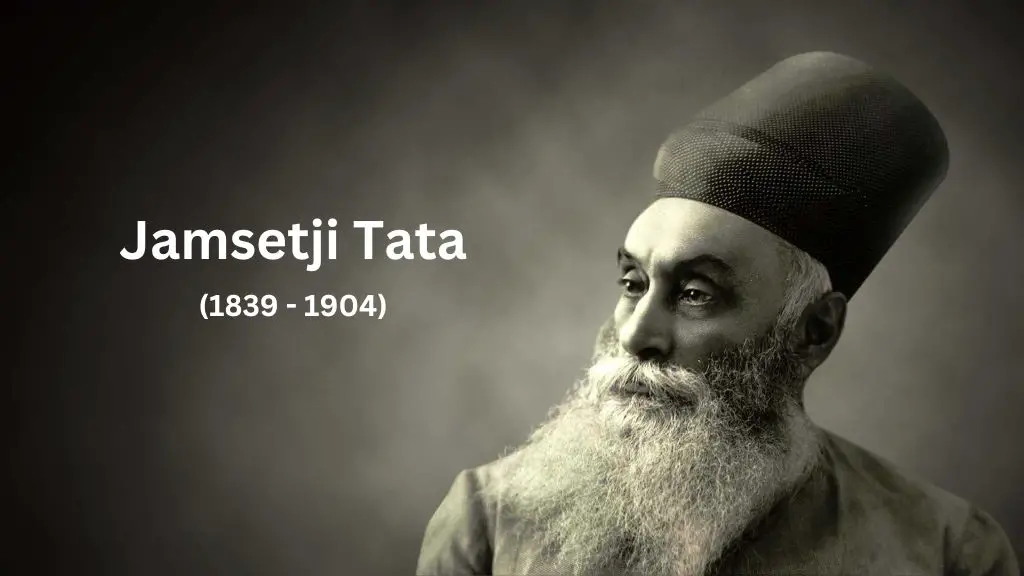

The Tata Group has been enshrined in Indian history for more than a century. A value-based corporation whose objective has always been Integrity, Responsibility, Excellence, Unity, transparency, fair trade, and everything in favor of the economy. A trading firm that was started by Jamsetji Tata in 1868 is leading ten business verticals on a national level.

The conglomerate Tata Group has a combined market capitalization of USD 300 billion (INR 24 trillion) as of 31 July 2023. The group marked USD 150 billion of revenues for the fiscal 2022-23.

We all have heard numerous stories of the righteous Tata Group and the contribution it strives to make continuously in the Indian market. Tata Group has touched probably every segment and industry and has delivered commendable outcomes for the company itself and for the people who are associated with it. The businesses of Tata Group include but are not limited to Technology, Steel, Automotive, Consumer and Retail, Infrastructure, Financial Services, Aerospace and Defense, Tourism and Travel, Telecom and Media, and Trading and Investment.

Tata Group is known as India’s most valuable brand and in 2023 it also topped the rank of Brand Finance India Ranking.

Read Also: Best Foreign MNC Stocks Listed in India

Tata Capital IPO: RBI Regulations Mandating Listing

As for the IPO, Tata Capital is restructuring its operations and expanding its board. These changes are being implemented with Tata Capital IPO in mind.

The Reserve Bank of India (RBI) introduced the Scale Based Regulation (SBR) framework in October 2021. This Regulatory framework segregates the NBFCs into four layers. According to these regulations, once a NBFC is classified as Upper Layer (NBFC-UL), it will become subject to additional regulatory requirements. In the list announced by RBI for the year 2023-24 under the Scale Based Regulation, two companies of Tata Group, namely Tata Sons Private Limited and Tata Capital Financial Services Limited have been categorized as Upper Layer (NBFC-UL).

Read Also: Here is Why Tata Sons IPO is Not Desirable

The regulations also state that a non-listed ‘upper-layer’ NBFC must be listed within three years of being classified as such. Therefore, Tata Capital IPO is being taken up at high priority within the group after RBI notification. According to some market estimates, Tata Capital is valued at a whopping sum of INR 11 lakh crores.

Some of the other companies categorized as Upper Layer (NBFC-UL) include Bajaj Housing Finance, HDB Financial Services, Indiabulls Housing Finance, and Piramal Capital & Housing Finance.

As per the latest news in the market, the Tata Capital IPO will likely be floored around September 2025. In all probability, Tata Capital IPO would make it to the list of largest IPOs in India.

All of the companies of Tata Group are widely known for their values, care for its employees, integrity, and welfare of the society and these characteristics have contributed towards its constant growth as well. The IPO will be a prosperous opportunity for the investors to invest in and will give new direction to the operations of the company.