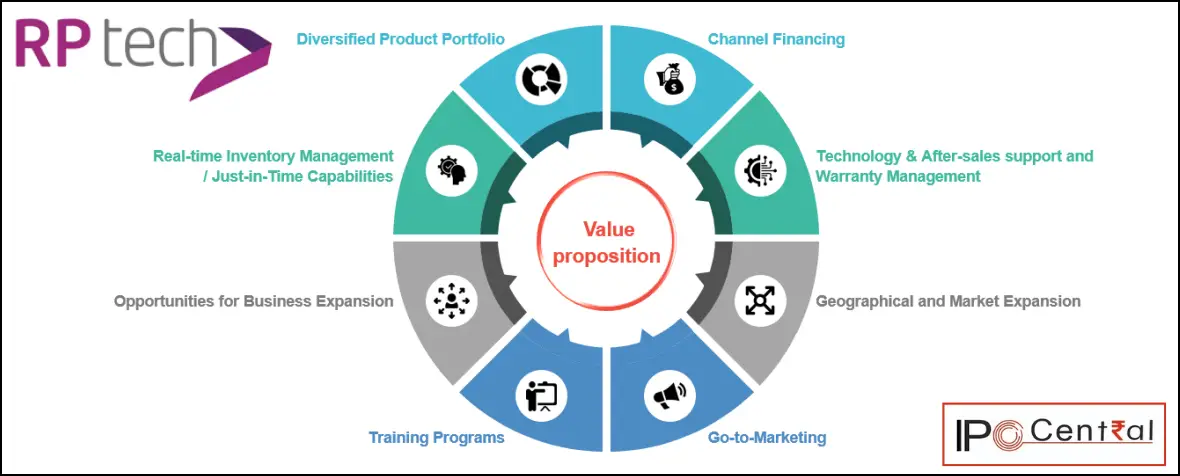

Rashi Peripherals IPO Description – Since 1989, Rashi Peripherals has been a powerhouse distributing global tech brands in India, specializing in cutting-edge Information and Communication Technology (ICT) products. The company extends its service portfolio to encompass valuable additions like pre-sales activities, solution design, technical support, marketing services, credit solutions, and warranty management services.

As of 30 September 2023, the company’s pan-India distribution network spans 50 branches functioning as both sales and service centers, complemented by 63 warehouses. This extensive network allows the company to reach, and 8,402 Channel Partners serve 680 locations across India.

The company operates primarily in two distinct verticals: Personal Computing, Enterprise, and Cloud Solutions (PES), along with Lifestyle and IT Essentials (LIT). It serves as the conduit for the distribution of ICT products from 48 global technology brands in India.

As of 30 September 2023, the company boasts a workforce of 1,433 employees. Among them, 549 are dedicated to the sales and marketing team, while 64 are committed to providing technical support.

Promoters of Rashi Peripherals – Krishna Kumar Choudhary, Sureshkumar Pansari, Kapal Suresh Pansari, Keshav Krishna Kumar Choudhary, Chaman Pansari, Krishna Kumar Choudhary (HUF), and Suresh M Pansari HUF

Table of Contents

Rashi Peripherals IPO Details

| Rashi Peripherals IPO Dates | 7 – 9 February 2024 |

| Rashi Peripherals Issue Price | INR 295 – 311 per share |

| Fresh issue | INR 600 crore |

| Offer For Sale | NIL |

| Total IPO size | INR 600 crore |

| Minimum bid (lot size) | 48 shares (INR 14,928) |

| Face Value | INR 5 per share |

| Retail Allocation | 35% |

| Listing On | BSE, NSE |

Rashi Peripherals Financial Performance

| FY 2020 | FY 2021 | FY 2022 | FY 2023 | H1 FY 2024 | |

| Revenue | 3,934.48 | 5,925.05 | 9,313.44 | 9,454.28 | 5,468.51 |

| Expenses | 3,891.09 | 5,751.37 | 9,082.07 | 9,304.32 | 5,370.66 |

| Net income | 38.23 | 136.35 | 182.51 | 123.34 | 72.02 |

| Margin (%) | 0.97 | 2.30 | 1.96 | 1.30 | 1.32 |

Rashi Peripherals Offer News

- Rashi Peripherals RHP

- Rashi Peripherals DRHP

- ASBA IPO Forms

- Live IPO Subscription Status

- IPO Allotment Status

Rashi Peripherals Valuations & Margins

| FY 2020 | FY 2021 | FY 2022 | FY 2023 | |

| EPS | 9.48 | 31.20 | 43.57 | 29.50 |

| PE ratio | – | – | – | 10.00 – 10.54 |

| RONW (%) | 15.07 | 33.07 | 31.66 | 17.60 |

| NAV | 62.88 | 94.34 | 137.63 | 167.56 |

| ROCE (%) | 14.58 | 23.46 | 20.13 | 14.21 |

| EBITDA (%) | 2.39 | 3.63 | 3.28 | 2.83 |

| Debt/Equity | 1.25 | 1.23 | 1.52 | 1.53 |

Rashi Peripherals IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 13 February 2024 | 60 | – | – |

| 12 February 2024 | 75 | – | – |

| 10 February 2024 | 80 | – | – |

| 9 February 2024 | 75 | – | – |

| 8 February 2024 | 82 | – | – |

| 7 February 2024 | 80 | – | – |

| 6 February 2024 | 75 | – | – |

| 5 February 2024 | 70 | – | – |

| 3 February 2024 | 50 | – | – |

| 2 February 2024 | 28 | – | – |

Rashi Peripherals IPO Objectives

The company proposes to utilize the Net Proceeds from the Offer towards funding the following objects:

- Prepayment or scheduled repayment of all or a portion of certain outstanding borrowings availed by the company – INR 326 crore

- Funding working capital requirements of the company – INR 220 crore

- General corporate purposes

Rashi Peripherals IPO Subscription – Live Updates

| Category | QIB | NII | Retail | Total |

| Shares Offered | 4,067,796 | 3,050,848 | 7,118,645 | 14,237,289 |

| 9 Feb 2024 | 143.66 | 62.75 | 10.44 | 59.71 |

| 8 Feb 2024 | 0.72 | 5.88 | 3.46 | 3.19 |

| 7 Feb 2024 | 0.01 | 1.87 | 1.36 | 1.09 |

| As on 07:00:00 PM | ||||

Rashi Peripherals – Comparison With Listed Peers

| Company | Face Value | PE ratio | EPS | RONW (%) | NAV | Revenue (Cr.) |

| Rashi Peripherals | 5 | 10.54 | 43.57 | 31.66 | 137.63 | 9,321.92 |

| Redington India | 2 | 11.09 | 2.44 | 22.12 | 74.03 | 62,731.57 |

Rashi Peripherals IPO Allotment Status

Rashi Peripherals IPO allotment status is now available on Link Intime’s website. Click on Link Intime IPO weblink to get allotment status.

Rashi Peripherals IPO Dates & Listing Performance

| Rashi IPO Opening Date | 7 February 2024 |

| Rashi IPO Closing Date | 9 February 2024 |

| Finalization of Basis of Allotment | 12 February 2024 |

| Initiation of refunds | 13 February 2024 |

| Transfer of shares to demat accounts | 13 February 2024 |

| Rashi Peripherals IPO Listing Date | 14 February 2024 |

| Opening Price on NSE | INR 339.5 per share (up 9.16%) |

| Closing Price on NSE | INR 321.50 per share (up 3.38%) |

Rashi Peripherals IPO Reviews – Subscribe or Avoid?

Angel One –

Anand Rathi – Subscribe

Axis Capital – Not rated

Antique Stock Broking –

Arihant Capital –

Ashika Research –

BP Wealth – Subscribe

Capital Market – Neutral

Canara Bank Securities – Subscribe

Choice Broking – Subscribe

Dalal & Broacha –

Elite Wealth – Apply for long term

GCL Broking –

Geojit –

GEPL Capital – Subscribe

Hem Securities – Subscribe

ICICIdirect –

Indsec Securities – Subscribe

Investmentz –

Jainam Broking –

DR Choksey –

LKP Research –

Marwadi Financial – Subscribe

Motilal Oswal –

Nirmal Bang –

Reliance Securities –

Religare Broking –

SBI Securities – Subscribe for long term Horizon

Samco Securities – Subscribe for listing gains

SBI Securities –

SMC Global – 2/5

Swastika Investmart – Subscribe

Ventura Securities – Subscribe

Rashi Peripherals IPO Lead Manager

JM FINANCIAL LIMITED

7th Floor, Cnergy, Appasaheb Marathe Marg,

Prabhadevi, Mumbai 400 025,

Maharashtra, India

Phone: +91 22 6630 3030

Email: [email protected]

Website: www.jmfl.com

Rashi Peripherals Offer Registrar

LINK INTIME INDIA PRIVATE LIMITED

C-101, 1st Floor, 247 Park L.B.S. Marg,

Vikhroli West, Mumbai – 400 083, Maharashtra

Telephone: +91 22 4918 6200

Email: [email protected]

Website: www.linkintime.co.in

Rashi Peripherals Contact Details

RASHI PERIPHERALS LIMITED

Ariisto House, 5th Floor, Corner of Telli Galli,

Andheri (E), Mumbai 400 069, Maharashtra, India

Phone: +91 22 6177 1771/72

Email: [email protected]

Website: www.rptechindia.com

Rashi Peripherals IPO FAQs

How many shares in Rashi Peripherals IPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 50%, NII – 15%, and Retail – 35%.

How to apply in Rashi Peripherals Public Offer?

The best way to apply in Rashi Peripherals’ public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is Rashi Peripherals IPO GMP today?

Rashi Peripherals IPO GMP today is INR 60 per share.

What is Rashi Peripherals kostak rate today?

Rashi Peripherals kostak rate today is INR NA per application.

What is Rashi Peripherals Subject to Sauda rate today?

Rashi Peripherals Subject to Sauda rate today is INR NA per application.