Last Updated on March 3, 2020 by Krishna Bagra

Stock markets are in panic mode due to Coronavirus scare and this has predictably impacted SBI Cards IPO as well. So we created a Twitter poll to understand investors’ expectations from the IPO and the potential listing gains from SBI Cards IPO. Please participate and share with your family, friends and relatives for maximum reach.

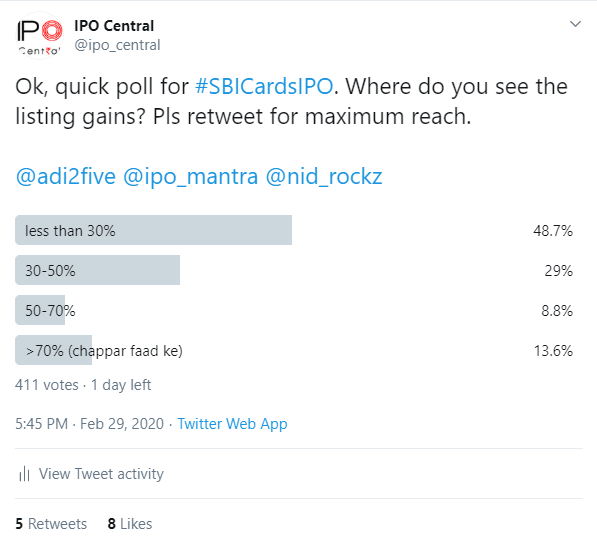

Ok, quick poll for #SBICardsIPO. Where do you see the listing gains? Pls retweet for maximum reach. @adi2five @ipo_mantra @nid_rockz

— IPO Central (@ipo_central) February 29, 2020

Read Also: SBI Cards IPO Review: We’ve seen this movie

While the poll will be active for another day, we have over 400 responses so far (at 3 PM on 1 March 2020) and it is quite a revelation that 49% investors expect less than 30% resturns from this mega IPO. This is surprising since the Grey Market Premium (GMP) just a couple of days back was nearly 50% and many investors were expecting the stock to double on listing day.

This is yet another instance of investor expectations tempering down in a jiffy. SBI Cards IPO listing gains could fall further when the market opens for trading on Monday. We are not predicting anything at the moment but will continue to update this page with latest statistics. Watch this pace.

Update: As we mentioned earlier, SBI Cards’ grey market premium continued its downward trend and has now come down to just INR150 per share. This is more than 50% reduction from peak grey premium of INR335 per share. The end results of the poll are updated now and it appears the majority is correct in expecting less than 30% listing gains.