Last updated on February 4, 2023

SBI Cards IPO has been priced in the range of INR750-755 per share and will open for subscription on 2 March. Going by the massive interest around this IPO, it is not surprising that the offer is commanding strong premium in the grey market. Through this review, we try to assess if SBI Cards IPO is worth subscribing (while knowing fully that the offer will be oversubscribed!). First up, some important details about the offer:

SBI Cards IPO details

| Subscription Dates | 2 – 5 March 2020 |

| Price Band | INR750 – 755 per share (employee discount – INR75 per share) |

| Fresh issue | INR500 crore |

| Offer For Sale | 130,526,798 shares (INR9,789.5 – 9,854.8 crore) |

| Total IPO size | INR10,289.5 – 10,354.8 crore |

| Minimum bid (lot size) | 19 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

SBI Cards IPO Review: Strong parentage

As a credit card company, SBI Cards has a huge advantage of having SBI as its parent. The company started operations in 1998 as a joint venture between SBI and GE Capital. The latter cashed out in 2017 and its stake was purchased by SBI and Carlyle Group affiliate CA Rover Holdings. SBI currently owns 76% equity in SBI Cards while the rest is held by CA Rover Holdings.

Since SBI is one of the biggest and trusted financial brands in India, it played a vital role in the aggressive expansion of credit card operations.

SBI Cards IPO Review: Interest and fee income

Almost everyone reading this analysis must have fielded sales pitches by either SBI or other credit card companies. Their sales force is in airports, shopping malls, cinemas, restaurants, and even colleges. In short, they are omnipresent and this helps them in user acquisition. Apart from having access to SBI’s network of 21,961 branches across India, the credit card subsidiary had 32,677 outsourced sales personnel as of 31 December 2019 to sell these cards. This network allowed the company to become the second largest credit card issuer in India with a market share of 18.1% (that translates into 9.83 million credit cards outstanding) in number of credit cards outstanding as of 30 November 2019.

These are obviously big numbers and feed into SBI Card’s overall revenues. There are two major revenue sources for SBI Cards – (i) interest on credit card receivables and (ii) fee-based income such as interchange fees, late fees, annual credit card membership fees and other fees. This might be surprising to some readers that SBI Cards makes slightly more than half of its revenues from interest income. Think about the times when you pay the minimum amount due and roll-over the payments and all the EMI purchases on your card.

SBI Cards Financial performance: Up, up and above

As one can see from the table below, the company has posted solid numbers on key parameters like revenues, income and profitability. What this means is that SBI Cards is firing on all cylinders. Its revenues have more than doubled in the last three years and the latest 9 month top line is almost equal to last year’s revenue. Not only SBI Cards issuing more credit cards but its customers are also using the plastic money more.

This growth in revenues also led to an increase in earnings which have increased from INR371.4 crore in FY2017 to INR859.6 crore in FY2019. The performance in the latest 9 months has exceeded what it earned in the previous financial year.

SBI Cards’ financial performance (in INR crore)

| FY2017 | FY2018 | FY2019 | 9M FY2020 | |

| Revenue | 3,471.0 | 5,370.2 | 7,286.8 | 7,240.2 |

| Expenses | 2,899.4 | 4,450.8 | 5,955.2 | 5,621.5 |

| Net income | 371.4 | 599.3 | 859.6 | 1,160.4 |

| Net margin (%) | 10.7 | 11.2 | 11.8 | 16.0 |

SBI Cards IPO Review: So far so good but should you invest?

The offer is among the biggest IPOs in India and thus, it is natural that investors are hopeful about their allotment chances. There is also a lot of excitement around the offer as it will be the first pure play credit card company to list in India. Throw in some numbers how credit card usage is low in India’s ever expanding market (which is actually true) and it is not difficult to see that SBI Cards is actually on to something big! Strong premium in the grey market is indicative of a bumper listing and HNI interest in the IPO is high to the point that NBFCs are struggling to satisfy IPO margin funding requests.

The positive aspects of SBI Cards have been extensively covered in media and it is a given that most broker reports will recommend investors to subscribe to the IPO. So in this piece, I’m going to focus on what is not so good in SBI Cards IPO.

First off, despite all the excitement around the offer, its pricing and valuation leaves very little on the table. Its annualized EPS for FY2020 should be around INR16.6 which means the price band of INR750 – 755 per share is at PE ratio of 45.2 – 45.5. Very high figures for my liking but hey, this kind of growth doesn’t come cheap! Return on Net Worth (RONW) is quite solid at 24% and Net Asset Value (NAV) is at INR51.73 per share for the nine months ended 31 December 2019. Again, not something I like but then, not such an important metric anyway.

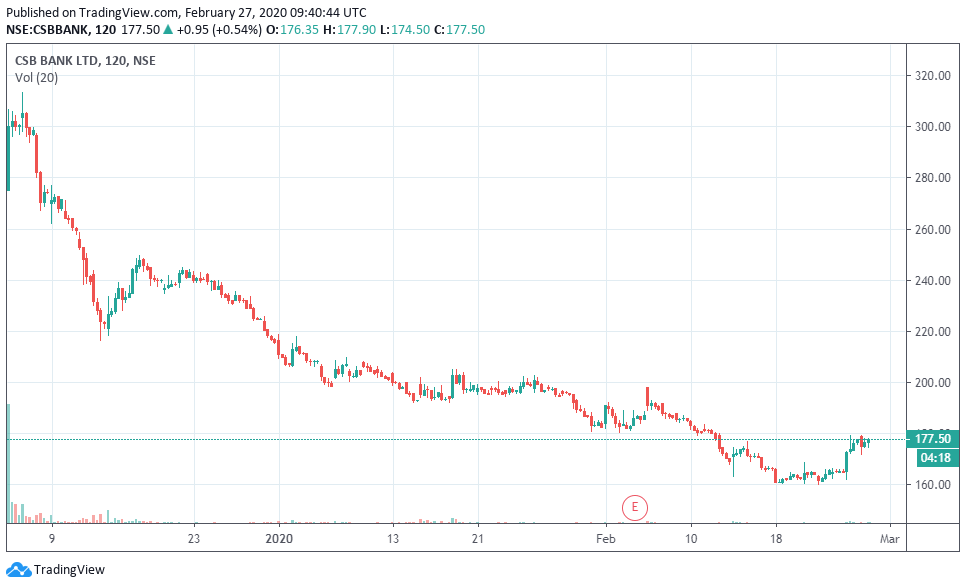

The same playbook was followed by another group company SBI Life Insurance which launched its IPO at high P/E valuation of 71.7 – 73.3. It had a poor listing and investors were trapped for nearly 18 months! Ok, it came above the IPO price briefly in April but the window was short (and you get the drift). Public memory is often short and if it is too old for you to remember, think CSB Bank which listed in December 2019. How about this for a chart?

Moving on, what is really disturbing is the detail in red herring prospectus (RHP) about the stake purchase by Carlyle. The prospectus mentions that CA Rover Holdings’ average cost of acquisition stood at INR92.52 per share. That deal took place in December 2017 at a P/E valuation of 19.48! Now, a lot of things have changed from 2017, the business has progressed for good and the growth is visible in financial numbers. Within these two years, SBI Cards profits have grown 2.5X, but the value of Carlyle’s investment has gone 8.2X. That’s superb result for the PE giant but probably not such good news for IPO investors. A practical example of greater fool theory!

If you look at it in a different way, the business was doing very well two years ago as well and all the theories one can employ about the long earnings runway, India young country, and low credit card usage were valid then too. Yet, a deal happened at a P/E multiple of 19.48! As such, I wouldn’t rule out lower multiples and lower levels post listing. While high HNI interest indicates superb demand, it also means high selling pressure on listing. So be prepared for high volatility post-listing.

How about longer term? Can it generate high returns like D-Mart parent Avenue Supermarts and IRCTC?

The question really is if SBI Cards is a portfolio stock. Of course credit card usage is very low in India and the only way is up and there is no other listed credit card company in India so SBI Cards stock should benefit. However, I’d look at this question purely from a point of view of risk.

The truth, however inconvenient, is that lending is inherently a risky business, even after employing all the artificial intelligence and data science advantages. Amid risks of a recession, sluggish economic growth and high job losses, it is no brainer that unsecured loans (this is where SBI Cards plays) will be hit hardest if the situation worsens from here.

The other risk for this business stems from the intertwined quarters of regulations and technology. Indian consumers may simply graduate to newer forms of payments and credit. Currently, there is no MDR on Rupay cards and UPI payments and some players like Axis Bank (through Freecharge) already offer credit card-like features on spends. Our regulators have, time and again, demonstrated a clear preference for simplified and lower cost solutions. Think UPI, think direct mutual funds, think trail fees curtailments on mutual fund sales. With their high cost structure, credit cards are inherently inefficient for merchants and consumers and thus, could see mass exodus as and when viable alternatives appear. As it happens with technology, it disrupts sooner and massively!

Disclosure – I plan to apply in SBI Cards IPO and look at booking partial profits on listing.

Excellent analysis both in terms of prospects and risk.. Thank you

Long term holding good company stocks for buying and holding for three to four years.

Very Useful analysis,

thanks