India’s leading agri derivatives exchange National Commodity & Derivatives Exchange (NCDEX) has filed draft IPO prospectus with market regular SEBI. According to draft prospectus, NCDEX IPO will be a mix of fresh shares and sale by existing investors. In total, the upcoming offer is likely to mobilize INR500 crore (INR5 billion). Here is a quick summary of the important points we gathered from NCDEX DRHP.

NCDEX IPO: Fresh + OFS

As mentioned above, NCDEX IPO will be a mix of fresh shares and an offer for sale (OFS) by existing shareholders. The company plans to raise INR100 crore by issuing new shares and IPO proceeds will be used towards contribution to the Core Settlement Guarantee Fund (SGF) as well as to fund net worth requirements of NCCL.

Some of its exiting investors intend to use the IPO as an exit route and offload 14,453,774 shares. These investors include Build India Capital Advisors LLP, Canara Bank, IFFCO, Investcorp Private Equity Fund I (formerly known as IDFC Private Equity Fund III), Jaypee Capital Services Limited, NABARD, Oman India Joint Investment Fund and PNB.

Read Also: Pharmacy chain MedPlus eyes INR1,000 crore IPO

NCDEX IPO: Pricing

There is no word yet about pricing but the word on street is that the IPO is likely to mobilize INR500 crore which indicates that pricing is likely to be in the range of INR250 – 300 per share.

This appears a reasonable estimate as Investcorp Private Equity Fund paid INR180 per share when it picked up 5% stake in the exchange over six years ago. Another big investor, Oman India Joint Investment Fund has an average cost of acquisition at INR182.41 per share.

Read Also: IPO Flashback 2019: Best and worst of the year

NCDEX: All about agri commodities

NCDEX is a leading agricultural commodity exchange in India with a market share of 78% in the agricultural commodity segments, based on average daily turnover by value (ADTV) as of 30 September 2019. The company offers its services across the following four business verticals:

- Futures and options trading in agricultural commodities through the exchange

- Clearing and settlement of trades through National Commodity Clearing Limited (NCCL)

- Online commodities spot market, through NCDEX e-Markets Limited (NeML)

- Issuance of electronic negotiable warehouse receipts for commodities, and provision of related services, through National E-Repository Limited (NERL)

NCDEX has also established a joint-venture with the Government of Karnataka, called Rashtriya e Market Services Private Limited (ReMS), which renders support to the agricultural market reform agenda of the state government. In addition, NCDEX holds 34.21% equity stake in Power Exchange India Limited (PXI), a power market infrastructure institution providing an electronic platform for transactions in power and allied products.

Read Also: IPO Process in India: All you need to know

In agri commodities, a strong network is one of the big differentiators. As of 30 September 2019, NCDEX’s network comprised 380 members, 13,316 terminals, nine Warehouse Service Providers (WSPs), 12 clearing banks, 41 financial institutions and 246 Farmer Producer Organization (FPOs) representing 461,619 farmers. In addition, NeML’s network comprised 171 mandis and had approximately 8,900 members and 7.8 million farmers.

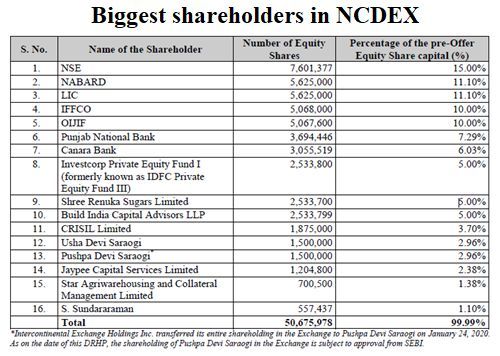

NCDEX Capital Structure: NSE, LIC, PNB on board

NCDEX has a diverse set of investors with National Stock Exchange (NSE) being the largest shareholder. Other major investors include Life Insurance Corporation of India (LIC), National Bank for Agriculture and Rural Development (NABARD), Indian Farmers Fertiliser Co-operative Limited (IFFCO), Oman India Joint Investment Fund, Punjab National Bank, Canara Bank, Build India Capital Advisors LLP, and Investcorp Private Equity Fund I (formerly known as IDFC Private Equity Fund III).

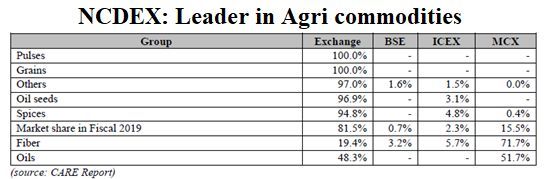

Specialized in agri commodities

NCDEX is the leader when it comes to trading in agri commodities and this is reflected in its dominant market share in some of the commodities listed below.

However, MCX is far ahead in terms of the overall commodities space. It had a market share of 91.8% in the latest year in commodity derivatives turnover while NCDEX trails with just 7.2% and this actually reduced from 9.8% in FY2018.

NCDEX’s shaky financial performance

Commodity trading is gradually picking up in India and NCDEX being the leader in this area has benefitted from the trend. Nevertheless, the revenue growth has been uneven and top line even dropped in FY2018 before increasing in the next year. At the same time, expenses have increased consistently and this has impacted profits. The company even posted losses in FY2018 and its profit margin has come down from double digits to single digit percentage.

NCDEX’s consolidated financial performance (in INR crore)

| FY2017 | FY2018 | FY2019 | H1 FY2020 | |

| Revenue | 166.3 | 162.2 | 194.7 | 92.6 |

| Expenses | 157.6 | 169.8 | 180.7 | 88.9 |

| Net income | 21.3 | -10.7 | 16.0 | 8.4 |

| Net margin (%) | 12.8 | -6.6 | 8.2 | 9.1 |

The exchange had a Return on Net Worth (RONW) of 3.42% for the full year ended 31 March 2019. This is abysmally low and it hasn’t been in double digits in any of the last three years. In comparison, NSE and MCX have RONW of 22.63% and 11.05%, respectively.