Finally, 2019 is behind us! This is said with an exclamation since an average investor would be relieved that a painful year eventually came to an end. This is not really surprising since the portfolios of most retail investors are saddled with midcaps from Indore-based advisors or their ilk. But that’s for another post. This flashback post is about finding out how an average IPO investor fared in 2019. Read on for more.

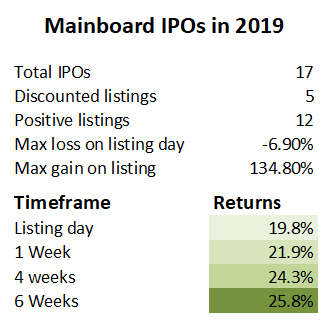

The year just went by was not really a notable one in terms of total number of mainboard issues. In total, there were only 17 mainboard primary offers during 2019, the lowest in the last five years. In comparison, 2018 had 24 IPOs, and 2017 had 38 offers. The figure was at 27 in 2016. Even 2015 had 20 IPOs!

IPOs in 2019: Poor, very poor start

Things were looking bleak for the primary market even before the starting of the year. The situation was so bad following the withdrawal of Dinesh Engineers IPO in September 2018 that no company tapped primary markets for the next four months.

The first mainboard listing of the year was Xelpmoc Design and Tech and it closed the day down 5% from its IPO price, indicating the pensive mood of the street.

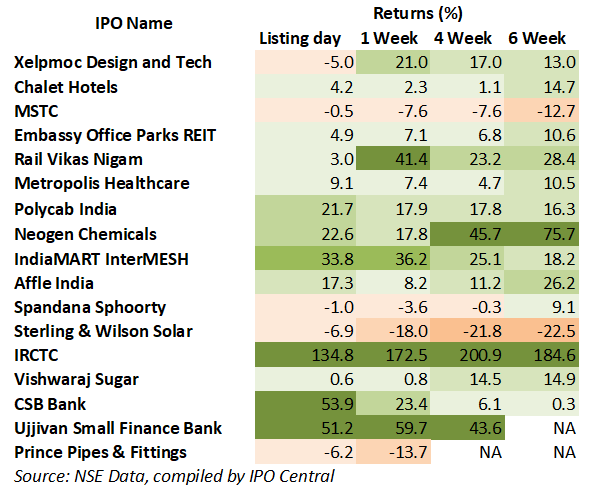

Total eight companies brought IPOs in the first-half of the year and only two of these rewarded investors with double-digit returns. Four of the IPOs closed their listing day with single-digit returns while two listed at discount, although both were small losses. Another highlight was the withdrawal of KPR Agrochem IPO even before its scheduled launch on 28 June.

Read Also: SBI Cards IPO Grey Market Premium, SBI Cards IPO GMP Trend

IPO Flashback 2019: Improvement in second-half

The sentiments on the IPO street improved as the year progressed and the second-half of the year witnessed listing of nine companies. Three of these were lower than their IPO prices but the losses were limited to single-digit percentages. On the other hand, five IPOs rewarded investors with at least double-digit percentages and it was only the Vishwaraj Sugar IPO which had a muted listing. The highlight was IRCTC IPO which left little too much money on the table and IPO investors were rewarded with 134% gains on the listing day (it has since increased to 200%)!

Read Also: Best IPOs that doubled investors’ money in 5 years

IPOs in 2019: Overall a good year, 19.8% average gains

Out of the total 17 offerings in the year, five IPOs closed lower than the issue price on listing day. And this number decreased to just two when we increased the timeframe to 6 weeks. This is important to highlight that the 6 week data is based on only 15 IPOs since Ujjivan Small Finance Bank and Prince Pipes & Fittings haven’t yet completed six weeks on the bourses.

As the image shows, mainboard IPOs returned 19.8% gains on listing day in the year. The gains increase further as we increase the holding period. The gains go up to 25.8% if IPO shares are held for 6 weeks which is not bad at all.

These are of course average returns so some IPOs are outliers on the upside like IRCTC and some on the downside such as Sterling & Wilson Solar. The following image captures the performance of each IPO in these time intervals and it is pretty clear that there is more green (gains) than orange (losses) and that most IPOs gained when held for longer.

One logical explanation of this behavior is the improvement in sentiments in secondary markets during the year. While it is difficult to contest this logic, it will be interesting to see the correlation between post-listing performances and different timeframes.

Looking forward, 2020 is likely to be a much better year for investors with a promising IPO pipeline – with SEBI approvals and awaiting – lined up. The season will start with SBI Cards & Payments.

Read Also: Upcoming IPOs in 2020 – 10 most interesting IPOs lined up for the year

PS – The results are indicative as I’ve assumed that investors were allotted at least one lot in every IPO.