Mutual fund registrar and transfer agent Computer Age Management Services (CAMS) has filed draft prospectus with SEBI. The company is a leader among mutual fund registrars in India and is likely to launch its IPO in the first quarter of the current calendar year. CAMS IPO is likely to mobilize around INR1,500 crore (INR15 billion) through Offer For Sale (OFS) by existing shareholders. In total, 12,164,400 shares are planned to be sold by existing shareholders Great Terrain, NSE Investments, HDFC, HDB Trust and Acsys. As 24.95% of the company’s equity share capital is planned to be offloaded through the IPO, the offer size indicates that the company will be valued around INR6,000 crore.

Read on for some interesting points about the upcoming IPO of India’s biggest mutual fund registrar.

CAMS IPO: Centered around mutual funds

According to the DRHP, the company is India’s largest registrar and transfer agent of mutual funds with an aggregate market share of 69.4% based on mutual fund Average Assets Under Management (AAUM) managed by its clients and serviced by CAMS during November 2019. In the last five years, the company has been able to expand its market share from 60.5% in March 2015 to 67.6% in March 2019, based on AAUM serviced.

Some of its prominent clients include HDFC Asset Management Company (HDFC AMC), ICICI Prudential Asset Management Company, SBI Funds Management Private, Aditya Birla Capital, and DSP Investment Managers. In total, the company serviced INR18.7 trillion of AAUM of 16 mutual funds as of November 2019. The company earns revenue on the basis of mutual fund AAUM of its clients. Over the last five years, the AUM of equity mutual funds serviced by it grew from INR2,180 billion to INR6,643 billion in FY2019, representing a CAGR of 32.1%.

Read Also: Biocon Biologics IPO in works, Kiran Mazumdar-Shaw hints

CAMS IPO: But expanding into other verticals

Over the years, CAMS has expanded its product lines and it now offers services in six business verticals apart from Mutual Funds. These include Electronic Payment Collection, Insurance, Alternative Investment Fund, Banking and Non-Banking Services, KYC Registration Agency, and Software Solutions Business. In fact, it had a market share of 39% of the insurance repository business in FY2018, based on e-insurance policies being managed.

CAMS IPO: Extensive backend network

To support the extensive operations, the company has a physical network that included 278 service centers spread over 25 states and five union territories as of 30 September 2019. In addition, CAMS has call centers in four major cities and operates four back offices including a disaster recovery site.

As of 30 September 2019, the company had employed 1,336 personnel at front offices while its back offices employed another 5,114.

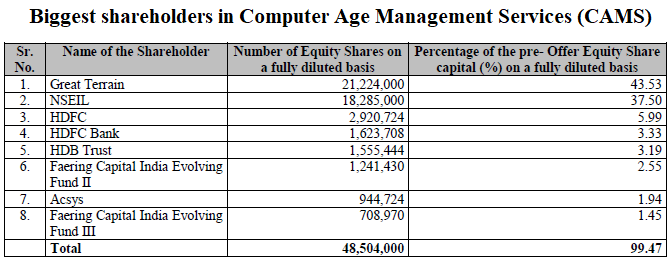

CAMS IPO: Warburg Pincus, HDFC, NSE among investors (selling)

Established in 1988, CAMS has attracted several marquee investors. The list includes private equity investor Warburg Pincus as well as homegrown players like NSE Investments, HDFC twins and Faering Capital.

Warburg Pincus picked up 37.5% equity stake in the company in 2018 through its affiliate Great Terrain and increased it to current 43.53% the next year. Great Terrain is also the promoter of CAMS.

Trivia: Great Terrain’s average cost of acquisition is at INR686.88 per share.

CAMS IPO: Debt-free balance sheet and healthy margins

Financially, CAMS seems to have perfected the business over the last 30 years while its long-standing relationships with key clients have also helped. At a time when more of millennials are putting their savings into mutual funds, CAMS is a natural beneficiary and this is reflected in its financial performance. CAMS’ topline growth in the last three years implies a CAGR of 20.4%.

Profits have also grown, although less consistently and a dip in profitability in the latest year caused the net income figure to drop from FY2018 levels. Nevertheless, even at last year’s depressed levels, CAMS’ profitability stood at a robust 18.3% and the latest data for H1 FY2020 indicates that margins have recovered to 23%. Apart from other factors, a debt-free balance sheet has helped the company in maintaining healthy profitability.

CAMS’ consolidated financial performance (in INR crore)

| FY2017 | FY2018 | FY2019 | H1 FY2020 | |

| Revenue | 502.6 | 661.4 | 711.5 | 360.0 |

| Expenses | 313.4 | 434.9 | 510.6 | 239.6 |

| Net income | 123.5 | 145.9 | 130.4 | 82.7 |

| Net margin (%) | 24.6 | 22.1 | 18.3 | 23.0 |

CAMS IPO: Outsmarting its peers

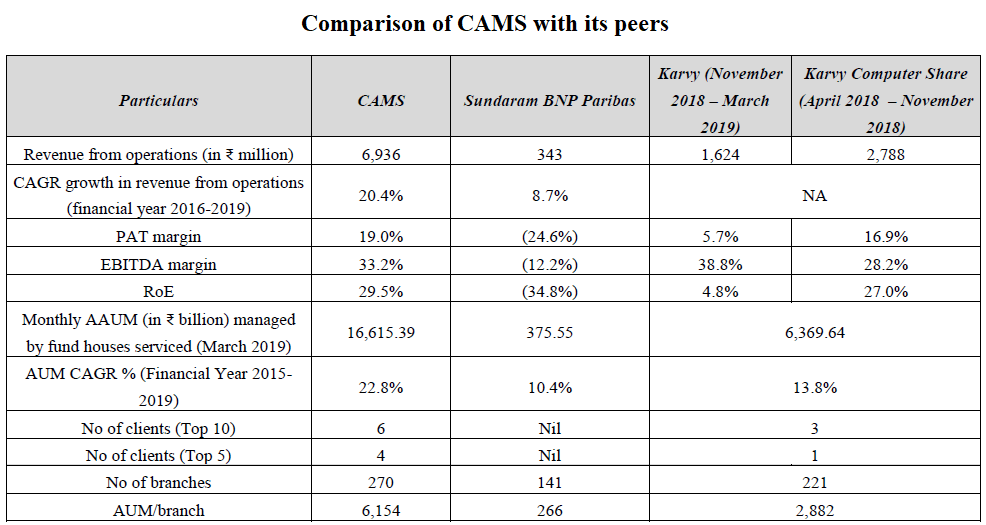

Without a doubt, CAMS competes with formidable peers like KFin Technologies (erstwhile Karvy Fintech), Sundaram BNP Paribas Fund Services (part of KFin Technologies now) and Franklin Templeton Asset Management. Despite this stiff competition, CAMS has been able to post robust performance and has better performance on almost every financial parameter.

Best information.