The IPO of Security and Intelligence Services (SIS) India will be 17th mainboard public offer when it opens next week for subscription. Through SIS India IPO review, we explore if the public offer is good for retail investors. Here are some essential details about the IPO.

The IPO of Security and Intelligence Services (SIS) India will be 17th mainboard public offer when it opens next week for subscription. Through SIS India IPO review, we explore if the public offer is good for retail investors. Here are some essential details about the IPO.

The New Delhi-based security and cash logistics services firm has priced the public offer in the range of INR805 – 815 per share. Investors can place orders for minimum 18 shares and in multiples thereafter from 31 July to 2 August 2017. Through the IPO, the CX Partners-backed company plans to raise INR362.25 crore while 5,120,619 shares will be sold by existing shareholders. In total, the upcoming IPO will mobilize INR774.46 – 779.58 crore.

SIS India IPO details | |

| Subscription Dates | 31 July – 2 August 2017 |

| Price Band | INR805 – 815 per share |

| Fresh issue | INR362.25 crore |

| Offer For Sale | 5,120,619 shares (INR412.21 – 417.33 crore) |

| Total IPO size | INR774.46 – 779.58 crore |

| Minimum bid (lot size) | 18 shares |

| Face Value | INR10 per share |

| Retail Allocation | 10% |

| Listing On | NSE, BSE |

SIS India IPO Review: CX Partners on board

As mentioned above, the IPO will be a mix of fresh shares and an Offer For Sale (OFS). The company will receive INR362.25 crore by issuing new shares and plans to use the funds towards repayment and pre-payment of outstanding indebtedness, funding working capital requirements, and general corporate purposes. Out of the total, the company aims to use INR200 crore towards debt reduction while INR60 crore will be used to augment working capital, leaving the remaining for general corporate purposes.

SIS India is backed by private equity (PE) investor CX Partners which plans to participate in the OFS. The PE investor has invested in the company through its investment arms Theano Private Limited and AAJV Investment Trust. Theano plans to sell 3,402,764 shares while 68,336 shares will be offered by AAJV. Theano holds 10,439,781 shares or nearly 15.2% equity stake in SIS India while AAJV has a small shareholding. In total, CX Partners owns nearly 15.5% equity in the company through the two firms. Promoters Ravindra Kishore Sinha (786,517 shares) and Rituraj Kishore Sinha (524,345 shares) will also sell some of their stakes. Other shareholders will sell 338,657 units.

The IPO will be managed by Axis Capital, Kotak Mahindra Capital, ICICI Securities, IIFL Holdings, Yes Securities, SBI Caps, and IDBI Capital Markets while Link Intime will be the registrar.

SIS India IPO Review: Business Background

The company is a leading provider of private security and facility management services in India and Australia. It claims to be the leading security services player in Australia and second largest in India in terms of revenues. It is also the second largest cash logistics company in India.

As of 30 April 2017, its network included 251 branches in 124 cities and towns in India, covering 630 districts. The company employed 148,678 personnel in India and offered security and facility management services at 11,869 customer premises across the country. It also operates 18 training centers in 15 states. In Australia, it is present in all the eight states and employed 5,754 personnel servicing 245 customers.

Although it operates in three business lines – security services, facility management services, and cash logistics services – it is the security business which brings in the maximum revenue. In the year ended 31 March 2017, the company registered 87.2% of its total revenues from security services. 8.6% came from facility management services and cash logistics services accounted for only 3.6%. Within the security services business, it is interesting to see that the company gets majority of business from Australia and not India. Nevertheless, it is the business in India which has grown at a faster rate. In the similar fashion, smaller facility management services and cash logistics services businesses have demonstrated stronger business growth in the last five years.

SIS India IPO Review: Financial performance

Financial performance of SIS India has been on a solid footing as the table demonstrates. The company’s revenues increased from an already-large base of INR2,657.7 crore in FY2013 to INR4,577.1 crore in FY2017. This translates into an average annual growth of 14.6%. Quite impressive!!! In line with growing top line, profits also increased from INR57.2 crore to INR91.3 crore in the same timeframe. Amid all these growing performances, what has remained little changed is the profitability at near 2% of revenues. Now, our regular readers know we don’t like low-margin businesses but more on this later.

SIS India’s financial performance (in INR crore) | ||||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | ||

| Total revenue | 2,657.7 | 3,107.7 | 3,565.2 | 3,850.1 | 4,577.1 | |

| Total expenses | 2,575.9 | 3,006.0 | 3,484.5 | 3,757.5 | 4,465.9 | |

| Profit after tax | 57.2 | 68.7 | 62.7 | 75.7 | 91.3 | |

| Profit margin (%) | 2.15 | 2.21 | 1.76 | 1.97 | 1.99 | |

SIS India IPO Review: Should you invest?

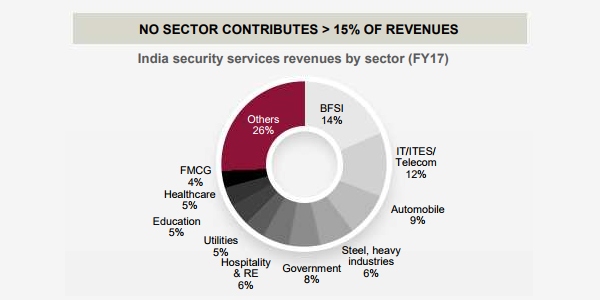

When it comes to valuations of SIS India, couple of things stand out in case of the company. The verticals it operates into are fairly new and the concept of outsourced security services didn’t exist a few decades back. Nearly 26% of its revenues are from Banking, Financial Services and Insurance (BFSI) and IT/ITES/Telecom sectors which have contributed immensely to the trend of outsourcing security services. This means the industry is still evolving and a relatively large portion of market share is concentrated in the hands of large players. These dynamics, when coupled with high entry barriers and differentiation, usually offer a significant headstart to pioneers. However, security service is not the most likely of the industries to create such differentiation. At the same time, it is not difficult to imagine that low entry barriers will keep a steady supply of new competitors.

When it comes to valuations of SIS India, couple of things stand out in case of the company. The verticals it operates into are fairly new and the concept of outsourced security services didn’t exist a few decades back. Nearly 26% of its revenues are from Banking, Financial Services and Insurance (BFSI) and IT/ITES/Telecom sectors which have contributed immensely to the trend of outsourcing security services. This means the industry is still evolving and a relatively large portion of market share is concentrated in the hands of large players. These dynamics, when coupled with high entry barriers and differentiation, usually offer a significant headstart to pioneers. However, security service is not the most likely of the industries to create such differentiation. At the same time, it is not difficult to imagine that low entry barriers will keep a steady supply of new competitors.

This naturally leads us to the low-margin nature of the industry. Over the last five years, the company’s margins have largely remained flat at 2% and there is little to suggest that performance on this parameter will change anytime soon. Even though the claims of more growth going ahead are understandable, this growth will be shared across a higher number of players than in the past.

At the upper end of the price band of INR805 – 815 per share, the company is asking for a PE multiple in the range of 61.8 – 62.5. The company believes there is no other player with a similar set of operations but picks up Quess Corp as a listed peer which is somewhat comparable. The only thing common in the two companies’ business model is human resources but they essentially cater to different segments. Quess Corp, which brought its IPO last year, was a high growth play, with revenues growing five-fold over four years. SIS India represents a growing business but its growth is nowhere close to that of Quess. Its debt to equity ratio of 1.37 times is also quite high while the Return on Net Worth (RONW) of 16.81 is decent. SIS India is going to see a reduction in its debt levels after the IPO but the interest outgo is still going to eat into its margins.

In light of the above points, it doesn’t take rocket science to understand that valuations are a little too high for SIS IPO. In all, SIS India IPO review reveals that despite CX Partners’ continued presence and strong fundamentals, there is little on the table to offer a cushion. With the secondary market continuing to move up, a similar downside is also being created.

what is grey market premium for SIS?