Last Updated on May 5, 2025 by Mahesh Yadav

In 2023, Tata Technologies IPO marked the first public offering from the Tata Group in 19 years which was a resounding success with a bumper listing on the stock exchange. Following this grand success, the group is planning to list six more companies in 2025. These Tata Group IPOs in 2025 are from different industries. Let’s take a closer look at which companies these are:

Table of Contents

#1 Big Basket IPO

BigBasket, one of India’s largest online grocery platforms, is set to launch its Initial Public Offering (IPO) in late 2025. This much-anticipated move comes as the company looks to scale its operations and strengthen its position in the rapidly growing e-commerce sector.

Big Basket has carved a niche in the competitive grocery delivery market by providing a comprehensive range of fresh produce, staples, and ready-to-cook products. It has leveraged cutting-edge technology to streamline its supply chain and offer timely deliveries, even expanding into the quick-commerce segment through its BB Now service, which delivers items within 20-30 minutes. The platform serves millions of customers across major Indian cities. Big Basket reported a revenue of INR 10,062 crore in FY 2024, and its total expenses reduced to INR 11,515 crore. In the broader grocery segment, BigBasket competes with Reliance JioMart, Walmart-owned Flipkart, and Amazon India.

#2 Tata Passenger Electric Mobility IPO – EV Player in Tata’s Upcoming IPO

Tata Passenger Electric Mobility (TPEML), a subsidiary of Tata Motors focused on electric vehicle (EV) manufacturing, is gearing up for an initial public offering (IPO) within the next 12 to 18 months. The IPO is projected to target a valuation of approximately USD 1 to 2 billion, depending on market conditions. TPEML aims to raise between INR 7,500 – 15,000 crore as it seeks to capitalize on its growing business in the EV sector. Recently, the company acquired Ford India’s manufacturing plant in Sanand for INR 725.7 crore, significantly enhancing its production capacity to 3,00,000 vehicles annually, with scalability options reaching 4,20,000 units.

TPEML holds a commanding 80% market share in the Indian electric vehicle market, bolstered by successful models such as the Nexon EV and Tiago EV. This upcoming IPO represents a significant step for Tata Group as it continues to strengthen its position in the rapidly evolving electric vehicle market, reflecting broader industry trends toward sustainable transportation solutions.

Read Also: Rekha Jhunjhunwala Portfolio, Net Worth, and More Details

#3 Tata Capital: Foremost of the Upcoming Tata Group IPOs in 2024

Tata Capital, a subsidiary of Tata Sons Limited, was established in 2007. The company is registered with the Reserve Bank of India as a systemically important deposit-accepting non-banking financial company.

It offers services like commercial finance, consumer loans, treasury advisory, private equity, investment banking, and credit cards.

Tata Capital has been profitable since its inception and currently has a loan book of INR 1,57,760 crore, with secured loans accounting for 79%. It has a wide presence across India serving over 4.5 million customers through its 723 branches. During FY 2024, the company reported a net NPA of 0.4% in FY 2024 and net profits rose to 3,150 crore reflecting a Y-O-Y growth of 37%.

As of now, there is no official valuation for the upcoming Tata Group IPO, but it is aiming for a valuation similar to Jio Financial Services, the financial arm of Mukesh Ambani’s Reliance Jio, which was around INR 10,000 crore in 2023.

Read Also: Tata Capital IPO – Another Tata Group IPO in Sight Amid Regulations

Tata Projects

Tata Projects, part of the Tata Group, is a leading Indian engineering, procurement, and construction (EPC) company known for its sustainable technology solutions. The company is reportedly considering a potential IPO within the next 12 to 18 months. The company focuses on infrastructure development across various sectors, including transportation, power, and urban development. For the fiscal year ending 31 March 2024, Tata Projects reported a consolidated profit after tax of INR 81.97 crore, a significant recovery from a loss of INR 855.65 crore in the previous year.

Financial performance showed total revenues reaching INR 17,247 crore in FY 2023-24, an increase from INR 16,755 crore in FY 2022-23. This growth was supported by an order backlog of INR 36,780 crore. Key ongoing projects include the Micron Semiconductor unit in Gujarat and the Chennai Metro Line, alongside major completed projects like the New Parliament Building and solar manufacturing plants. As of June 2024, Tata Projects had an order book valued at around INR 44,000 crore, with about 90% of these orders sourced from India.

#4 Tata Play IPO: Delayed But in Works

Tata Play, formerly known as Tata Sky, is a joint venture between Tata Sons and TFCF Corporation (formerly Twenty-First Century Fox, Inc., and now a part of the Walt Disney Company).

Tata Play was incorporated in 2001 and initiated services in 2006. It is one of India’s leading content distribution platforms providing Pay TV and OTT services. As of March 2023, according to the Telecom Regulatory Authority of India, Tata Play serves 21.3 million subscribers which is 32.65% of total DTH users in India.

In FY 2024, Tata Play’s net loss widens to INR 353.9 crore as compared to net losses of INR 105.25 crore in FY 2023. The company swung to a loss as a result of a 4.32% decline in revenue from operations to INR 4,304 crore in FY 2024. Tata Play IPO is aiming to mobilize around INR 2,000-2,500 crore. Walt Disney has finalized a deal to sell its 29.8% minority stake in the subscription television broadcaster Tata Play to the Tata Group. The transaction values the Tata Play at approximately USD 1 billion, which will give the Tata Group full control over the platform.

The company received approval from the SEBI board in May 2023 and was planning to launch the IPO last year. However, the public offer got delayed and the management is now targeting a stock market listing in 18 to 24 months. The IPO dates are yet to be announced.

Also Read: Tata Group Companies: Comprehensive List of All Companies

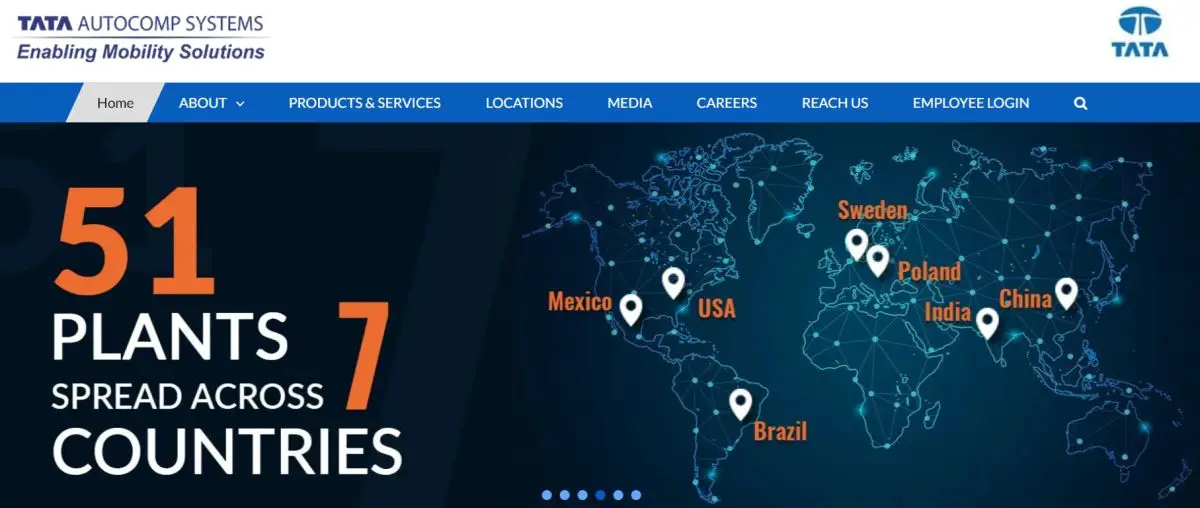

#5 Tata Autocomp Systems: Another Tata Group IPO From Automotive Industry

Tata Autocomp Systems (TACO) – an auto ancillary player – was incorporated in 1995 and is fully owned by Tata Group entities with direct holding by Tata Sons. Tata Sons owns around 21% of TACO, while the remaining is held by Tata Industries.

The company has 51 manufacturing facilities spread across India, North America, Latin America, Europe, and China. It is primarily involved in the design, development, manufacturing, and supply of auto component products and services to both passenger and commercial vehicle manufacturers under the brand name “AUTOCOMP”.

This is the company’s latest attempt to tap primary markets after a failed attempt several years back in 2011 when TACO IPO had to be withdrawn in light of unfavourable market conditions. Nevertheless, market conditions are favourable this time and the company’s strong financial performance, coupled with Tata’s brand name, is likely to pull investors to TACO IPO.

Read Also: Upcoming Reliance Group IPOs: Two IPOs Lined-Up

#6 Tata Advanced Systems IPO: An Aviation Player in Fray

Another interesting Tata Group IPO planned this year is Tata Advanced Systems (TASL). Incorporated in 2007, Tata Advanced Systems (TASL) is a wholly-owned subsidiary of Tata Sons, which focuses on aerospace and defence manufacturing, including military vehicles, radars, missiles, and unmanned aerial vehicles. Initially, Tata Motors-owned TASL as part of its defence business, but later divested the defence business, and TASL is now directly owned by Tata Sons.

Tata Advanced Systems has a strong portfolio of partnerships and joint ventures with leading global aerospace and defence firms, making it an integral partner in the international supply chain and in some instances, a global single-source provider for leading defence OEMs.

Teaming up with giants like Airbus, TASL strengthens India’s defence muscle by building new weapons and expanding the supply chain. They’re even partnering with space tech leader Satellogic to build India’s own homegrown space tech.

In the financial year 2024, Tata Advanced Systems generated a revenue of INR 4,844 crore which is 35.26% up from the previous year, and the net profits increased from INR 59 crore to INR 177 crore in 2024. Given the strong investor interest in defence and space technology companies in the recent past, Tata Advanced Systems IPO will be surely closely watched.

As of November 2024, the Indian primary market has seen a total of 77 IPOs. Out of this, 60 listings have achieved positive performance. However, there were challenges as well, with 17 IPOs experiencing negative returns. Notably, the average listing day return stands at an impressive 27.59% for IPOs, underscoring the potential for significant gains in this dynamic market.

Latest Content From IPO Central

- SEBI IPO Approvals This Week

- Top Startups Eyeing IPOs in 2026: 44 in the Pipeline

- Smart Wearables Brand GoBoult Plans IPO by Mid-2027

- Lotte Eyes Indian IPO for Merged Havmor-Lotte Ice Cream Venture

- Top Steel Companies in India

- Top Fundamentally Strong IPOs Available at Up to ~55% Discount

- Is Reliance Industries Undervalued Or Jio and Retail Overvalued?

- Upcoming IPOs in February 2026: Expected ₹24,000 Cr+ Fundraising

- Upcoming PSU IPOs with Shareholder Quota

- Biggest Unlisted Companies in India

- Upcoming Mega IPOs in 2026

Read Also: Top 10 AC Brands in India

I am happy and appreciate the steps taken y Tata Sons to launch New I.P.O.s in different business segments I wish for great Sucess in all Business Segments.Thanks

Tata is a worldwide reliable Brand.

Tata must comprehensively develop its defence manufacturing venture in a serious way by investing adequate fund with experts and experienced workers team.

Secondly, Tata’s quality defence products will have a very good export market.

After all, Tata is Tata so far quality,reliability and honesty are there.

This is the best blog post ever I read. I follow your blog article and get inspired to write more. Thanks for your details discussion and support. I would like to republish your article through my small blog website.

Which Tata company stocks should you hold so that you are eligible to apply for these IPOs?

None from this list as their parents are not listed. However, you can go ahead and buy Tata Motors shares which will make you eligible for Tata Passenger Electric Mobility IPO.