In recent years, India’s primary market has experienced a surge in Initial Public Offerings (IPOs), with numerous companies choosing this route to raise capital. IPOs are big for investors as it’s the first sale of shares to the public. While there may be concerns that big IPOs may suck out liquidity from the market, recent trends suggest the market is big enough to absorb large issues. Let’s take a look at the biggest IPOs in India that have impacted the market.

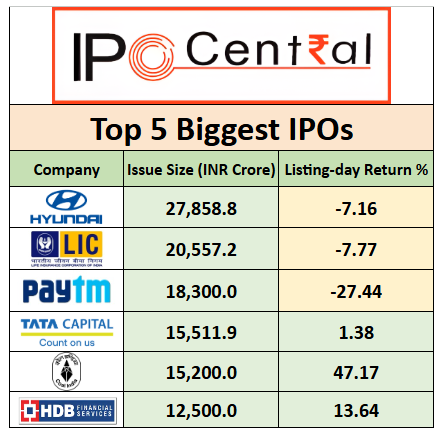

Top Biggest IPOs in India

List of Biggest IPOs by Issue Size

#1 Hyundai IPO: Top Entry in Biggest IPOs in India – INR 27,858.75 crore

- Issue dates: 15 – 17 October 2024

- Issue size: INR 27,858.75 crore

- Price: INR 1,865 – 1,960 per share (Employee Discount – INR 186 per share)

- Listing date: 22 October 2024

- Listing price on NSE: INR 1934 per share (down 1.33%)

- Closing price on NSE: INR 1819.60 per share (down 7.16%)

Hyundai Motor India’s IPO is the top 10 biggest IPOs in India at INR 27,870 crore. Despite robust institutional interest (6.97 times), overall subscription was only 2.4 times, retail investors were lukewarm. On the listing day, shares were listed at INR 1,934, a disappointing debut with a decline of over 5.87% from the issue price by end of the day.

Read Also: Upcoming Reliance Group IPOs: Two IPOs Lined-Up

#2 LIC IPO: Second Entry in Largest IPO in India – INR 20,557.23 crore

- Issue dates: 4 – 9 May 2022

- Issue size: INR 20,557.23 crore

- Price: INR 902 – 949 per share (discount of INR 45 for retail investors)

- Listing date: 17 May 2022

- Listing price on NSE: INR 872 per share (down 8.11%)

- Closing price on NSE: INR 875.25 per share (down 7.77%)

The LIC IPO is second in the top 10 biggest IPOs by issue size. It was also a highly anticipated one and generated significant interest among the general public.

The IPO surpassed INR 21,000 crore in India, and the offering received decent subscription at nearly 3X over six days, with full subscription in all five IPO investor categories.

However, the stock performance has been disappointing post-listing, with the shares losing 26.6% in just six weeks.

Read Also: Best IPO Stocks That Doubled Investors’ Money

#3 Paytm IPO – INR 18,300 crore

- Issue dates: 8 – 10 November 2021

- Issue size: INR 18,300 crore

- Price: INR 2,080 – 2,150 per share (discount of 5% for retail investors)

- Listing date: 18 November 2021

- Listing price on NSE: INR 1,950 per share (down 9.30% from IPO price)

- Closing price on NSE: INR 1,560 per share (down 27.44% from IPO price)

One97 Communications, the parent company of Paytm, launched its IPO with much fanfare during the great IPO rush of 2021, surpassing Coal India as the largest IPO. The IPO size was INR 18,300 crore, but it received a relatively low total subscription at less than 2 times, with HNIs avoiding it. Tepid demand in the grey market and lack of profitability in the coming years affected investor sentiment.

Not surprisingly, Paytm IPO listed at a discount of 9.3% to its offer price. However, it quickly became a horror show for IPO investors as the stock lost over a quarter of its value through the day and closed with 27% losses.

#4 Tata Capital IPO: Highest IPO in India in 2025 – INR 15,511.87 crore

- Issue dates: 6 – 8 October 2025

- Issue size: INR 15,511.87 crore

- Price: INR 310 – 326 per share

- Listing date: 13 October 2025

- Listing price on NSE: INR 330 per share (up 1.23% for retail investors)

- Closing price on NSE: INR 330.50 per share (up 1.38% for retail investors)

Tata Capital, the flagship financial services arm of the Tata Group and India’s third-largest diversified NBFC, made headlines with the country’s biggest IPO of 2025, raising over INR 15,512 crore. The IPO received robust demand, being subscribed 1.95 times overall — QIB 3.42x, NII 1.98x, and Retail 1.10x. With an EPS of INR 9.3 and RONW of 11.2%, Tata Capital’s strong fundamentals and growth momentum underline its leadership in India’s NBFC sector.

#5 Coal India IPO: India’s Biggest IPO for 11 years – INR 15,200 crore

- Issue dates: 18 – 21 October 2010

- Issue size: 631,636,440 shares

- Price: INR 225 – 245 per share (discount of 5% for retail investors)

- Listing date: 4 November 2010

- Listing price on NSE: INR 291 per share (up 25% for retail investors)

- Closing price on NSE: INR 342.55 per share (up 47.17% for retail investors)

Coal India, the world’s largest coal miner and a former Navratna company (now a Maharatna) made history with its IPO. The IPO was a blockbuster, raising INR 15,200 crore, the largest IPO in India at that time. Investors were so enthusiastic that the subscription was over 15 times the issue size, and the total subscription was over INR 240,000 crore.

Coal India opened at INR 291 per share, giving listing returns of 25% to retail investors who received a 5% discount on their bids. The shares went on to reward investors even further and closed the first day at INR 342.55 per share, showing a growth of 47.17% on retail investors’ IPO price.

#6 HDB Financial Services IPO: Another 2025 Entry Among the Most Popular Highest IPOs in India – INR 12,500 crore

- Issue dates: 25 – 27 June 2025

- Issue size: INR 12,500 crore

- Price: INR 700 – 740 per share

- Shareholder Quota: 1,78,57,142 shares, no discount

- Employee Quota: 2,85,714 shares, no discount

- Listing date: 2 July 2025

- Listing price on NSE: INR 835 per share (up 12.84% for retail investors)

- Closing price on NSE: INR 840.95 per share (up 13.64% for retail investors)

HDB Financial Services, a subsidiary of HDFC Bank, launched a INR 12,500 crore IPO in June 2025, which was subscribed 16.69 times overall — led by strong QIB demand at 55.47x. The company reported FY 2025 revenue of INR 16,300 crore and PAT of INR 2,180 crore, with a robust loan book of INR 1.07 lakh crore and 19.2 million customers. Backed by AAA credit ratings and a CRAR of 19.22%, HDB listed at INR 835 on NSE, gaining 13.6%, With it remains a key player among India’s top NBFCs.

Read Also: Highest IPO Subscription

#7 Reliance Power IPO: Most Remembered Among Highest IPOs in India – INR 11,700 crore

- Issue dates: 15 – 18 January 2008

- Issue size: 260,000,000 shares

- Price: INR 405 – 450 per share

- Listing date: 11 February 2008

- Listing price on NSE: INR 530 per share (up 17.77% from IPO price)

- Closing price on NSE: INR 372.3 per share (down 17.27% from IPO price)

The IPO that was to be the launch of Anil Ambani, turned out to be a disaster for him and investors alike. Although the company had no operational power plant at the time of the offer, it did not deter investors and a 100% premium in the grey market further threw caution out of the window. India’s biggest IPO by issue size at the time was fully subscribed within minutes and eventually garnered 73 times the bids.

The Indian market was riding high on euphoria, only to be abruptly shaken by the emergence of the US subprime crisis just before the listing of Reliance Power. Despite being overvalued, the company’s shares managed to debut at a premium of 17%. However, this initial excitement quickly dissipated as the share prices lost momentum within a mere five minutes of trading. By the end of the day, investors were disheartened to witness a 17% loss on their investments.

While it was not a massive loss, the entire Reliance Group – largely known for value creation till the point – received a big jolt. Shareholders in Reliance Power continued to lose money afterward as well as shares slid further, even though the company gave free bonus shares to IPO investors. Among the biggest IPOs in India, it is easily the most hated one!

#8 LG Electronics India IPO – INR 11,607.01 crore

- Issue dates: 7 – 9 October 2025

- Issue size: INR 11,607.01 crore

- Price: INR 1,080 – 1,140 per share (Employee Discount – INR 108 per share)

- Listing date: 14 October 2025

- Listing price on NSE: INR 1,710 per share (up 50.01%)

- Closing price on NSE: INR 1,689.90 per share (up 48.24%)

LG Electronics India IPO, valued at INR 11,607.01 crore, is the largest in the country. The offering received over 65 lakh+ (6.5 million) applications and was subscribed 54 times, making it one of India’s biggest IPOs of 2025.

#9 Swiggy IPO – INR 11,327.43 crore

- Issue dates: 6 – 8 November 2024

- Issue size: INR 11,327.43 crore

- Price: INR 371 – 390 per share (Employee Discount – INR 25 per share)

- Listing date: 13 November 2024

- Listing price on NSE: INR 420 per share (up 7.69%)

- Closing price on NSE: INR 456 per share (up 16.92%)

Swiggy’s IPO is the largest in India at INR 11,327.43 crore. Despite robust institutional interest (6.02 times), the overall subscription was only 3.6 times, with HNI investors showing a lukewarm response.

Swiggy’s IPO, which debuted on 13th Nov 2024, did well despite a cautious market. The shares opened at INR 420 on the National Stock Exchange (NSE), reflecting a 7.7% premium over the issue price of INR 390, exceeding initial expectations that suggested a more muted performance due to low investor enthusiasm indicated by grey market premiums. By the end of the trading session, Swiggy’s stock rose further to INR 456, culminating in a total increase of 16.92% from the issue price.

#10 General Insurance Corporation (GIC) IPO – INR 11,256.83 crore

- Issue dates: 11 – 13 October 2017

- Issue size: 124,700,000 shares

- Price: INR 855 – 912 per share (discount of INR 45 per share for retail investors)

- Listing date: 25 October 2017

- Listing price on NSE: INR 850 per share (down 1.96% from IPO price for retail investors)

- Closing price on NSE: INR 874.3 per share (up 0.84% from IPO price for retail investors)

India’s sole reinsurance player, GIC, made its debut on the IPO street, offering the government’s maiden share. The IPO raised a significant INR 11,256.83 crore by selling 124,700,000 shares. Priced in the range of INR 855 to INR 912 per share, retail investors were granted a discount of INR 45 per share.

As High Networth Individuals (HNIs) and retail investors stayed away, it is not widely remembered even after featuring among the biggest IPOs in India. Apart from the IPO’s big size, poor listings of ICICI Lombard and SBI Life Insurance played spoilsport for GIC as it had a subdued listing. Thanks to the discount, retail investors were saved and the stock closed the listing day with marginal gains.

Read Also: Upcoming IPO Calendar in India

#11 ICICI Prudential AMC IPO – INR 10,602.65 crore

- Issue dates: 12 – 16 December 2025

- Issue size: INR 10,602.65 crore

- Price: INR 2,061 – 2,165 per share (Shareholder Reservation, No Discount)

- Listing date: 19 December 2025

- Listing price on NSE: INR 2,600 per share (down 20.09% from IPO price)

- Closing price on NSE: INR 2,585.90 per share (down 19.44% from IPO price)

ICICI Prudential Asset Management Company, India’s leading mutual fund house, entered the capital markets with a public offering of INR 10,602.65 crore. The IPO consisted entirely of an offer-for-sale by its promoters. The issue saw strong demand from institutional and retail investors. Despite short-term fluctuations in the mutual fund industry, ICICI AMC’s steady earnings and leadership among private fund houses will help it to maintain investor interest post-listing.

#12 SBI Cards & Payments IPO – INR 10,340.79 crore

- Issue dates: 2 – 5 March 2020

- Issue size: INR 10,340.79 crore

- Price: INR 750 – 755 per share (discount of INR 75 for employees)

- Listing date: 16 March 2020

- Listing price on NSE: INR 661 per share (down 12.45% from IPO price)

- Closing price on NSE: INR 678 per share (down 10.20% from IPO price)

SBI Cards, the country’s second-largest credit card player, launched its IPO on 2nd March 2020. The IPO raised over INR 10,340 crore, a mix of Offer for Sale (OFS) and fresh issue. The issue was oversubscribed 26.5 times, mainly driven by QIBs and HNIs.

But between subscription closing and listing dates the situation went downhill due to Covid-19 pandemic. As a result, the stock faced a challenging debut, listing at a discount of 12.45% and ending the first trading day in the red. The pandemic-induced uncertainty weighed heavily on the initial performance of the stock.

Read Also: State-wise IPO in India

Vodafone Idea FPO – Largest FPO in India

Vodafone Idea FPO is recognized as the Biggest FPO in India, launched from April 18 to April 22, 2024. The issue size was INR 18,000 crore, with shares priced between INR 10 and INR 11 per share. It was subscribed 6.36 times overall, particularly attracting qualified institutional buyers at 17.56 times. On listing day, 25 April 2024, shares debuted at INR 11.80 (up 7.27%) and closed at INR 13.90 (up 26.36%), reflecting strong market interest and expectations for recovery plans.

A clear and compelling trend has emerged in the Indian IPO market: the dominance of technology companies. This shift has been evident in recent years, with three of the Biggest IPOs in India making their mark in 2017. As the country embraces the digital age and technological advancements, this trend is expected to continue reshaping the list of largest IPOs in the coming years.

A good example would be the National Stock Exchange (NSE) which has been slow in coming up with its offer but once the IPO is launched, the INR 10,000 crore issue is expected to feature in this list of Biggest IPOs in India. Before the NSE IPO, the Tata Capital IPO had already included itself in this list, although investors didn’t enjoy the experience. ICICI Prudential AMC is also among the expected upcoming IPOs in 2025 which is also likely to mobilize over 17.65 million equity shares.

Latest Content From IPO Central

- Latest SEBI IPO Approval: Record 13 IPOs Receive Observations

- Upcoming PSU IPOs with Shareholder Quota

- Upcoming Mega IPOs in 2026

- PhonePe Files UDRHP for ₹12,000 Cr IPO

- Top Consumer Durable Stocks in India to Watch in 2026

- Unlisted Shares Buying Guide & FAQs

- Biggest IPOs by Applications

- Most Expensive Share In India 2026

- Discount Coupons for Shareholders: Checkout These Interesting Deals

- Who is a Company Promoter? Definition, Promoter Group Rules, MPC & IPO Lock-in

- What Are Market Makers in SME IPO? A Full Guide for Investors

Read Also: Top Drone Stocks in India

India’s Biggest IPOs FAQ

Which IPO is the biggest in India?

Hyundai Motors India launched its INR 27,858.75 crore IPO in 2024, which is the biggest ipo in Indian history to date.

What has been the average listing day performance of the top 10 biggest IPOs in India?

The average listing gain for the top 10 biggest IPOs in India by issue size is around 6%, with about 60% of them ending up with negative returns.

What is the highest IPO price per share in India?

In the last 6 years, One97 Communications (Paytm) has had the highest IPO allotment price of INR 2,150 per share.

Which recent tech IPO was the largest in the history of the indian stock market?

Paytm’s IPO in November 2021, raising INR 18,300 crore, is the largest tech IPO in Indian stock market history, despite a poor market debut.