Hero Motors Unlisted Share Price Description – Hero Motors, a prominent arm of the Hero Motors Company (HMC) Group, is an Indian automotive conglomerate with core strengths in bicycle manufacturing, high-performance electric drivetrain systems, and precision automotive components. Founded in 1998, Hero Motors has diversified operations spanning bicycles, electric mobility solutions, automotive transmissions, and two-wheeler gearboxes. Leveraging innovation and operational scale, the company exports to over 80 countries and has a substantial presence in both Indian and international automobile and component markets.

The company operates across six facilities globally, including manufacturing plants in India (Uttar Pradesh, Ludhiana), Thailand (Samut Prakan), and a design centre in the United Kingdom (Maidenhead).

Read Also: Sterlite Power Unlisted Shares

Business Model of Hero Motors

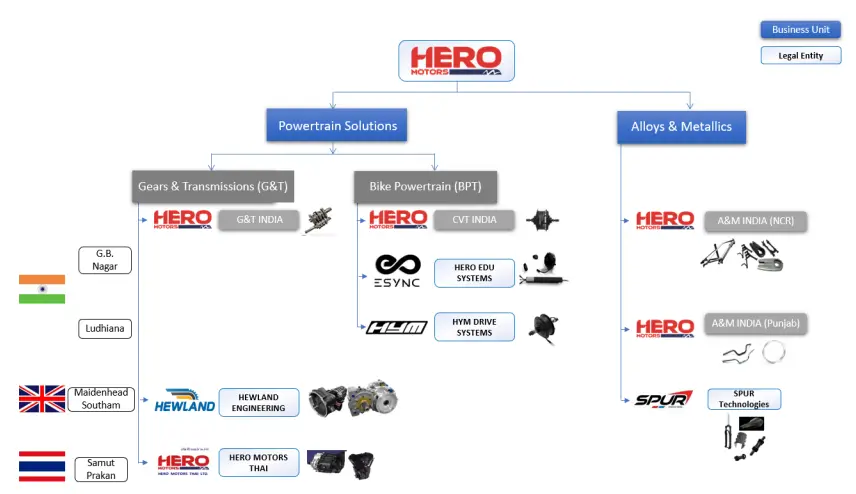

Hero Motors’ business is divided into two primary segments:

- Powertrain Solutions (Gears & Transmissions + Bike Powertrain):

- Contributed 48.88% of FY24 revenue

- Includes EV-focused sub-segments such as EDUs, CVTs, and electric motors

- EV segment contributed INR 128.09 crore in FY24 (~12.03% of revenue)

- Alloys and Metallics (A&M):

- Traditionally stronger contributor at 51.12%

- Supplies structural auto components like swing arms, chain cases, etc.

The company’s EV business, despite showing a dip in FY24 due to European e-bike inventory overhang, is expected to rebound given the underlying industry growth.

Services of Hero Motors

- Powertrain Solutions – End-to-end design, development, and manufacturing for ICE and EV powertrains.

- Product Engineering – Custom design and R&D for gear systems and transmissions.

- Manufacturing – ISO-certified, global production facilities in India, the UK, and Thailand.

- Testing & Validation – In-house performance and compliance testing.

- OEM Support – Export logistics, after-sales, and technical support for global clients.

Key Customers and Global Footprint

Hero Motors has established a prestigious global clientele, including renowned names such as BMW AG, Ducati, Formula Motorsport, Enviolo, Hummingbird EV, and HWA AG. It serves as the exclusive supplier for multiple BMW programs and has maintained decade-long partnerships with its top five clients, who collectively contribute over 60% of the company’s revenue.

In FY24, international markets contributed nearly 40% of Hero Motors’ total revenue, with Europe accounting for 29.33%, the USA for 7.7%, and the ASEAN region making up the remainder. Despite this strong global presence, India continues to be the largest revenue source, contributing 58.72%.

EV Opportunity and Market Position

Hero Motors is at the forefront of e-bike innovation, serving as the only Indian exporter of continuously variable transmission (CVT) hubs to global OEMs. The company is capitalizing on its joint venture with Yamaha Motors Japan (under the HYM brand) to manufacture high-torque electric motors and is expanding into integrated electric drive unit (EDU) solutions through its proprietary ‘ESYNC’ brand.

The global e-bike market is projected to grow at a CAGR of 13%–15%, reaching 14–18 million units by 2029. Meanwhile, demand for CVT hubs is expected to surge at an even faster pace, with a projected CAGR of 35%–40%. These trends place Hero Motors in a strong position to benefit from the accelerating global shift towards micro-mobility.

Further strengthening its EV capabilities, the company’s strategic acquisition of Hewland Engineering (UK) in 2022–23 has enhanced its expertise in design, simulation, and prototyping, particularly in high-performance EVs and motorsports applications.

Read Also: PharmEasy Unlisted Share Price

Key Highlights – FY 2023 – 24

- Hero Motors, a Noida-based automotive technology company, is set to refile its DRHP for an IPO worth INR 1,200 crore, combining a fresh issue and offer-for-sale.

- Exclusive supplier to BMW; strong global OEM partnerships

- Client Base: Long-term relationships with top 5 clients (BMW, Ducati, Enviolo, HWA AG, Hummingbird EV), contributing over 60% of total revenue.

- Nearly 40% revenue from Europe, the USA, and the ASEAN markets

- Only Indian exporter of CVT hubs for e-bikes

- 💰 Revenue CAGR: Achieved a 13% revenue CAGR over the past 5 years (FY19–FY24), driven by exports, EV components, and new client programs.

- 📈 EBITDA margin stood at ~16% in FY24, supported by a shift toward high-value e-mobility and precision components.

- 📦 Order Book Strength: Secured a robust order book of INR 4,500+ crore as of FY24, ensuring strong revenue visibility over the next 3–4 years.

- CVT Hub Leadership: Only Indian company exporting CVT hubs; expected to capture a significant share of the 35%–40% CAGR CVT hub market growth by 2029.

Read Also: Biggest Unlisted Companies in India

Hero Motors Board of Directors

- Mr. Pankaj Munjal, Chairman

- Mr. Amit Gupta, Managing Director & CEO

- Mr. Abhishek Munjal, Whole Time Director

- Ms. Sheeba Dhamija, Independent Director

- Mr. Ritesh Kumar Agrawal, Independent Director

Hero Motors Share Price Details

| Name | Hero Motors Unlisted Share Price Details |

| Face Value | INR 10 per share |

| ISIN Code | INE012G01022 |

| Lot Size | 100 shares |

| Demat Status | NSDL, CDSL |

| Share Price of Hero Motors | INR 230 per share |

| Market Cap | INR 8,724 crores |

| Total number of shares | 37,93,07,960 shares |

| Website | www.vikramsolar.com |

Hero Motors Unlisted Share Price Details – Shareholding Pattern

The details of shareholders’ holding of equity shares:

| Shareholder Name | % to Holding | No. of shares |

| O P Munjal Holdings | 71.09 | 27,31,23,055 |

| South Asia Growth Invest, LLC | 12.20 | 4,68,55,307 |

| Pankaj Munjal | 2.45 | 94,00,436 |

| Hero Cycles | 2.02 | 77,52,750 |

Read Also: TATA Technologies Unlisted Share Price

Hero Motors Unlisted Share Price – Financial Performance

| FY 2022 | FY 2023 | FY 2024 | 9M FY 2025 | |

| Revenue | 914.19 | 1,054.62 | 1,064.39 | 807.27 |

| Revenue Growth (%) | 1.13 | 15.36 | 0.93 | – |

| Expenses | 849.25 | 1,016.24 | 1,059.11 | 799.28 |

| Net income | 99.02 | 40.51 | 17.04 | 22.39 |

| Margin (%) | 10.83 | 3.84 | 1.60 | 2.77 |

| RONW (%) | 62.24 | 11.76 | 4.42 | 5.43 |

| EBITDA (%) | 18.37 | 9.23 | 7.78 | 9.34 |

| ROCE (%) | 29.38 | 26.16 | 22.59 | 13.39 |

| Debt/Equity | 1.65 | 0.80 | 0.81 | 0.91 |

| EPS | 2.80 | 1.12 | 0.35 | 0.44 |

Hero Motors Annual Reports

Hero Motors IPO DRHP

Hero Motors Annual Report FY 2023 – 24

Hero Motors Annual Report FY 2022 – 23

Hero Motors Annual Report FY 2021 – 22

Read Also: NSE Unlisted Share Price

Hero Motors Unlisted Share Price – Peer Comparison

| Company | PE ratio | EPS | RONW (%) | NAV | Revenue (Cr.) |

| Hero Motors | 657.14 | 0.35 | 4.42 | 10.29 | 1,064.39 |

| CIE Automotive India | 21.14 | 21.03 | 15.82 | 157.84 | 9,280.35 |

| Endurance Technologies | 54.37 | 48.38 | 14.41 | 335.73 | 10,240.87 |

| Sona BLW Precision | 54.44 | 8.83 | 20.24 | 47.75 | 3,184.77 |

Read Also: Orbis Financial Unlisted Share Price

Hero Motors Unlisted Share Price FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is Hero Motors’ unlisted share price?

Hero Motors share price today is INR 230 per share. Shares are purchased in lots of 100 shares.

Who determines the Hero Motors unlisted share price?

Hero Motors share price is determined by various factors including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.

When is Hero Motors IPO planned?

Hero Motors has refiled its DRHP with SEBI for a 2025 IPO worth INR 1,200 crore, including a fresh issue of INR 8,000 crore and an OFS of INR 4,000 crore.