Last Updated on December 23, 2025 by Krishna Bagra

Adani Wilmar IPO is all set to open for subscription on 27 January 2022. The company is one of the biggest players in the edible oil category and has also dabbled into packaged food and FMCG products. It competes with the likes of Hindustan Unilever, Britannia Industries, Tata Consumer Products, Dabur, Marico, and Nestle among others. Adani Wilmar IPO Review is aimed to bringing readers up to the speed with regards to the company’s business, strengths and IPO valuation.

Adani Wilmar IPO Review – Strengths

- Comprehensive B2C packaged consumer products portfolio

- Broad customer reach and strong brand recall

- Strong raw material sourcing capabilities

- Integrated business model with well-established operational infrastructure and strong manufacturing capabilities

- Extensive pan-India distribution network

- Strong parentage with professional management and experienced board

Adani Wilmar IPO – Risk Factors

- Raw material supply is subject to external risks with very little control in the hands of the company

- High dependence on imports for raw material exposes it to developments like import restrictions

- Significant portion of revenue (82.23% in FY2021) from edible oil business segment

- The company, its Directors, Promoters and Subsidiaries are involved in certain legal proceedings

- Exchange rate fluctuations – the company is the largest importer of crude edible oil in India

Adani Wilmar IPO Analysis – Financial Performance

| FY2019 | FY2020 | FY2021 | H1 FY2022 | |

| Revenue | 28,919.7 | 29,767.0 | 37,195.7 | 24,957.3 |

| Expenses | 28,352.4 | 29,158.0 | 36,439.0 | 24,502.8 |

| Net income | 374.6 | 459.7 | 727.4 | 353.3 |

| Margin (%) | 1.3 | 1.5 | 2.0 | 1.4 |

Adani Wilmar Valuations & Margins

| FY2019 | FY2020 | FY2021 | |

| EPS | 3.29 | 4.03 | 6.37 |

| PE ratio | – | – | 34.22 – 36.11 |

| RONW (%) | 17.79 | 17.93 | 22.06 |

| ROCE (%) | 12.75 | 12.76 | 11.06 |

| EBITDA (%) | 4.33 | 4.77 | 3.85 |

| Debt/Equity | 0.50 | 0.50 | 0.39 |

| NAV | – | – | 28.86 |

Adani Wilmar IPO Review – Subscribe or Avoid?

For a company of its size and operations, manufacturing infrastructure is a must and Adani Wilmar fits the bill completely here. The company has 22 manufacturing units spread across 10 states in India. This manufacturing base includes 10 crushing units and 19 refineries.

Much of its manufacturing base is integrated in nature which helps in reducing costs and sharing supply chain, storage facilities, distribution network and experienced manpower among different products and reduce the overall costs for processing and logistics. Most of its crushing units are integrated with refineries to refine crude oil produced in-house as well as manufacture oleochemical products such as soap noodles, stearic acid and glycerin, and FMCG, such as soaps and handwash.

Read Also: What Adani Wilmar IPO grey premium indicates ahead of listing?

Another key differentiator in this business is the distribution reach. Once established, an extensive network allows the company to quickly reach customers with new and value-added products. Adani Wilmar trumps here with its network of 5,590 distributors in 28 states and union territories. This is the widest network among all branded edible oil companies in India. As mentioned above, this network has been used effectively to expand the company’s product portfolio in recent years.

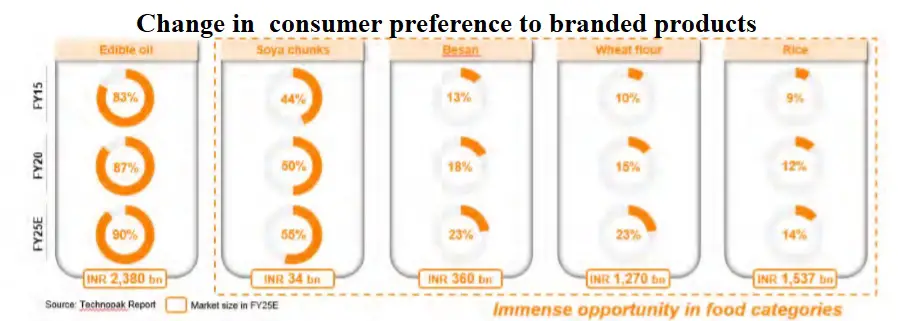

This is visible in the company’s financial performance which hasn’t been affected much by Covid-19 pandemic. Given the essential nature of its products, it isn’t exactly surprising but this performance was also supported by the company’s expansion in new categories. The company is well-placed to benefit from the shift in consumer preferences in favor of branded products.

The company operates with manageable debt and this, along with move into value-added products, has also helped in posting better profit margins.

In terms of valuations, the price range of INR218 – 230 per share translates into P/E ratio range of 34.22 – 36.11. This is low than the valuations commanded by most of its competitors having similar return profiles.

Overall, the company appears to be reasonably priced for the growth it promises to offer. This isn’t the typical low float story that goes on to double on listing but Adani Wilmar surely looks like a safe bet for even long-term investing.

Adani Wilmar IPO – Broker Recommendations

Angel One – Subscribe

Arihant Capital –

Ashika Research – Subscribe

Asit C Mehta –

BP Wealth – Subscribe

Canara Bank Securities – Subscribe

Choice Broking – Subscribe

Elite Wealth – Subscribe

GEPL Capital –

Hem Securities – Long term subscribe

ICICIdirect – Unrated

KR Choksey – Subscribe

Marwadi Financial Services – Subscribe

Motilal Oswal –

Nirmal Bang –

Religare Broking –

Samco Securities – Subscribe for long term

SMC Global – 2.5/5

Ventura Securities – Subscribe

Understand there is quota for shareholders of Adani Enterprise Ltd (AEL). How can I apply under this group of shareholders, keeping in mind that I wish to apply in general category too.

Will appreciate your guidance.

Thanks

Hello Prabhu,

Here is an article to understand the process and requirements for shareholder quota

https://ipocentral.in/upcoming-ipos-with-shareholders-quota/

Adani Wilmar opportunity is gone as the record date has passed but it will be helpful for the next IPOs.