What are the benefits of SME IPO? How do SME companies benefit from stock market listing?

As a promoter of Small and Medium Enterprise (SME), this question might have crossed your mind several times. Well, this is a perfect place to find answers to all your queries related to the advantages of SME IPOs.

To begin with, SME IPOs offer benefits to business owners at different levels. Owing to these numerous advantages over other avenues, SME IPOs have become quite popular with promoters and this is very well reflected in the number of offers and the amount raised through these public offers.

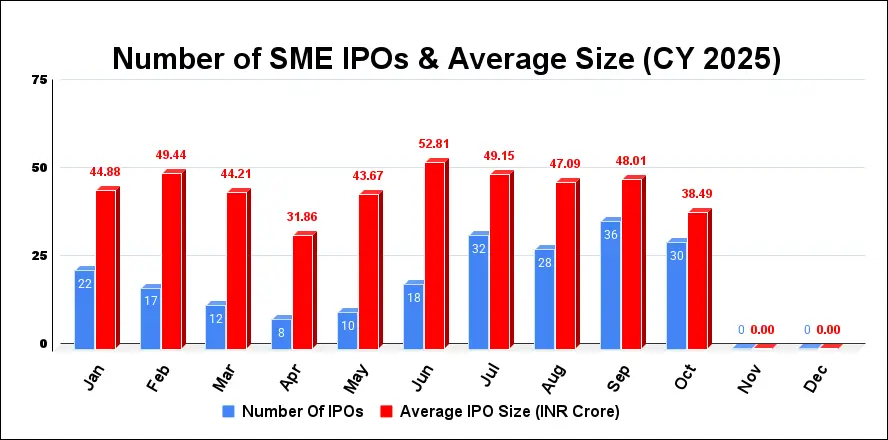

SME IPO Market Performance: Nine Months of CY 2025

In the nine months of 2025, the SME segment continued to shine with 183 listings that raised INR 8,620.5 crore, reflecting the sector’s growing depth and retail investor appetite. Despite smaller issue sizes — averaging INR 47.11 crore — listing performance remained impressive at an average gain of 13.06 %. Top performers such as TechD Cybersecurity and Airfloa Rail Technology nearly doubled investors’ money on debut, underscoring strong momentum in smaller-cap offerings. Maharashtra and Gujarat led the SME surge, together contributing more than half of all new listings, cementing their dominance in India’s emerging-enterprise ecosystem.

By comparison, the full year 2024 saw 247 SME IPO listings, with an average issue size of INR 38.79 crore. These IPOs delivered a significantly higher average return of 60.26% to investors, including those listed on both the NSE and BSE.

Overall, while returns have moderated in 2025, the consistent listing activity and healthy capital mobilisation indicate that the market continues to reward SME IPOs across several parameters—an encouraging sign for business owners and company promoters alike.

Having established the growing acceptance of SME IPOs in the investing circles, let’s go back to the original topic of the distinct advantages of SME IPOs. Here are the key benefits of SME IPO.

Benefits of SME IPO for Companies

Table of Contents

#1 Access to Capital

By definition, SMEs are small and medium businesses and this means that these growth-oriented businesses need capital to scale up their operations. At the same time, SMEs might be quite lower on the priority lists of banks. Even when lending, banks and financial institutions may impose stringent conditions on SMEs.

Through SME IPO, business owners can access funding from a wider pool of investors, to support their growth needs. This wider pool also means the absence of restrictions in entering new markets, diversifying product range/reducing debts, or providing for working capital.

Also Read: All About SME to Mainboard Migration

#2 Enhanced Credibility and Visibility

One of the biggest benefits of SME IPO listing is the immediate boost in credibility and visibility of the company. This increased recognition can help attract more and better business opportunities including partnerships and contracts as listed companies are perceived as more reliable and stable than their unlisted counterparts.

#3 Exit Strategy for Existing Investors

In many cases, SMEs are often bootstrapped businesses with early-stage funding offered by friends and family members. However, an exit becomes difficult for these investors as it often means that the business owner will need to buy them out.

An IPO provides an excellent exit route to such investors and even founders looking to realize some gains from their investments. SME IPO route offers liquidity, allowing them to sell part or all of their stake at a market-driven price.

#4 Employee Retention and Incentives

SMEs can use stock options as a strategic tool to attract and retain talent. Offering shares to employees aligns their interests with the company’s success and can be an effective retention and motivational tool that encourages loyalty and dedication.

#5 Better Valuation and Access to Cheaper Capital

Listed companies often have higher valuations than their private counterparts. Higher valuation can lead to cheaper debt when raising debt as the company’s equity is seen as more valuable as collateral.

#6 Facilitating Acquisitions

With access to equity markets, SME owners can use their publicly traded stock as a currency for acquisitions. This can be an efficient way to grow and expand into new markets or segments without raising additional debt. When used correctly, this is a huge advantage for company owners.

#7 Growth Opportunities

Apart from funding acquisitions through equity, promoters can also use the equity route to unlock a plethora of growth opportunities at subsequent stages. Increased access to capital and improved financial visibility can help companies to expand their operations, invest in new technologies and explore international markets.

SME IPO Disadvantages

SME IPO is not exactly a panacea for founders and like most other things in life, there are downsides of it as well. Here are the main disadvantages of SME IPOs:

#1 High Costs

The expenses associated with going public through an SME IPO can be considerable. These include underwriting fees, legal fees, accounting fees, filing costs, printing costs and expense allowance for the underwriting firm. For small and medium sized enterprises, these high costs can be a significant financial burden.

#2 Increased Regulation and Compliance

When a company goes public, it has to comply with extensive financial reporting requirements and other regulations like Sarbanes-Oxley. Many small private companies don’t have the staff or expertise to manage the additional paperwork and oversight. This additional regulatory burden can be tough for SMEs.

#3 Illiquidity and Volatility

SMEs shares may not have the liquidity of larger companies, posing challenges for investors who want to trade them. Also the share price may be volatile due to the company’s small size and limited analyst coverage. Investors could find themselves holding onto illiquid shares if market sentiment shifts post-IPO.

#4 Loss of Privacy

Transitioning to a public status necessitates SMEs to unveil confidential financial particulars, executive remuneration, interconnected transactions, and previous legal entanglements within the prospectus. Additionally, the company must convene compulsory annual gatherings where management needs to field inquiries from investors. This erosion of privacy can instigate discomfort among the founders and management personnel.

#5 Management Challenges

When operating as a public entity, SMEs encounter the obligation to satisfy a substantial shareholder base seeking steady earnings expansion. The management cadre may confront legal repercussions for any misrepresentations concerning the company’s financial status or future outlook. The imperative to achieve outcomes can divert attention from fundamental business operations.

#6 Risks of Early-Stage Companies

SMEs embarking on the journey of going public frequently find themselves in the nascent phases of their existence, hence encountering substantial risks. The viability of the business model might remain untested, and the company could possess a limited operating track record. In certain instances, SME IPOs have culminated in the company’s dissolution.

Conclusion

As can be seen above, the advantages of SME IPOs are manifold and often straddle the range of direct and indirect benefits. While the process of getting listed on stock exchanges can be daunting for uninitiated company promoters, an objective assessment of SME IPO advantages and disadvantages reveals that the benefits far outweigh the disadvantages or risks.

Are you looking to raise funds for your business? If yes, we can offer end-to-end valuable assistance in your fund-raising journey.

SME IPO Advantages and Disadvantages – FAQs

What are the advantages of SME IPOs?

The benefits of SME IPOs include access to capital, enhanced credibility and visibility, an exit strategy for existing investors, better valuation and access to cheaper capital, and more.

What are the risks involved in participating in SME IPOs?

Nevertheless, we advise investors to comprehend the risks associated with SME stocks, including larger lot sizes, lower credibility, smaller scale of company operations, and limited financial performance track record.