Last Updated on November 16, 2024 by Team IPOCentral

The call money market plays a crucial role in the financial ecosystem, dealing with short-term financial assets that closely resemble cash and can be easily repaid on demand, ensuring high liquidity. This type of liquid money is predominantly used by banks to meet their short-term capital requirements and uphold financial stability. Before we explore the intricacies of the call money market, it’s essential to first understand the broader concept of the Money Market.

Table of Contents

What Is the Money Market?

The money market is a segment of the financial market where short-term borrowing and lending of funds occur, typically involving instruments with maturities of one year or less. It facilitates liquidity for governments, banks, and corporations by allowing them to meet immediate cash flow needs through instruments like Treasury bills and commercial paper.

This market is essential for maintaining economic stability, providing low-risk investment opportunities for individual investors while ensuring that large institutions can manage their short-term financial obligations effectively.

Read Also: Electronics Mart IPO GMP, Price, Date, Allotment

What is Call Money Market?

The call money market is a crucial segment of the financial market where banks and financial institutions lend and borrow funds for very short periods, typically ranging from one day to two weeks. This market addresses urgent liquidity needs, allowing participants to manage their cash flow effectively. Loans in this market are usually unsecured and are repaid on demand, making it a flexible option for institutions. The interest rates fluctuate based on supply and demand, reflecting the overall liquidity conditions in the economy.

Call Money Market in India

The call money market caters to the day-to-day funding requirements, particularly in the bullion market and stock exchanges.

- Money lent for one day is referred to as call money.

- Money lent for more than one day and less than 15 days is called Notice Money.

- Money lent for more than 15 days is known as term money.

Also Read: Top Artificial Intelligence Stocks in India

Why do Banks Need Call Money?

Banks require call money for various purposes:

- Managing temporary funding mismatches

- Complying with the cash reserve ratio (CRR) and the statutory liquidity ratio (SLR)

- Meeting excess demand caused by a net outflow of funds from disinvestment or imports

Call Money Market Features

The call money market has several key features that distinguish it within the financial landscape:

- High Liquidity: The market provides exceptional liquidity, allowing banks and financial institutions to quickly access funds for short durations, typically overnight.

- Unsecured Transactions: Loans in the call money market are generally unsecured, meaning no collateral is required, which simplifies borrowing.

- Flexible Duration: Borrowing periods are very short, usually ranging from one day to two weeks, accommodating urgent liquidity needs.

- Over-the-Counter Market: Transactions occur directly between parties without the need for intermediaries like brokers, enhancing efficiency.

- Interest Rate Variability: The call loan rate is the interest charged on short-term loans between financial institutions. Brokers use call money as a quick funding source for margin accounts in leveraged investments, with interest rates on securities loans varying based on the call money rate set by the RBI.

- Participants: Key participants include scheduled commercial banks, cooperative banks, and primary dealers, all of whom engage in borrowing and lending activities.

- Regulatory Oversight: The Reserve Bank of India (RBI) regulates this market to ensure stability and transparency, influencing interest rates and liquidity through monetary policy.

Participants of the Call Money Market in India

Participants in the call money market in India include a variety of financial institutions, each playing a crucial role in facilitating short-term borrowing and lending. The key participants are:

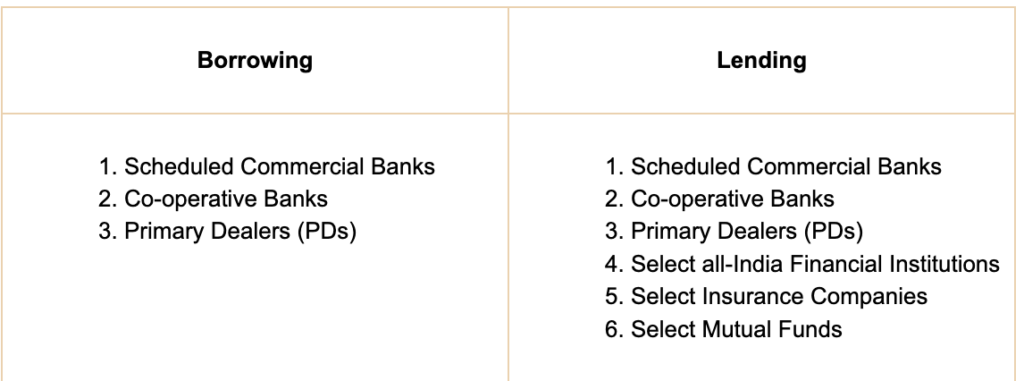

- Scheduled Commercial Banks: These banks are the primary players in the call money market, lending and borrowing funds to manage their liquidity needs. They can set their borrowing limits as per RBI guidelines.

- Co-operative Banks: Similar to commercial banks, these institutions also participate in the call money market but are generally limited to certain types of lending and borrowing activities.

- Primary Dealers (PDs): PDs are financial institutions that play a significant role in the government securities market and also engage in call money transactions.

- Development Finance Institutions (DFIs): These entities participate primarily as lenders, providing funds to other institutions in need of short-term capital.

- Insurance Companies and Mutual Funds: Certain insurance companies and mutual funds may also participate, typically acting as lenders rather than borrowers, contributing surplus funds to the market.

- Discount and Finance House of India (DFHI): This institution facilitates transactions in the call money market and acts as both a lender and borrower.

Check Out: List of Institutions Permitted to Participate in the Call/Notice

How does the Call Money Market work?

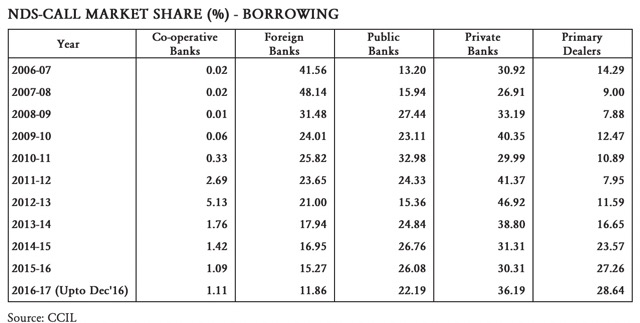

Loans in the Call Money Market (CMM) are facilitated through auctions where lenders offer funds, and borrowers submit bids, competing primarily on interest rates. The allocation of funds goes to the bidder who proposes the highest interest rate for a specific loan. Transactions in the CMM are conducted via the Negotiated Dealing System (NDS), a regulated electronic trading platform operated by the Reserve Bank of India (RBI). The call money rate is known for its volatility, influenced by various factors including corporate demand fluctuations, bank deposit volumes, and cyclical economic changes.

The call money rate is significantly affected by liquidity dynamics; when liquidity is scarce, rates tend to rise, and conversely, they fall when liquidity is abundant. This rate acts as a crucial indicator of monetary conditions and is closely monitored by the RBI as part of its monetary policy framework.

In conclusion, the call money market plays a crucial role in providing short-term funds to banks and institutions, ensuring smooth operations, and maintaining financial equilibrium. As it offers high liquidity and security, it remains a vital aspect of India’s financial landscape, regulated by the RBI to uphold stability and transparency.

What is the Call Money market in India?

The call money market is a segment of the financial market where banks and financial institutions lend and borrow funds for very short periods.

Why Do Banks Need Call Money?

Banks use call money to manage funding mismatches, comply with CRR and SLR, and address excess demand from outflows.