Go Digit Insurance, a leading player in the Indian non-life insurance sector, is set to make waves in the investment world with its upcoming Initial Public Offering (IPO). As an investor, understanding the unique aspects of this company is crucial for making informed decisions. Here are 10 key points to consider Go Digit IPO:

Table of Contents

#1 Go Digit IPO: Market Leadership

As of 31 December 2023, as per a RedSeer Report, Go Digit Insurance has a significantly larger market share, responsible for around 82.5% and 82.1% of the Gross Written Premiums (GWP) written by digital full-stack insurance players in 9M FY 2024 and FY 2023. Apart from the company, the other digital full-stack insurance players are Acko and Navi, making it the largest digital full-stack insurance player in India.

#2 Go Digit IPO: Rapid Growth

Go Digit Insurance has shown an impressive growth of GWP CAGR of 49.4% from FY 2021 to FY 2023. Go Digit Insurance also emerged as the quickest GWP private non-life insurer during the same timeframe. As of FY 2024, Digit Insurance has a 4.7/5.0 Google rating with over 0.22+ million reviews and a 4.9/5.0 Facebook rating with over 27,000+ reviews.

Read Also: Best Foreign MNC Stocks Listed in India

#3 Go Digit IPO: Customer Base

As of 31 December 2023, over its 7 calendar years of existence, Go Digit has acquired a total of approximately 43.26 million customers. This includes 43.26 million customers who were acquired in motor insurance products; 27.74 million acquired in December 2024 were acquired in health products, which include personal accident and travel, with 14.97 million customers and 0.55 million were acquired in other insurance products.

Read Also: Best IPOs that Doubled Investors’ Money

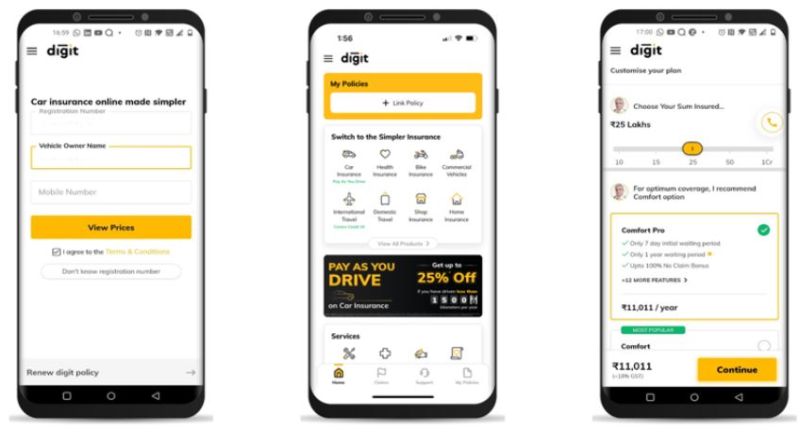

#4 Go Digit IPO: Customer-Centric Brand

Go Digit General Insurance has a vision of making insurance simple, which is reflected in its customer-centeredness that is integrated at every level of interaction with the company. The human-centric approach to insurance is well-received among consumers and is supported by rising levels of brand awareness and meaningful dialogue with customers.

#5 Go Digit General Insurance IPO: Offer Details

The Go Digit IPO is scheduled for 15 to 17 May 2024. The public issue consists of an Offer for Sale (OFS) of 5,47,66,392 shares and a Fresh Issue amounting to INR 1,125 crores. The retail investors are allotted 10% of the shares. The IPO will be listed on both BSE and NSE.

#6 Go Digit General Insurance IPO: Diversified Product Portfolio

Go Digit Insurance offers various additional general insurance products including but not limited to health insurance, property and engineering insurance, travel insurance, personal accident insurance, liability insurance, and other miscellaneous insurance covers in addition to motor insurance. These diverse product offerings continue to enhance customer engagement and offer additional avenues for premium generation in a variety of insurance categories.

The company launched 74 active products in all business lines. As of the nine months ended 31 December 2023 and Financial Year 2023, Go Digit’s market share in the motor insurance segment stood at 6.0% and 5.4%, respectively, in various market segments. Motor insurance is one of the largest sectors in the non-life insurance industry, it is particularly related to the growth areas for Go Digit. Furthermore, given the extensive variety of motor insurance products and its customer satisfaction commitment, the company can benefit tremendously from this lucrative market.

Read Also: Tata Sons IPO: Here is Why a Listing is Not Desirable

#7 Go Digit: Extensive Distribution Network

Go Digit Insurance has access to an extensive distribution network, enabled by an approach designed around a diversified distribution model, facilitated by a large number of 61,972 Key Distribution Partners, which includes approximately 58,532 POSPs, as well as thousands of individual agents, brokers, corporate agents, and web aggregators. The extended network allows the company to offer its services throughout India, including tier 2 and tier 3 cities.

#8 Go Digit IPO: Strong Financial Performance & Margins

With GWP reaching INR 66.80 billion and INR 72.43 billion for the nine months ended 31 December 2023, and Financial Year 2023, respectively, Go Digit Insurance has demonstrated robust financial performance, indicating its ability to capture market share and generate revenue.

| FY 2021 | FY 2022 | FY 2023 | 9M FY 2024 | |

| Premium Earned | 1,943.69 | 3,404.23 | 5,163.67 | 5,114.61 |

| Operating income | (185.49) | (375.14) | (66.28) | (10.12) |

| Net income | (122.76) | (295.85) | 35.55 | 129.02 |

Read Also: Top Bootstrapped Companies in India

| FY 2021 | FY 2022 | FY 2023 (Pre Issue) | FY 2024 (Post-Issue)* | |

| EPS | (1.40) | (3.38) | 0.41 | 1.88 |

| PE Ratio | – | – | 635.60 – 670.09 | 137.56 – 145.02 |

| FY 2021 | FY 2022 | FY 2023 | |

| RONW (%) | (10.82) | (15.85) | 1.53 |

| NAV | 12.95 | 21.32 | 26.55 |

| ROE (%) | (10.82) | (15.85) | 1.50 |

| EBITDA (%) | (3.5) | (5.4) | 0.7 |

#9 Go Digit Insurance’s Advanced Technology Platform

What distinguishes Go Digit Insurance from its competitors is its cutting-edge technology platform, based on which its operations are powered. The company operates on more than 473 active AI-driven microsystems, which enable Go Digit Insurance to drastically simplify its work, reduce turnarounds, and significantly improve the customer experience in comparison to a traditional insurance company.

Read Also: Biggest IPOs of 2024

#10 Go Digit Insurance IPO: Market Opportunity

Positioned in the rapidly growing Indian non-life insurance market, Go Digit Insurance taps into a significant opportunity. India’s non-life insurance sector has been experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of 11.2% from Financial Year 2018 to Financial Year 2023, presenting an enticing prospect for investors eyeing long-term growth potential.

To conclude, according to the data above, the upcoming IPO of Go Digit Insurance is a lucrative opportunity for an investor to take a stake in a major full-stack insurer that has succeeded in generating share prices that have doubled its initial public-providing value. However, a potential investor should exercise caution and ensure they have done their study and are mindful of the risks before investing.