Khadim India Limited (KIL) plans to open its IPO next week in what would be India’s 34th mainboard public offer this year. The IPO of the foot retailer company will involve fresh issue and an Offer For Sale (OFS). The offer will mobilize up to INR543.05 crore by selling shares in the range of INR745 – 750 per share. Investors can place bids for minimum 20 shares and in multiples thereafter. Through Khadim India IPO review, we aim to investigate if the offer deserves your consideration. Here are essential details of the upcoming IPO.

Khadim India IPO details | |

| Subscription Dates | 2 – 6 November 2017 |

| Price Band | INR745 – 750 per share |

| Fresh issue | INR50 crore |

| Offer For Sale | 6,574,093 shares (INR489.77 – 493.05 crore) |

| Total IPO size | INR539.77 – 543.05 crore |

| Minimum bid (lot size) | 20 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Khadim India IPO Review: Fairwinds to exit

The IPO will yield INR50 crore to the company through issuance of fresh shares. Out of this, INR40 crore will be used towards prepayment or repayment of term loans and working capital facilities availed by the company. The remaining INR10 crore will be used for general corporate purposes.

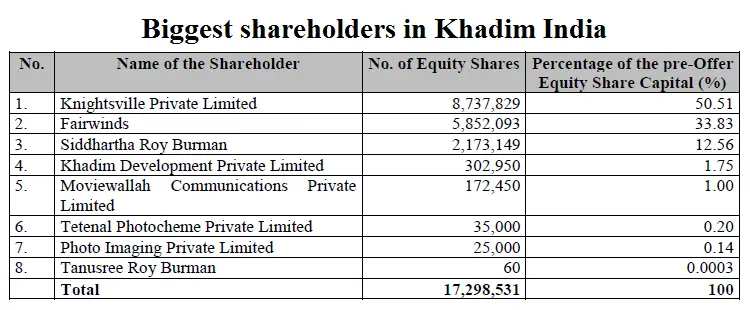

In addition, the OFS component will be led by private equity (PE) firm Fairwinds which plans to sell 5,852,093 shares. The PE firm owns nearly 34% equity stake in the Kolkata-based shoe retailer and will be making a complete exit. As Fairwinds’ average cost of acquisition is INR153.79 per share, its four-year old investment has grown 5X. In addition, promoter Siddhartha Roy Burman will sell 722,000 shares.

Khadim India IPO Review: Regional player, eyeing pan-India role

Incorporated in 1981 as S.N. Footwear Industries, the company is quite old when it comes to the business of selling shoes. Nevertheless, its initial operations were in trading and retailing while manufacturing operations started much later in 2002. In the last 15 years, the company has made strong progress in establishing the brand, especially in eastern India. The company is the second largest footwear retailer in India in terms of number of exclusive retail stores operating under the ‘Khadim’s’ brand, with the largest presence in East India and one of the top three players in South India, in fiscal 2016. As of 30 June 2017, the company operated 853 ‘Khadim’s’ branded exclusive retail stores across 23 states and one union territory in India, through its retail business vertical. The retail business constituted 73.48% of the company’s net revenues in FY2017. As of 31 March 2017, it operates two manufacturing facilities in West Bengal with total installed capacity of 2.3 crore pairs.

The company is also in distribution business which operates through a wide network of distributors catering to lower and middle income consumers in metros and Tier I – Tier III cities, who primarily shop in multi-brand-outlets (MBO) for functional products. The company is also engaged in the business of institutional sales and export of footwear. It operated a network of 377 distributors as of 30 June 2017. The distribution business constituted 27.12% of its net revenue in FY2017.

Khadim India IPO Review: Low but stable margins

While the company is strong is eastern parts of the country, it is not an unknown name in other parts. Khadim India has been able to grow its revenues every year except in FY2015 in the last five years. The company achieved its highest annual turnover of INR625.5 crore last year and the performance in the first quarter indicates that it is on track to surpass last year’s milestone.

Along with revenues, profits have also kept their upwards journey intact, except a brief half in FY2015. A positive trend we see is with improving profitability. In the latest year, its profit margin as at the highest level (4.9%) during the last five years. This has been made possible by an improving balance sheet. Khadim India’s net Debt/Equity (D/E) ratio reduced from 2.2 in FY2013 to 0.6 in FY2017. This also had a positive impact on other financial metrics like Return on Equity (improvement from 18.5% to 21%) and Return on Capital Employed (improvement from 19% to 21%) in the same timeframe.

Khadim India’s financial performance (in INR crore) | ||||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | Q1 FY2018 | |

| Total revenue | 425.7 | 483.1 | 465.7 | 538.8 | 625.5 | 179.8 |

| Total expenses | 412.2 | 464.8 | 484.8 | 513.0 | 584.8 | 168.9 |

| Profit after tax | 8.9 | 12.1 | -18.7 | 25.2 | 30.8 | 7.1 |

| Net margin (%) | 2.1 | 2.5 | -4.0 | 4.7 | 4.9 | 3.9 |

Khadim India IPO Review: Should you invest?

Branded footwear market is expected to grow at an average rate of 20% by 2020 and this is likely to increase branded share from 40% to 50%. Although its retail network is largely concentrated in east India (67% of stores in east India), the company is well-poised to take advantage of this trend. Over the last few years, Khadim India has focused on opening more stores in south India and plans to replicate the approach in north India after witnessing encouraging results.

What’s noteworthy is that Khadim India has the retail presence second only to Bata but its network is way ahead of Relaxo. Despite this advantage, Khadim trails Relaxo in revenues. A key difference between the two companies’ formats is that most of Relaxo’s stores are company owned while around 80% of Khadim’s exclusive retail stores are franchisee-owned. Although it is a relatively small factor considering that significant sales come from other channels like multi-brand outlets, it indicates the gap yet to be plugged by Khadim India. In the retail line, the company’s strategy has been to grow in smaller cities and towns (69% stores are in tier II and tier III cities as of 31 March 2017) and this approach naturally limits sales potential per store, although the decision to grow through franchisee route has played an important role in boosting margins.

In the last three years, the company’s distribution business has grown at a faster rate than the retail operations. The distribution business is characterized by smaller average ticket size and lower margins and given that this business line is outperforming the retail business, we can expect margins to remain where they are.

It also means that Khadim India’s comparison with Relaxo will not be a prudent approach since the two companies are as similar as chalk and cheese. Valuation-wise, the company’s Earnings Per Share (EPS) of INR17.78 means the offer is in the Price/Earnings (P/E) range of 41.90 – 42.18. Since the company’s margins are lower, a discount compared to its listed peers is warranted on this front. This is indeed the case as both Bata and Relaxo trade at P/E ratio of more than 50. With Return on Net Worth (RONW) of 16.61%, Khadim India underperforms Relaxo (20.33%) but is ahead of Bata (12%).

The company could be a good play on the consumption theme in smaller cities and towns in India, although there are other options within the sector to ride the consumption boom. All in all, Khadim India IPO review reveals the tale of a second-rung player whose valuations are in line with competitors in a bull market. While realistic valuations are positive, it may not be enough for investors to make money. Nevertheless, check out our discussion page on Khadim India to get a better understanding of the sentiment on the street and grey market movements.