Kronox Lab Sciences, renowned for its expertise in High Purity Specialty Fine Chemicals, is gearing up for its IPO next week. The company plans to raise INR 130.15 crores through an Offer For Sale (OFS) by current investors. Here’s what you need to know about the upcoming Kronox Lab Sciences IPO.

#1 Kronox Lab Sciences IPO: Business Overview

Kronox Lab Sciences specializes in the manufacture of High Purity Specialty Fine Chemicals for various industries. Their products are used as reacting agents in manufacturing Active Pharmaceutical Ingredients (APIs), excipients in pharmaceutical formulations, ingredients in nutraceuticals, biotech, personal care products, animal health products, reagents for scientific research and laboratory testing, and more. The company focuses on product development, quality standards, and customer specifications to maintain repeat orders from clients.

Also Read: All About SME to Mainboard Migration

#2 Kronox Lab Sciences IPO: Manufacturing Plants

The company operates three strategically located manufacturing facilities in Padra, Vadodara, Gujarat. These plants benefit from proximity to major ports such as Kandla, Mundra, Hazira, and Nhava Sheva, facilitating efficient import and export logistics. Additionally, they are near the Delhi-Mumbai Industrial Corridor (DMIC) and have access to rail and airport facilities, enhancing logistical synergies and operational efficiencies.

#3 Kronox Lab IPO: Capacity Utilization

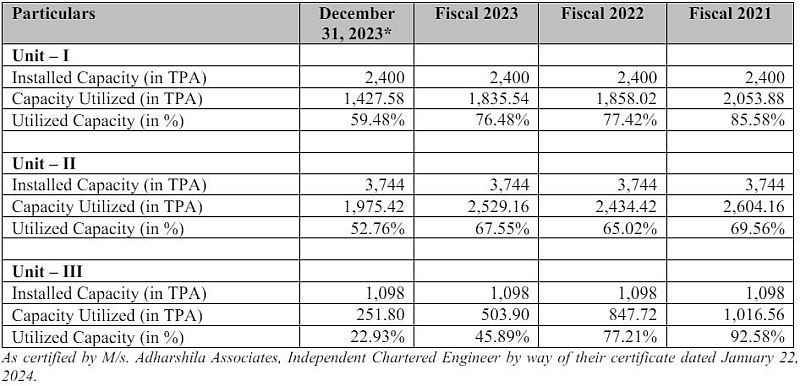

As of 31 December 2023, Kronox’s aggregate installed capacity across its three manufacturing facilities is 7,242 tonnes per annum. The company plans to expand by establishing a new manufacturing unit at GIDC Dahej-II Industrial Estate to meet growing customer demand and introduce new products.

The following table sets forth certain information relating to its installed capacity and capacity utilization for each of the manufacturing facilities for the periods indicated:

Read Also: Best PMS in India in 2023 – All About PMS Services

#4 Kronox Lab Sciences IPO: Offer Details

The Kronox Lab Sciences IPO is scheduled for 3 to 5 June 2024, with a price range of INR 129 to 136 per share. The IPO consists of an OFS of 95,70,000 shares, valuing the offering between INR 123.45 – 130.15 crore. It is worth highlighting that the company will not get any funds from IPO proceeds as it is an OFS. The minimum bid size is 110 shares, priced at INR 14,960, and retail investors are allotted 35% of the shares. The IPO will be listed on both BSE and NSE.

#5 Kronox Lab Sciences IPO: Revenues

The company has experienced consistent revenue growth, with a Compound Annual Growth Rate (CAGR) of 23.70% from Fiscal 2021 to Fiscal 2023. For the nine months ended 31 December 2023, revenue from operations was INR 67.69 crore, primarily driven by domestic sales, which constituted 65.91% of total revenue. The revenue for Fiscal 2023 was INR 95.58 crore, showing substantial growth compared to previous years.

#6 Kronox Lab IPO: Exports

The company’s products are supplied to customers in India and more than 20 countries including the United States, Argentina, Mexico, Australia, Egypt, Spain, Turkey, United Kingdom, Belgium, United Arab Emirates, and China, among others, with the United States being the largest market, contributing significantly to export revenue. For the nine months ended 31 December 2023, exports accounted for 25.07% of total revenue.

Also Read: Top 10 Most Expensive Stocks In India

#7 Kronox Lab Sciences IPO: Patents & Intellectual Property

The company conducts extensive research and development (R&D) to maintain a competitive edge. As of 31 December 2023, it has 122 products under various phases of R&D. The R&D efforts are led by experienced personnel, ensuring continuous innovation and adherence to customer-specific requirements.

#8 Kronox Lab Sciences IPO – Risk Factors

Kronox faces several risks, including dependency on top customers for a significant portion of revenue, stringent product standards, and long customer approval cycles. Any failure to meet customer specifications or execute expansion strategies could adversely affect business prospects.

#9 Kronox Lab Sciences IPO – Financial Performance & Valuations

Kronox is strengthened by a zero-debt balance sheet, giving it a competitive edge and clout to fuel strategic initiatives. Over time there has been consistent growth in key financials ( revenue, EBITDA; PAT) proving the sustainability i.e. financial strength and operational efficiency of the company. For the nine months ended 31 December 2023, EBITDA stood at INR 20.46 crore, with EBITDA margin at 30.23 % and PAT was at INR 15.47 crore.

| FY 2021 | FY 2022 | FY 2023 | 9M FY 2024 | |

| Revenue | 62.46 | 82.25 | 95.58 | 67.69 |

| Expenses | 50.02 | 64.99 | 75.17 | 48.23 |

| Net income | 9.73 | 13.63 | 16.62 | 15.47 |

| Margin (%) | 15.58 | 16.57 | 17.39 | 22.85 |

Read Also: Nifty Pharma Stocks List With Weightage in 2024

| FY 2021 | FY 2022 | FY 2023 (Pre Issue) | FY 2024 (Post-Issue)* | |

| EPS | 2.62 | 3.67 | 4.48 | 5.56 |

| PE Ratio | – | – | 28.8 – 30.36 | 23.2 – 24.46 |

| FY 2021 | FY 2022 | FY 2023 | |

| RONW (%) | 36.29 | 33.77 | 37.19 |

| NAV | 7.23 | 10.88 | 12.04 |

| ROCE (%) | 51.78 | 46.27 | 49.86 |

| EBITDA (%) | 23.70 | 23.95 | 23.01 |

| Debt/Equity | Nil | 0.02 | – |

#10 Kronox Lab IPO: Customers & Customer Retention

Kronox boasts a diversified customer portfolio with over 592 domestic and global customers in the last three financial years. During the nine months ended 31 December 2023 of which 141 customers amounting to 23.82% of total customers placed repeat orders. The company has established long-term relationships with its top 10 and top 20 customers, with average tenures of 7-9 years. Repeat customer orders constituted significant revenue, reflecting strong customer loyalty.