Everyone knows the exchange where their shares are listed. But the real enabler of these transactions is the broker who acts as a bridge between the investor and the exchange. Brokers are hence an integral part of the trading ecosystem. In India, to buy or sell delivery-based securities, one needs to have both a trading account and a demat account—and these are provided by stock brokers who, in turn, charge brokerage for their services. In this article, we will list out the top brokers in India by active clients. But before we get into that, let’s have a quick look at the history behind it.

Table of Contents

What is the History of Stock Brokerage?

The first account of shares being purchased and sold is from 1602, when the Dutch East India Company released the first publicly traded stocks through the Amsterdam Stock Exchange. Although similar trading used to take place in some markets before this, the traded instruments were mostly related to debt, and the key ingredient – stocks – was missing. This can be seen as the first instance of organized stock issuance and trading. Owing to the law of private property rights indoctrinated in the Dutch Empire, the profession of stockbrokers flourished.

At the end of the 17th century, the London Stock Exchange came into existence, and almost a hundred years later, in 1792, the New York Stock Exchange was formed. India and Asia saw the first stock exchange in the form of the Bombay Stock Exchange (BSE) in 1875.

Fast forward to the current day, and India has a flourishing stock market servicing millions of domestic and overseas investors through hundreds of stock brokers.

Top Stock Brokers Market Share: List of Stock Brokers in India

Read Also: Is Your Stock Broker charging you higher than stipulated clearing fees?

Types of Share Market Brokers in the Market

That’s where the journey of share market brokers began. There are many types of brokers, and their clients have to decide which one suits them best. Every broker has its advantages and disadvantages. Understanding those differences before you choose a broker to handle your investments is crucial.

- Discount Stockbrokers

Discount or internet stock brokers are getting more and more popular because of their accessibility and affordability. They enable Internet trading without the need for face-to-face contact between the investor and the broker. Discount brokers may not be appropriate for consumers with large investment portfolios because not all of them offer the same level of knowledge as standard brokers. Nevertheless, they may be a great starting point for stock market investing for investors with a little extra cash.

- Full-Service or Traditional Stockbrokers

Full-service stock brokers offer a variety of services, including dealing in stocks, investment guidance, retirement planning, and portfolio management. Even though they have more experience and a bigger commission, they can help you increase your earning potential and reduce dangers.

Also Read: Largest Stock Brokers in India 2025

What’s the difference between a Discount and a Full-Service Broker?

| Discount Brokers | Full-Service Brokers |

| Lower fees and commissions | Higher fees and commissions |

| Limited investment guidance | Personalized investment advice and guidance |

| Online trading platform | Personalized trading platform |

| No or limited research and analysis | In-depth research and analysis |

| Limited or no access to IPOs | Access to IPOs and other exclusive investments |

| Minimal customer support | Extensive customer support and assistance |

| Ideal for self-directed investors | Ideal for investors seeking personalized advice and assistance |

Read Also: Fyers Brokerage Calculator

List of Top Brokers in India by Active Clients

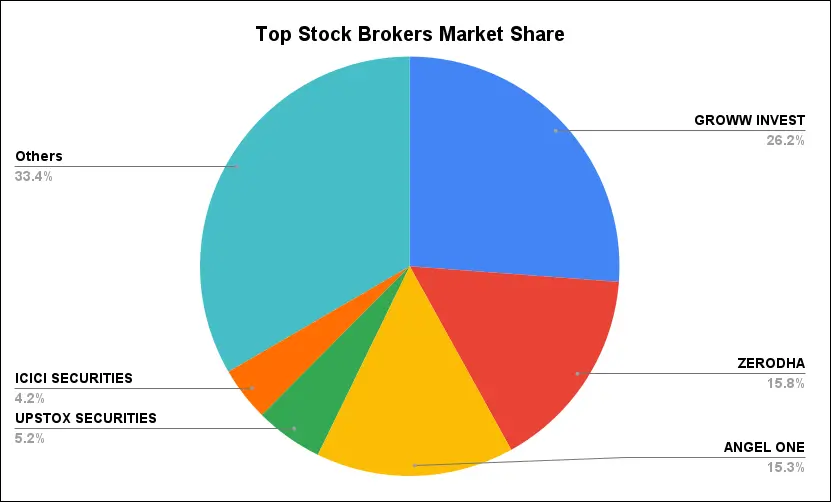

Given the huge addressable market, the list of the top 100 stock broking companies in India by active clients is quite long. As of 31 July 2025, there were 215 stock brokers registered with NSE. Below is the list of NSE active clients in India.

| Broker Name | Active Clients | Market Share (%) | Number of Complaints | % of Number of Complaints Resolved |

|---|---|---|---|---|

| Groww Invest Tech | 12,351,761 | 26.19 | 780 | 88.46 |

| Zerodha Broking | 7,433,773 | 15.76 | 317 | 79.50 |

| Angel One | 7,196,742 | 15.26 | 391 | 75.96 |

| Upstox Securities | 2,474,081 | 5.25 | 427 | 74.47 |

| ICICI Securities | 1,958,688 | 4.15 | 250 | 68.40 |

| HDFC Securities | 1,574,443 | 3.34 | 154 | 70.78 |

| Kotak Securities | 1,443,751 | 3.06 | 273 | 74.36 |

| SBICAP Securities | 1,047,604 | 2.22 | 95 | 77.89 |

| Moneylicious Securities | 996,436 | 2.11 | 59 | 91.53 |

| Motilal Oswal Financial Services | 983,934 | 2.09 | 357 | 72.27 |

| Indstocks | 807,692 | 1.71 | 25 | 80.00 |

| Paytm Money | 746,352 | 1.58 | 62 | 64.52 |

| Sharekhan | 608,713 | 1.29 | 84 | 76.19 |

| Mirae Asset Capital Markets ( India ) | 422,973 | 0.90 | 253 | 83.40 |

| IIFL Capital Services | 405,603 | 0.86 | 148 | 81.76 |

| 5paisa Capital | 392,994 | 0.83 | 50 | 76.00 |

| Axis Securities | 388,891 | 0.82 | 60 | 63.33 |

| Phonepe Wealth Broking | 326,177 | 0.69 | 46 | 86.96 |

| Choice Equity Broking | 249,848 | 0.53 | 106 | 63.21 |

| Geojit Investments | 231,894 | 0.49 | 13 | 92.31 |

| Fyers Securities | 222,329 | 0.47 | 37 | 59.46 |

| Smc Global Securities | 168,758 | 0.36 | 52 | 73.08 |

| Nuvama Wealth And Investment | 156,000 | 0.33 | 34 | 70.59 |

| Anand Rathi Share And Stock Brokers | 145,286 | 0.31 | 59 | 88.14 |

| Nirmal Bang Securities | 144,576 | 0.31 | 17 | 64.71 |

| Religare Broking | 140,137 | 0.30 | 45 | 82.22 |

| Finvasia Securities | 135,768 | 0.29 | 44 | 75.00 |

| Marwadi Shares And Finance | 135,560 | 0.29 | 4 | 75.00 |

| Jainam Broking | 126,994 | 0.27 | 24 | 70.83 |

| JM Financial Services | 119,123 | 0.25 | 65 | 64.62 |

| Alice Blue Fin Svcs P Ltd | 111,092 | 0.24 | 27 | 70.37 |

| Ventura Securities Limited | 110,945 | 0.24 | 51 | 90.20 |

| Aditya Birla Money Limited | 89,550 | 0.19 | 25 | 92.00 |

| Tradebulls Securities (p) Ltd. | 79,844 | 0.17 | 18 | 83.33 |

| NJ India Invest Private Limited | 79,793 | 0.17 | 1 | 100.00 |

| Yes Securities (india) Limited | 75,413 | 0.16 | 25 | 84.00 |

| NU Investors Technologies Private Limited | 70,624 | 0.15 | 19 | 68.42 |

| Samco Securities Limited | 65,365 | 0.14 | 20 | 95.00 |

| Swastika Investmart Limited | 64,424 | 0.14 | 14 | 71.43 |

| Master Capital Services Limited | 63,323 | 0.13 | 8 | 87.50 |

| Globe Capital Market Limited | 61,855 | 0.13 | 24 | 41.67 |

| IDBI Capital Markets & Securities Ltd. | 57,369 | 0.12 | 3 | 100.00 |

| Reliance Securities Limited | 56,803 | 0.12 | 28 | 82.14 |

| Bonanza Portfolio Ltd. | 56,264 | 0.12 | 9 | 77.78 |

| Bajaj Financial Securities Ltd. | 53,434 | 0.11 | 21 | 76.19 |

| Arihant Capital Markets Limited | 53,087 | 0.11 | 11 | 54.55 |

| Monarch Networth Capital Limited | 52,707 | 0.11 | 5 | 60.00 |

| Integrated Enterprises (india) Private Limited | 48,538 | 0.10 | 4 | 25.00 |

| Prabhudas Lilladher Pvt. Ltd. | 47,217 | 0.10 | 14 | 42.86 |

| Suresh Rathi Securities Private Limited | 44,087 | 0.09 | 2 | 100.00 |

| Shah Investors Home Limited | 36,522 | 0.08 | 1 | 0.00 |

| Fortune Capital Services Private Limited | 35,936 | 0.08 | 35 | 77.14 |

| Cholamandalam Securities Limited | 35,879 | 0.08 | 8 | 62.50 |

| Indiabulls Securities Limited (formerly Known As Dhani Stocks Limited) | 34,679 | 0.07 | 25 | 80.00 |

| Profitmart Securities Private Limited | 31,197 | 0.07 | 4 | 25.00 |

| Goodwill Wealth Management Pvt Ltd | 29,585 | 0.06 | 83 | 79.52 |

| Prudent Corporate Advisory Services Limited | 28,094 | 0.06 | 4 | 100.00 |

| Eureka Stock & Share Broking Services Limited | 27,741 | 0.06 | 1 | 100.00 |

| Shriram Insight Share Brokers Limited | 27,725 | 0.06 | 1 | 100.00 |

| Lakshmishree Investment & Securities Pvt. Ltd. | 27,010 | 0.06 | 1 | 0.00 |

| Astha Credit & Securities (p) Ltd | 26,016 | 0.06 | 14 | 57.14 |

| LKP Securities | 25,963 | 0.06 | 7 | 71.43 |

| Way2wealth Brokers Private Limited | 23,448 | 0.05 | 3 | 33.33 |

| KIFS Trade Capital Private Limited | 22,435 | 0.05 | 1 | 100.00 |

| Aaritya Broking Private Limited | 21,491 | 0.05 | 19 | 94.74 |

| Arham Share Private Limited | 20,876 | 0.04 | 1 | 0.00 |

| Moneywise Finvest Limited | 20,793 | 0.04 | 9 | 44.44 |

| Ashika Stock Broking Ltd. | 20,536 | 0.04 | 14 | 100.00 |

| Finwizard Technology Private Limited | 20,385 | 0.04 | 1 | 100.00 |

| Aionion Capital Market Services Private Limited | 19,928 | 0.04 | 2 | 100.00 |

| B N Rathi Securities Limited | 17,954 | 0.04 | 1 | 0.00 |

| Tradesmart Fintech Securities Limited | 16,962 | 0.04 | 6 | 100.00 |

| Steel City Securities Ltd. | 16,961 | 0.04 | 1 | 0.00 |

| Phillipcapital (india) Pvt. Ltd | 16,398 | 0.03 | 2 | 100.00 |

| BOB Capital Markets Limited | 15,970 | 0.03 | 13 | 92.31 |

| South Asian Stocks Ltd. | 15,254 | 0.03 | 16 | 68.75 |

| Alankit Imaginations Limited | 15,232 | 0.03 | 1 | 100.00 |

| R Wadiwala Securities Pvt. Ltd. | 15,057 | 0.03 | 1 | 100.00 |

| Acumen Capital Market (india) Ltd | 14,976 | 0.03 | 2 | 50.00 |

| Univest Stock Broking Private Limited | 13,780 | 0.03 | 12 | 100.00 |

| Rudra Shares & Stock Brokers Limited | 13,663 | 0.03 | 1 | 100.00 |

| Sykes & Ray Equities (i) Ltd. | 13,106 | 0.03 | 1 | 100.00 |

| Zebu Share And Wealth Managements Private Limited | 13,048 | 0.03 | 3 | 66.67 |

| BP Equities Private Limited | 12,792 | 0.03 | 1 | 100.00 |

| Inventure Growth & Securities Limited | 12,197 | 0.03 | 1 | 0.00 |

| Navia Markets Ltd. | 11,851 | 0.03 | 10 | 80.00 |

| Bhansali Value Creations Private Limited | 11,802 | 0.03 | 2 | 100.00 |

| Tradejini Financial Services Pvt Ltd | 11,742 | 0.02 | 2 | 50.00 |

| Pravin Ratilal Share And Stock Brokers Ltd | 11,419 | 0.02 | 1 | 100.00 |

| Jk Securities Pvt. Ltd. | 11,076 | 0.02 | 2 | 100.00 |

| Prudent Broking Services Private Limited | 11,055 | 0.02 | 1 | 100.00 |

| Sky Commodities India Pvt Ltd | 10,176 | 0.02 | 33 | 78.79 |

| Enrich Financial Market Private Limited | 9,784 | 0.02 | 7 | 28.57 |

| Standard Chartered Securities (india) Limited | 9,754 | 0.02 | 3 | 66.67 |

| GEPL Capital Private Limited | 9,740 | 0.02 | 1 | 100.00 |

| Adroit Financial Services Private Limited | 9,185 | 0.02 | 1 | 100.00 |

| Shree Bahubali Stock Broking Ltd | 8,560 | 0.02 | 2 | 50.00 |

| Mansukh Securities & Finance Limited | 8,454 | 0.02 | 3 | 100.00 |

| A C Agarwal Share Brokers Pvt Ltd | 8,436 | 0.02 | 2 | 50.00 |

| Sunidhi Securities & Finance Limited | 8,434 | 0.02 | 1 | 100.00 |

| Progressive Share Brokers Private Limited | 7,572 | 0.02 | 1 | 100.00 |

| R K Global Shares & Securities Limited | 7,175 | 0.02 | 1 | 100.00 |

| DBFS Securities Limited | 6,937 | 0.01 | 1 | 100.00 |

| Sunlight Broking Llp | 6,922 | 0.01 | 1 | 100.00 |

| Espresso Financial Services Private Limited. | 6,740 | 0.01 | 2 | 50.00 |

| RKSV Commodities India Private Limited | 6,560 | 0.01 | 2 | 100.00 |

| Market-hub Stock Broking Private Limited | 6,233 | 0.01 | 3 | 33.33 |

| SMIFS Limited | 5,764 | 0.01 | 1 | 100.00 |

| Sunflower Broking Pvt. Ltd. | 5,585 | 0.01 | 2 | 100.00 |

| Mandot Securities Private Limited | 5,430 | 0.01 | 58 | 84.48 |

| Marfatia Stock Broking Private Limited | 5,422 | 0.01 | 1 | 0.00 |

| Raghunandan Capital Private Limited | 5,348 | 0.01 | 3 | 100.00 |

| Ganganagar Commodity Limited | 5,347 | 0.01 | 2 | 100.00 |

| Patel Wealth Advisors Pvt Ltd | 5,213 | 0.01 | 1 | 100.00 |

| Wealthyin Broking Private Limited | 5,045 | 0.01 | 4 | 100.00 |

| Pace Stock Broking Services Private Limited | 4,666 | 0.01 | 1 | 100.00 |

| Elite Wealth Limited | 4,634 | 0.01 | 4 | 100.00 |

| Zuari Finserv Limited | 4,593 | 0.01 | 3 | 66.67 |

| Nco Securities & Share Broking (p) Ltd | 4,453 | 0.01 | 1 | 0.00 |

| 360 One Distribution Services Limited | 4,099 | 0.01 | 2 | 0.00 |

| Muthoot Securities Ltd. | 4,006 | 0.01 | 5 | 100.00 |

| Ashlar Securities Private Limited | 3,517 | 0.01 | 2 | 100.00 |

| Ats Share Brokers Private Limited | 3,185 | 0.01 | 15 | 73.33 |

| Centrum Broking Limited | 3,097 | 0.01 | 2 | 100.00 |

| Julius Baer Wealth Advisors (india) Private Limited | 2,938 | 0.01 | 1 | 100.00 |

| South Gujarat Shares & Sharebrokers Ltd | 2,712 | 0.01 | 1 | 100.00 |

| Arham Wealth Management Pvt Ltd | 2,677 | 0.01 | 1 | 100.00 |

| Kedia Capital Services Private Limited | 2,356 | 0.00 | 1 | 100.00 |

| Torus Financial Markets Private Limited | 2,332 | 0.00 | 1 | 0.00 |

| Ghalla Bhansali Stock Brokers Private Limited | 2,234 | 0.00 | 1 | 100.00 |

| Dealmoney Commodities Pvt. Ltd. | 2,103 | 0.00 | 4 | 75.00 |

| Motisons Shares Private Limited | 2,078 | 0.00 | 3 | 66.67 |

| Standard Securities & Investment Intermediates Limited | 2,035 | 0.00 | 2 | 0.00 |

| Indo Thai Securities Limited | 1,821 | 0.00 | 3 | 100.00 |

| CIL Securities Ltd. | 1,649 | 0.00 | 30 | 10.00 |

| Intellect Stock Broking Limited | 1,640 | 0.00 | 1 | 100.00 |

| J L Shah Securities Private Limited | 1,615 | 0.00 | 3 | 100.00 |

| Fair Intermediate Investment Pvt. Ltd. | 1,551 | 0.00 | 1 | 100.00 |

| Tipsons Stock Brokers Private Limited | 1,408 | 0.00 | 1 | 100.00 |

| Abhipra Capital Ltd. | 1,395 | 0.00 | 6 | 33.33 |

| Nda Securities Ltd. | 1,355 | 0.00 | 1 | 100.00 |

| Spark Pwm Private Limited | 1,338 | 0.00 | 2 | 0.00 |

| Bondbazaar Securities Private Limited | 1,335 | 0.00 | 1 | 100.00 |

| A . G. Shares & Securities Ltd. | 1,324 | 0.00 | 2 | 100.00 |

| Interactive Brokers (india) Private Limited | 1,131 | 0.00 | 3 | 66.67 |

| Gogia Capital Services Limited | 960 | 0.00 | 1 | 0.00 |

| Khandwala Securities Ltd. | 839 | 0.00 | 1 | 100.00 |

| C.D. Equisearch Pvt. Ltd | 786 | 0.00 | 1 | 100.00 |

| Acemoney Intermediaries Private Limited | 667 | 0.00 | 1 | 0.00 |

| Nuvama Wealth Management Limited | 594 | 0.00 | 5 | 100.00 |

| Prrsaar Sampada Private Limited | 425 | 0.00 | 2 | 100.00 |

| Morgan Stanley India Company Private Limited | 399 | 0.00 | 2 | 100.00 |

| Citigroup Global Markets India Pvt. Ltd. | 353 | 0.00 | 7 | 85.71 |

| Growth Securities Private Limited | 351 | 0.00 | 1 | 100.00 |

| Oswal Shares And Securities Limited | 334 | 0.00 | 5 | 100.00 |

| UBS Securities India Pvt. Ltd. | 301 | 0.00 | 2 | 100.00 |

| Pocketful Fintech Capital Private Limited | 294 | 0.00 | 1 | 100.00 |

| Abhinandan Stock Broking Pvt. Ltd. | 246 | 0.00 | 1 | 0.00 |

| Hsbc Securities & Capital Markets (india) Pvt. Ltd. | 231 | 0.00 | 1 | 100.00 |

| Gill Broking Private Limited | 229 | 0.00 | 1 | 100.00 |

| Barclays Securities (india) Private Limited | 196 | 0.00 | 1 | 100.00 |

| Khosla Tradewise Private Limited | 107 | 0.00 | 27 | 55.56 |

| Yashwi Securities (p) Limited | 89 | 0.00 | 1 | 100.00 |

| Dimensional Securities Pvt. Ltd | 43 | 0.00 | 1 | 100.00 |

| Dhan Stock & Share Brokers Pvt. Ltd. | 27 | 0.00 | 24 | 75.00 |

| Bajaj Share & Stock Brokers Pvt. Ltd | 19 | 0.00 | 1 | 100.00 |

| Parim Finserv Pvt Ltd | 17 | 0.00 | 3 | 100.00 |

| Trdez Investment Private Limited | 15 | 0.00 | 10 | 50.00 |

| Ganesham Securities Private Limited | 8 | 0.00 | 1 | 100.00 |

| Indianivesh Shares And Securities Private Limited | 6 | 0.00 | 5 | 40.00 |

| 123 Capitals | 3 | 0.00 | 1 | 100.00 |

| Adroit Share & Stock Broker Pvt. Ltd. | 1 | 0.00 | 1 | 100.00 |

| Advent Stock Broking Private Limited | 1 | 0.00 | 1 | 100.00 |

| Axis Bank Ltd. | 1 | 0.00 | 3 | 66.67 |

| Bank Of Baroda | 1 | 0.00 | 2 | 50.00 |

| Citadel Securities India Markets Private Limited | 1 | 0.00 | 8 | 50.00 |

| Fortune Capital Services | 1 | 0.00 | 3 | 100.00 |

| ICICI Bank Ltd. | 1 | 0.00 | 20 | 70.00 |

| IDBI Bank Limited | 1 | 0.00 | 1 | 0.00 |

| IMC India Securities Private Limited | 1 | 0.00 | 1 | 100.00 |

| Indusind Bank Limited | 1 | 0.00 | 1 | 100.00 |

| Union Bank Of India | 1 | 0.00 | 1 | 100.00 |

| Universal Stock Brokers Pvt. Ltd. | 1 | 0.00 | 1 | 100.00 |

| Yes Bank Limited | 1 | 0.00 | 1 | 100.00 |

| 1 Finance Private Limited | 0 | 0.00 | 3 | 100.00 |

| 4A Securities Limited | 0 | 0.00 | 8 | 87.50 |

| A To Z Stock Trade Pvt. Ltd. | 0 | 0.00 | 1 | 0.00 |

| Abbott Wealth Management Limited | 0 | 0.00 | 8 | 100.00 |

| Allgrow Finance & Investment Private Limited | 0 | 0.00 | 1 | 100.00 |

| Angel Securities Ltd | 0 | 0.00 | 48 | 66.67 |

| Dealmoney Securities Private Limited | 0 | 0.00 | 9 | 55.56 |

| Fairwealth Commodity Broking Private Limited | 0 | 0.00 | 1 | 0.00 |

| Fourdegreewater Services Private Limited | 0 | 0.00 | 1 | 100.00 |

| Hcg Stock & Share Brokers Ltd. | 0 | 0.00 | 14 | 100.00 |

| HDFC Bank Ltd | 0 | 0.00 | 2 | 50.00 |

| Hem Securities Ltd. | 0 | 0.00 | 4 | 100.00 |

| Horizon Capital Ltd. | 0 | 0.00 | 4 | 50.00 |

| Il&fs Securities Services Limited | 0 | 0.00 | 8 | 37.50 |

| India Bond Private Limited | 0 | 0.00 | 1 | 100.00 |

| Iss Enterprise Limited | 0 | 0.00 | 1 | 0.00 |

| Karvy Comtrade Limited | 0 | 0.00 | 47 | 78.72 |

| Kotak Mahindra Bank Ltd. | 0 | 0.00 | 1 | 100.00 |

| Maashitla Securities Pvt. Ltd. | 0 | 0.00 | 2 | 0.00 |

| Ng Rathi Investrades Pvt. Ltd. | 0 | 0.00 | 1 | 0.00 |

| Nirmal Bang Commodities Private Limited | 0 | 0.00 | 1 | 100.00 |

| Northern Arc Securities Private Limited | 0 | 0.00 | 3 | 66.67 |

| Pentagon Stock Brokers Private Limited | 0 | 0.00 | 4 | 100.00 |

| Pnb Investment Services Limited | 0 | 0.00 | 1 | 0.00 |

| Quant Broking Private Limited | 0 | 0.00 | 1 | 100.00 |

| Quantum Securities Pvt. Ltd. | 0 | 0.00 | 7 | 100.00 |

| Rk Global Equity Broking Ltd. | 0 | 0.00 | 1 | 100.00 |

| Satco Capital Markets Limited | 0 | 0.00 | 1 | 100.00 |

| Stock Holding Corporation Of India Ltd | 0 | 0.00 | 18 | 94.44 |

| Sunglow Capital Services Ltd. | 0 | 0.00 | 1 | 100.00 |

| Zerodha Commodities Private Limited | 0 | 0.00 | 12 | 91.67 |

Latest Content From IPO Central

- Upcoming IPOs in March 2026

- Latest SEBI IPO Approvals

- Why Shree Ram Twistex IPO Allotment Might Feel Like a Loss Already

- Top Startups Eyeing IPOs in 2026: 44 in the Pipeline

- Largest Stock Brokers in India 2026

- Top Steel Companies in India

- Is Reliance Industries Undervalued Or Jio and Retail Overvalued?

- Upcoming PSU IPOs with Shareholder Quota

- Upcoming Mega IPOs in 2026

Stock Brokers FAQs

What is a stockbroker?

For a fee or commission, stockbrokers purchase and sell stocks and other assets on behalf of ordinary and institutional clients over the counter or through a stock exchange. Retail investors coexist with institutional stockbrokers and fund managers in the world of finance.

Which are the top stock brokers in India?

Groww is the biggest stockbroker in the country, followed by Zerodha and Angel One in terms of the number of active clients.

Is it permitted to open more than one account with different brokers?

Yes, just like bank accounts, it is quite legal to open multiple demat and trading accounts in India.

How many NSE brokers list in India?

As of 31 July 2025, there were 215 stock brokers registered with NSE.

Noble broking of saChitra web world is a registered plateform or not.

Is it fake broker…….????