The initial public offering (IPO) of Manba Finance has captured the attention of investors and analysts alike as it opens for subscription. The company aims to raise INR 150 crore through this offering, and several brokerage houses have provided their recommendations based on their analyses of the company’s financial health and market potential. Here’s a summary of Manba Finance IPO Recommendations by major brokerage houses.

Manba Finance IPO Recommendations

Swastika Investmart – Subscribe with Caution

Analysts at Swastika Investmart have recommended that investors with a high-risk tolerance might consider applying for the Manba Finance IPO but advised caution. They noted that while the company has demonstrated robust growth in revenue and other positive financial metrics, its valuation appears fully priced. Swastika Investmart cautioned, “Careful consideration of the company’s size and potential risks is essential before investing.”

Nirmal Bang Securities – Subscribe

Nirmal Bang Securities has issued a clear “subscribe” recommendation for the Manba Finance IPO. In their analysis, they highlighted the company’s strong fundamentals and growth trajectory. They noted that Manba Finance has shown impressive revenue growth and a solid business model that positions it well in the competitive NBFC landscape. Nirmal Bang stated, “Investors looking for exposure in the financial services sector should consider subscribing to this IPO, given its robust performance indicators.

SMIFS – Subscribe for Long Term

Another positive word among Manba Finance IPO recommendations came from brokerage firm SMIFS which suggested that investors with a medium risk appetite subscribe to the upcoming IPO as a long-term investment. They pointed out that while the company is relatively small with limited geographical presence and elevated non-performing asset (NPA) levels, it possesses a decent growth track record and future growth opportunities. SMIFS remarked, “The long-term potential of Manba Finance makes it an attractive option for investors willing to hold for extended periods.”

BP Equities – Subscribe for Medium to Long-Term

BP Equities has assigned a “subscribe” rating to the Manba Finance IPO, advocating for a medium to long-term investment perspective. They emphasized that the issue is priced at a price-to-book value (P/BV) of 2.3x based on FY24 book value, which they consider fair valuation. BP Equities believes that with its strategic focus on customer satisfaction and innovative financial products, Manba Finance is well-equipped to adapt to evolving market needs. They stated, “Investors can look forward to reasonable returns as the company continues to grow.”

Arihant Capital – Listing Gains

Analysts at Arihant Capital noted that the company has potential to expand into new and untapped regions. “Plans to introduce Used Car Loans, Small Business Loans, and Personal Loans further diversify the portfolio, targeting existing customers and expanding market reach. At the upper band of INR 120, the issue is valued at a P/E ratio of 19.19x, based on a FY24 EPS of INR 6.25. P/B ratio of 3x. We are recommending a ‘Subscribe for listing gains’ for this issue,” said its research note.

Canara Bank Securities – Subscribe

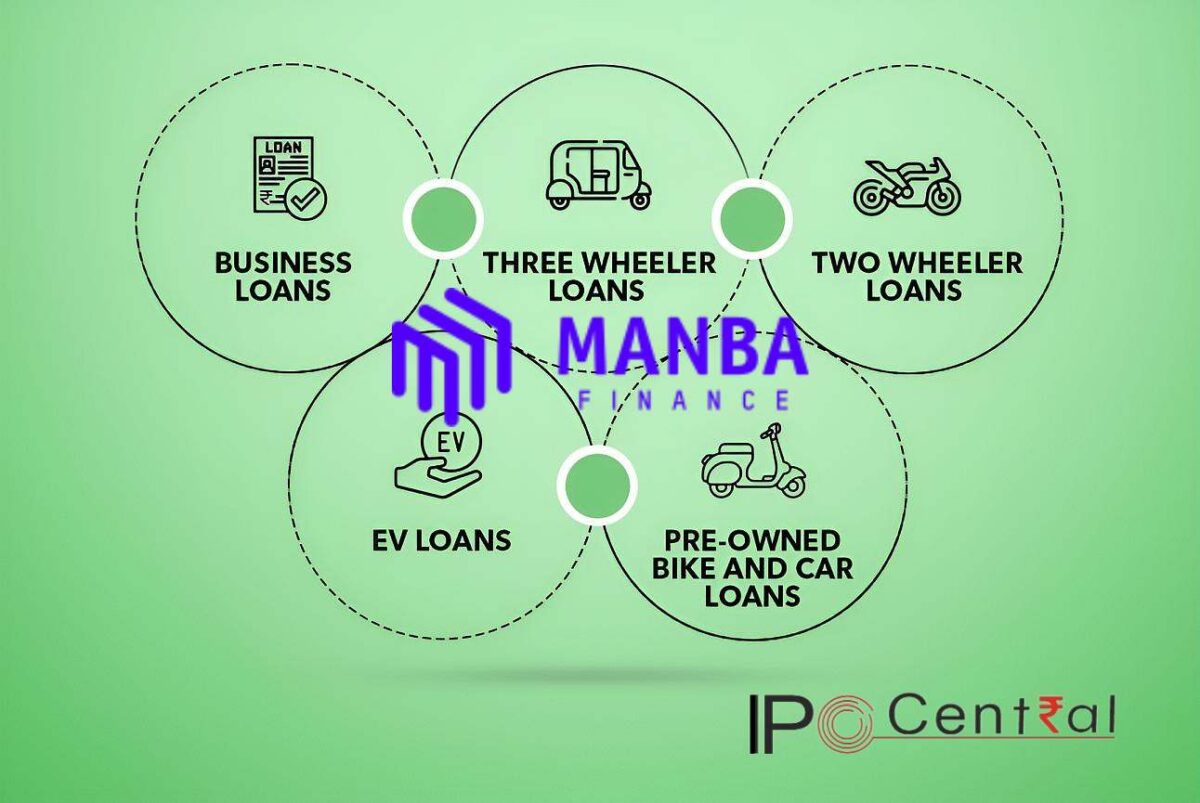

Manba Finance IPO Recommendations saw another positive view from Canara Bank Securities. Analyst Sankita V noted that the company is planning to diversify its offerings, aiming to reduce its two-wheeler loan concentration to 65% by FY26 from the current levels of 91%. The analyst also highlighted the significant concentration risk due to the company’s heavy reliance on two-wheeler loans.

“However, with plans to diversify and expand into other loan segments, Manba Finance is well-positioned for long-term growth,” stated the broker’s research note.

Manba Finance IPO Recommendations – Bottomline

In conclusion, brokerage houses are generally optimistic about the Manba Finance IPO, recommending subscriptions based on varying risk appetites and investment horizons. While some firms advocate for long-term investments due to growth potential, others emphasize caution due to market volatility and company size considerations.

In addition, there is a healthy premium in the informal or grey market, reflecting listing with potential gains of 40%. Nevertheless, investors are encouraged to assess their individual risk profiles and conduct thorough research before participating in this IPO.