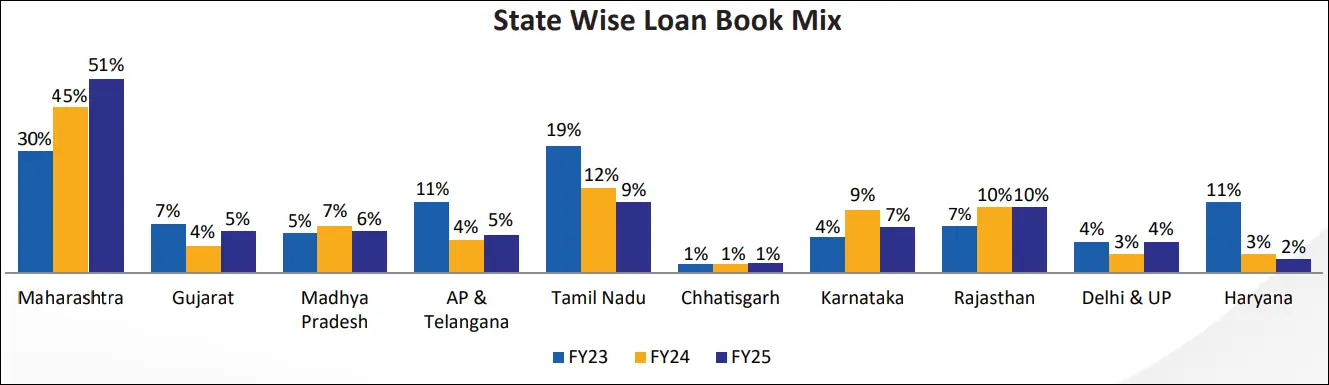

Motilal Oswal Home Finance Share Price Description – Motilal Oswal Home Finance (MOHFL) is a public limited company established in October 2013 and headquartered in Mumbai, Maharashtra. As a subsidiary of Motilal Oswal Financial Services, MOHFL is registered with the National Housing Bank (NHB) and operates across 12 states in India, including Andhra Pradesh, Chhattisgarh, Gujarat, Haryana, Delhi, Karnataka, Madhya Pradesh, Maharashtra, Rajasthan, Tamil Nadu, Uttar Pradesh, and Telangana. The company has established a network of 112 locations to serve its customers effectively.

MOHFL operates under a business philosophy centered on financial inclusion for lower-income families in India, aiming to provide them with access to long-term housing finance. As a subsidiary of Motilal Oswal Financial Services, a well-diversified financial services company, MOHFL is committed to enhancing the financial landscape for these families by facilitating their journey towards home ownership.

Motilal Oswal Home Finance is registered with the Reserve Bank of India (RBI) under Section 29A of the National Housing Bank (NHB) Act of 1987. The registration was done with Certificate of Registration No. DOR-00111 on 12th Feb 2020. Before this, MOHFL was registered with the NHB under Certificate No. 05.0111.14, effective 19 May 2014.

Read Also: Axles India Unlisted Share Price

Products & Services of the Motilal Oswal Home Finance

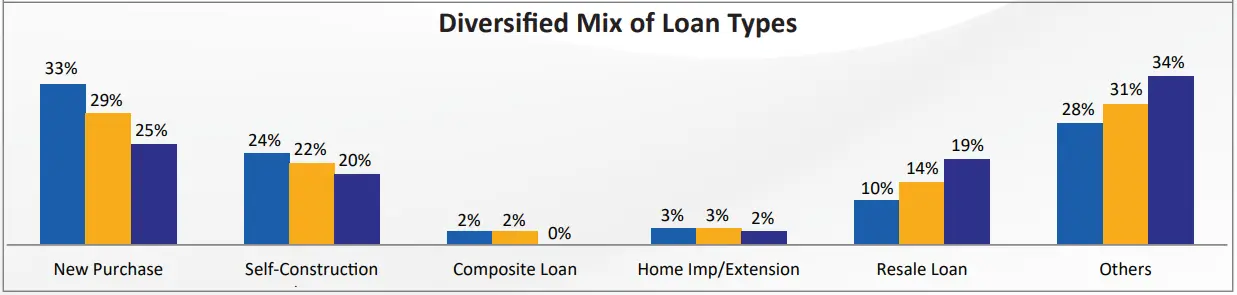

- Home Purchase Loans

- Home Construction Loan

- Home Improvement Loans

- Home Extension Loans

- Loan Against Property

- Construction Finance

- Pradhan Mantri Awas Yojana (PMAY)

Key Highlights Q3 & 9M FY 2025–26 Results

- AUM grew 24% YoY to INR 5,379 crore as of December 2025, driven by strong retail traction in the affordable housing segment (adjusted AUM growth ~29% YoY).

- Retail-focused growth sustained, with retail loans contributing ~90% of the total loan book, supported by deeper penetration in Tier II & Tier III markets.

- Disbursements stood at INR 364 crore in Q3 FY26; adjusted for one-time accounting changes, disbursements grew ~59% YoY to INR 578 crore, reflecting healthy underlying demand.

- Profit After Tax (PAT) increased 14% YoY to INR 42 crore in Q3 FY26, supported by steady margins and operating efficiency.

- Net Interest Income (NII) rose 9% YoY to INR 96 crore, despite a competitive funding environment and marginal yield compression.

- Margins remained stable, with spreads maintained at ~5.2%, aided by lower cost of funds and balanced growth strategy.

- Asset quality remained stable and best-in-class, with GNPA at 1.4% and NNPA at 0.9%, reflecting prudent underwriting and strong collections.

- Capital adequacy remained strong at 40.7% (CRAR), providing ample headroom for future growth during the expansion phase.

- Sales RM count increased 16% YoY to 190, driving improved reach, productivity, and disbursement momentum.

- Credit rating upgraded to AA+ (Stable) by ICRA, reinforcing financial strength, governance standards, and funding access.

Read Also:

- Motilal Oswal Home Finance Q3 FY26 Results

- Motilal Oswal Home Finance Q2 FY26 Results

- Motilal Oswal Home Finance Q1 FY26 Results

- Motilal Oswal Home Finance Q4 FY25 Results

- Motilal Oswal Home Finance Q3 FY25 Results

- Motilal Oswal Home Finance Q2 FY25 Results

Key Highlights FY 2024 – 25

- Loan Book rose from INR 4,074 crore to INR 4,857 crore (19.22% YoY growth).

- Profit After Tax (PAT) was slightly lower, decreasing from INR 133 crore (FY24) to INR 130 crore (FY25), indicating a controlled impact during a strategic growth phase.

- Sales Relationship Managers (RMs) increased by 44%, from 925 in March 2024 to 1,329 in March 2025.

- Retail Loan Book per Branch improved from INR 30.77 crore to INR 36.88 crore.

- The company has an in-house Loan Management System (LMS), Loan Origination System (LOS), and separate mobile apps for sales, credit, and collection.

Motilal Oswal Home Finance Unlisted Share Price – Business Performance

– MOHFL achieved robust growth in loan disbursements, amounting to INR 1,794 crore in FY 2025, an increase of 78%

– Geographical reach across 12 states/UTs with 112 branches

– Collection team of 450 members, along with a robust legal team

– Catering to 50,600+ families

– Average LTV of 58% and FOIR of 43% for FY 2025

– Collection Efficiency (Total EMI Collected/1 EMI Due) of 124.3% in FY 2025

– Total staff count of 2,848 employees

Read Also: Pace Digitek Unlisted Share Price

Motilal Oswal Home Finance Unlisted Share Price – Financial Performance FY 2025

- Net Worth improved from INR 1,287 crore (Mar’24) to INR 1,429 crore (Mar’25).

- Profit stood at INR 130.26 crore during FY 2025

- NIM – 7.3%, Spread – 5.3%

- GNPA – 0.8%, NNPA – 0.4%

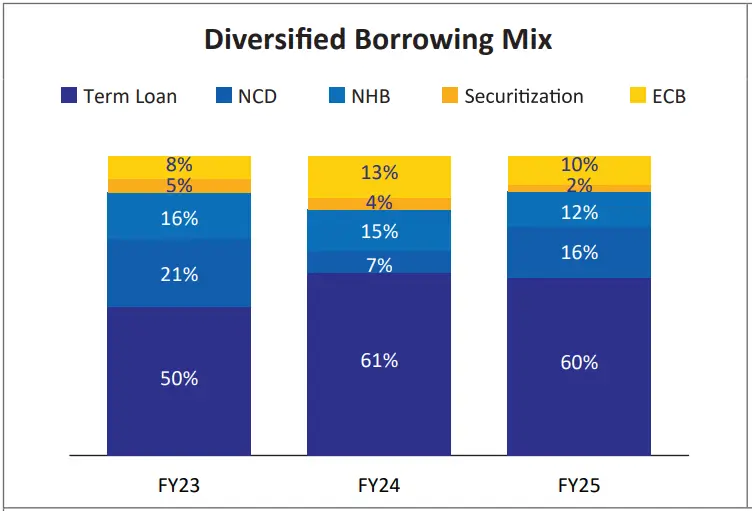

- Net Debt to Equity – 2.2x

- Financial margins were healthy, with a yield of 13.7% and a Cost of Funds (COF) of 8.4%.

- The Stage 3 Provision Coverage Ratio was robust at 55.9%.

- Cost/Income Ratio worsened from 45.9% to 56% due to higher expenses or lower income.

- Capital adequacy remained strong at 40.8%

Motilal Oswal Home Finance Board of Directors

- Mr. Motilal Oswal, Chairman & Non-Executive Director

- Mr. Raamdeo Agrawal, Non-Executive Director

- Mr. Sukesh Bhowa, Managing Director and Chief Executive Officer

- Ms. Divya Momaya, Independent Director

- Dr. S. S. Rana, Independent Director

- Mrs. Neha Gada, Independent Director

Read Also: NCDEX Unlisted Share Price

MOHFL Unlisted Share Price Details

| Name | Motilal Oswal Home Finance Share Price Details |

| Face Value | INR 1 per share |

| ISIN Code | INE658R01011 |

| Lot Size | 1,000 shares |

| Demat Status | NSDL, CDSL |

| Motilal Oswal Home Finance Share Price | INR 12.55 per share |

| Market Cap | INR 7,597 crore |

| Total number of shares | 6,05,39,25,379 shares |

| Website | www.motilaloswalhf.com |

Motilal Oswal Home Finance Unlisted Share Price – Shareholding Pattern

Details of shares held by promoters/promoter group as of 31 March 2025:

| Shareholder Name | % to Holding | No. of shares |

| Motilal Oswal Financial Services | 75.10 | 4,54,64,13,025 |

| Motilal Oswal Finvest | 9.91 | 60,00,00,000 |

| Motilal Oswal Wealth | 7.96 | 48,21,62,594 |

| Motilal Oswal Investment Advisors | 3.97 | 24,01,02,336 |

| Others | 3.06 | 18,52,47,424 |

Motilal Oswal Unlisted Share Price – Financial Metrics

| Particulars | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 526.80 | 577.99 | 629.95 |

| Revenue Growth (%) | 0.98 | 9.72 | 8.99 |

| Expenses | 356.39 | 417.80 | 485.15 |

| Net income | 136.36 | 132.52 | 130.26 |

| Margin (%) | 26.56 | 23.74 | 20.68 |

| EPS | 0.23 | 0.22 | 0.21 |

| Debt/Equity | 2.52 | 2.33 | 2.59 |

Read Also: Garuda Aerospace Unlisted Share Price

Motilal Oswal Unlisted Share Price – Peer Comparison

| Company | 3-yr Sales CAGR (%) | PE Ratio | Net Margin (%) | MCap (INR crore) |

| Motilal Oswal Home Finance | 1.78 | 59.76 | 23.74 | 7,597 |

| Aptus Value Housing Finance | 29.0 | 16.2 | 42.91 | 13,665 |

| PNB Housing Finance | 7.60 | 9.79 | 25.53 | 21,918 |

Motilal Oswal Home Finance Annual Reports

Motilal Oswal Home Finance Annual Report FY 2024 – 2025

Motilal Oswal Home Finance Annual Report FY 2023 – 2024

Motilal Oswal Home Finance Annual Report FY 2022 – 2023

Motilal Oswal Home Finance Unlisted Share Price FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is Motilal Oswal Home Finance unlisted share price?

Motilal Oswal Home Finance unlisted stock price today is INR 12.55 per share. Shares are purchased in lots of 1,000 shares.

Who determines Motilal Oswal Home Finance unlisted share price?

The unlisted share price is determined by various factors including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.

What is Motilal Oswal Home Finance IPO expected date?

Motilal Oswal Home Finance has not yet launched its IPO, and while there’s speculation about a potential IPO, there’s no confirmed date for it yet.

How can I buy Motilal Oswal Home Finance unlisted shares

MOHF EXPACTED DATE OF LISTENING

Date of mohf ipo