Prataap Snacks IPO is scheduled to open on 22 September, following the massive SBI Life Insurance public offer that aims to mobilize as much as INR8,400 crore. In comparison, Prataap Snacks’ offer will be small. The company plans to raise INR200 crore by selling new shares while existing shareholders aim to sell shares worth as much as INR281.94 crore. The IPO of the Indore-based snackmaker is priced in the range of INR930 – 938 per share. The IPO is keenly watched as the regional player spreads its footprint nationwide. Through Prataap Snacks IPO review, we try to find out if this fast-growing company should get your investment.

Prataap Snacks IPO details | |

| Subscription Dates | 22 – 26 September 2017 |

| Price Band | INR930 – 938 per share |

| Fresh issue | INR200 crore |

| Offer For Sale | 3,005,770 shares (INR279.53 – 281.94 crore) |

| Total IPO size | INR479.53 – 481.94 crore |

| Minimum bid (lot size) | 15 shares |

| Face Value | INR5 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Prataap Snacks IPO Review: Fresh + OFS

Prataap Snacks IPO Review: Fresh + OFS

Prataap Snacks IPO will be a combination of fresh shares and an Offer For Sale (OFS) from existing shareholders. The sale of new shares will raise INR200 crore for the company and these funds are scheduled to be used towards:

- Repayment/pre-payment, in full or part, of certain borrowings availed by the company – INR13 crore

- Funding capital expenditure requirements in relation to expansion (including through setting up of a new production line and construction of a building) and modernisation at some of the existing manufacturing facilities – INR67 crore

- Investment in subsidiary, Pure N Sure, towards enabling the repayment/pre-payment of certain borrowings availed of by the subsidiary – INR4 crore

- Marketing and brand-building activities – INR40 crore

- General corporate purposes

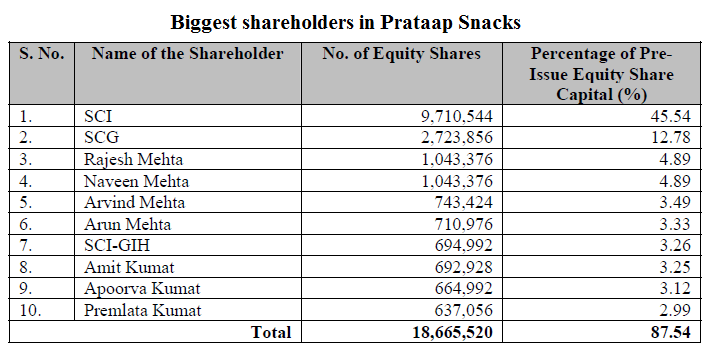

The company first received private equity (PE) funding from Sequoia in 2011. In subsequent years, the PE investor made more investments in Prataap Snacks and now effectively controls the company through its different investment vehicles. It is, therefore, no wonder that the OFS will be led by the PE group. Leading the charge will be SCI (1,317,093 Equity Shares), while SCG and SCIGIH will sell 369,451 and 94,266 Equity Shares respectively. Investment by a prominent PE investor is a great validation for the business. Nevertheless, the sight of a growing enterprise controlled by a PE investor is not a good one.

Among other selling shareholders are Arvind Mehta (183,740 Equity Shares), Naveen Mehta (139,200 Equity Shares), Arun Mehta (139,200 Equity Shares), Rajesh Mehta (361,920 Equity Shares), Kanta Mehta (66,820 Equity Shares), Premlata Kumat (77,950 Equity Shares), Swati Bapna (22,270 Equity Shares), Apoorva Kumat (116,930 Equity Shares) and Amit Kumat (116,930 Equity Shares).

Prataap Snacks IPO Review: Puffs, Rings, Chips, and Namkeen

Prataap Snacks’ product line includes three categories – Extruded Snacks, Chips and Namkeen. Extruded Snacks like puffs, rings and pellets account for a wide majority of revenues (62.99%) in FY2017 while Chips contributed 23.85%. The remaining 12.23% came from Namkeen.

Read Also: Upcoming IPOs in India this year that promise good returns

The company started off as a regional player but has gradually expanded its presence nationwide and this would not have been possible without an extensive distribution network. As of 30 June 2017, its distribution network included 218 super stockists across 26 States and one Union Territory in India and over 3,500 distributors. The company also owns and operates three manufacturing facilities, one located at Indore, Madhya Pradesh and the other two located at Guwahati, Assam. In addition, Prataap Snacks has also engaged two facilities on contract manufacturing in Bangalore, Karnataka and Kolkata, West Bengal.

Prataap Snacks IPO Review: Revenues but not profits

Prataap Snacks’ growth has been astonishing in recent years and it is clearly visible in revenues. The company, started as Prakash Snacks Private Limited in 2002, achieved revenues of INR905.5 crore in FY2017. This growth hasn’t slowed down in recent years as the figure for FY2013 was just INR344.5 crore. However, this kind of rapid expansion usually leads to an uncontrolled increase in costs and this is the case with Prataap Snacks. In the last four years, its cost of raw materials has pretty much remained the same but margins have come down from 4.3% in FY2013 to 1.1% in FY2017. As a result, net profits in the timeframe have actually come down from INR14.9 crore to INR9.9 crore.

Prataap Snacks’ financial performance (in INR crore) | ||||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | ||

| Total revenue | 344.5 | 446.8 | 560.6 | 757.9 | 905.5 | |

| Total expenses | 316.2 | 425.5 | 524.9 | 700.7 | 863.0 | |

| Profit after tax | 14.9 | 5.4 | 9.9 | 27.4 | 9.9 | |

| Net margin (%) | 4.3 | 1.2 | 1.8 | 3.6 | 1.1 | |

The costs which have skyrocketed in these years are Freight and forwarding charges (134.4% increase from FY2013 levels to INR72.5 crore), Advertisement and sales promotion (13-fold increase to INR36.8 crore), Freight and forwarding charges (323.7% increase to INR26.1 crore), and Employee benefits expense (360.6% increase to INR25.3 crore). Clearly, the growth is coming at the cost of profitability. Some of these costs are avoidable.

Prataap Snacks IPO Review: Gaps, any?

Prataap Snacks’ prospectus makes a good reading and it also leads the reader to some insights about the company’s business. The company states that its brand philosophy emphasises delivery of maximum value to consumers through regular introduction of new flavours, relatively high per pack weight to volume ratio and inclusion of promotional items such as toys.

Majority of its products are aimed at kids where the theory of high weight to volume ratio isn’t at play. Extruded products, including puffs and rings account for nearly 63% of revenues. Inclusion of toys and low prices (INR5 packs) has played more important role in the success of these product lines. Without giving specific details, the prospectus adds that the INR5 SKU contributed “the significant majority” of its total revenue in FY2017. The presence of toys and a low enough ticket price is a smart combination that ensures enough demand from their target market (kids) without rattling buyers (kids’ parents).

Read Also: SBI Life Insurance IPO Review: A step ahead of ICICI Prudential

However, there is a downside of this approach and that’s visible in the company’s financial performance in recent years in the form of declining profitability. Coupled with other factors like production and distribution challenges, profitability of a business can easily go for a toss which is what is happening with Prataap Snacks. The company’s smallest market is in the South region (6.16% of revenues in FY2017) but it has engaged a production facility on contract manufacturing basis in Bangalore. A similar mismatch is in the form of a high production concentration in East region which houses two plants in Assam and another contract manufacturing facility in West Bengal. Although East Zone has emerged as the biggest regional market with a share of 35%, the surge in freight and forwarding charges indicates the company is far from refining the movement of its goods.

In terms of valuations, the price band of INR930 – 938 per share and FY2017 Earnings Per Share (EPS) of INR4.77 mean that the company is asking for a Price/Earnings (P/E) valuation of 196.64 at the upper end of the price band. Prataap Snacks’ Return on Net Worth (RONW) stood at 4.15% for FY2017. The company lists Britannia Industries as its listed peer which is available at a P/E ratio of 59.4 and RONW of 32.78%. Britannia is nearly 10 times the size of Prataap Snacks in terms of revenues and thus, a comparison between the two wouldn’t be fair. A better peer is Delhi-based DFM Foods (the company behind the CRAX brand) which is available at a P/E ratio of 86 and also has a better RONW at 19.65%.

All in all, the company’s business is a great success story amid well-entrenched players but Prataap Snacks IPO review outlines that the company has lost its way in recent years. Steep valuations of the IPO don’t help either and the pricing comes across as an attempt to factor in the growth for the next five years. Nevertheless, don’t just go by our analysis, check out what other investors have to say about the offer on this page and feel free to check latest grey market rates on this one.

Surprisingly in spite of such steep valuation and unsatisfactory ronw grey market rate shoe a premium of 30pc.

I feel like the Snacks might be unhealthy but the IPO does seem Healthy