When in bull run, act pricey

This line pretty much sums up the attitude of lead managers and company management which are trying to take advantage of historically high stock markets. Ok, markets have corrected a bit lately but are still trading with substantial gains compared to last year. MEP Infrastructure Developers ([stock_quote symbol=”MEP” show=”” zero=”#000000″ minus=”#FF0000″ plus=”#448800″ nolink=”1″]) INR324 crore IPO fell prey to this mentality.

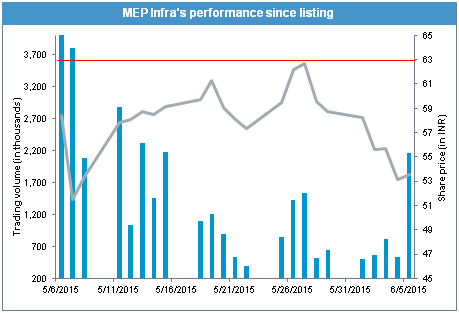

Shares of this toll plaza operator got listed last month at a discount to its issue price of INR63 a piece (represented by the red line in the following chart). Shares ended the day 7.3% below the issue price of INR63 per share. Considering the poor listing, investors were quick to dump their shares. This led to further pressure on the stock which dropped to as low as INR51.5 per share on the next day of listing. As the selling pressure eased a bit in the following days, the stock started moving up and came close to the issue price once on closing basis. However, it never managed to cross the bar.

It is noteworthy that MEP Infrastructure’s IPO followed the massively oversubscribed offer of VRL Logistics which rewarded investors handsomely. However, bankers and promoters of MEP Infrastructure failed to take cues from VRL Logistics’ IPO and priced the offer at a premium to its listed peers. Unsurprisingly, investors were spooked by the high debt and inconsistent earnings of the company. The IPO remained undersubscribed in the retail category and although it didn’t struggle like Adlabs Entertainment Ltd (which had to be extended after price revision), it was participation from institutional investors which helped the IPO to sail through.

It is noteworthy that MEP Infrastructure’s IPO followed the massively oversubscribed offer of VRL Logistics which rewarded investors handsomely. However, bankers and promoters of MEP Infrastructure failed to take cues from VRL Logistics’ IPO and priced the offer at a premium to its listed peers. Unsurprisingly, investors were spooked by the high debt and inconsistent earnings of the company. The IPO remained undersubscribed in the retail category and although it didn’t struggle like Adlabs Entertainment Ltd (which had to be extended after price revision), it was participation from institutional investors which helped the IPO to sail through.

To make the matter worse, anchor investors Tata Mutual Fund and HDFC Mutual Fund were issued shares at a higher rate of INR65 a piece. This is a perfect recipe for disaster. In retrospect, it is no wonder that the stock saw a four-fold spurt in trading volumes to more than 21 lakh shares on 5 June. Anchor investors were quite fast considering that this is the earliest they could sell their shares.

In retrospect, some signs of this lackluster performance were visible. This remains the only IPO this year without an offer for sale (OFS) from existing shareholders. As we have seen in the past, IPO hijacking by existing investors is not a good sign but so is the complete absence of such investors. With the abundant venture funding and private equity (PE) investments available in recent years, it is no big deal to rope in pre-IPO investors. As such, absence of such investors point to the likelihood of the business not being attractive enough.

If a business is not good enough for PE players, there has to be an exceptionally solid reason it will be good for you. As it turns out, this exceptionally solid reason is non-existing in case of MEP Infrastructure Developers.