Philips India Unlisted Share Price Description – Philips India, a publicly traded company, is a subsidiary of Koninklijke Philips N.V. (Royal Philips). Royal Philips’ business is focused on diagnostic imaging, ultrasound, image-guided therapy, monitoring, enterprise informatics, and personal health.

In July 2021, Philips India discontinued its kitchen appliances, which include juicers, blenders, food processors, air fryers, home care containing vacuum cleaners, air purifiers, garment care involving irons and steam generators, and coffee makers, among others. These entities and Preethi Kitchen Appliances Private Limited (a wholly owned subsidiary) were spun off into a distinct subsidiary called Philips Domestic Appliances India Limited.

Philips India operates with three key business divisions: Healthcare Systems, Future of Personal Health, and Invention Services. The company’s R&D and manufacturing center is situated in Pune, Maharashtra, while other production locations are in Baddi, Himachal Pradesh, and a co-manufacturing facility in Silvassa, Union Territory.

The company also inaugurated an innovation campus in Yelahanka, Bengaluru, in November 2023. The 650,000 sq. ft. facility aims to house over 5,000 professionals focusing on innovative health technologies.

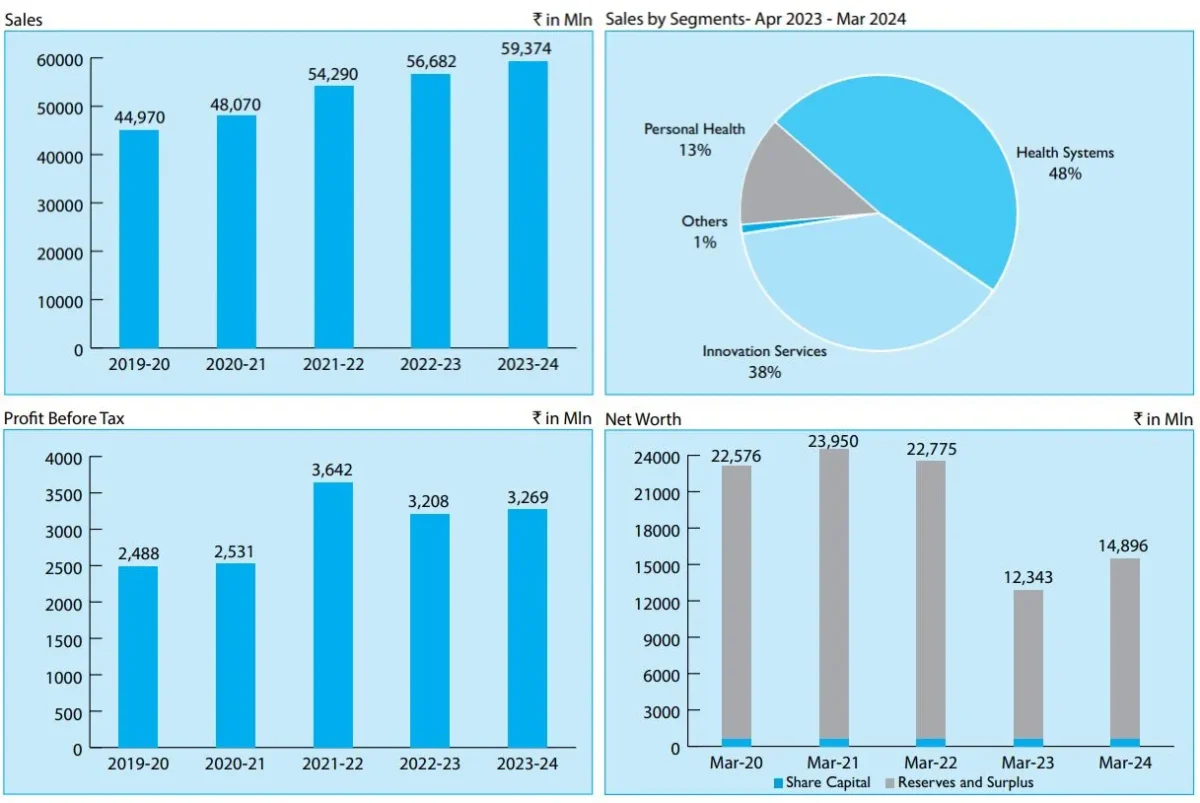

The health systems division stands out as the primary revenue driver for the company, accounting for approximately 48% of total sales during the fiscal year 2024. Philips markets medical equipment and healthcare machinery to hospitals and clinics through this division. Philips India boasts a robust presence nationwide, with a widespread network of sales and service centers.

Table of Contents

Read Also: Bira 91 Unlisted Share Price

Philips India Business Verticals

- Health Care Products and Solutions

- Personal Care Products

- Mother and Child Care Products

- TV, Monitors, and Video

- Audio

- Communication

Key Highlights

- In the fiscal year 2024, the company experienced a 0.96% decrease in earnings, with Profit After Tax amounting to INR 257.5 crore, compared to INR 260 crore in the preceding fiscal year.

- As of the fiscal year 2024, capital expenditure incurred is INR 620.1 crore, vis-à-vis INR 170.1 crore during the previous year (2022-23), and was towards HIC capacity, PIC new facility, IT equipment, etc.

- Despite facing challenges, Philips India saw a modest uptick in sales revenue, marking a 4.65% increase from INR 5,668.2 crore to INR 5,937.4 crore. This growth was primarily fueled by a robust order intake from its clientele.

Read Also: Biggest Unlisted Companies in India

Philips India Business Performance FY 2023-2024

Philips India Board of Directors

- Mr. A.D.A. Ratnam, Chairman and Non-Executive Independent Director

- Mr. Dev Kumar Tripathy, Whole-Time Director and Chief Financial Officer

- Mr. Bharath Ram Raman Sesha, Managing Director

- Mr. Harish Chawla, Whole-Time Director

- Ms. Geetu Gidwani Verma, Non-Executive Independent Director

Philips Share Price Details

| Name | Philips India Unlisted Share Price Details |

| Face Value | INR 10 per share |

| ISIN Code | INE319A01016 |

| Lot Size | 50 shares |

| Demat Status | NSDL, CDSL |

| Philips India Share Price | INR 925 per share |

| Philips Market Cap | INR 5,320 crore |

| Total Number of Shares | 57,517,242 shares |

| Website | www.philips.co.in |

Read Also: Reliance Retail Unlisted Share Price

Philips Unlisted Share Price Details – Shareholding Pattern

Details of shareholders holding shares of the company as of 31 March 2024:

| Shareholder Name | % to Holding | No. of shares |

| Koninklijke Philips N.V. (KPNV) | 96.13 | 55,290,182 |

| Others | 3.87 | 2,227,060 |

Read Also: Biggest Holding Companies in India

Philips Unlisted Share Price Details – Financial Metrics

| Particulars | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

| Revenue | 4,842.7 | 5,481.4 | 5,734.0 | 6,000.4 |

| Revenue Growth (%) | 6.8 | 13.2 | 4.6 | 4.65 |

| Expenses | 4,630.4 | 5,312.9 | 5,485.1 | 5,734.4 |

| Net income | 176.0 | 265.9 | 260.0 | 257.5 |

| Margin (%) | 3.6 | 4.9 | 4.5 | 4.29 |

| ROCE (%) | 9.5 | 8.9 | 23.99 | 22.01 |

| ROE (%) | 7.8 | 11.6 | 14.81 | 18.91 |

| EPS | 30.6 | 46.2 | 45.2 | 44.78 |

Read Also: Best Foreign MNC Stocks Listed in India

Philips India Unlisted Share Price – Peer Comparison

| Company | 3-yr Sales CAGR (%) | PE Ratio | ROCE (%) | Net Margin (%) | MCap (INR crore) |

| Philips India | 7.41 | 20.66 | 22.66 | 4.29 | 5,320 |

| Gillette India | 9.93 | 59.6 | 58.9 | 15.64 | 33,563 |

| Havells India | 16.0 | 65.4 | 25.3 | 6.75 | 92,228 |

| Dixon Technologies (India) | 53.7 | 113.0 | 39.8 | 3.17 | 97,349 |

Philips India Annual Reports

Philips India Annual Report FY 2023 – 2024

Philips India Annual Report FY 2022 – 2023

Philips India Annual Report FY 2021 – 2022

Philips India Annual Report FY 2020 – 2021

Philips India Unlisted Share Price FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is Philips India unlisted share price?

Philips India stock price today is INR 925 per share. Shares are purchased in lots of 50 shares.

Who determines Philips India unlisted share price?

The unlisted share price is determined by a variety of factors including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.

What is Philips IPO expected date?

Philips India is preparing for an IPO, with plans to offer up to 2.82 crore equity shares. The final details regarding the price band and allotment for various investor categories will be announced soon, following the filing of the Draft Red Herring Prospectus (DRHP) with SEBI.

What is Philips India IPO date?

Philips India, as a company, doesn’t have a specific IPO date, as it’s not a publicly listed company in India.