Capital Small Finance Bank Unlisted Share Description – Capital Small Finance Bank started operations as India’s first Small Finance Bank on 24 April 2016 after conversion from Capital Local Area Bank. Prior to conversion to a Small Finance Bank, Capital Local Area Bank was operating as India’s largest local area bank since 14 January 2000.

The bank pioneered in bringing modern banking facilities to rural areas at low cost. The bank introduced 7-day branch banking with extended banking hours since its first day of operations. Within a short period, most of the branches became market leaders in their respective centers. The bank is providing a safe, efficient, and service-oriented repository of savings to the local community while reducing their dependence on moneylenders by making need-based credit easily available.

After converting to a Small Finance Bank, the bank has opened 121 new branches, taking the total number of branches to 170. After establishing a strong footprint in the state of Punjab, the bank has now started expansion in the states of Delhi, Haryana, Rajasthan, and Himachal Pradesh along with the Union Territory of Chandigarh.

Capital Small Finance Bank has been granted Scheduled Status by the Reserve Bank of India vide notification dated 16 February 2017.

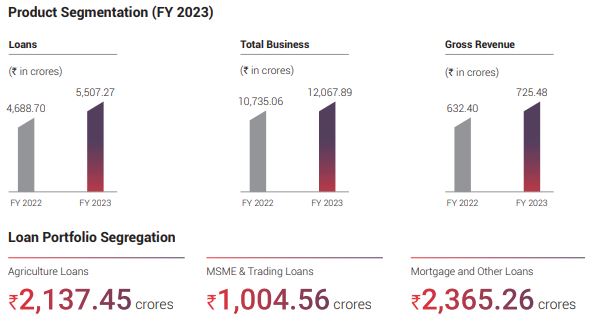

The total business of the bank has crossed INR 12,000 crores with over 8,97,000 accounts. The bank has 70% of its business in rural and semi-urban areas, with priority sector lending of 78.85% of the Adjusted Net Bank Credit as on 31 March 2023. As on 31 March 2023, 65.49% of the total advances are too small borrowers with an average ticket size of INR 25 lacs or less.

Read Also: Lakeshore Hospital Unlisted Share Price

The stock has been listed on stock exchanges following a successful IPO. Check all details of Capital Small Finance Bank IPO.

Products & Services of the Capital Small Finance Bank

- Saving Account

- Current Account

- Term Deposit

- Loans:

Housing Loans

Auto Loans

Kisan Credit Card

Scheme for SME

Financing to Commission Agents

Personal Loans

Loan Against Rentals

Mortgage Loans Against Property

Preowned Vehicle

Gold Loan

General Credit Card Scheme

Key Highlights – FY 2022

- In November 2021, CSFB filed its draft red herring prospectus for IPO to issue fresh equity worth INR 450 crores and an offer for the sale of up to 38.40 lakh equity shares by existing shareholders.

- For FY 2023, the savings bank deposits, current deposits, and term deposits stood at INR 2,506.73 crores, INR 241.16 crores, and INR 3,812.73 crores respectively. The Bank also serves NRI customers and offers NRE and NRO accounts.

Read Also: Capgemini Technology Services Unlisted Share Price

Capital Small Finance Bank Board of Directors

- Mr. Navin Kumar Maini, Part-Time Chairman, and Independent Director

- Mr. Sarvjit Singh Samra, Managing Director & CEO

- Mr. Srinath Srinivasan, Nominee Director

- Mr. Mahesh Parasuraman, Nominee Director

- Mr. Balbir Singh, Nominee Director

- Mr. Dinesh Gupta, Non-Executive Director

- Mr. Gurpreet Singh Chug, Independent Director

- Mrs. Harmesh Khanna, Independent Director (Women Director)

- Mr. Rakesh Soni, Independent Director

- Mr. Gurdeep Singh, Independent Director

- Mr. Sham Singh Bains, Independent Director

- Mr. Nageswara Rao Yalamanchili, Independent Director

Capital Small Finance Bank Unlisted Share Details

| Name | Capital Small Finance Bank Unlisted Share Details |

| Face Value | INR 10 per share |

| ISIN Code | INE646H01017 |

| Lot Size | 100 shares |

| Demat Status | NSDL, CDSL |

| Capital Small Finance Bank Unlisted Share Price | INR 468 per share |

| Market Cap | INR 1,439 crore |

| Total Number of Shares | 34,252,454 shares |

| Website | www.capitalbank.co.in |

Read Also: Motilal Oswal Home Finance Unlisted Share Price

Read Also: Capital Small Finance Bank IPO

Capital Small Finance Bank Unlisted Share Details – Shareholding Pattern

Top 10 equity shareholders of the company as on 31 March 2021:

| Shareholder Name | % to Holding | No. of shares |

| Sarvjit Singh Samra | 12.24 | 4,174,619 |

| Oman India Joint Investment Fund II | 9.82 | 3,346,914 |

| Santokh Singh Chhokar | 5.16 | 1,760,000 |

| PI Ventures LLP | 4.95 | 1,686,980 |

| Amarjit Singh Samra | 4.81 | 1,640,864 |

| Amicus Capital Private Equity I LLP | 4.43 | 1,511,535 |

| HDFC Life Insurance Company Limited | 4.09 | 1,394,400 |

| Small Industries Development Bank of India | 3.96 | 1,349,650 |

| ICICI Prudential Life Insurance Company Limited | 3.88 | 1,322,400 |

| Surinder Kaur Samra | 2.75 | 936,486 |

Read Also: Swiggy Unlisted Share Price

Capital Small Finance Bank Unlisted Share Details – Financial Metrics

| Particulars | FY 2020 | FY 2021 | FY 2022 | FY 2023 |

| Revenue | 458.13 | 511.44 | 578.21 | 676.01 |

| Expenses | 475.71 | 516.51 | 569.83 | 631.89 |

| Net income | 25.38 | 40.78 | 62.57 | 93.60 |

| Margin (%) | 5.54 | 7.97 | 10.82 | 13.85 |

| ROE (%) | 7.72 | 9.51 | 12.95 | 16.62 |

| CAR (%) | 19.11 | 19.80 | 18.63 | 18.87 |

| NPA (%) | 1.25 | 1.13 | 1.36 | 1.36 |

| EPS | 8.18 | 11.98 | 18.22 | 27.21 |

| Dividend (per share) | – | 0.80 | 1.00 | 1.20 |

Read Also: boAt Unlisted Share Price

Capital Small Finance Bank Unlisted Share Peer Comparison

| Company | 3-yr Sales CAGR (%) | PE Ratio | Book Value | Net Margin (%) | MCap (INR crore) |

| Capital Small Finance Bank | 13.86 | 17.20 | 117.36 | 13.85 | 1,439 |

| AU Small Finance Bank | 24.2 | 24.1 | 165.0 | 17.40 | 38,225 |

| Equitas Small Finance Bank | 16.3 | 14.1 | 46.4 | 13.79 | 10,987 |

Capital Small Finance Bank Annual Reports

Capital Small Finance Bank RHP

Capital Small Finance Bank Annual Report FY 2021 – 2022

Capital Small Finance Bank DRHP October 2021

Capital Small Finance Bank Annual Report FY 2020 – 2021

Capital Small Finance Bank Annual Report FY 2019 – 2020

Capital Small Finance Bank Unlisted Share FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is Capital Small Finance Bank’s unlisted share price?

Capital Small Finance Bank’s unlisted stock price in February 2024 is INR 468 per share. Shares are purchased in lots of 100 shares.

Who determines Capital Small Finance Bank share price?

The unlisted share price is determined by a variety of factors including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.

When is Capital Small Finance Bank IPO planned?

Capital Small Finance Bank Ltd, one of the fastest growing unlisted SFBs in India filed its DRHP in November 2021 and SEBI has already approved the IPO in February 2022 by giving its observations.