EMA Partners is a prominent executive search firm that provides customized leadership hiring solutions to clients across diverse sectors. The company operates through three distinct business verticals, catering to a wide range of hiring needs.

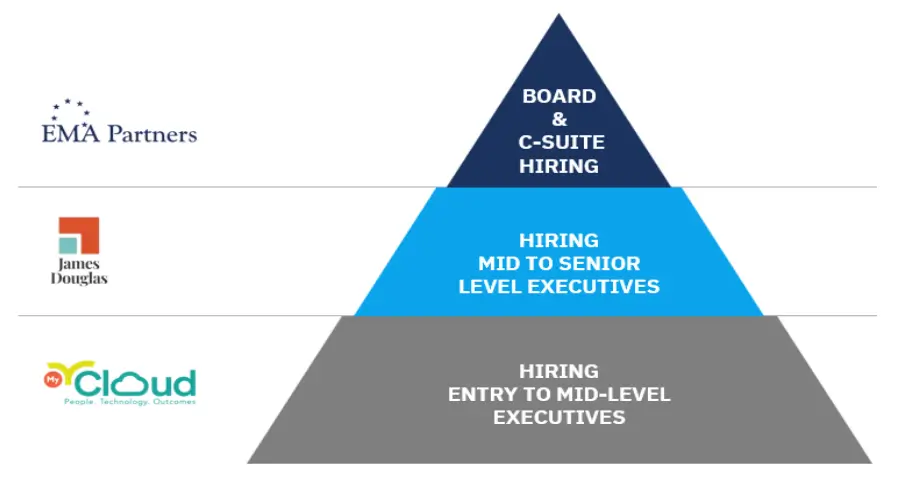

EMA Partners India covers the entire spectrum of white-collar hiring, from entry-level roles to senior leadership positions. It operates in three major verticals

- EMA Partners – Mainstay business that oversees Board and C-suite appointments

- James Douglas – Started in 2022, it specializes in mid to senior-level hiring

- MyRCloud – a SaaS platform that focuses on entry to mid-level recruitment

As EMA Partners prepares for its upcoming public offering, IPO Central had the opportunity to engage with the company’s management team. The interaction provided valuable insights into EMA Partners’ business strategies, future plans, and vision for growth. Representing the firm in this discussion were Managing Director Mr. K. Sudarshan and Group CFO Mr. Manish Dhanuka.

From Inception to Innovation

IPO Central: Could you provide an overview of EMA Partners and its key areas of operation?

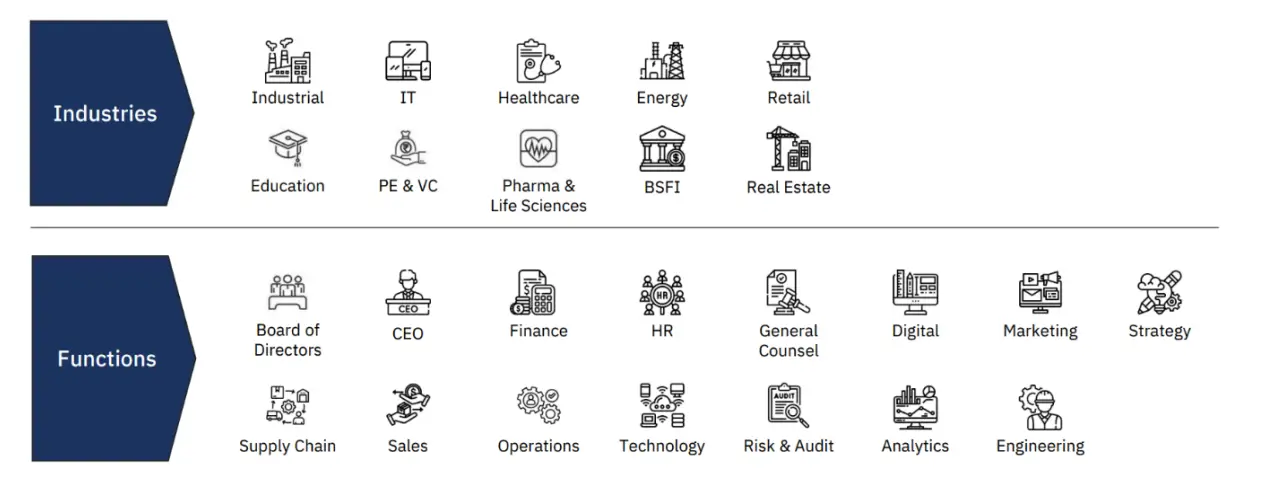

Mr. K. Sudarshan: EMA Partners India was established in 2003 as part of the EMA Partners global partnership. EMA Partners India specialises in CXO and other senior-level executive searches, Board Consulting and Director appointments across multiple industry verticals. Through these years, we have worked with over 500 domestic and international clients. Our business is retained executive search focused on the C-suite.

In 2022, we launched James Douglas, a dedicated arm targeting mid-to-senior-level hires with compensation packages ranging from INR 50 lakh to over INR 1 crore. It is a growing market with untapped potential.

In addition, we are experimenting with a SaaS-based recruitment platform designed to simplify bulk hiring and aggregate small recruiters into one streamlined ecosystem.

Milestones on the Growth Journey

IPO Central: Could you elaborate on key milestones of EMA Partners so far?

Mr. K. Sudarshan: Our growth story reflects our adaptability and ambition. Here are some highlights:

- 2003: Established as a member of EMA Partners International.

- 2011: Expanded operations to Singapore.

- 2016: Launched operations in Dubai.

- 2021: Rolled out a SaaS-based recruitment platform.

- 2022: Introduced the James Douglas brand for mid-to-senior hiring.

In 2025, we achieved global recognition with our representative joining the global board of AESC (Association of Executive Search Consultants), a testament to our growing influence in the industry.

Spotlight on James Douglas

IPO Central: What distinguishes James Douglas from your other operations, and what is its growth potential?

Mr. K. Sudarshan: James Douglas focuses on the massively underserved, mid-to-senior hiring market, catering to specialized roles that demand personalized recruitment approaches. With limited institutional presence, this segment has shown significant growth. In 2024, James Douglas contributed INR 2 crores in revenue (roughly 2.9% of total revenues), and we anticipate strong momentum in the coming years. To accelerate growth, we are actively exploring inorganic opportunities, including partnerships and acquisitions.

Innovating Recruitment with Technology

IPO Central: Tell us more about the SaaS-based recruitment platform. How does it work, and what are its objectives?

Mr. K. Sudarshan: The SaaS platform is named MyRCloud and is designed to address mass recruitment needs. Companies can post job requirements, and independent/freelance recruiters on the platform handle sourcing and hiring. AI/automation tools manage interviews and workflows, reducing the complexities of large-scale recruitment. One key aspect that makes it a differentiated offering is the fact that it focuses on the B2B market, unlike most other products that focus on the B2C segment.

This technology platform is modelled like Uber, connecting recruiters with job opportunities. We are targeting the recruitment of professionals from the entry to mid-levels across various industries. Although still in its early stages, we are optimistic about its potential to revolutionize mass hiring processes through the deployment of technology tools, particularly in industries with high-volume recruitment needs.

A Strategic IPO Approach

IPO Central: Why focus on the SME platform for EMA Partners’ IPO instead of a mainboard listing?

Mr. K. Sudarshan: The SME platform provides an opportunity to test the waters with measured steps. It allows us to establish a solid foundation and showcase our growth potential to investors before transitioning to the mainboard, which we aim to achieve within the next three years. We eventually plan to be on the main board within three years, focusing on steady growth.

Financial Highlights and Future Vision

IPO Central: What are your financial highlights, and how do you ensure sustainable growth?

Mr. Manish Dhanuka: In FY 2023-24, we achieved INR 69 crores in revenue with a net profit of INR 14.3 crores. Our executive search business generates an average fee of INR 47 lakhs per appointment. With a debt-light structure, we ensure financial stability while funding growth initiatives like James Douglas and the SaaS platform.

Our future focus includes expanding both our core and newer business lines. While we are currently prioritizing the Indian market, our plans include strategically entering international markets like Southeast Asia and the Middle East.

IPO Central: What is EMA Partners’ comfort level with debt, especially for M&A opportunities?

Mr. K. Sudarshan: Regarding consolidation in the industry, we are committed to a conservative approach and our focus is clearly on value-creating acquisitions. Potential acquisition targets include founder-led firms with high-value clients. We would consider debt only for potential acquisitions, not for working capital.

Vision 2030

IPO Central: What is your vision for EMA Partners over the next five years?

Mr. K. Sudarshan: With India’s economy on track to reach USD 10 trillion, we see immense opportunities for growth. By 2030, we aim to:

- Consolidate our position as one of India’s top executive search firms.

- Scale James Douglas into a leading platform for mid-to-senior hiring.

- Expand internationally, with a focus on Southeast Asia and the Middle East.

- Establish our SaaS platform as a leader in the mass recruitment space.

Message to Investors

IPO Central: Any final thoughts for potential investors?

Mr. K. Sudarshan: Our journey is built on trust, innovation, and long-standing relationships with clients. As we prepare for this next phase of growth, we invite investors to join us on this exciting journey. The IPO marks the beginning of another transformative chapter for EMA Partners.

With their proven track record, innovative solutions, and clear vision for the future, EMA Partners is poised to make waves in the recruitment industry. Their journey underscores their commitment to excellence and sustainable growth—a story worth watching.

For more details related to IPO GMP, SEBI IPO Approval, and Live Subscription stay tuned to IPO Central.