Happiest Minds Technologies received SEBI’s IPO approval recently after filing its draft papers in June 2020. The Bengaluru-based Information Technology (IT) services company has attracted investors’ attention and we will shortly see why. Here are 5 things investors need to know about Happiest Minds IPO which is opening for subscription on 7 September 2020.

#1 Happiest Minds IPO structure: Fresh + OFS

The upcoming IPO plans to mobilize INR110 crore (INR1.1 billion) by issuing fresh shares. However, there will also be an Offer For Sale (OFS) by promoters and existing investors, involving 35,663,585 shares amounting to as much as INR592.01 crore. This puts the total IPO size to INR 702.01 crore.

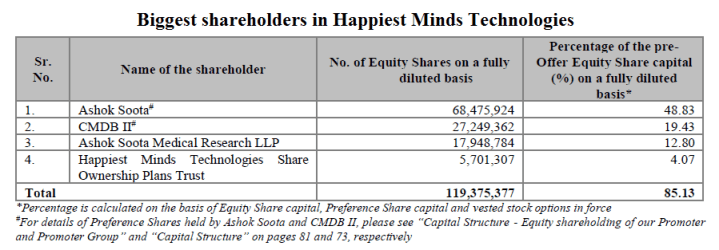

#2 Major Shareholders in Happiest Minds

The USP of the company in the IPO market, without a doubt, is Ashok Soota. Being a high profile tech executive and having helmed behemoths like Wipro and Mindtree, it is not surprising that his presence has attracted private equity investor JP Morgan CMDB II as the second largest shareholder.

#3 Financial Performance & Balance Sheet

Happiest Minds has been able to post consistent revenue growth in recent years. According to the information disclosed in the draft prospectus, the company has grown its revenue from INR489.1 crore in FY2018 to INR714.2 crore in FY2020. Along with the rise in revenues, its bottomline has also improved considerably in the last three years. Recovering from a loss in FY2018, the company has swung to a profit of INR60.5 crore in FY2020.

Read Also: Best IPOs in 5 years that doubled investors’ money

Happiest Minds IPO is going to benefit from the fact that the company has a lean balance sheet and has reduced its debt in the recent years. As a result, its finance cost in FY2020 stood at just INR8 crore, reflecting a 50% reduction from previous year. As on 15 May 2020, the company’s financial indebtedness stood at just INR63.1 crore.

Happiest Minds Technologies financial performance (in INR crore)

| FY2018 | FY2019 | FY2020 | ||

| Revenue | 489.1 | 601.8 | 714.2 | |

| Expenses | 512.2 | 576.3 | 629.4 | |

| Net income | -25.2 | 17.4 | 60.5 | |

| Net margin (%) | -5.2 | 2.9 | 8.5 |

#4 Smaller allocation for retail

Included in the table above, it is important to highlight that the company hasn’t been profitable in the last three years. SEBI deems such companies risky for retail investors and thus, has guided investment banks to allocate a small portion of the offer for small investors. Accordingly, only 10% of the offer will be made available to retail investors. As a result, the offer is likely to be heavily subscribed in the retail category, making allotment even more difficult.

#5 High Exposure to the US market

Majority of its revenues come from the US which has the majority market share of global technology spend. The share of the US in the company’s revenue has been consistently above 70% and stood at 77.5% in FY2020, representing an increase from 73.5% in FY2018. With a contribution of 11.9% in FY2020, India is the second largest contributor, followed by the UK.

Don’t forget to check user comments at the discussion page for Happiest Minds Technology IPO. You might also want to check the latest grey market rates for this IPO.

Hii

thanks for sharing knowledgeable news