Hero FinCorp Share Price Description – Hero FinCorp was established in December 1991 as Hero Honda FinLease, marking the beginning of its journey in the Indian financial sector. Over the years, the company has expanded its operations to include leasing, financing, and bill discounting. It also has a wholly owned subsidiary, Hero Housing Finance, dedicated to providing housing loan solutions.

The company offers a comprehensive portfolio of financial products designed to meet diverse customer needs. These include Used Car Financing, Personal Loans for both loyal customers and those in the open market, and Partnership Financing. The company also provides Collateral-Free Business Loans, Inventory Funding, and Supply Chain Financing. In addition, its offerings cover Construction Financing, Loans Against Property, as well as tailored solutions for SMEs and emerging corporates.

By the end of FY 2025, the two-wheeler business had established a presence across 1,000+ dealerships nationwide. Hero FinCorp’s services are now accessible through 4,600+ touchpoints, covering 18,600 pincodes across more than 2,000 cities, towns, and villages. To date, the company has catered to over 12 million customers. Strengthening its operational capacity, the team can now process up to 3,500 loan applications per month, spanning both EMI and no-EMI offerings.

Read Also: Unlisted Share Buying Guide and FAQs

Products & Services of Hero FinCorp

- Personal Loan

- Business Loan

- Two-Wheeler Loan

- Used Car Loan

- Loan Against Property

- Loyalty Loan

- Home Loan

- Insurance

Read Also: PharmEasy Unlisted Share Price

Key Highlights

- In Q2 FY26 (Sep 2025), standalone net loss of INR 112.82 Cr (vs prior year profit INR 26.52 Cr), sales down 5.64% to INR 2,137.36 Cr; H1 FY26 consolidated net loss ~INR 131 Cr.

- CARE reaffirmed long-term bank facilities at CARE AA+; Stable (INR 10,699 Cr) on 21 Nov 2025; issuer rating unchanged.

- As of July 2025, Hero FinCorp raised INR 50 cr from Vattikuti Ventures in pre-IPO round 2, cutting fresh issue to INR 1,790 cr; IPO totals INR 3,668.1 cr.

- Hero FinCorp IPO received an observation letter from SEBI on 22 May 2025 to launch its IPO.

- Hero FinCorp has got the green light for its IPO of equity shares. That involves a fresh issue of shares worth INR 2,100 crore and an offer for sale of INR 1,568 crore by some of its existing shareholders. The total capital the company plans to raise through that IPO is INR 3,668 crore. The funds from the fresh issue will be utilized to strengthen the company’s capital base for future lending activities.

- The company’s assets under management crossed the landmark of INR 50,000 crore, currently standing at INR 57,720 crore as of 31 March 2025, having grown 11.38% from last year.

- During the review period, receivables from financing activities, including the leasing portfolio, increased by 7.29%, rising from INR 46,488 crore in FY 2023-24 to INR 49,876 crore in FY 2024-25.

Read Also: Biggest Unlisted Companies in India

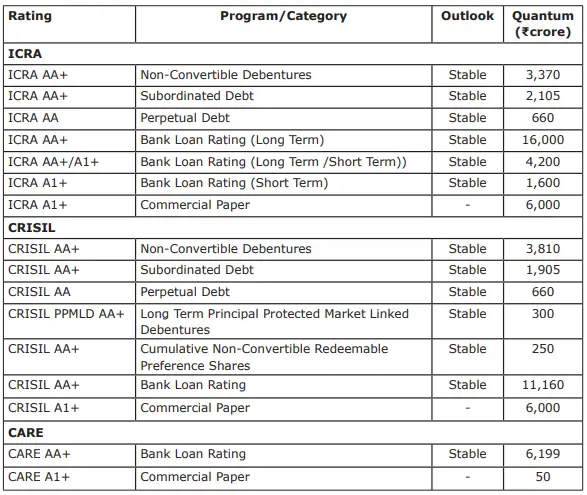

Hero FinCorp Credit Rating:

HFCL’s strong credit rating and brand equity enable it to borrow at competitive rates. As of 31 March 2025, the company’s credit ratings were:

Hero FinCorp Board of Directors

- Mr. Abhimanyu Munjal, Joint MD & CEO

- Mrs. Renu Munjal, Non-Executive Director

- Mr. Pawan Munjal, Chairman & Director

- Mr. Paramdeep Singh, Independent Director

- Mr. Amar Raj Bindra, Independent Director

- Mr. Sanjay Kukreja, Independent Director

- Mr. Pradeep Dinodia, Independent Director

- Ms. Anuranjita Kumar, Independent Director

- Mr. Kaushik Dutt, Independent Director

- Ms. Aparna Popat Ved, Independent Director

Hero FinCorp Unlisted Share Details

| Name | Hero FinCorp Share Price Details |

| Face Value | INR 5 per share |

| ISIN Code | INE957N01016 |

| Lot Size | 25 shares |

| Demat Status | NSDL, CDSL |

| Hero FinCorp Share Price Today | INR 1,965 per share |

| Market Cap | INR 25,036 crores |

| Total number of shares | 12,74,12,759 shares |

| Website | www.herofincorp.com |

Hero FinCorp Unlisted Share Details – Shareholding Pattern

The details of shareholders holding more than 5% of shares:

| Shareholder Name | % to Holding | No. of shares |

| Promoters’ Holding | 79.54 | 10,12,56,432 |

| Non-Promoters’ Holding | 20.46 | 2,61,56,327 |

Read Also: TATA Technologies Unlisted Share Price

Hero FinCorp Unlisted Share Details – Financial Performance

| Particulars | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 4,738.66 | 6,401.60 | 8,290.90 | 9,832.73 |

| Revenue Growth (%) | 10.77 | 35.09 | 29.51 | 18.60 |

| Expenses | 5,051.69 | 5,712.33 | 7,399.17 | 9,647.24 |

| Net income | (191.90) | 479.95 | 637.05 | 109.95 |

| Margin (%) | (4.05) | 7.50 | 7.68 | 1.12 |

| Debt/Equity | – | 4.09 | 4.66 | 5.80 |

| EPS | (15.07) | 37.67 | 49.94 | 8.62 |

| Dividend (per share) | 0.00 | 8.10 | 10.0 | 1.10 |

Hero FinCorp Annual Reports

Hero FinCorp Annual Report FY 2024 – 2025

Hero FinCorp Annual Report FY 2023 – 2024

Hero FinCorp Annual Report FY 2022 – 2023

Hero FinCorp Annual Report FY 2021 – 2022

Hero FinCorp Share Price – Peer Comparison

| Company | 3-yr Sales CAGR (%) | Debt/ Equity | PE Ratio | Net Margin (%) | MCap (INR crore) |

| Hero FinCorp | 27.6 | 5.8 | 227.96 | 1.12 | 25,036 |

| Cholamandalam Investment | 36.6 | 7.23 | 30.0 | 16.49 | 1,39,216 |

| Bajaj Finance | 30.1 | 3.85 | 31.6 | 24.1 | 5,77,353 |

| Shriram Finance | 31.7 | 3.87 | 20.6 | 21.79 | 1,88,638 |

Read Also: NSE Unlisted Share Price

Hero FinCorp Unlisted Share FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is Hero FinCorp share price today?

Hero FinCorp grey market price today is INR 1,965 per share. Shares are purchased in lots of 25 shares.

Who determines Hero FinCorp unlisted share price?

Hero FinCorp share price is determined by various factors, including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.

When is Hero FinCorp IPO planned?

Hero FinCorp IPO will be launched soon, as the company has received an observation letter from SEBI.

Ready to sell 1200 shares of hero fincorp. Pl quote the max price.