Mumbai to see continued sales growth capturing record home registrations in March

Following stagnant sales for nearly seven years, increasingly more green shoots are visible in the housing sector since Diwali 2020. During the October – December 2020 quarter, several reputed developers, such as Godrej Properties, clocked significant sales while Lodha Group reported over INR2,500 crores of bookings in the three months.

As reported by Knight Frank India, Mumbai witnessed upsurge in property registrations driven by home sales that jumped over four-fold in March to 12,696 units in comparison to March last year.

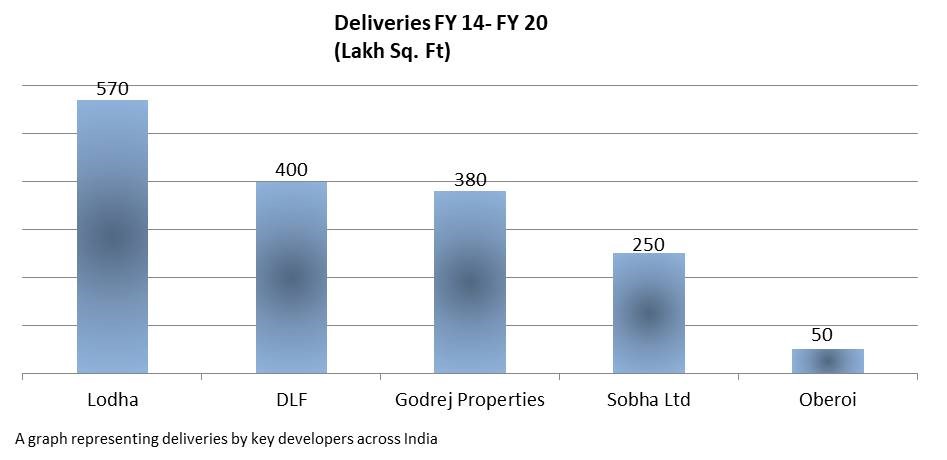

The shift among homebuyers towards reputed developers with proven capabilities is quite apparent. Most notable of these capabilities are timely delivery and quality of construction. While small builders find themselves lost in the new regulations and changing customer preferences, large builders with deep understanding of the market are often able to navigate through these waters effortlessly. For example, brands like Lodha have an edge in Mumbai, having already delivered 570 Lakh sq. ft. in FY 2014 – 2020 and over the years 770 lakhs sq. ft. developable area completed and leading the chart of deliveries in Mumbai.

A housing-led revival has several other positive implications for the GDP. A relevant and closely associated example is construction industry which employs nearly 5 people and is considered the second largest employer in the country. In addition, the industry creates several jobs in the allied sectors. It is expected that the construction industry will employ nearly 7.6 crore people by 2022 and is likely to become the largest industry in India going by the employment generated. Given the fact that nearly 25% of the value of a house sold goes to government, the industry also helps tremendously towards the cause of nation building.

When it comes to home ownership, one of the biggest challenges is affordability not just in the isolated sense of price of the unit but also the prevailing interest rates on home loans since a majority of home purchases are financed via banks and NBFCs. It is interesting to note that home loan interest rates were in excess of 10% nearly a decade back. This contrasts with current home loan interest rates of just 6.75% – marking a new all-time low. This has been possible due to an all-time-low repo rate of 4% and has offered additional tailwinds to home buyers through reduced EMI.

Thankfully, the sector is one of the focus areas for the central government. Specifically, the residential sector is expected to grow significantly, with central government aiming to build several affordable housing projects in urban areas across the country under the Pradhan Mantri Awas Yojana (PMAY) scheme. Independent research forecasts that the real estate sector in India is expected to reach USD 1 trillion by 2030 in value. By 2025, the sector is expected to contribute 13% to the country’s GDP. Emergence of nuclear families, rapid urbanisation and rising household income are likely to remain the key drivers for growth in all spheres of real estate, including residential, commercial, and retail.

Real estate in India is thus expected to post strong growth in the coming years. While the advantages to home buyers are quite evident, it is likely to create several opportunities for investors as well. Stay tuned for more.