The IPO market is inherently volatile, often swayed by the sentiments prevailing in broader financial markets. Despite this volatility, it remains a fundamental component of the financial and securities ecosystem. Numerous IPOs have generated significant wealth for investors. However, one challenge that new (as well as seasoned) investors face is how to find good IPOs. On the face of it, most IPOs may look good and taking a longer-term view is where things get complicated.

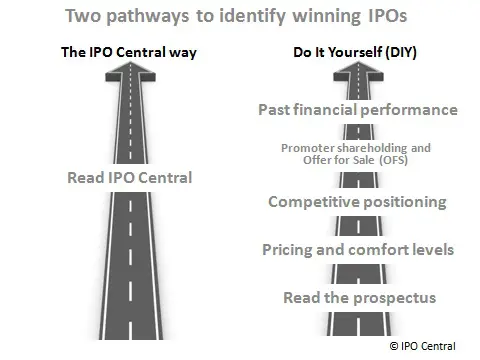

In a typical tongue-in-cheek style, we are going to suggest that you visit IPO Central regularly (subscription form on the right!) and follow us on social media platforms to find good IPOs. Since IPO Central is oriented towards investor education, we are more than happy to share the IPO selection process which indicates if a public offer is worth your hard-earned money. Here are some steps to identify good IPOs:

Table of Contents

#1 Read The Prospectus To Find Good IPOs

Investing in IPOs is fundamentally different from trading stocks. New investors often rush to invest in any IPO that becomes available. However, for those focused on IPO investments, it’s crucial to understand the company’s business prospects and operations. The IPO selection process includes the management’s track record, associated risks, and the purpose behind raising funds. A thorough examination of the red herring prospectus (RHP) can reveal vital information, making it an essential tool in the IPO selection process. This aspect cannot be overstated, and there are compelling reasons why SEBI mandates comprehensive disclosures.

Read Also: Most Essential Financial Ratios in IPO Investing

#2 Check Pricing And Peer Valuation For Better IPO Selection

Pricing in absolute terms does not mean anything. An IPO at INR 10 per share may be expensive and another one at INR 50 per share may be inexpensive. Pricing is of utmost importance but needs to be seen along with profits and business growth. The stock market is a forward-looking mechanism and is often willing to pay a high premium for companies that promise huge growth. During bull-runs, promoters tend to price IPOs at steep valuations leaving little or no money on the table. There has to be some margin for error and indicators like grey market premium (GMP) vanish quickly if something bad happens in global markets.

Thus, it is critical for investors to avoid applying to IPOs with steep pricing and peer valuation is very helpful in ascertaining this. By comparing various valuation metrics such as price/earnings ratio, it can be checked if a particular IPO is overpriced or not. Despite being a strong brand and showing business growth in the years leading to the IPO, S Chand failed to deliver returns for IPO investors. It was a clear case of stretched valuations as another equally successful listed peer Navneet Education was available at lower valuations. As we covered in this case study, S Chand actually went on to lose 78% from its IPO price in the next two years.

Read Also: How many IPOs have withdrawn in India?

Many IPO investors aim for quick listing gains, but it’s important to have a solid understanding and comfort level with the sector in which you’re investing. If market sentiments shift and shares debut at a discount, investors should be prepared to hold onto their shares for a while—ideally at least six months. For a risk-averse investor, diving into the IPO of an emerging technology company could lead to significant challenges and potential losses.

#3 Look For The Company’s Competitive Positioning

Factors like past performance, number of years in business, and growth prospects can offer valuable insights to find good IPOs. Market share is another great indicator, more so in emerging sectors where profits may still be far. Going forward, a number of green energy players are expected to tap the primary markets. Most of these companies will not be as profitable as Waaree Energies. However, a leading player in its sector cannot be discounted solely on account of loss-making operations.

Frequently, companies preparing for an IPO assert that there are no comparable businesses to justify their high valuations. However, aside from a few exceptions—such as an IPO by a stock exchange—these claims often lack credibility. Even in situations where there are no direct competitors listed in the same industry, analogous examples can typically be found in other sectors.

Read Also: List of IPOs with SEBI approval in India

#4 Promoters of Good IPOs Have Skin In The Game

Promoters should have a vested interest in the company. If the promoters of a struggling firm are among those selling shares in an IPO, it can be discouraging for retail investors. Likewise, IPOs with a significant Offer For Sale (OFS) component may not be ideal for small investors. After all, why would an investor choose to exit a thriving business?

It needs to be mentioned though that a little more analysis is required in the case. Private equity investors are not promoters and thus, need to sell out after 4-7 years of making their investments but these investors exiting completely is generally a sign of offers that are not rewarding for IPO investors. On the other hand, if a prominent external investor decides to stick around in a profitable business, even though selling some stake, it is a sign of confidence that there are better times ahead. Quite effective to identify good IPOs, isn’t it?

Read Also: Biggest Unlisted Companies in India

#5 Avoid Companies That Are Too Generous To Promoters

Another effective strategy for investors seeking promising IPOs is to assess whether promoters are compensating themselves excessively. Businesses should prioritize generating profits for their shareholders, and if promoters are the sole shareholders, it can quickly lead to troubling situations. Promoters may end up paying themselves too much, either directly or indirectly, which is generally a red flag. This issue is especially prevalent among first-generation entrepreneurs and SME IPOs, where internal controls tend to be weak, and the lines between the promoter and the business often blur.

If promoters have sucked profits out of a business in the past, there are strong chances that they will figure out ways of doing the same after the IPO. There are a number of ways of doing it and investors can do well by avoiding companies that have been too generous to their promoters in the past. It can take the form of remuneration not linked to performance, excessive dividends or a web of related companies that supply goods or services at high prices.

Read Also: SEBI Regulations on Stock Market Exchange: A Historical Perspective

Conclusion

Overall, long-term IPO investments can be quite rewarding, especially when the IPO selection process is thorough. It’s important to familiarize yourself with the details of the company before investing. Long-term investors tend to remain calm during market fluctuations, patiently waiting for conditions to improve. In contrast, those seeking short-term gains should consider selling their shares whenever profits arise.

We hope you find these practical tips for identifying promising IPOs helpful. We’d love to hear your thoughts in the comments below!