The Nifty PSE Index consists of 20 stocks that are traded on the National Stock Exchange (NSE). This index specifically includes Public Sector Enterprises (PSEs) in which at least 51% of the outstanding share capital is owned by either the Central Government or State Government, whether directly or indirectly.

The calculation of the Nifty PSE Index is based on the free float market capitalization approach. This means that the index value represents the total market value of all included stocks’ free float, measured against a predetermined base market capitalization value.

In this article, we have compiled a Nifty PSE stocks weightage which is periodically updated. Nifty PSE Index can be used for a variety of purposes, such as benchmarking fund portfolios, and launching index funds, ETFs, and structured products.

What is the Nifty PSE Full Form and Index?

The full form of Nifty PSE is Nifty Public Sector Enterprises. The NIFTY PSE is a thematic index on the NSE that tracks the real-time performance of Indian public sector enterprises. Weights of each stock in the Nifty PSE index are calculated based on its free-float market capitalization, such that no single stock shall be more than 33% and the weights of the top 3 stocks cumulatively shall not be more than 62% at the time of rebalancing. The index has a base date of 2 January 1995 and is indexed to a base value of 1000.

Read Also: Nifty Pharma Stocks List With Weightage in 2025

Nifty PSE Companies Re-Balancing & Governance

The Nifty PSE Index is reviewed and rebalanced semi-annually, with cut-off dates on 31 January and 31 July each year. The review considers average data from the preceding six months ending on the respective cut-off date. Any changes resulting from the review are communicated to the market at least four weeks in advance and become effective from 31 March and 30 September, respectively.

All NSE indices, including the Nifty PSE Index, are managed by a dedicated professional team operating under a robust three-tier governance structure. This includes oversight by the Board of Directors of NSE Indices Limited, guidance from the Index Advisory Committee (Equity), and implementation support from the Index Maintenance Sub-Committee.

Nifty PSE Index: Key Drivers

Key business decisions of public sector undertakings in India are largely dictated by the government’s ideology and political requirements at the time. This also means that these companies are at the receiving end of populist measures, especially in election years. As a result, index heavyweights in the oil & gas space have had long patches of under-recoveries and limited to no price autonomy. Despite numerous reforms, these limitations have persisted in one form or another and aren’t likely to go away anytime soon.

Read Also: Nifty FMCG Stocks List With Weightage in 2025

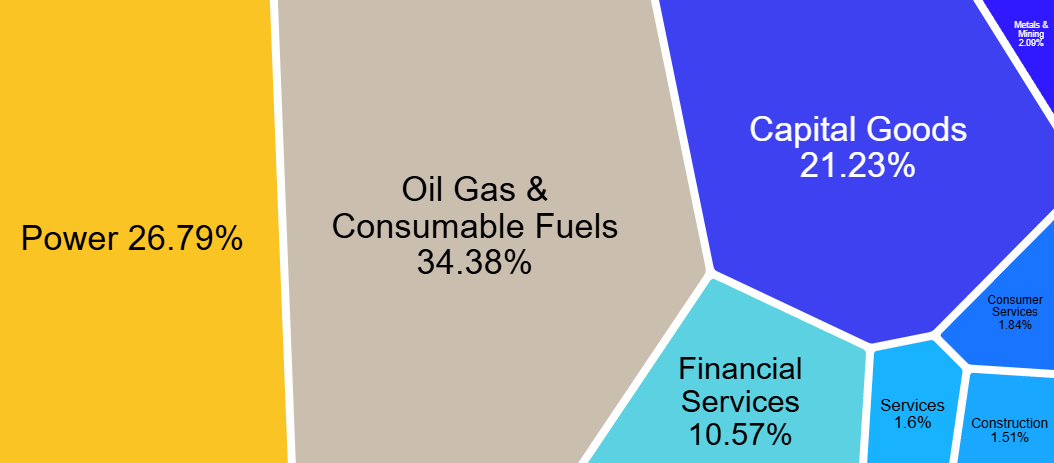

Nifty PSE Sector Weightage

The NIFTY PSE Index gives a weightage of 34.38% to Oil, Gas & Consumable Fuels, 26.79% to Power, 21.23% to Capital Goods, 10.57% to Financial Services, and 2.09% to Metals & Mining. The NIFTY PSE index is a free-float market capitalization index. It is important to highlight that the Nifty PSE weightage of sectors keeps changing according to the performance of constituent stocks.

Nifty PSE Sectoral Distribution

Nifty PSE Stocks List With Weightage

| COMPANY NAME | SECTOR | WEIGHTAGE (%) |

| NTPC Ltd. | Power | 13.66 |

| Bharat Electronics Ltd. | Capital Goods | 11.64 |

| Power Grid Corporation of India Ltd. | Power | 10.97 |

| Oil & Natural Gas Corporation Ltd. | Oil Gas & Consumable Fuels | 7.99 |

| Coal India Ltd. | Oil Gas & Consumable Fuels | 7.49 |

| Hindustan Aeronautics Ltd. | Capital Goods | 7.24 |

| Bharat Petroleum Corporation Ltd. | Oil Gas & Consumable Fuels | 5.26 |

| Power Finance Corporation Ltd. | Financial Services | 4.86 |

| Indian Oil Corporation Ltd. | Oil Gas & Consumable Fuels | 4.49 |

| GAIL (India) Ltd. | Oil Gas & Consumable Fuels | 4.11 |

| REC Ltd. | Financial Services | 3.85 |

| Hindustan Petroleum Corporation Ltd. | Oil Gas & Consumable Fuels | 3.18 |

| Bharat Heavy Electricals Ltd. | Capital Goods | 2.35 |

| NHPC Ltd. | Power | 2.15 |

| NMDC Ltd. | Metals & Mining | 2.09 |

| Oil India Ltd. | Oil Gas & Consumable Fuels | 1.87 |

| Indian Railway Finance Corporation | Financial Services | 1.86 |

| Indian Railway Catering And Tourism Corporation Ltd. | Consumer Services | 1.84 |

| Container Corporation of India Ltd. | Services | 1.60 |

| Rail Vikas Nigam | Construction | 1.51 |

Nifty PSE Index Vs Other Sectoral Indices

Read Also: Nifty IT Stocks List With Weightage in 2025

Nifty PSE Index List: Eligibility Criteria

- Inclusion in Nifty 500: Companies must be part of the Nifty 500 index at the time of review. If there are fewer than 10 eligible stocks from a specific sector within the Nifty 500, additional stocks will be selected from the top 800 ranked by average daily turnover and average daily full market capitalization, based on data from the previous six months used for Nifty 500 index rebalancing.

- Government Ownership: A minimum of 51% of a company’s outstanding share capital must be owned by the Central Government and/or State Government, either directly or indirectly.

- Trading Frequency: The company should have maintained a trading frequency of at least 90% over the last six months.

- Listing History: The company must have a minimum listing history of one month as of the cutoff date.

- Final Selection Process: The final selection of 20 companies will be based on their free-float market capitalization.

- Weightage Calculation: The weightage of each stock in the index is determined by its free-float market capitalization, ensuring that no single stock exceeds 33% and that the cumulative weightage of the top three stocks does not surpass 62% during rebalancing.

Nifty PSE Index List: Eligible Basic Industries

Companies from the following industries are eligible to be considered for inclusion in the Nifty PSE Index List:

- Capital Goods

- Oil, Gas & Consumable Fuels

- Services

- Consumer Services

- Financial Services

- Power

- Metals & Mining

Read Also: Nifty Auto Stocks List With Weightage in 2025

Nifty PSE Stocks Weightage FAQs

How many stocks are there in the Nifty PSE Index?

Nifty PSE Index has 20 stocks like NTPC, Bharat Electronics, Power Grid Corporation of India, Oil & Natural Gas Corporation, and Hindustan Aeronautics.

How frequently is the Nifty PSE Index rebalanced?

The Nifty PSE Index is rebalanced every 6 months with the cut-off dates being 31 January and 31 July each year.

Which company tops in Nifty PSE weightage stocks?

On 29 August 2025, NTPC had the maximum weightage of 13.66%, followed by Bharat Electronics at 11.64%.

What is Nifty PSE performance in the last 12 months?

As of 29 August 2025, the index delivered losses of 18.28% over the last 1 year including dividends.

Can we trade directly in the Nifty PSE index?

Unfortunately, there are no instruments to trade solely in the PSE index. Mutual funds and ETFs tracking public sector undertakings (such as ICICI Prudential PSU Equity Fund and Invesco India PSU Equity Fund) are the closest proxies that investors can resort to.