Mumbai-headquartered cement manufacturer Nuvoco Vistas Corporation has filed papers for a INR5,000-crore IPO with the market regulator SEBI. Nuvoco Vistas IPO includes a fresh issue of equity shares aggregating up to INR1,500 crore and an Offer for Sale aggregating up to INR3,500 crore by selling shareholders. Promoted by Karsanbhai Patel, also the promoter of Nirma group, Nuvoco Vistas has been the fastest growing cement company in the country in the last five years in terms of capacity addition.

The building materials major was originally incorporated as Infra Cement India Pvt Ltd thereafter changed name to Lafarge India Pvt Ltd after acquiring Indian assets of the French company and merging the same with cement division of Kolkata-based Emami. Interestingly, Emami Cement had also filed IPO papers in October 2018.

According to the draft prospectus, majority of the proceeds from Nuvoco Vistas IPO are proposed to go towards repayment or prepayment of debt.

Investment Bankers appointed to the issue are ICICI Securities Ltd, Axis Capital Limited, HSBC Securities and Capital Markets (India) Pvt Ltd, JP Morgan India Pvt Ltd and SBI Capital Markets Ltd. Link Intime has been appointed the registrar of Nuvoco Vistas IPO.

Read Also: Shyam Metalics IPO: 10 points you need to know

Nuvoco Vistas – An East India Company

In terms of manufacturing capacity, Nuvoco Vistas is currently India’s fifth biggest cement producer. However, most of its capacity is in eastern parts of the country where it sells under brand names such as Concreto, Duraguard, Double Bull, ZeroM and Instamix.

The company’s cement plants are in the states of West Bengal, Bihar, Odisha, Chhattisgarh and Jharkhand in East India and Rajasthan and Haryana in North India, while its RMX plants are located across India. As of 31 December 2020, Nuvoco Vistas’s installed capacity stood at 22.32 MMTPA while additional expansion of 1.5 and 1.2 MMTPA is underway at its Jojobera, Jharkhand and Bhabua, Bihar plants.

Uneven Financial performance

The company’s financial performance in recent years has been a mixed bag as a result of mergers. Topline has been constant in recent years but profits showed an uptick before slumping in the current fiscal.

Nuvoco Vistas’ Financial Performance (Figures in INR crore)

| FY2018 | FY2019 | FY2020 | 9M FY2021 | |

| Revenue | 6,911.7 | 7,105.9 | 6,829.9 | 4,879.4 |

| Expenses | 6,749.6 | 7,089.3 | 6,443.2 | 4,993.9 |

| Comprehensive income | 88.6 | -28.1 | 246.2 | -62.4 |

| Margin (%) | 1.3 | -0.4 | 3.6 | -1.3 |

Profit margins have been slim and have also ventured in the negative territory. Similarly, its Return on Net Worth (RONW) has been on the lower side when compared with industry peers. In FY2020 – a relatively better year for the company – its RONW stood at just 4.7% as compared to double-digit figures for competitors Ultratech, Shree Cement, Ambuja and ACC.

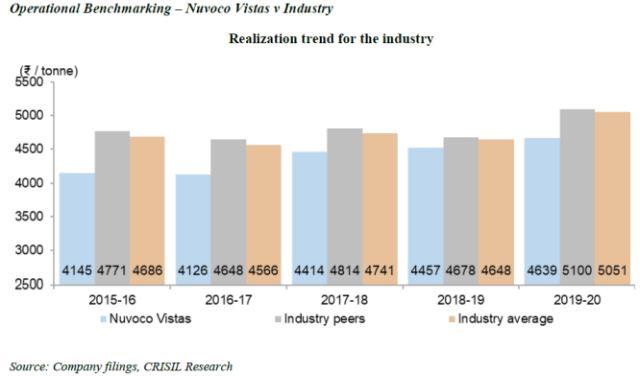

The company’s underperformance isn’t surprising considering the fact that it has been a laggard in terms of realizations. As seen in the following image taken from draft prospectus, its realizations per tonne have trailed industry average in each of the last five years.

Nevertheless, cement industry is coming out of a multi-year consolidation phase marked by weak demand and limited capacity addition. Considering that demand outlook is turning better for the industry, Nuvoco Vistas IPO may turn out to be an interesting bet.