Investors in India’s primary market are spoiled with choices as several IPOs are scheduled to be launched this week. While there is no dearth of public offers to invest in, the upcoming IPO of Rajputana Industries comes across as a promising opportunity. The company, deeply rooted in the manufacturing of non-ferrous metal products, has made significant strides in its sector. Here are ten crucial points that investors should know about Rajputana Industries IPO:

#1 Rajputana Industries IPO: Business Overview

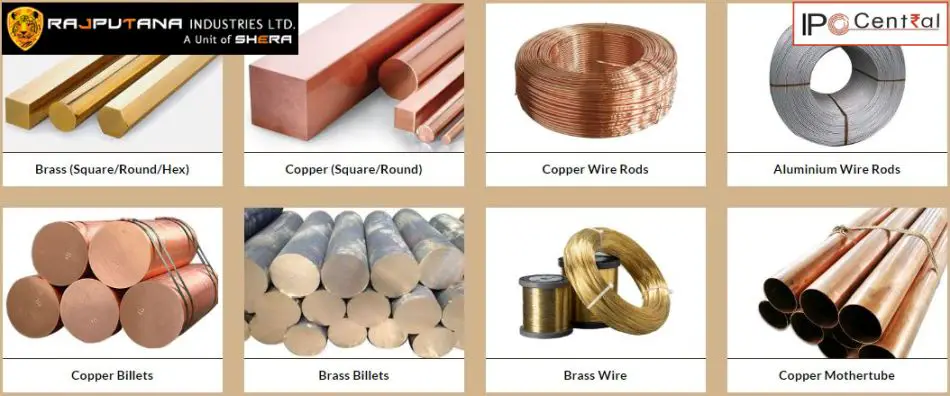

Rajputana Industries specializes in the production of a wide array of non-ferrous metal products, including copper, aluminum, brass, and different alloys. These products are made from recycled scrap metal. The company sources scrap metal from the open market and converts it into billets. These billets are then transformed into products such as copper rods, aluminum rods, copper mother tubes, brass wires, and super-enameled copper conductors. The company’s ability to manufacture products in various shapes and sizes to meet market demand positions it as a versatile player in the industry.

Also Read: All About SME to Mainboard Migration

#2 Rajputana Industries IPO: Expansion into the Cable Manufacturing Sector

Rajputana Industries is set to diversify its product portfolio by entering the cable manufacturing sector. The company plans to produce residential and submersible cables for motors, primarily targeting the construction industry. The new cable plant will be established at the company’s existing manufacturing facility in Reengus, Sikar. The total project cost is estimated at INR 5.88 crore, which will be funded through a mix of fresh bank borrowings and internal accruals. The plant is expected to be operational by September 2024, with an annual production capacity of 13,000 Kw.

#3 Rajputana Industries IPO: Robust Manufacturing Infrastructure

The company’s manufacturing facilities boast the latest technology in plant and machinery, ensuring high-quality production and stringent quality control. As of March 31, 2023, Rajputana Industries had an annual installed capacity of 9,860 MT. The facilities include in-house testing equipment, allowing the company to maintain strict quality standards across all products. This focus on quality has been a cornerstone of their operations, ensuring customer satisfaction and repeat orders.

Read Also: IPO Market Next Week: 3 Mainboard, 8 SME IPOs to Keep Investors Busy

#4 Rajputana Industries IPO: Offer Details

The Rajputana Industries IPO is scheduled for 30 July to 1 August 2024, with a price range of INR 36 to 38 per share. The IPO consists of a fresh issue of 62,85,000 shares, valuing the offering between INR 22.63 – 23.88 crore. The minimum bid size is 3,000 shares, priced at INR 1,14,000, and retail investors are allotted 35% of the shares. The IPO will be listed on NSE EMERGE.

#5 Rajputana Industries – Comparison With Listed Peers

| Company | PE ratio | EPS | RONW (%) | NAV | Revenue (Cr.) |

| Rajputana Industries | 11.38 | 3.34 | 15.74 | 21.25 | 326.51 |

| Nupur Recyclers | 62.14 | 1.54 | 12.32 | 12.48 | 180.82 |

| Baheti Recycling | 40.20 | 6.94 | 17.30 | 40.15 | 429.34 |

#6 Rajputana Industries IPO: Objectives

The company proposes to utilize the Net Proceeds from the Fresh Issue towards funding the following objects:

- Funding the working capital requirements of the company – INR 14 crore

- Purchase of Grid Solar Power Generating System – INR 4.50 crore

- General corporate purposes

#7 Rajputana Industries IPO: Strategic Acquisition and Integration

In 2017, Rajputana Industries was acquired by Shera Energy Limited, a company with significant experience in manufacturing winding wires and strips made from non-ferrous metals. This acquisition was strategically aimed at forward integration, as Rajputana’s production of billets serves as raw material for Shera Energy’s winding wires and strips. The synergy between the two companies enhances operational efficiency and expands their market reach. In FY 2021-2022, Shera Energy had an annual installed capacity of 15,600 MT, underscoring the scale and capability of the combined entity.

#8 Rajputana Industries IPO: Strong Client Relationships and Suppliers

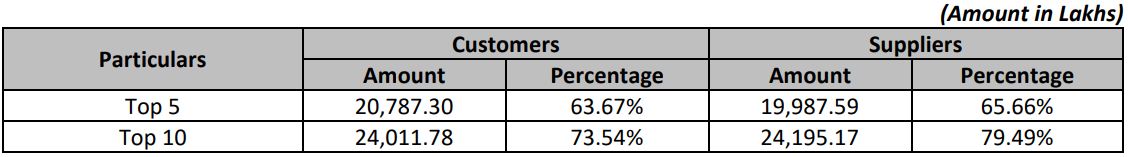

Rajputana Industries has built long-standing relationships with its clients, which have significantly contributed to its revenue. The company’s top ten customers have been a substantial part of their business for many years, with relationships spanning more than a decade. This commitment to quality and customer satisfaction has fostered repeat business and opened new opportunities in the industry.

The company primarily procures its raw materials and sells its products to various organizations and wholesalers. Below is the breakdown of the top five and top ten customers and suppliers for the fiscal year ending on 31 March 2024:

Also Read: Top 10 Most Expensive Stocks In India

#9 Rajputana Industries IPO – Financial Performance & Valuations

Ever since its acquisition by Shera Energy, Rajputana Industries has staged a remarkable turnaround. This is also reflected in the company’s financial figures and key operating metrics. The company has posted higher topline and bottomline in the last three years and has also reported a marked improvement in profitability as indicated by EBITDA margins.

Despite the improvement on key parameters, the IPO is being made at reasonable valuations. At the upper end of the price band, the PE ratio works out to 11.38 which is quite attractive.

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 244.35 | 254.67 | 326.51 |

| Expenses | 240.98 | 251.06 | 320.14 |

| Net income | 2.64 | 3.10 | 5.13 |

| FY 2022 | FY 2023 | FY 2024 | |

| EPS | 1.87 | 2.19 | 3.34 |

| PE ratio | – | – | 10.78 – 11.38 |

| RONW (%) | 15.40 | 11.29 | 15.74 |

| NAV | 12.12 | 17.90 | 21.25 |

| ROCE (%) | 27.35 | 22.67 | 30.28 |

| EBITDA (%) | 4.92 | 5.10 | 5.56 |

Read Also: Nifty Pharma Stocks List With Weightage in 2024

#10 Rajputana Industries IPO: Conclusion

Given the points mentioned above, Rajputana Industries’ IPO comes across as a compelling opportunity for investors. The company’s diverse product range, expansion into new sectors, robust manufacturing infrastructure, strategic acquisitions, experienced leadership, strong client relationships, and suppliers. It is a promising player in the non-ferrous metal products industry. The presence of a robust grey premium for the shares is also a big positive for prospective investors. All in all, Rajputana Industries IPO is likely to receive high subscription during the offer period.